WTI Crude Breaks $78 – Can Oil Prices Rally to $90 Amid Supply Cuts and Geopolitical Tensions?

With OPEC+ delaying production hikes and Russia prioritizing China over Europe, oil markets are tightening fast. Will crude oil prices continue their climb, or will economic uncertainty trigger a pullback? | That's TradingNEWS

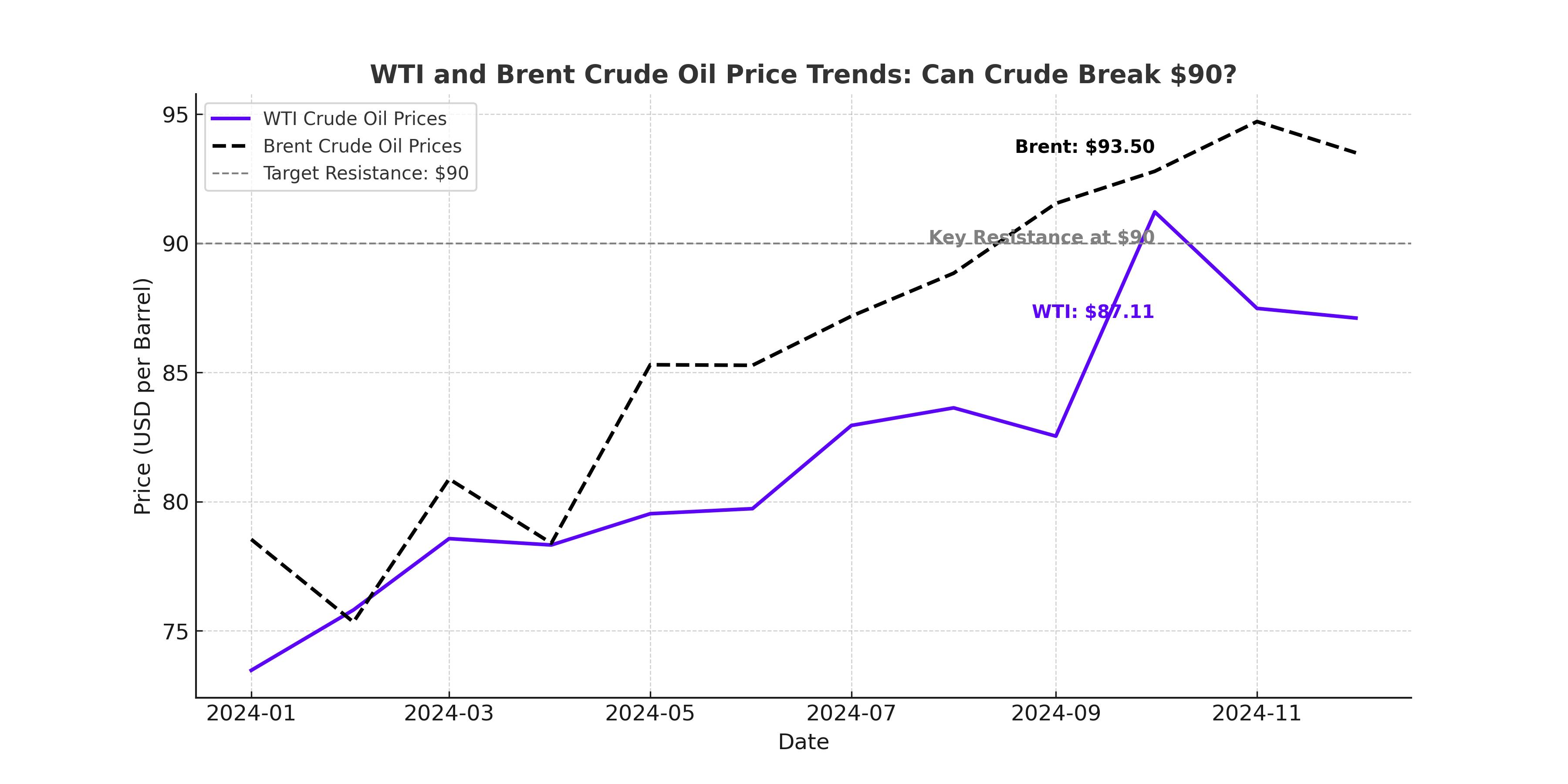

WTI and Brent Oil Prices Surge: Can Crude Break $90 or Is a Reversal Coming?

OPEC+ Supply Cuts and Delayed Production Increases Tighten Global Oil Markets

Oil prices are surging as global supply constraints, geopolitical tensions, and shifting demand dynamics push WTI (CL=F) and Brent (BZ=F) higher. West Texas Intermediate crude (WTI) is trading near $78 per barrel, while Brent crude has climbed above $82, fueled by OPEC+ production cuts, Russia’s shift in crude exports, and rising demand from China. The big question for traders and investors: will crude oil break through $90 in the coming months, or are these gains setting the stage for another correction?

OPEC+ Sticks to Supply Cuts – Why It’s Keeping Oil Prices High

OPEC+ has once again demonstrated its control over global oil markets by delaying the planned production hike initially scheduled for early 2025. The cartel had intended to gradually unwind voluntary supply cuts, but mounting concerns over demand stability and price weakness led to a strategic pause. The decision effectively removes over 800,000 barrels per day from the market in 2025, tightening global supply and providing a bullish backdrop for oil prices.

OPEC+ leaders, particularly Saudi Arabia, have been clear in their stance: they want to prevent an oversupply scenario that could send oil prices crashing. This strategy has worked so far, with WTI rebounding from its lows of $70 per barrel late last year. The next critical moment will be OPEC’s meeting in April, where discussions on potential output increases will take center stage. If the cartel maintains production discipline, crude could push above $85.

Russia’s Oil Exports Shift: Will China’s Demand Keep Prices Elevated?

Russia’s crude oil exports fell 2.8% in 2024 as Moscow cut production in line with its OPEC+ commitments. However, the real story lies in where that oil is going. With European markets effectively closed due to sanctions, Russia has redirected massive volumes of crude to China and India. Gazprom’s pipeline flows to China reached full capacity, and shipments of Russian Urals crude to Asia surged, providing some price stability for Moscow despite Western restrictions.

China's economy remains a critical factor for oil prices. While demand has shown resilience, any signs of economic weakness could weigh on crude markets. So far, China has been absorbing discounted Russian barrels, keeping global supply relatively tight. But if Chinese demand slows, it could introduce fresh volatility into oil markets.

U.S. Shale Producers Hold Steady – No Rapid Production Growth This Time

Unlike previous oil price surges where U.S. shale drillers rapidly ramped up output, 2025 is shaping up differently. Major oil companies like ExxonMobil (NYSE: XOM) and Chevron (NYSE: CVX) have focused on capital discipline rather than aggressive expansion. U.S. production remains near record highs at around 13.1 million barrels per day, but there’s little indication of a major supply surge that could disrupt OPEC+’s market control.

Shale companies have shifted their priorities toward shareholder returns, buybacks, and dividends rather than aggressive drilling campaigns. This means that even if oil prices climb higher, we won’t necessarily see a flood of new U.S. supply hitting the market.

Trump’s Oil Policy – Will OPEC Bow to U.S. Pressure to Lower Prices?

Former President Donald Trump has made it clear that he wants lower oil prices. In a recent speech, he called on Saudi Arabia and OPEC to cut prices, arguing that high crude prices are fueling Russia’s war effort in Ukraine. However, OPEC+ is unlikely to comply. The cartel’s current strategy is focused on market stability, and slashing prices too quickly could destabilize key economies that rely on higher oil revenues.

Trump’s stance on energy policy could also have broader implications. His push for U.S. energy independence could lead to further deregulation of the shale industry, potentially encouraging more domestic production. However, OPEC+ holds the real power over global prices, and as long as the cartel sticks to its current supply strategy, crude oil will likely remain supported.

Technical Levels to Watch: Can WTI Break $85 and Brent Reach $90?

From a technical perspective, WTI crude is approaching key resistance levels. The $80 per barrel mark is a major psychological and technical barrier. If WTI breaks above $80, the next target would be $85, with a possible run toward $90 if bullish momentum continues.

For Brent crude, the key resistance level is around $85. A breakout above this could send prices toward $90 per barrel, a level not seen since late 2023. However, traders should watch for potential profit-taking if prices approach these levels too quickly.

On the downside, WTI has strong support around $75. A drop below this level could signal a pullback toward $70, particularly if economic concerns resurface or OPEC+ unexpectedly increases production.

Outlook: Bullish Momentum Remains, But Risks Loom

Oil prices have strong bullish catalysts in 2025, driven by OPEC+ supply cuts, Russia’s export strategy, and resilient global demand. However, risks remain. A slowdown in China’s economy, unexpected production increases from the U.S. or OPEC, or shifts in geopolitical dynamics could all impact crude markets.

For now, the path of least resistance remains upward, with WTI crude eyeing $80+ and Brent crude potentially testing $90 in the coming months. The market remains volatile, and traders should be prepared for sharp price swings as supply and demand dynamics evolve.

That's TradingNEWS

Gold Price Smashes $2,775 – Is a Break Above $2,800 Inevitable?

WTI Crude at $72.62 – Will Oil Prices Bounce Back or Crash Lower?