Will Micron Technology (NASDAQ:MU) Regain Momentum and Hit $115?

Micron's (NASDAQ:MU) focus on AI-driven DRAM and HBM offers hope, but can it overcome NAND weakness and market pressures? | That's TradingNEWS

Micron Technology (NASDAQ:MU): Navigating Cycles and AI Opportunities

Micron Technology (NASDAQ:MU), a global leader in memory and storage solutions, has recently found itself at the center of market volatility. The company’s first-quarter FY2025 earnings revealed a complex picture: robust growth in DRAM and AI-driven segments offset by weakness in consumer-oriented NAND products. As Micron's shares trade near $85 following a sharp selloff, the question arises: does this represent a compelling buying opportunity, or is there more turbulence ahead?

The Impact of Memory Market Cyclicality on NASDAQ:MU

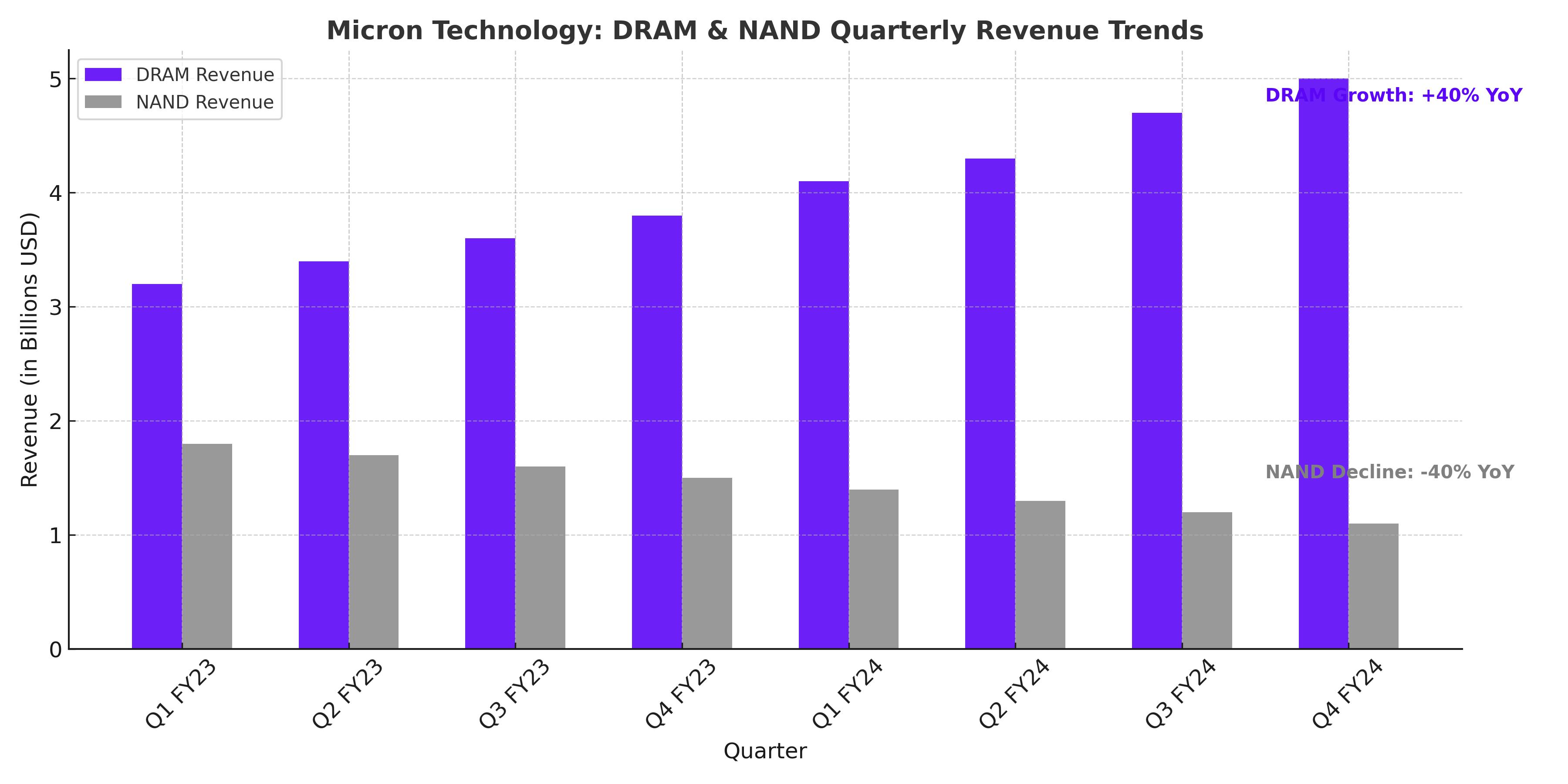

Micron’s revenue has historically been highly cyclical, reflecting the boom-and-bust nature of the memory industry. In FY2023, Micron experienced a staggering 50% year-over-year revenue decline, underscoring the risks inherent in this sector. Investors have often discounted MU stock during down cycles, fearing prolonged revenue contractions. However, this pattern also presents opportunities. In August 2022, MU shares hovered near $45 during a cyclical trough, only to rally above $150 in June 2024 before retracing to current levels.

The memory industry remains inherently cyclical due to supply-demand imbalances and pricing volatility. Micron has strategically positioned itself to weather these fluctuations, leveraging its technological edge and strong foothold in DRAM, which accounted for 73% of total revenue in Q1 FY2025. The company's ability to adapt to shifting market conditions, including its focus on AI-centric products, offers some insulation from the cyclical risks traditionally associated with NAND products.

DRAM and AI: The Bright Spots for NASDAQ:MU

Micron's DRAM business has been a standout performer, with revenue up 20% quarter-over-quarter in Q1 FY2025. High-bandwidth memory (HBM), a critical component for AI workloads, has emerged as a growth engine. Data center revenue now constitutes over 50% of Micron's total revenue, a dramatic increase from 20% just a year ago. This shift underscores Micron's strategic pivot towards AI-driven applications, which demand advanced memory solutions.

Micron’s heavy reliance on Nvidia (NASDAQ:NVDA), the leader in AI accelerators, presents both opportunities and risks. Nvidia's dominance in AI could propel Micron's HBM sales further, but any slowdown in Nvidia's growth or market share could adversely impact Micron. The company faces stiff competition from SK Hynix and Samsung, both of which are aggressively expanding their HBM capabilities. Notably, Nvidia CEO Jensen Huang has evaluated Samsung's latest HBM3E offerings, signaling potential diversification in Nvidia's supply chain.

NAND Weakness Weighs on Q1 FY2025 Performance

While DRAM and HBM have been bright spots, Micron's NAND revenue has struggled. A 4.7% sequential decline in NAND revenue reflects sluggish demand in consumer markets, including PCs and smartphones. Excess inventory and weak seasonal trends have exacerbated the downturn. Micron anticipates continued softness in NAND through the first half of FY2025, with potential for recovery in the latter half as inventory levels normalize and enterprise demand strengthens.

Capex Prioritization and the AI Opportunity

Micron has raised its FY2025 capital expenditure guidance to $14 billion, focusing on DRAM and HBM production capacity. This represents a significant investment, with capex accounting for approximately 40% of projected revenue, up from prior guidance in the mid-30% range. This strategic pivot underscores Micron's commitment to capturing the growing demand for AI-driven memory solutions.

While the increased capex reflects confidence in long-term growth, it also raises near-term concerns about free cash flow. If demand for AI solutions does not scale as expected, Micron could face challenges in justifying these investments.

Valuation and Investor Sentiment

Micron’s stock is trading at a forward P/E multiple of 7.9x, significantly below the sector average and its historical peak valuation of 12.2x in June 2024. Despite the recent selloff, Micron remains attractively valued relative to its growth prospects, with a forward PEG ratio of 0.36. Analysts expect 44% year-over-year EPS growth in FY2025, driven by robust demand for AI-centric memory products and improving gross margins.

The recent pullback has also realigned investor expectations. Market pessimism appears priced in, particularly regarding NAND weakness and near-term margin pressures. However, the potential for a rebound in HBM and DRAM sales in the latter half of FY2025 provides a compelling case for long-term investors.

Risks to Watch for NASDAQ:MU Investors

Micron faces several risks, including its reliance on Nvidia, competitive pressures from SK Hynix and Samsung, and macroeconomic uncertainties. Additionally, any delays in the recovery of consumer markets or softer-than-expected AI demand could impact revenue and margins. While the company's AI-focused strategy has strong potential, its concentration in data center applications makes it vulnerable to shifts in enterprise spending.

Outlook for NASDAQ:MU

Micron’s transformation into a leader in AI memory solutions positions it for long-term growth. The stock's current valuation, coupled with its strategic investments in DRAM and HBM, suggests significant upside potential as the AI market expands. However, investors must weigh these opportunities against near-term challenges, including NAND weakness and heightened competitive pressures.

Micron’s stock appears poised for a recovery, with the $115 resistance level serving as a critical threshold. Long-term investors should view the recent pullback as a buying opportunity, especially given the company’s attractive valuation and growth potential in the AI-driven memory market. Whether MU can capitalize on these trends will depend on its ability to execute on its ambitious capex plans and maintain its competitive edge in a rapidly evolving industry.

That's TradingNEWS

Read More

-

NLR ETF at $145.21: Uranium, Nuclear Power and the AI Baseline Energy Trade

14.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Demand Lifts XRPI, XRPR and Bitwise XRP as XRP-USD Defends $2.10 Support

14.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Slides Toward $3 as Warm Winter Clashes With LNG Demand

14.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Climbs Toward 160 as Japan’s Debt Fears Clash With BoJ Hike Hopes

14.01.2026 · TradingNEWS ArchiveForex