Warner Bros. Discovery (NASDAQ:WBD): Streaming Surge, Debt Moves, and Blockbuster Expectations

With 7M+ New Subscribers, Debt Payments Near $1B, and the Next Big Blockbuster on the Horizon, Is WBD Positioned for a Major Comeback? | That's TradingNEWS

Warner Bros. Discovery (NASDAQ:WBD): A Comprehensive Analysis of Q3 Earnings, Debt Challenges, and Strategic Opportunities

Debt Reduction: A Pressing Priority

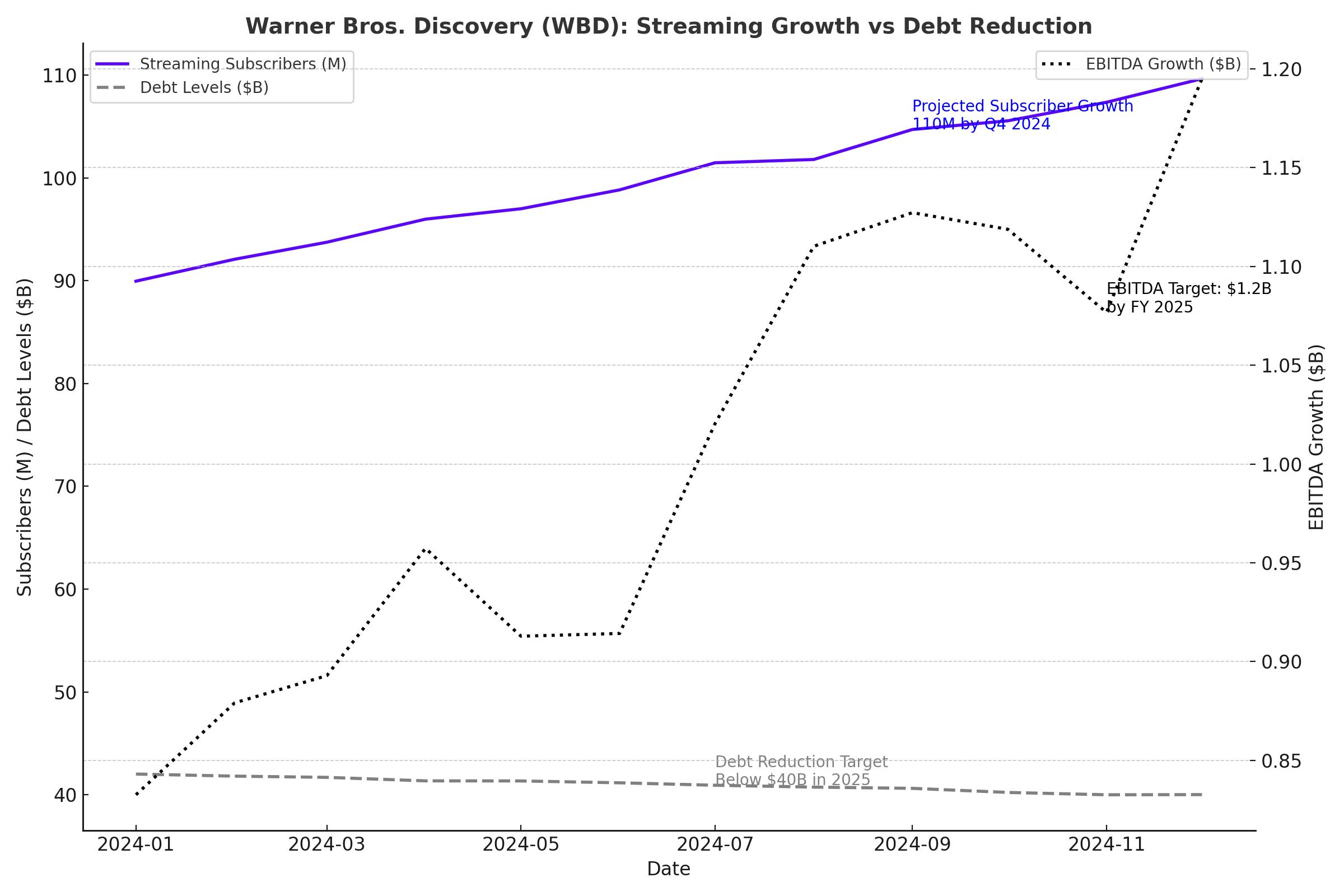

Warner Bros. Discovery (NASDAQ:WBD) continues to face significant headwinds from its substantial debt burden, which currently stands at $40.7 billion, reflecting a leverage ratio of 4.2x. In Q3 2024, the company made progress by reducing its debt by $900 million from the previous quarter, but this remains a slow process given the challenges in its operating environment.

Interest expenses reached $1.5 billion over the past nine months, and the company’s free cash flow has decreased to $600 million, down from $2 billion in the same period last year. This declining cash flow amplifies the urgency to aggressively deleverage. Analysts speculate that asset divestitures, such as cable channels or even non-core assets like video game divisions, could be considered as potential pathways to generate liquidity and reduce financial pressure.

For real-time insights into Warner Bros. Discovery's financial health and insider transactions, visit WBD stock profile.

Q3 Earnings: A Glimmer of Hope

The Q3 earnings release on November 7, 2024, brought some positive news, propelling the stock by nearly 12% to $9.37. The company swung to a GAAP profit of $0.05 per diluted share, beating Wall Street expectations by $0.12. However, on a nine-month basis, Warner Bros. recorded a deeper loss of $4.42 per share compared to $1.12 in the previous year.

Despite these financial hurdles, valuation metrics remain favorable. WBD’s forward price-to-cash-flow ratio stands at 4, significantly below the sector median of 8, while its EV/EBITDA ratio of 6 aligns well with industry standards.

For a deeper look at WBD's real-time stock performance, click here.

Streaming Growth: A Bright Spot

The streaming segment reported its best quarter ever, with global subscriber additions exceeding 7.2 million, bringing the total base to over 110 million. This growth has been fueled by bundling strategies and new product offerings, such as the collaboration with Disney+.

Streaming EBITDA surged to record highs, demonstrating disciplined cost control. Warner Bros. Discovery expects its direct-to-consumer (DTC) business to surpass $1 billion in EBITDA by FY2025. In comparison, Netflix took years to achieve positive cash flow in this segment, highlighting WBD’s operational efficiency.

Theatrical and Content Strategy: Consistency Is Key

The studio segment underperformed due to weaker-than-expected results from major releases like The Joker sequel, which grossed just $200 million globally. In contrast, the Barbie movie remains a high benchmark for future releases. However, the upcoming summer slate, led by high-profile projects like Superman, could provide much-needed momentum.

Management has emphasized the need for consistency across its content pipeline. The current restructuring aims to avoid over-reliance on blockbuster hits and instead focus on steady performance across theatrical and streaming platforms.

Games and Networks: Areas for Improvement

The gaming division, while promising, faced impairment charges this quarter. CEO David Zaslav has committed to a quality-over-quantity approach, echoing strategies seen at rivals like Disney. Meanwhile, the networks segment experienced EBITDA declines due to linear audience reductions and Olympic-related expenses. However, post-Olympics monetization opportunities could mitigate these losses in the coming quarters.

Debt Sustainability and Balance Sheet Management

Warner Bros. Discovery’s financial strategy centers on maintaining manageable debt levels while pursuing growth. With $3.5 billion in cash and a 13.6-year average debt maturity at 4.7% interest, the company has avoided near-term solvency risks. However, it remains imperative to reduce debt by at least $10–15 billion over the next five years to enhance financial flexibility and lower its $2 billion annual interest burden.

Valuation and Technical Analysis

Technically, WBD’s stock shows potential but has yet to confirm a breakout. Following the Q3 earnings rally, the stock retraced to $9.18 on November 8. The 52-week high of $12 remains a key resistance level. Investors are closely watching for further asset sales and operational improvements to sustain upward momentum.

Strategic Outlook: M&A and Long-Term Vision

Speculation around potential acquisitions or activist investor involvement has gained traction. Apple’s rumored interest in Warner Bros. highlights the strategic value of its content library. However, antitrust concerns and the company’s existing debt may complicate such moves.

Zaslav’s focus on streamlining operations, coupled with the potential for billion-dollar hits from franchises like DC and Harry Potter, could catalyze a turnaround. Additionally, improvements in EBITDA and free cash flow would position WBD for institutional investor interest, potentially driving the stock above $10.

Final Take: A Speculative Buy with Long-Term Potential

Warner Bros. Discovery (NASDAQ:WBD) offers a compelling deep-value investment opportunity for patient investors. While the road to recovery is fraught with challenges, the company’s strategic focus on deleveraging, streaming growth, and consistent content production positions it well for a rebound. Investors should monitor developments closely, particularly regarding asset sales and operational execution, as these will dictate the pace of recovery and shareholder returns.