MicroStrategy (NASDAQ:MSTR): A Bitcoin Powerhouse or a Dangerous Leverage Play?

The Core of MicroStrategy (NASDAQ:MSTR)'s Strategy: Is It a Pure Bitcoin Bet?

MicroStrategy (NASDAQ:MSTR), once a business intelligence software company, has fully transformed into a Bitcoin powerhouse under CEO Michael Saylor. The company now holds approximately 478,000 BTC, valued at $48.7 billion based on current Bitcoin prices. However, unlike traditional companies that use cash flow to fund expansion, MSTR has gone all-in on debt financing to buy more Bitcoin.

This aggressive approach has paid off—so far. Since the company began accumulating Bitcoin in 2020, MSTR stock has soared by 219% in the past year alone, driven by Bitcoin’s rally. But the key question is: Can this momentum last, or is this a house of cards built on leverage?

Debt-Fueled Bitcoin Purchases: A Genius Move or a Time Bomb?

MSTR doesn’t just hold Bitcoin; it borrows billions to buy more, making it one of the most leveraged Bitcoin plays on the market. The company has raised over $5 billion in convertible bonds—all with a 0% coupon rate, essentially free money—allowing it to keep adding to its BTC treasury.

But the risk is clear: If Bitcoin crashes, MSTR’s debt could become unmanageable. The company needs BTC prices to stay high (or go higher) to avoid being forced to sell Bitcoin at a loss to cover liabilities.

In December 2024, MSTR issued $3 billion in new convertible bonds. In February 2025, it added another $2 billion to the mix. The company still has $3 billion in out-of-the-money convertible debt, which could become an issue if Bitcoin prices drop significantly.

If BTC remains strong, this strategy could work beautifully. But if BTC enters a prolonged bear market, MSTR's leveraged position could quickly become a major problem.

MicroStrategy’s Stock vs. Bitcoin: Is the Premium Gone?

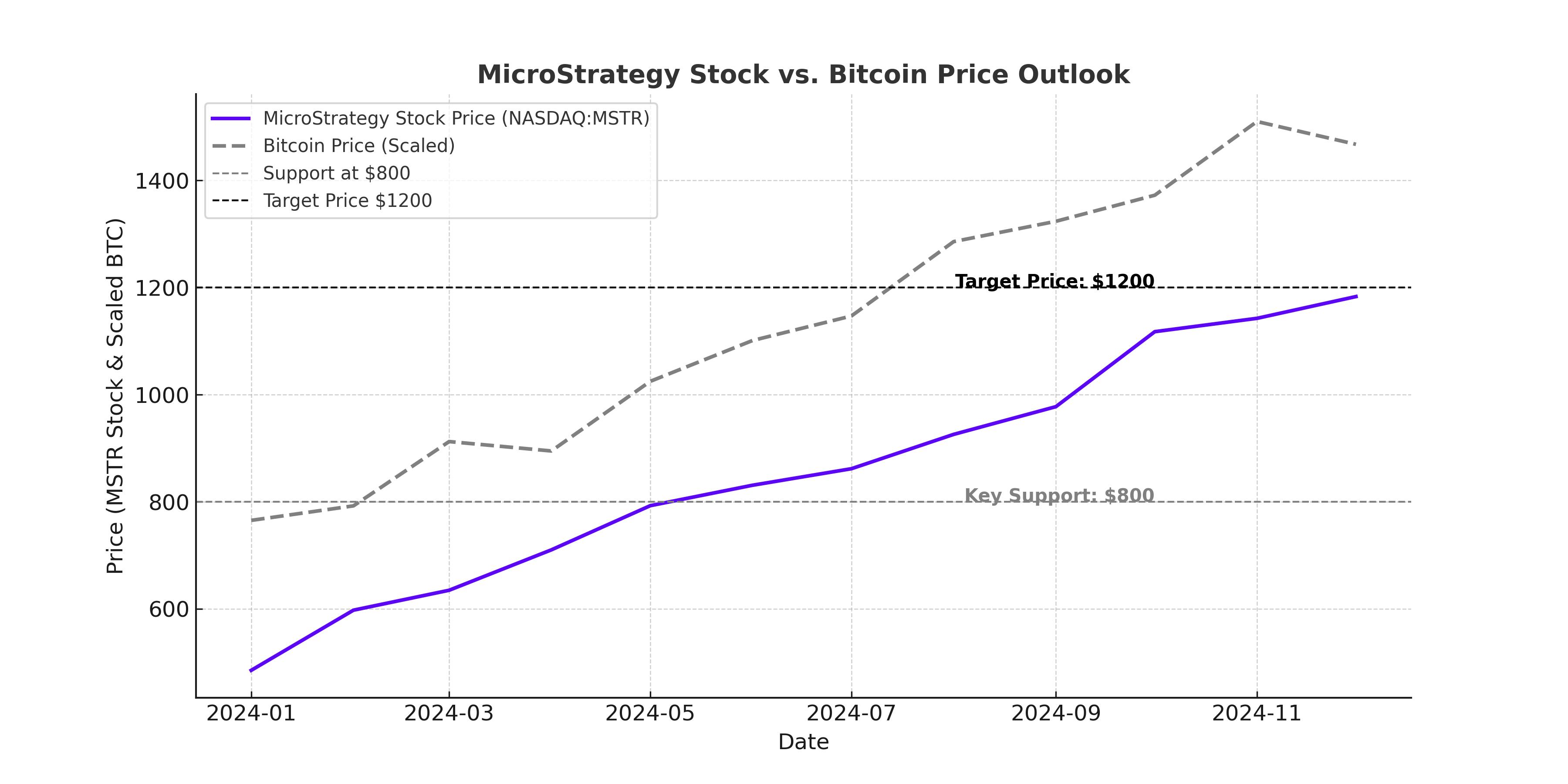

Historically, MSTR traded at a huge premium to its Bitcoin holdings, sometimes as high as 3.1x NAV (Net Asset Value). That premium has collapsed to around 1x NAV, meaning investors are no longer willing to pay extra for MSTR’s Bitcoin exposure.

The stock now closely follows Bitcoin’s movements, with a 0.98 correlation coefficient at Bitcoin’s peak of $109,000. This means MSTR is essentially acting like a high-risk, leveraged Bitcoin ETF.

If Bitcoin hits the $150,000 price target that many analysts predict, MSTR could rally significantly. But with the NAV premium gone, much of the easy money has already been made.

How Sustainable Is MSTR’s Strategy in a Bear Market?

Many skeptics argue that MSTR’s strategy works only in a Bitcoin bull market. If BTC were to fall significantly, MSTR could be forced to sell Bitcoin at a loss to cover its debt.

However, Michael Saylor has structured the company’s financials in a way that avoids forced liquidations

Most of MSTR’s debt is unsecured, meaning its Bitcoin holdings are not collateral. Only $1.05 billion in convertible notes are due soon, which MSTR can likely manage without selling BTC. The new STRK preferred stock offers a creative financing tool with an 8% dividend yield, allowing MSTR to keep raising capital without dumping Bitcoin.

Even in a worst-case scenario, MSTR is positioned to avoid margin calls, but investors should remain aware of the dilution risk from more stock issuances.

Is MSTR a Better Bitcoin Play Than a Spot ETF?

With the launch of Bitcoin spot ETFs, some investors are questioning whether MSTR is even necessary as a Bitcoin investment. ETFs offer direct exposure without the added risk of leverage and dilution.

However, MSTR still has a few advantages over ETFs

It amplifies Bitcoin gains due to leverage, making it a potentially bigger winner in a bull market. It avoids ETF outflows, which could pressure Bitcoin prices when investors rotate out. It benefits from Saylor’s strategic capital moves, allowing the company to accumulate more BTC even when the price is down.

On the flip side, if you only want exposure to Bitcoin’s price movements, a spot ETF may be a safer choice without the risk of MicroStrategy’s debt structure.

Buy, Hold, or Sell? Where Does MSTR Go From Here?

MSTR is not for the faint of heart. It remains one of the most aggressive Bitcoin bets on the market, with massive upside potential but significant risks if BTC crashes.

Reasons to Buy MSTR

If you believe Bitcoin is heading to $150,000 or higher, MSTR could significantly outperform spot BTC due to leverage. If you trust Michael Saylor’s strategy, his financial engineering has consistently allowed MSTR to add to its Bitcoin holdings without major issues. If you prefer exposure to Bitcoin but also want equity upside, MSTR acts as a leveraged BTC play with potential for even bigger gains.

Reasons to Sell or Avoid MSTR

If Bitcoin enters a bear market, MSTR could face a severe price collapse due to its leverage. If dilution concerns you, new stock issuances could erode shareholder value over time. If you prefer lower risk BTC exposure, a Bitcoin spot ETF like IBIT or GBTC is a safer alternative.

Final Verdict: Is MSTR Still a Buy?

At current levels, MSTR is a high-risk, high-reward stock that will live or die based on Bitcoin’s trajectory. If Bitcoin continues its march toward $150,000 or more, MSTR could still see huge gains. However, the stock’s premium to NAV has collapsed, and its aggressive debt-fueled strategy could backfire if Bitcoin corrects sharply.

For aggressive investors, MSTR remains a strong buy in a Bitcoin bull market. For those who want Bitcoin exposure without the risk of leverage or dilution, a Bitcoin spot ETF may be the smarter move.