Record Member Growth and Product Expansion

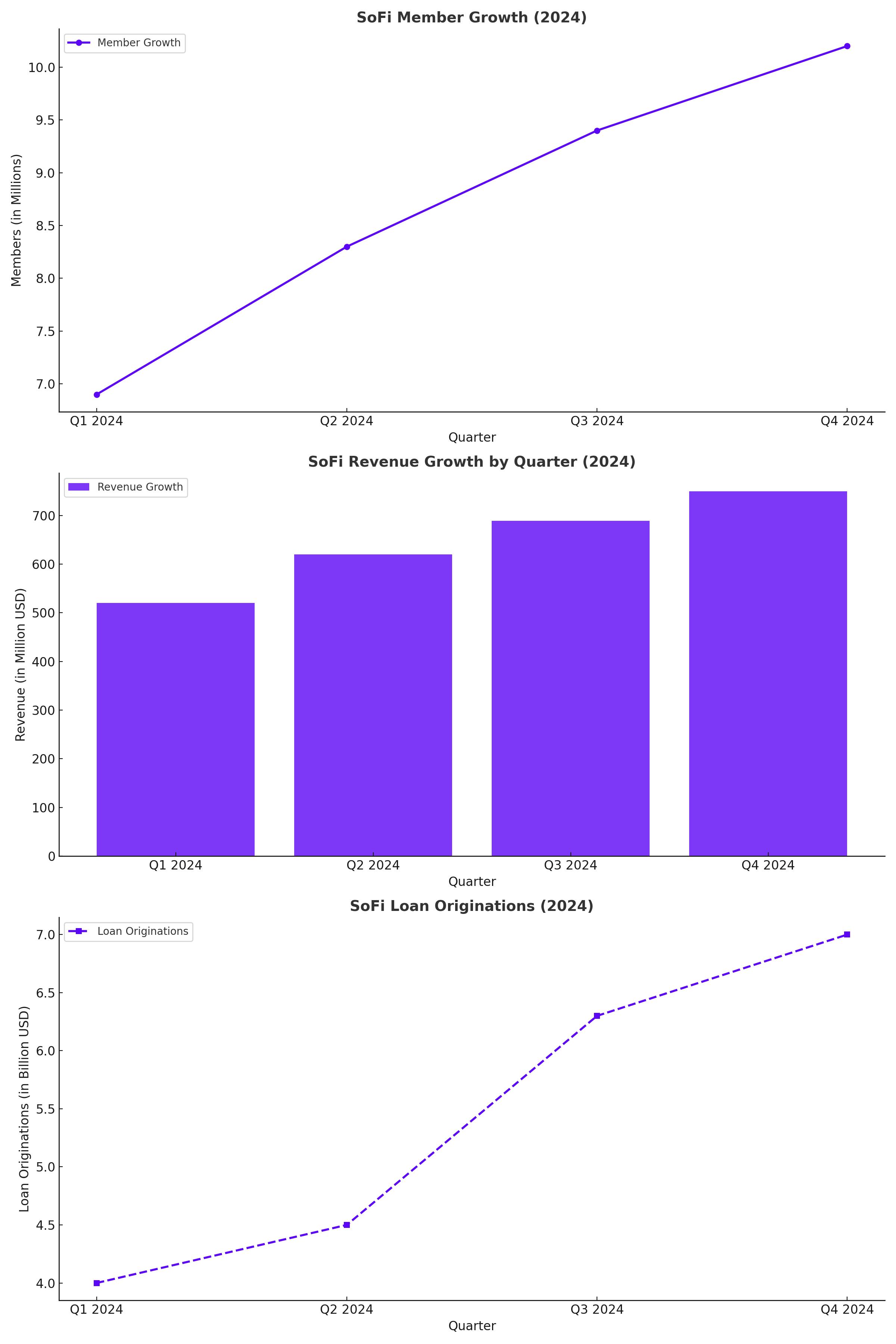

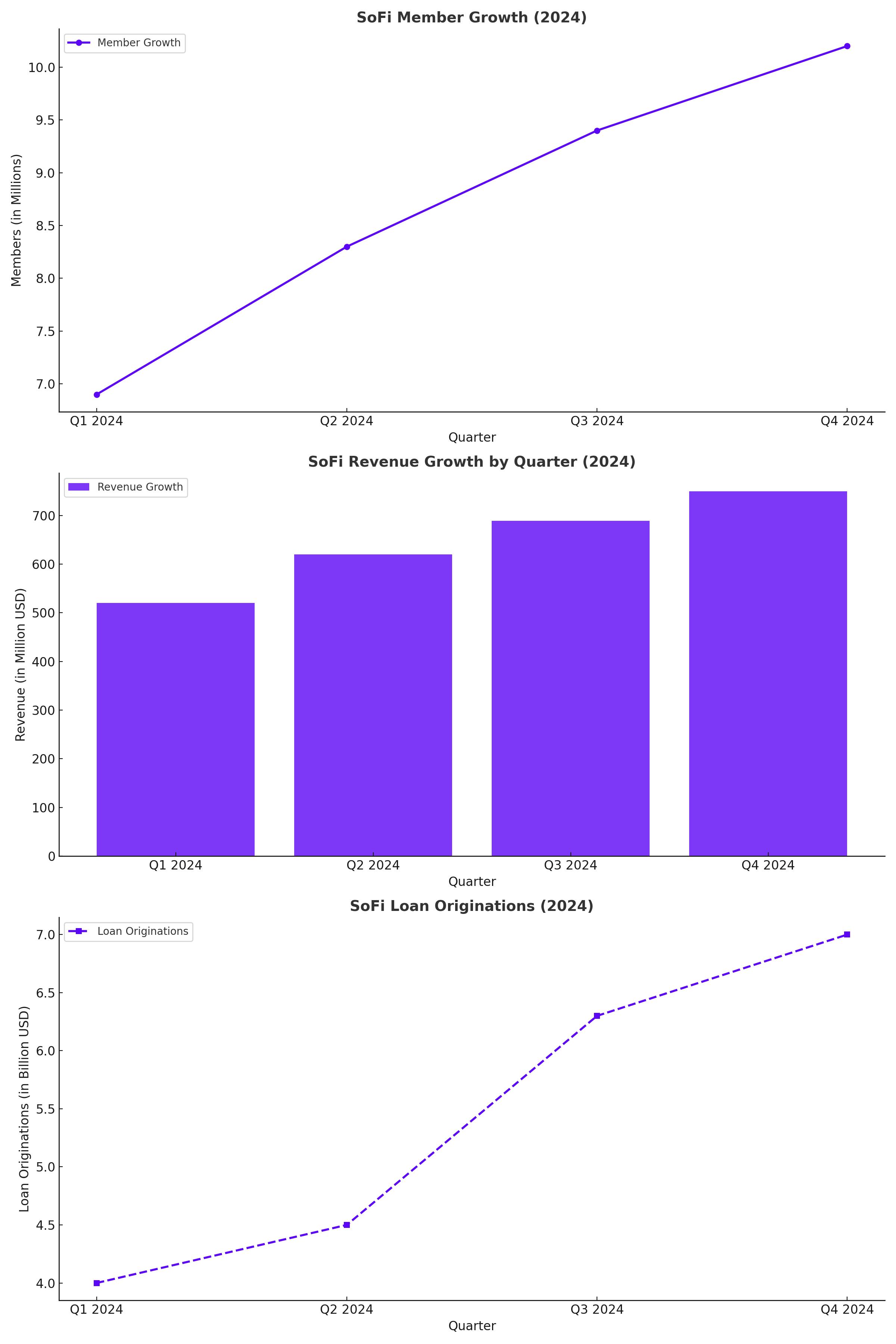

In Q3 2024, SoFi recorded a 35% year-over-year increase in members, reaching 9.4 million, driven by strategic marketing and enhanced product offerings. It also added 1.1 million new products, marking a 37% YoY surge. This expansion reflects SoFi's ability to attract and retain customers with its comprehensive ecosystem of financial services.

The platform’s annualized revenue per product reached $81, a notable 52% increase YoY, showcasing SoFi’s capacity to monetize its growing member base effectively. Products like SoFi Money, Invest, and personal loans have seen heightened adoption, with 32% of new products coming from existing members, indicating strong cross-selling success.

Diversified Revenue Streams and Fee-Based Income Focus

Management has strategically shifted toward fee-based revenue, which now constitutes 25% of adjusted net revenue, making SoFi less reliant on interest-rate-sensitive lending. Notably, SoFi's loan platform generated $61 million in revenue in Q3, with $56 million derived from platform fees—a 5x increase YoY. This transition stabilizes earnings and positions the company for sustainable growth.

SoFi's lending business remains a cornerstone of its operations, contributing $391.9 million to net revenue in Q3, a 15.58% QoQ increase. Personal loans dominated originations, accounting for $4.9 billion of the $6.3 billion total in Q3, reflecting strong demand in this segment.

Impressive Financial Performance and Raised Guidance

Q3 2024 marked a turning point for profitability, with net income reaching $60.7 million compared to a $266.7 million loss a year earlier. Adjusted EBITDA soared to $186 million, a 27% YoY increase, while the adjusted EBITDA margin expanded to 27%. Revenue grew to $689 million in Q3, a robust 30% YoY rise, driven by higher loan originations and increased adoption of financial services.

Management raised full-year 2024 guidance, projecting revenue between $2.535 billion and $2.55 billion and adjusted EBITDA in the range of $640 million to $645 million. This upward revision reflects SoFi’s confidence in its growth trajectory, supported by a surge in tangible book value growth expected to exceed $1 billion in 2024.

Technology Platform and Banking-as-a-Service (BaaS) Potential

The Technology Platform segment, including Galileo and Technisys, reported $102.5 million in revenue in Q3, a 14% YoY increase. Galileo’s Transaction Risk GScore and Instant Verification Engine have enhanced SoFi’s fraud prevention capabilities, strengthening its appeal to institutional partners.

SoFi is participating in RFPs to provide banking infrastructure to other financial institutions, signaling its ambition to become a leader in banking-as-a-service (BaaS). CEO Anthony Noto expressed confidence in securing significant contracts, which could unlock recurring revenue streams and solidify SoFi’s hybrid valuation as both a fintech and a technology company.

Balance Sheet Strength and Competitive Advantage

Since obtaining its national banking charter in Q1 2022, SoFi's deposits have grown by over 2,000%, reaching $23.25 billion. This growth far outpaces legacy banks like JPMorgan (down 5.09%) and Bank of America (down 6.85%) during the same period. The ability to attract deposits underscores SoFi's competitiveness against traditional financial institutions.

SoFi’s leverage ratio improved from 15% at the end of 2023 to 14% in Q3 2024, reflecting prudent financial management. Additionally, its forward-thinking product innovations, such as alternative investment options and white-label credit cards, enhance its market position.

Risks and Challenges

Despite its strong performance, SoFi faces risks from declining net interest margins, which fell to 5.57% in Q3 from 5.99% a year earlier. The Federal Reserve’s anticipated rate cuts in 2025 could further pressure margins. Additionally, reliance on personal loans, which comprise 77% of total loan originations, exposes SoFi to higher credit risk during economic downturns.

Insider selling between June and October raises concerns, particularly if it continues. However, institutional activity remains supportive, with notable purchases from Dimensional Fund Advisors and JPMorgan in Q3.

Valuation and Market Sentiment

SoFi trades at 6x sales, a premium compared to many peers but justified by its robust growth and diversification. While short interest remains above 15%, signaling skepticism, the company's performance defies bearish expectations. Analysts have revised price targets upward, with firms like JPMorgan raising their target to $16, reflecting optimism about SoFi's growth prospects.

Conclusion: NASDAQ:SOFI – A Growth Powerhouse

SoFi Technologies has demonstrated remarkable resilience and innovation, achieving record member growth, robust financial performance, and a successful pivot to fee-based income. While challenges remain, the company’s strong fundamentals, technological edge, and expanding product ecosystem position it as a transformative force in the financial industry. As the hybrid fintech-tech valuation narrative gains traction, SoFi remains a compelling investment for long-term growth.

That's TradingNEWS

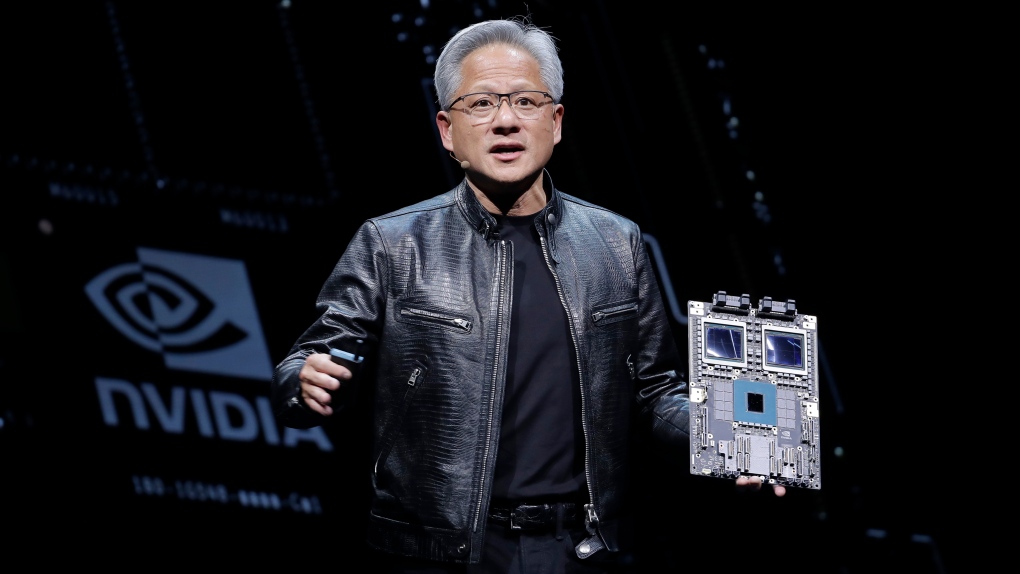

NVIDIA (NASDAQ:NVDA): The Powerhouse Behind AI’s Multi-Trillion-Dollar Boom

NVIDIA (NASDAQ:NVDA): The Powerhouse Behind AI’s Multi-Trillion-Dollar Boom

Microsoft (NASDAQ:MSFT): Racing Toward $500 on AI and Gaming Explosion

Microsoft (NASDAQ:MSFT): Racing Toward $500 on AI and Gaming Explosion

SoFi Technologies (NASDAQ:SOFI): Revolutionizing Finance with Explosive Growth

SoFi Technologies (NASDAQ:SOFI): Revolutionizing Finance with Explosive Growth

Chevron (NYSE:CVX) Ignites Momentum: Record Permian Growth, $75B Buybacks, and High-Yield Dividends

Chevron (NYSE:CVX) Ignites Momentum: Record Permian Growth, $75B Buybacks, and High-Yield Dividends

Archer Aviation (NYSE:ACHR) Soars 125%: Pioneering the Future of Urban Air Travel

Archer Aviation (NYSE:ACHR) Soars 125%: Pioneering the Future of Urban Air Travel