Marvell Technology (NASDAQ: MRVL) Positioned for 43% Upside Amid Explosive AI Growth

As AI revenues surge, Marvell Technology’s custom silicon solutions and partnerships with tech giants like Amazon and Alphabet make it a top stock pick for investors seeking major gains | That's TradingNEWS

Marvell Technology (NASDAQ:MRVL) – Explosive AI Growth Fuels Massive Upside Potential

Insider Moves Signal Confidence – CEO’s $1M Bet

Excitement is mounting for NASDAQ:MRVL as shares jumped 1.8% to $80.85, fueled by a major insider buy from CEO Matthew J. Murphy. He added 13,000 shares to his portfolio at an average price of $77.63, putting his money where his mouth is with a $1.01 million investment! Murphy now holds 221,915 shares worth over $17.2 million, a bold signal of confidence in Marvell's future. His aggressive buy has lit a fire under investor sentiment, sparking a rally that shows just how bullish insiders are on the company's trajectory.

AI Growth Powerhouse: $1.5 Billion Revenue in FY25 Alone!

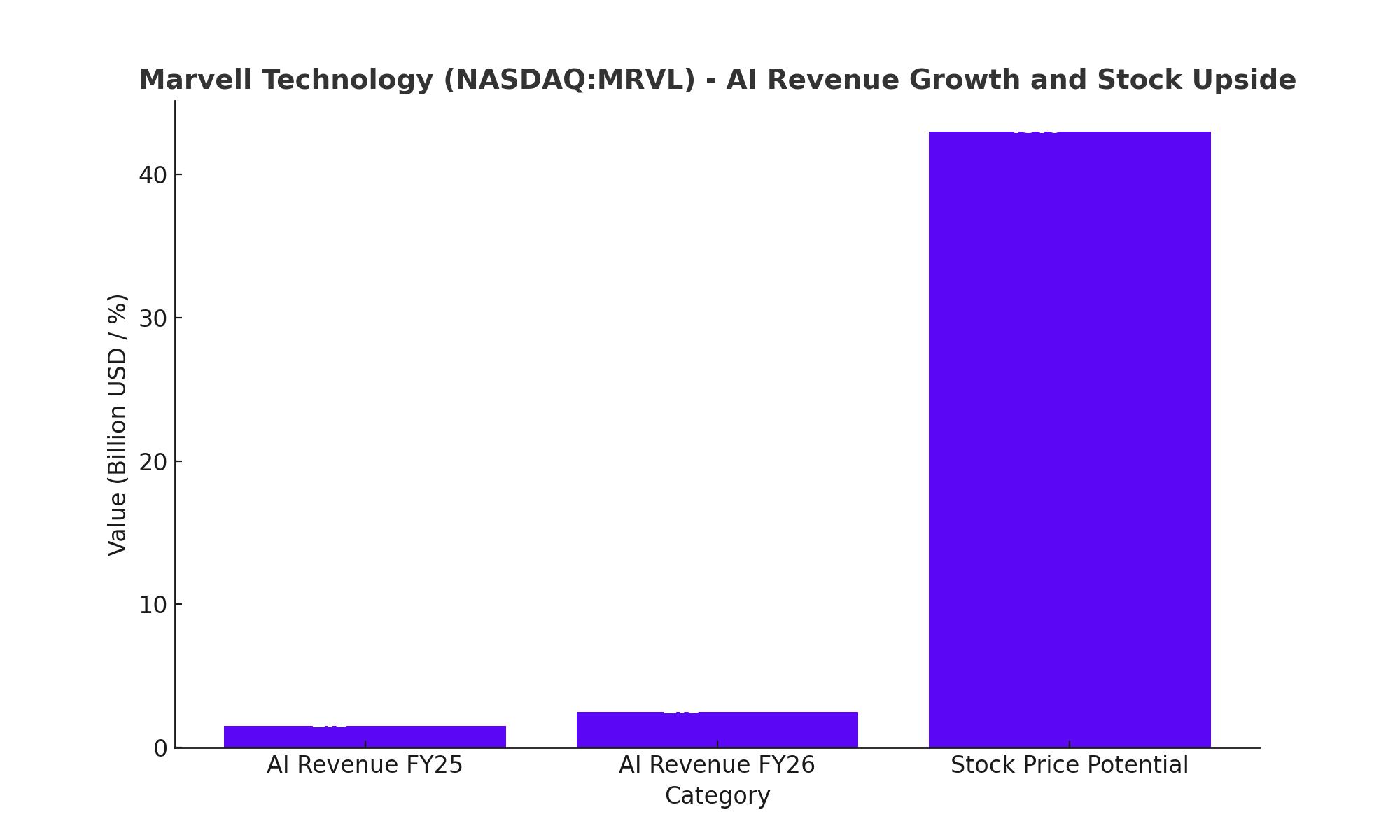

Marvell Technology’s ascent is being driven by one word: AI. The company’s data center business, powered by custom silicon solutions for Amazon and Alphabet, has seen explosive growth. Marvell is projecting $1.5 billion in AI-related revenue for FY25, with a stunning increase to $2.5 billion by FY26! This surge is not just hype—Marvell’s custom silicon business for AI is in high demand, with the company helping power Amazon’s Trainium AI chips, which are up to 4x faster than their predecessors and offer significant cost savings. The AI boom is real, and Marvell is at the center of it, capturing market share in the highly lucrative AI semiconductor space.

Analysts See a Massive Upside – Price Targets as High as $115!

Wall Street is buzzing about Marvell's potential. Benchmark has set a sky-high price target of $115, while Bank of America and KeyCorp have raised their targets to $90 and $95 respectively. Currently trading at $80.85, this means a potential upside of 43%! With 20 out of 22 analysts rating the stock a “Buy,” Marvell is positioned for a breakout, with the consensus price target at $91.62. The combination of AI growth, insider confidence, and strong institutional backing is painting a very bullish picture for the stock.

AI-Powered Revenue Growth – Data Center Leads the Charge

The numbers don’t lie—Marvell’s data center revenue grew by a staggering 92% year-over-year in Q2 FY25, and it now makes up 69% of total revenue. With custom silicon orders ramping up from hyperscalers like Amazon, the data center is expected to continue as the company’s primary growth engine. Marvell is expecting 25% growth in this segment for Q3 and Q4, driven by increasing demand for its high-speed AI networking solutions.

On top of that, Marvell introduced the industry’s first 1.6 Tbps PAM4 DSP, a cutting-edge solution for high-speed data transfer that’s critical for AI workloads. These advancements place Marvell in a prime position to capitalize on the AI infrastructure market, which is expected to grow to a whopping $421 billion by 2033.

Valuation and Future Growth – High, but Justified

Marvell’s current P/E ratio of 48.6 may seem high, but that’s only part of the story. Analysts are forecasting a steep drop in the P/E ratio to as low as 15.7 by 2028, driven by the company’s explosive earnings growth. With a forward PEG ratio of 1.46, Marvell’s growth potential is largely factored into its valuation. What’s exciting here is that the company is expected to accelerate its revenue growth, with 19% projected for FY26 onwards—meaning its lofty valuations today could look like a bargain in a few years.

Despite these high multiples, investors are clearly confident in Marvell’s ability to sustain its rapid growth, making it one of the most attractive AI plays in the semiconductor space.

Custom Silicon and the AI Revolution

Custom silicon is not just a buzzword—it's the heart of Marvell's future. With hyperscalers like Amazon relying on Marvell’s technology for their AI models, the company is positioned as a leader in AI hardware innovation. The Trainium2 chips used by Amazon are projected to experience rapid adoption, saving enterprises up to 50% on hardware costs and 20% on energy consumption. As AI workloads continue to grow, Marvell’s custom solutions are expected to drive $2.5 billion in revenue by FY26, a critical growth driver for the company.

Key Risks – China Exposure and Margin Compression

While the future looks bright, it’s important to consider the risks. Marvell’s heavy reliance on China—accounting for 46% of total revenue—could expose the company to geopolitical risks, especially as U.S.-China trade tensions remain a key concern. Additionally, the custom silicon business, while driving revenue, has lower gross margins compared to Marvell’s traditional merchant products. The non-GAAP gross margin is expected to decline to 61% in Q3 FY25, reflecting the drag from custom silicon projects.

Insider and Institutional Confidence – Hedge Funds Are Buying

Institutional investors continue to pile into (NASDAQ: MRVL), with hedge funds owning 83.51% of the company’s stock. Bruce G. Allen Investments LLC increased its position by 56%, and other major funds have acquired new stakes in the company, highlighting the broad confidence in Marvell’s AI-driven future.

The Bottom Line – Strong Buy with 43% Upside

Marvell Technology (NASDAQ: MRVL) is not just riding the AI wave—it’s helping build the infrastructure that powers it. With insider confidence, massive institutional backing, and a rapidly expanding AI business, Marvell is well-positioned for significant upside. The stock offers a 43% potential upside based on current price targets, and with AI revenue projected to hit $2.5 billion by FY26, Marvell is a strong buy for investors looking to capitalize on the AI revolution.