Bitcoin Rockets Past $93K: Is $100K the Next Big Milestone?

BTC Smashes Records: $93,265 All-Time High Bitcoin soars 115% YTD, consolidating near $91,600. Investors eye the $100K threshold | That's TradingNEWS

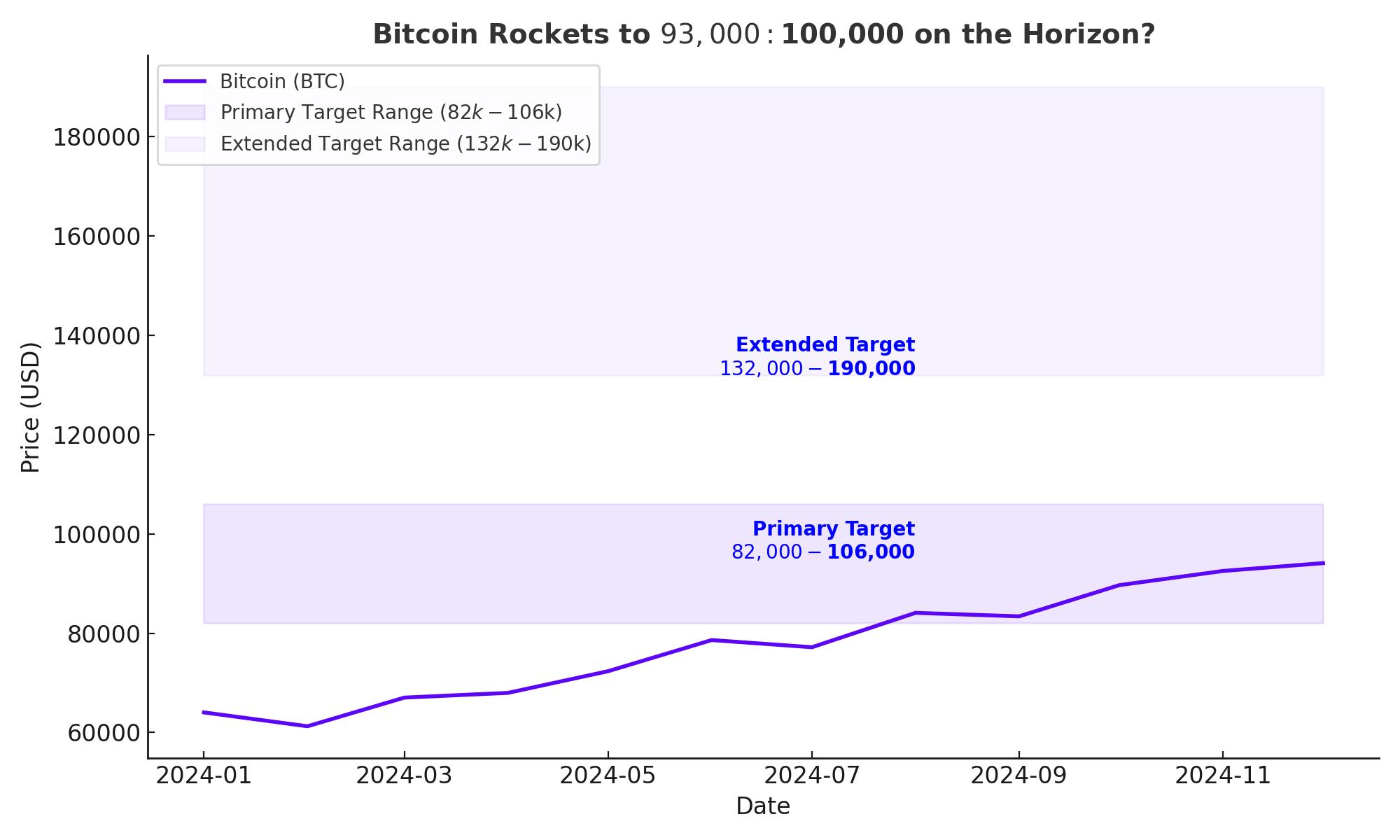

Bitcoin Rockets to $93,000: Is $100,000 the Next Target?

Bitcoin Price Surges to New Heights

Bitcoin (BTC-USD) is rewriting the rules of the financial world, hitting an all-time high of $93,265 on November 13, 2024. This unprecedented bull run has catapulted its year-to-date growth to an impressive 115%, with current prices consolidating around $91,600. The parabolic ascent has sparked speculation of an imminent breach of the $100,000 milestone.

Institutional Momentum and Macro Trends

The rally has been fueled by institutional interest and shifting regulatory stances. Cathie Wood, CEO of ARK Invest, projects Bitcoin reaching $650,000 by 2030 underpinned by its transformation into a mainstream asset. Her bullish outlook is mirrored by global macroeconomic trends, with corporations such as MicroStrategy investing heavily. In a bold move, MicroStrategy acquired 51,780 BTC worth $4.6 billion, highlighting institutional confidence in Bitcoin's long-term potential.

Trump’s Pro-Bitcoin Policy: A Game-Changer

President-elect Donald Trump has pledged to position the United States as the "crypto capital of the planet." His administration is exploring the creation of a U.S. Strategic Bitcoin Reserve, leveraging over 200,000 BTC seized from illicit activities. This initiative, combined with the potential dismissal of SEC Chair Gary Gensler, signals a regulatory shift favoring crypto innovation. State-level moves, such as Pennsylvania’s Bitcoin Strategic Reserve Act, further validate this trend, allowing the state to allocate 10% of its $7 billion treasury into Bitcoin.

Technical Analysis: Aiming for $100,000

Bitcoin’s Relative Strength Index (RSI) stands at 76, indicating overbought conditions but still showing strong bullish momentum. A breakout above $92,625 could signal a move toward $100,000, a critical psychological barrier. However, a correction to $87,000 or $85,000 could materialize if profit-taking accelerates.

The Golden Cross and Historical Metrics

On-chain metrics like the Puell Multiple suggest further upside. Historically, when the Puell Multiple crosses above its 365-day moving average, Bitcoin sees an average 90% price increase. Previous instances in March 2019, January 2020, and January 2024 were followed by rallies of 83%, 113%, and 76%, respectively. If history repeats, Bitcoin's price could surge well beyond $100,000.

Global Adoption and Strategic Reserve: A Bold Future

Bitcoin’s market cap recently surpassed silver, making it the 8th largest asset globally. Trump's proposal for a strategic reserve could add legitimacy and drive prices higher, with potential government acquisitions of 1 million BTC over five years. Meanwhile, global companies and institutional investors are increasingly integrating Bitcoin into their portfolios, further solidifying its role as a digital gold standard.

Investor Sentiment and Market Dynamics

Investor enthusiasm remains high, with 99.3% of UTXOs in profit, signaling strong market confidence. Futures Open Interest (OI) reached $56.75 billion, a clear indicator of sustained institutional demand. Stablecoin inflows into exchanges hit a record $1.8 billion, amplifying Bitcoin's purchasing power and bolstering its bullish narrative.

Challenges and Opportunities

Despite its meteoric rise, Bitcoin faces challenges, including regulatory hurdles and volatility concerns. Critics argue that the limited market cap of under $2 trillion poses scalability issues for widespread adoption. However, proponents believe these challenges are outweighed by its potential to disrupt traditional financial systems and serve as a hedge against inflation.

Verdict: Buy, Hold, or Sell?

Given its robust fundamentals, growing institutional backing, and favorable macro trends, Bitcoin appears poised for further gains. While short-term corrections are possible, the long-term outlook remains overwhelmingly bullish. Investors may consider Bitcoin a buy, with the potential for substantial returns as it targets $100,000 and beyond.

For real-time price updates and insights, visit Bitcoin Real-Time Chart.