Can NVIDIA (NASDAQ:NVDA) Reach $350 Amid Soaring AI Demand?

Exploring NVIDIA's AI leadership, record-breaking financials, and the strategic innovations driving its growth toward a $350 valuation | That's TradingNEWS

NVIDIA Corporation (NASDAQ:NVDA): A Comprehensive Analysis of Growth Potential Amid Technological Breakthroughs

Understanding NVIDIA’s Dominance and AI-Driven Expansion

NVIDIA Corporation (NASDAQ:NVDA) stands at the forefront of the technological revolution, driven by its unmatched dominance in the GPU market and rapid adoption of artificial intelligence (AI) applications. With a market share exceeding 90% in AI GPUs, NVIDIA’s position as the go-to supplier for AI and machine learning solutions has been further solidified by its strategic innovations, including the upcoming Blackwell and Rubin GPU architectures. The company’s ability to meet the surging demand for AI-driven data centers underscores its unmatched market leadership. Recent breakthroughs in quantum computing, led by Alphabet's Willow chip, highlight the rapidly advancing technological landscape in which NVIDIA is poised to thrive.

NVDA Stock’s Financial Momentum

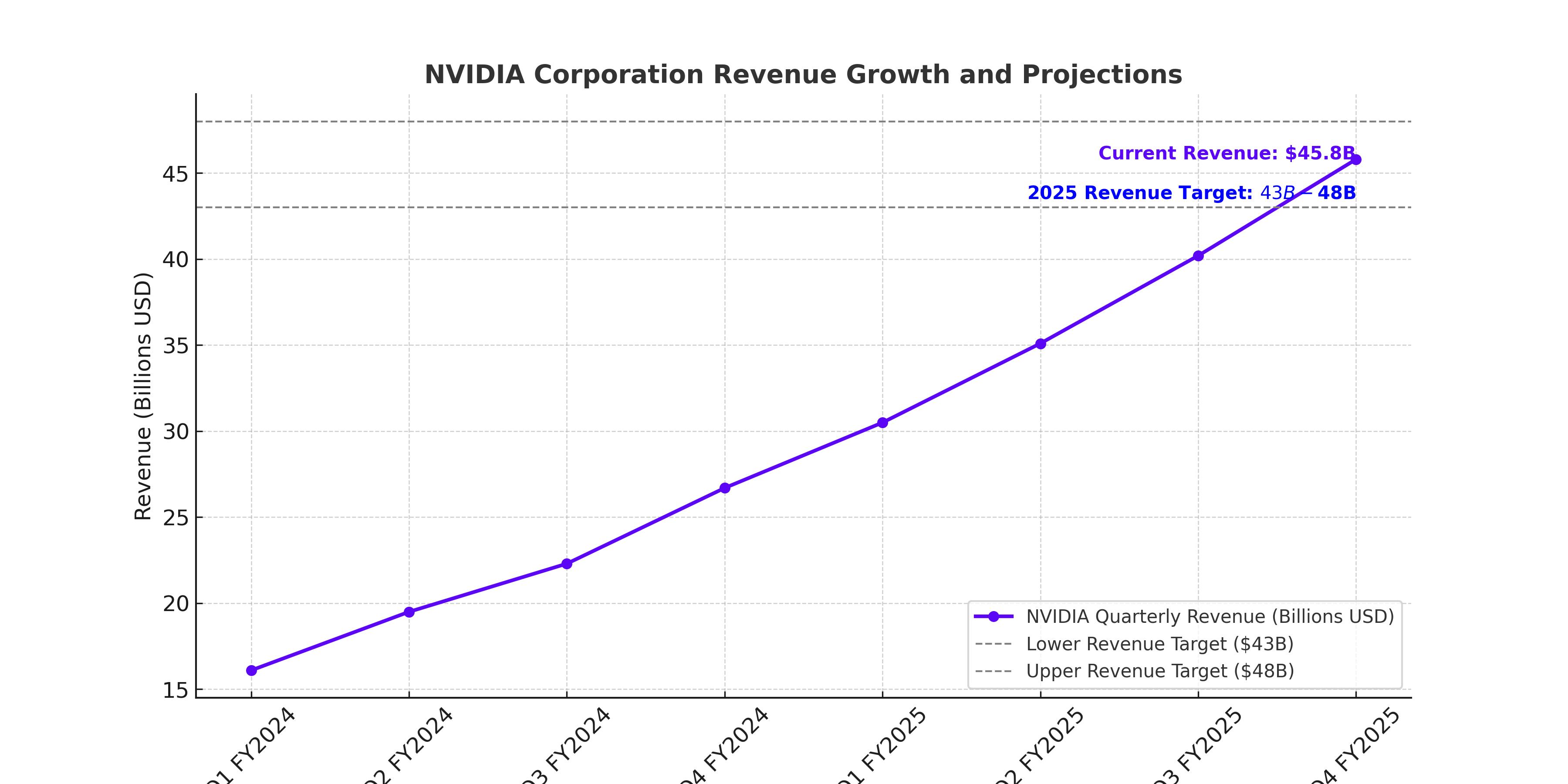

NVIDIA’s financial performance is nothing short of remarkable. In Q3 FY2025, the company reported a staggering $35.1 billion in revenue, marking 94% year-over-year growth. Its data center segment accounted for 88% of total revenue, driven by unprecedented demand for AI-focused GPUs. Free cash flow for the quarter reached $16.8 billion, positioning NVIDIA to potentially cross the $100 billion annual free cash flow threshold by 2025. This immense liquidity not only provides resilience but also enables substantial shareholder returns through dividends and stock buybacks.

The company’s operating income for the first nine months of FY2025 reached $61.3 billion, a 16x increase compared to FY2020. NVIDIA’s ability to capitalize on the expanding market for AI-driven applications and accelerated computing is a testament to its strategic execution.

Scaling AI Factories and Expanding Total Addressable Market

NVIDIA’s concept of "AI factories" represents a transformative shift in data center infrastructure. These facilities, optimized for continuous intelligence production, are set to drive the next wave of AI adoption. NVIDIA’s full-stack solutions, encompassing GPUs, DPUs, NVLink, Grace CPUs, and proprietary software frameworks, provide unparalleled integration capabilities for these high-compute infrastructures.

With the rise of generative AI and reasoning-centric models like OpenAI’s o3, the demand for test-time compute has skyrocketed. This paradigm shift requires exponentially larger inference clusters, which NVIDIA is uniquely positioned to deliver. The company’s ecosystem, supplier relationships, and decades of innovation ensure its capacity to meet these unprecedented computational demands.

Innovations in GPU Technology: Blackwell and Rubin

The Blackwell B200 GPU is a critical component of NVIDIA’s growth trajectory. Featuring 208 billion transistors and groundbreaking efficiency improvements, this chip is designed to meet the escalating demands of AI training and inference. By reducing costs and energy consumption by up to 25x compared to previous models, Blackwell exemplifies NVIDIA’s commitment to pushing technological boundaries. The anticipated launch of the Rubin GPU in 2026 further reinforces NVIDIA’s innovation pipeline, promising enhanced performance and energy efficiency.

NVIDIA’s Competitive Landscape

While NVIDIA remains the undisputed leader in AI GPUs, it faces intensifying competition from AMD, Intel, and hyperscalers like Amazon and Google, which are developing proprietary chips for specific workloads. However, NVIDIA’s unmatched product versatility and superior performance metrics maintain its competitive edge. For example, NVIDIA GPUs are indispensable for complex AI training and inference tasks, which competitors' in-house solutions have yet to rival.

The company’s strategic partnerships with hyperscalers mitigate competitive pressures. Amazon and Google continue to rely on NVIDIA’s high-performance GPUs for their AI infrastructure, underscoring the enduring demand for NVIDIA’s products despite efforts to diversify.

Valuation and Investor Outlook

At a forward P/E ratio of 30.4x, NVIDIA offers compelling value given its dominant market position and robust growth prospects. Analysts project a 25% annual EPS growth rate over the next five years, aligning with NVIDIA’s trajectory toward achieving $100 billion in free cash flow by 2025. The company’s forward-looking strategies, coupled with its ability to leverage AI adoption, position NVDA as a top investment opportunity.

DCF analysis suggests a fair value range of $315–$350 per share, indicating significant upside potential from current levels. NVIDIA’s ability to generate shareholder value through dividends, stock buybacks, and continued innovation makes it an attractive option for long-term investors.

Risks and Mitigation

NVIDIA’s reliance on AI and data centers as primary revenue drivers presents a concentration risk. Any slowdown in these sectors could impact financial performance. Additionally, advancements in alternative computing technologies or increased competition could challenge NVIDIA’s market dominance. However, the company’s continuous innovation and strategic diversification mitigate these risks.

Final Perspective

NVIDIA Corporation (NASDAQ:NVDA) stands as a dominant force in the rapidly expanding AI and accelerated computing sectors. Boasting a market-leading portfolio that includes its groundbreaking Blackwell and H100 GPUs, NVIDIA has solidified its role as the backbone of AI infrastructure, driving demand across data centers and emerging AI factories. With shares recently correcting to approximately $430, this presents a compelling entry point for investors eyeing long-term growth. NVIDIA’s robust financial performance, including a projected $100 billion in annual free cash flow by 2025, underscores its unmatched scalability in an industry expected to grow at a 30% CAGR through 2030. For further insights into NVDA’s trajectory and to explore its performance, access the NVIDIA stock chart and insider transactions.

That's TradingNEWS

Read More

-

SCHG ETF Near $33 High As AI Giants Drive 19% 2025 Rally

01.01.2026 · TradingNEWS ArchiveStocks

-

XRP-USD Stuck At $1.87 As XRPI Near $10.57 And XRPR Around $14.98 Despite $1.16B ETF Wave

01.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Slides Toward Key $3.57 Support As Ng=F Extends 33% Drop

01.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Near 156 As Fed Cuts Meet Boj Hawkish Turn

01.01.2026 · TradingNEWS ArchiveForex