Qualcomm (NASDAQ:QCOM): AI-Driven Growth and $16 Billion Buyback Spark Investor Excitement

Record-breaking Q4, automotive breakthroughs, and on-device AI make Qualcomm a 2024 tech powerhouse. Here’s why investors are buzzing about QCOM | That's TradingNEWS

Qualcomm (NASDAQ:QCOM): A Powerful Semiconductor Play with Emerging Growth Drivers

Qualcomm (NASDAQ:QCOM) delivered a strong Q4 2024 performance, underscoring its resilience and ability to adapt amidst market fluctuations. The company reported $10.2 billion in revenue, an impressive 18% year-over-year (YoY) growth, alongside non-GAAP earnings per share (EPS) of $2.69, which surged by 33% YoY. The quarter also marked a significant milestone in operational efficiency, with an earnings-before-tax margin of 35.1%, a notable expansion from the prior year. Qualcomm's ability to generate record-breaking free cash flow (FCF) of $11.2 billion showcases its operational strength. This cash was strategically deployed to pay down $914 million in debt, distribute $3.7 billion in dividends, and execute $4.1 billion in share buybacks. To further demonstrate shareholder commitment, Qualcomm expanded its buyback program by $15 billion, positioning itself to deliver even more value.

Expanding the Reach of QCT: The Backbone of Qualcomm’s Revenue

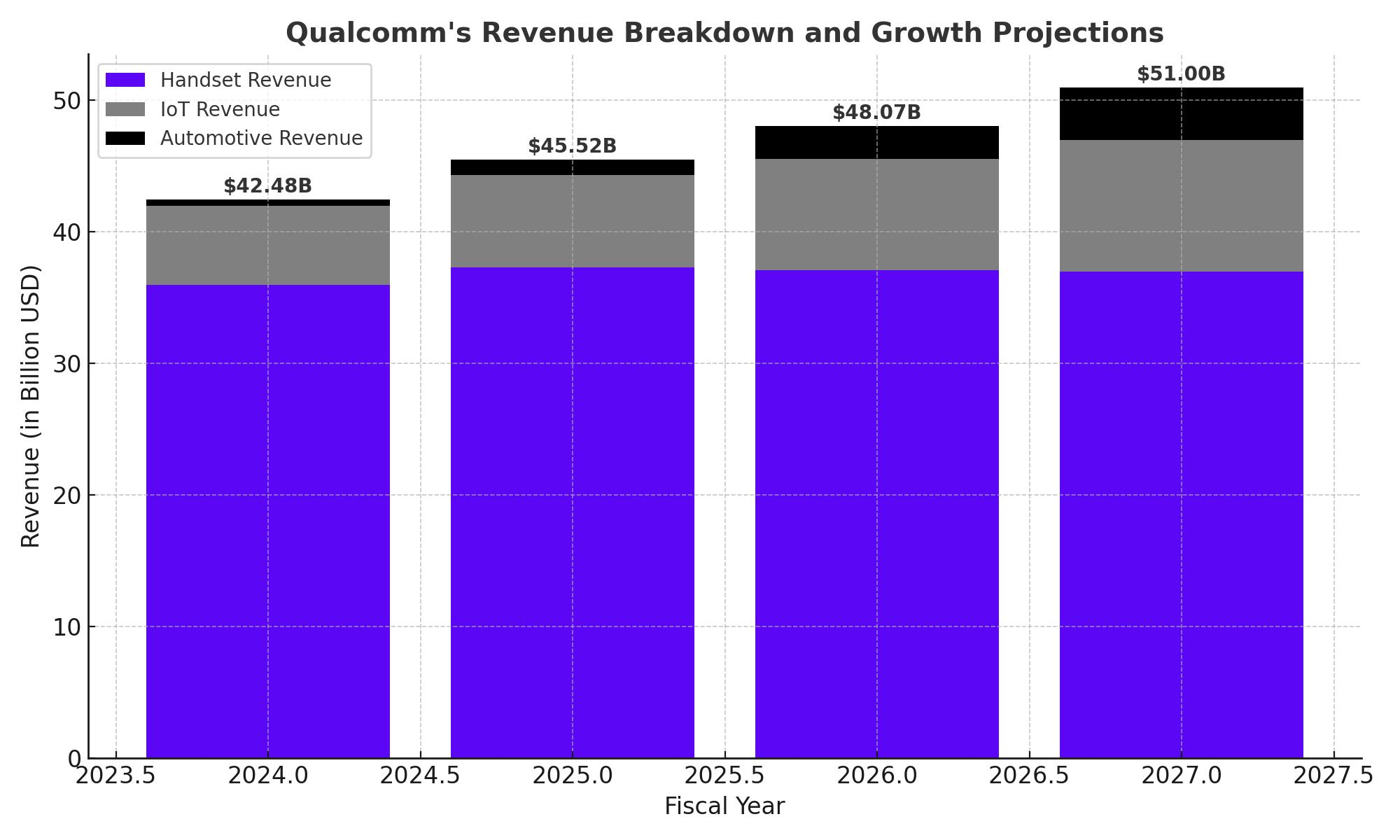

The Qualcomm CDMA Technologies (QCT) segment remains pivotal, contributing robustly across all revenue streams. Handset revenues surged 10% YoY, generating $6.1 billion, buoyed by increased demand for AI-enabled chips in smartphones. Automotive revenue jumped 35% YoY, highlighting Qualcomm's growing dominance in connected car technology. IoT (Internet of Things) revenues continued to expand, offering diversification and tapping into one of the fastest-growing global markets. The automotive business, which has grown steadily in recent quarters, is on the cusp of exponential growth. With its Snapdragon Cockpit Elite, powered by the cutting-edge Oryon CPU, Qualcomm is redefining the digital cockpit experience, cementing its role as a leader in automotive innovation.

AI’s Transformative Potential: Qualcomm’s New Revenue Catalyst

Artificial intelligence (AI) is set to redefine Qualcomm’s future. The company’s focus on on-device AI processing—offloading workloads from cloud to device—represents a game-changing approach in mobile, IoT, and automotive sectors. AI is not merely a buzzword here but a practical driver of higher smartphone average selling prices (ASPs) and deeper device adoption. Qualcomm CEO Cristiano Amon described AI’s role as: "AI is no longer optional. It enhances personalization, security, and reliability, transforming devices into indispensable tools for everyday life." AI’s ability to process data locally enhances user experience and efficiency, encouraging faster smartphone upgrades. As AI integration grows, Qualcomm stands to benefit from the subsequent demand for high-performance, energy-efficient processors.

Automotive Opportunities: A Billion-Dollar Horizon

The automotive sector is poised to be a significant growth engine for Qualcomm, with FY2024 revenues nearing $500 million. Analysts estimate the total addressable market for connected cars and autonomous driving technology will exceed $30 billion by 2030. Qualcomm's advancements in Snapdragon-powered automotive platforms position the company to capitalize on this market shift, adding a layer of resilience and diversification to its core business.

Challenges: Apple and China Loom Large

Despite Qualcomm’s stellar operational performance, two major risks remain. First, Apple’s (NASDAQ:QCOM) in-house modem project poses a potential revenue threat. Apple accounts for an estimated 20% of Qualcomm’s revenue, but repeated delays in Apple's modem development have kept Qualcomm at the forefront of 5G modem supply. Additionally, even if Apple succeeds, Qualcomm’s ongoing diversification into automotive and IoT ensures long-term stability. Second, Qualcomm’s exposure to China—50% of its revenue—is a double-edged sword. Rising U.S.-China trade tensions pose a risk to Qualcomm’s semiconductor exports. However, Qualcomm primarily supplies AI chips for smartphones, which are less likely to face regulatory restrictions compared to high-performance GPUs.

Valuation: An Undervalued Gem in the Semiconductor Sector

Qualcomm's valuation metrics signal a compelling investment opportunity. Trading at 13.2x forward earnings, the stock is significantly undervalued relative to its sector peers, where the median forward P/E hovers near 25x. Revenue projections for Qualcomm reinforce its growth trajectory. FY2025: $42.48 billion. FY2026: $45.52 billion. FY2027: $48.07 billion. Even with conservative growth assumptions, analysts estimate Qualcomm’s intrinsic value is 16% higher than its current market price, with room for even greater upside should automotive revenues accelerate.

A Strong Investment Case with High Potential Upside

Qualcomm (NASDAQ:QCOM) offers a unique blend of stability and growth. Its leadership in mobile technology, combined with emerging opportunities in automotive and AI, positions it as a standout player in the semiconductor industry. With a discounted valuation, robust cash flow, and expanding market share, Qualcomm represents a "Buy," with long-term potential for significant shareholder value creation. For real-time data, visit Qualcomm’s stock chart.

That's TradingNEWS