The Bold Expansion: MicroStrategy’s $42 Billion Bitcoin Plan

MicroStrategy now controls 331,200 Bitcoin, valued at $32 billion. What’s next? | That's TradingNEWS

NASDAQ:MSTR: The Unstoppable Rise of MicroStrategy in the Bitcoin Era

MicroStrategy’s Bold $42 Billion Bitcoin Expansion

MicroStrategy (NASDAQ:MSTR), a company once known for enterprise analytics, has fully transformed itself into a Bitcoin investment juggernaut. The company recently announced an aggressive plan to acquire $42 billion worth of Bitcoin over the next three years. This move would double its current holdings of 331,200 BTC—valued at approximately $32 billion—and elevate its stake to nearly 4% of the total Bitcoin supply.

To fund this unprecedented spree, MicroStrategy aims to raise $21 billion via convertible debt and another $21 billion through at-the-market (ATM) stock offerings. With Bitcoin recently crossing the $97,000 threshold, this strategy could significantly impact the cryptocurrency market and solidify MicroStrategy as a Bitcoin Treasury Company.

MSTR's Explosive Growth: Surpassing Major Benchmarks

Since its Bitcoin buying spree began in 2020, NASDAQ:MSTR has delivered returns that far outpace the broader market. With a 606% year-to-date (YTD) increase, MicroStrategy has even outperformed tech giants like Nvidia, Amazon, and Apple. This surge reflects the company’s innovative approach to leveraging Bitcoin’s growth potential.

- Stock Price: MSTR reached an all-time high of $495.98, reflecting a robust 90% rally in November 2024 alone.

- Market Cap: The company’s market cap has soared past $96 billion, making it one of the most significant players in the Bitcoin ecosystem.

For real-time updates, check the MSTR stock chart.

MicroStrategy as Bitcoin’s Investment Bank

MicroStrategy isn’t just a corporate Bitcoin holder; it operates as a Bitcoin investment bank, leveraging innovative financial instruments to secure and amplify its BTC holdings.

Convertible Bonds and ATM Offerings

- Recently, MicroStrategy issued $2.6 billion in convertible notes, with proceeds dedicated to buying Bitcoin. These instruments, often issued at low interest rates due to MSTR's high volatility, provide access to cheap capital.

- In November alone, the company raised $2.03 billion through ATM stock sales, demonstrating strong market confidence in its Bitcoin strategy.

This dual approach of issuing securities and acquiring Bitcoin positions MicroStrategy as a financial pioneer in the cryptocurrency space.

Accumulation and Market Impact

MicroStrategy's BTC purchases have a compounding effect on Bitcoin’s price, as large-scale acquisitions drive market momentum. The company’s executive chairman, Michael Saylor, has consistently emphasized this strategy, stating:

“Every dollar invested in Bitcoin through MicroStrategy creates exponential value for both our shareholders and the broader crypto ecosystem.”

Bitcoin Yield and Financial Engineering

MicroStrategy has introduced the concept of Bitcoin Yield—the growth in Bitcoin holdings per share over time—as a key performance metric.

Metrics at a Glance

- Current Holdings: 331,200 BTC

- Acquisition Cost: $25 billion

- Unrealized Gains: Approximately $15.51 billion

This innovative metric has redefined how investors evaluate Bitcoin-backed equities, positioning MSTR as a leader in financial engineering.

Risks and Market Sensitivities

Over-Reliance on Bitcoin

While MicroStrategy’s strategy has yielded spectacular returns, its valuation is tightly linked to Bitcoin’s price. A significant downturn in BTC could erode MSTR’s market cap, which currently trades at a 3.3x premium to its Bitcoin holdings.

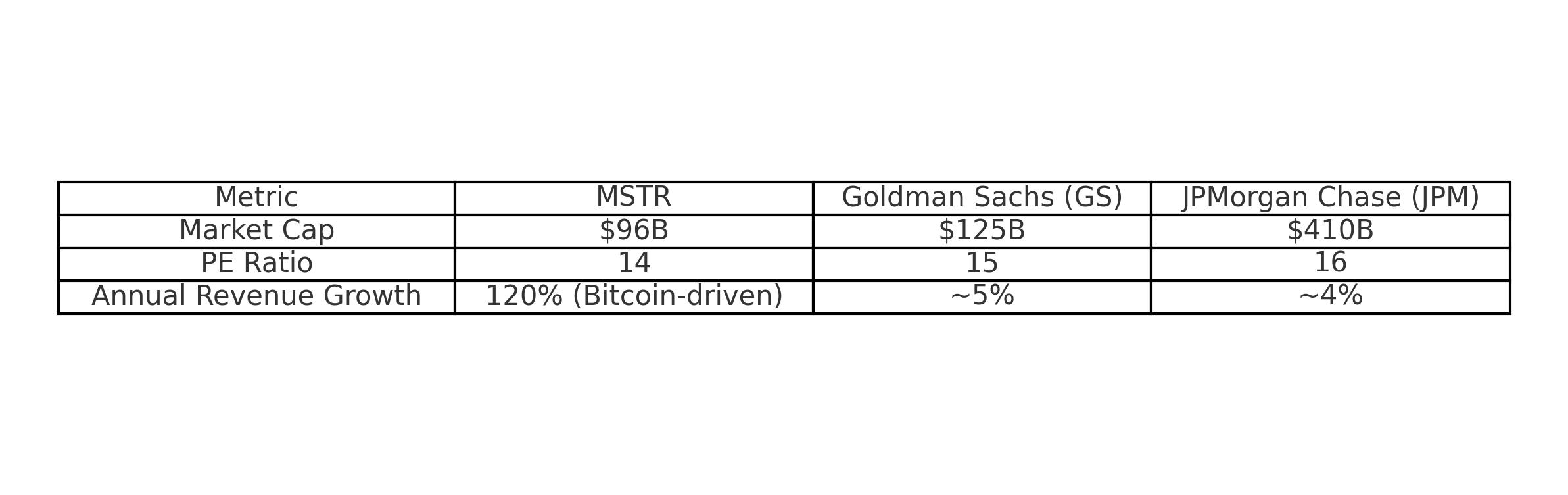

Comparing MSTR to Traditional Investment Banks

MicroStrategy’s model rivals that of traditional investment banks, with its spread driven by Bitcoin’s compound annual growth rate (CAGR) of over 50% and low-cost capital acquisition.

Future Projections: A Multi-Trillion-Dollar Opportunity?

MicroStrategy’s Bitcoin-centric strategy positions it as a potential multi-trillion-dollar enterprise:

- Market Dominance: Holding 4% of global Bitcoin supply creates a unique moat, ensuring its leadership in the Bitcoin ecosystem.

- Valuation Upside: Conservative projections suggest a market cap between $690 billion and $3 trillion, driven by expanded BTC holdings and innovative financial instruments.

Final Thoughts

MicroStrategy (NASDAQ:MSTR) has redefined corporate Bitcoin investment, combining visionary leadership with advanced financial strategies. With a clear path to exponential growth, MSTR remains a compelling choice for investors seeking exposure to Bitcoin’s future potential. Whether the company achieves its lofty ambitions depends on Bitcoin’s continued rise and MicroStrategy’s ability to innovate within this evolving space.

For ongoing updates and analysis, follow MSTR stock profile.