Micron Technology (NASDAQ:MU): $25B AI Memory Boom Powers 93% Revenue Surge

AI Drives Unstoppable Growth as Micron’s HBM Demand Soars—Sales, Margins, and Market Leadership Redefined! | That's TradingNEWS

Micron Technology (NASDAQ:MU): Leading the AI Memory Revolution with Explosive Growth Potential

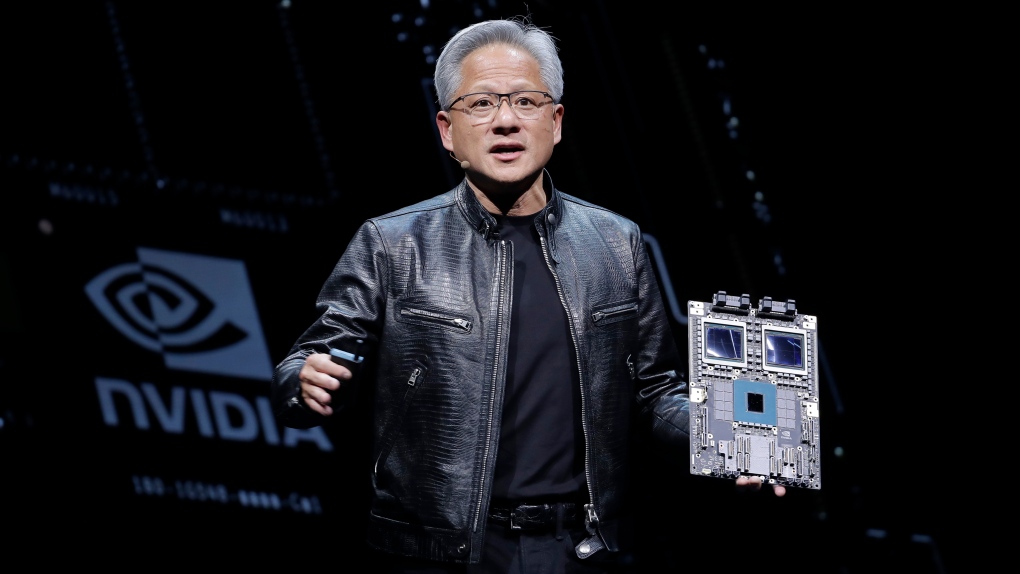

Micron Technology (NASDAQ:MU) is on a trajectory to redefine the memory and storage landscape, leveraging the surging demand for AI infrastructure and data center technologies. While GPUs and AI accelerators from NVIDIA (NASDAQ:NVDA) and AMD (NASDAQ:AMD) dominate headlines, Micron’s critical role in enabling these technologies has been overlooked. With FY2024 revenue up 62% year-over-year to $25.1 billion, the company is capitalizing on high-bandwidth memory (HBM) demand, the recovery of the PC market, and its unmatched position in the AI value chain.

Explosive Growth in High-Bandwidth Memory (HBM)

Micron is emerging as a leader in the HBM market, which is expected to grow from $4 billion in 2023 to over $25 billion by 2025, reflecting an unprecedented compound annual growth rate (CAGR) of 150%. AI workloads increasingly depend on faster memory solutions to manage massive data volumes, and Micron’s HBM technology is setting benchmarks in efficiency and performance. The HBM3E 12-high 36GB solution outpaces competitors with 50% more capacity and 20% lower power consumption.

This technological leadership has translated into significant market traction, with Micron’s HBM production fully sold out through 2025. The financial impact is already evident—HBM contributed to higher gross margins, which increased by 30 percentage points in FY2024 to 23.7%. As adoption scales, this margin expansion is expected to accelerate.

Data Center: A Growth Powerhouse

Micron’s data center segment has emerged as its fastest-growing division, with revenues reaching $7.75 billion in Q4 FY2024, a 93% year-over-year increase. This growth was driven by high-margin DRAM and HBM solutions, highlighting the company’s pivotal role in supporting AI and cloud infrastructure. Data center SSD revenue alone surpassed $1 billion in the quarter, and fiscal 2024 saw data center revenues more than triple.

The adoption of Micron’s DDR5 and LPDDR5 memory solutions has been particularly strong, with cloud giants like Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ:AMZN) integrating these technologies into their data centers. Micron’s high-capacity DDR5 DIMMs, offering up to 128GB per module, are enabling next-generation AI workloads. Low-power DRAM for servers, which enhances reliability and energy efficiency, is another area of growth, with demand from hyperscalers increasing exponentially.

Micron is making strategic investments to sustain this momentum, including new fabs in Idaho and New York. These facilities are geared to meet rising demand, particularly as AI adoption broadens from core cloud providers to edge computing applications.

Technological Leadership and Product Innovation

Micron is advancing its roadmap with innovative products like the 1-beta DRAM and G8/G9 NAND nodes, which are expected to drive performance gains and cost efficiencies. The company’s 1-gamma DRAM node, incorporating EUV lithography, is set for volume production in 2025, positioning Micron at the forefront of the industry’s technological evolution.

In the HBM market, Micron is set to launch its next-generation HBM3E products in 2025, offering up to 40% higher inference performance than NVIDIA’s H200 memory solutions. With the MI325X accelerator already gaining traction, Micron’s focus on AI-driven innovation ensures it remains competitive in an increasingly crowded market.

Expanding Horizons: AI PCs and the PC Market Recovery

The upcoming transition to AI-enabled PCs represents another significant growth avenue for Micron. PC unit volumes, which are expected to accelerate in the second half of FY2025, will be driven by the rollout of Windows 12 and the end of Windows 10 support in 2025. AI PCs demand significantly more memory—16GB for entry-level models and up to 64GB for premium configurations—compared to an average of 12GB in traditional PCs. This shift creates a substantial opportunity for Micron to expand its share in the PC segment, which generated $1.6 billion in Q4 FY2024 revenue, a 29% sequential increase.

Micron’s Strong Financial Performance

Micron’s financial performance underscores its resilience and growth potential. The company generated $25.1 billion in revenue for FY2024, while Non-GAAP gross margins expanded to 23.7%. Operating expenses, at $7.3 billion, were tightly managed despite significant investments in R&D and capacity expansion. Non-GAAP operating income rose to $4.3 billion, up 87% year-over-year, with operating margins increasing to 17%.

Micron’s Q1 FY2025 guidance is equally robust, with revenue projected at $8.7 billion, an 84% increase year-over-year. Gross margins are expected to rise to 39.5%, driven by continued strength in HBM and data center products. Free cash flow for FY2024 reached $3.8 billion, and the company maintains a healthy balance sheet with $9.16 billion in cash and investments. Debt-to-equity stands at a manageable 0.29, providing financial flexibility for future growth initiatives.

Valuation: A Deeply Discounted Opportunity

Despite its strong performance, Micron trades at a forward P/E ratio of just 10.97x, significantly below the semiconductor sector median of 25.37x. The company’s forward EV/EBITDA multiple of 5.89x represents a 62% discount to peers. Most compelling is its PEG ratio of 0.21x, far below the industry median of 1.9x, indicating that the market is undervaluing Micron’s growth potential.

With analysts forecasting EPS growth of 566% in FY2024 and 44.9% in FY2025, Micron is positioned for substantial upside. The company’s projected EPS of $12.55 in FY2025 suggests a potential stock price of $150, representing over 50% upside from current levels.

Navigating Risks and Challenges

While Micron’s prospects are strong, the company faces risks, including intensifying competition from SK Hynix and Samsung, geopolitical instability, and the cyclical nature of the memory industry. However, the structural shift toward AI-driven demand is mitigating cyclicality, creating a more stable growth environment. Micron’s investments in capacity and technology position it to overcome these challenges and capitalize on emerging opportunities.

Conclusion: A Long-Term Winner in AI Memory

Micron Technology is at the center of a transformative shift in the semiconductor industry, driven by AI, data centers, and the recovery of traditional markets. Its leadership in HBM and DRAM, combined with a robust financial foundation and undervalued stock price, makes it a compelling investment. With revenue, margins, and demand poised for sustained growth, Micron offers a rare opportunity to participate in the AI revolution at an attractive valuation. Investors seeking exposure to the next phase of AI infrastructure development should consider Micron a top pick for long-term growth.

That's TradingNEWS

Intel’s Comeback Story: Why NASDAQ:INTC Is a Buy

NASDAQ:AMD Accelerates Into the Future With Unmatched AI Growth