Indices Plunge as Growth Concerns Mount

Global equity benchmarks suffered steep reversals on Friday, with the Dow Jones Industrial Average tumbling 542.40 points (–1.23%) to 43,588.58, its sharpest single‐day slide since mid‐June. The S&P 500 surrendered 1.60%, closing at 6,238.01, marking a 2.4% weekly loss, while the Nasdaq Composite slumped 2.24% to 20,650.13, erasing gains built earlier in August. Defensive sectors briefly outperformed, but the magnitude of the sell‐off left most large‐caps in material drawdowns for the week.

Labor Market Softness Intensifies Fed Uncertainty

July’s payroll gain of only 73,000 jobs starkly undershot the 100,000 economist forecast, and downward revisions to May and June subtracting roughly 264,000 roles collectively painted a bleaker picture of hiring resilience. Despite the unemployment rate holding at 3.8%, the trend of shrinking job additions—a drop from 147,000 in June (revised to 14,000) and 125,000 in May (revised to 19,000)—has sent traders scrambling to reprice the path of monetary policy.

Tech Leaders Feel the Heat

Magnificent Seven heavyweights bore the brunt of the technology correction. Amazon (AMZN) plunged north of 8% after guiding to lighter operating income, while Nvidia (NVDA) erased 3.8% amid concerns that AI‐driven data‐center spending may decelerate. Meta Platforms (META) retreated 3.0% despite record ad‐revenue beats, and Apple (AAPL) gave back 2.5% following its strongest revenue growth in three years. Microsoft (MSFT), Alphabet (GOOG) and Tesla (TSLA) each surrendered 1.5%–1.8%, underscoring the breadth of the tech unwind.

Banking Sector Under Pressure

Fears of slowing credit demand and rising provisions weighed on financial stocks. JPMorgan Chase (JPM) slid 2.1%, Bank of America (BAC) –3.4%, Wells Fargo (WFC) –3.2%, Goldman Sachs (GS) –3.5% and Citigroup (C) –4.0%. The sector’s forward P/E multiples contracted as investors anticipated margin compression from muted lending growth and elevated funding costs.

Energy Earnings Hampered by Price Headwinds

Chevron (CVX) reported Q2 net income of $2.49 billion, down 44% year-over-year, a decline driven by softer oil benchmarks and the drag from the Hess acquisition. Although the stock fell only 0.1% in after-hours trading, the pronounced earnings slump highlights the challenges of balancing M&A integration with cyclical commodity swings.

Manufacturing Activity Slides into Contraction

The ISM manufacturing index dipped to 48.0, below expectations of 49.5 and deeper into contractionary territory. Capital‐goods bellwethers like Caterpillar (CAT) and GE Aerospace (GE) fell 1.5%–2.0%, signaling investors’ unease over potential capex pullbacks as industrial demand softens.

Consumers Trade Down as Tariffs Bite

The University of Michigan’s headline sentiment inched up to 61.7 but remains 7.1% below last year’s level, with one-year inflation expectations cooling to 4.5%—their lowest since February—and the five-year outlook at 3.4%. Evidence of household frugality emerged in appliance and household‐goods names: Whirlpool (WHR) shares plunged over 13% after reporting a 5% drop in North American major appliance sales, and Procter & Gamble (PG) flagged consumer shifts toward economy detergent SKUs like Gain.

Tariff Escalation Deepens Global Trade Uncertainty

President Trump’s expanded duties—35% on Canadian exports (up from 25%), 39% on Swiss watches, and up to 41% on transshipped goods—have roiled market sentiment. Luxury‐goods plays Richemont (CFR), Swatch Group (UHR) and Watches of Switzerland (WOSG) are bracing for margin pressure, while U.S. importers face sharper supply‐chain cost inflation.

Fed Rate-Cut Odds Surge on Disappointing Data

Following the weak jobs figures, CME Fed futures now embed an 86% probability of a 25 bp cut in September, and the prediction market Kalshi reflects 75% odds of that move (with an 8% chance of a larger cut). Governors Michelle Bowman and Christopher Waller publicly dissented, advocating an immediate quarter-point reduction, underscoring the growing divide on policy timing.

Market Breadth Reveals Winners and Losers

During Friday’s rout, 25 S&P 500 constituents hit new 52-week lows—including Charter Communications (CHTR), Chipotle (CMG), Lululemon (LULU) and UnitedHealth (UNH)—while 7 names traded at fresh highs: Altria (MO), CBOE Holdings (CBOE), ResMed (RMD), Northrop Grumman (NOC), American Electric Power (AEP), Evergy (EVRG) and Xcel Energy (XEL).

IPO Activity: Quantity Up, Proceeds Lag

Renaissance Capital reports 123 IPOs priced in 2025—a 48% increase—but total proceeds of $19.7 billion trail last year by 15%. Standouts include Circle Internet’s +492% surge and Figma’s +250% advance, spotlighting investor appetite for high‐growth debuts despite tepid aggregate fundraising.

Cruise Stocks Ride Strong Booking Momentum

Carnival (CCL) has rebounded 60% from April lows, buoyed by a record Q2 top line of $6.3 billion, while Norwegian Cruise Line (NCLH) is up 50% on accelerating “close-in” bookings. Royal Caribbean (RCL) tops the pack with an 80% rally as occupancy and yield enhancements outpace guidance.

Global Markets React to U.S. Sell-off

Asia‐Pacific benchmarks closed lower: Hang Seng –1.07% to 24,507.81, CSI 300 –0.51% to 4,045.93, Nikkei 225 –0.66% to 40,799.60, Topix +0.19% to 2,948.65, Kospi –3.88% to 3,119.41, Kosdaq –4.03% to 772.79, ASX 200 –0.92% to 8,662.00. In India, the Nifty 50 eased 0.48% and the Sensex down 0.34%.

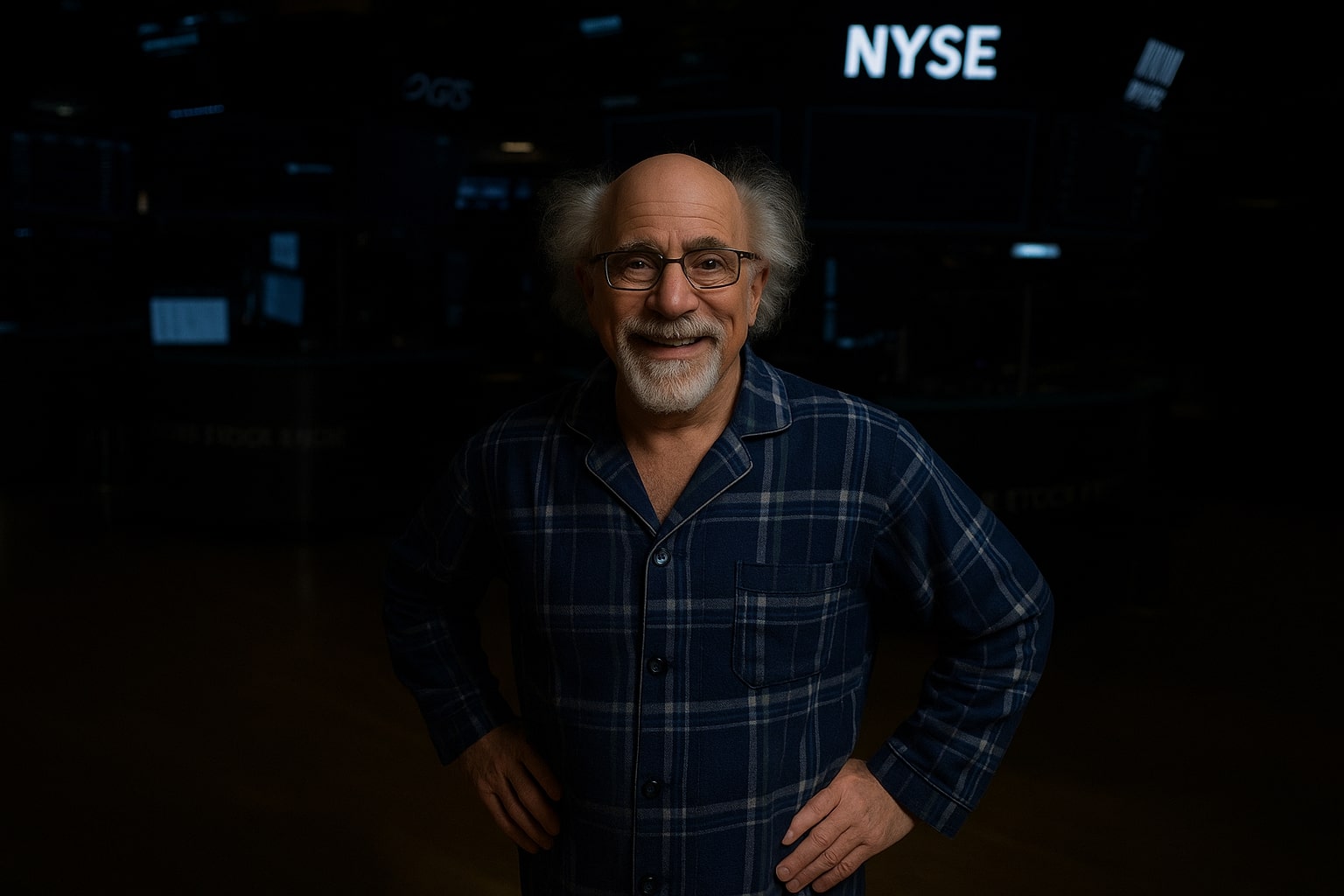

Strategic Divestitures and Corporate Developments

Billionaire Ray Dalio completed his exit from Bridgewater, selling his final shares and stepping off the board, cementing his post-2022 management transition. Enterprise AI specialist C3.ai (AI) posted Q4 revenue of $108.7 million (+26% YoY) and full-year sales of $389.1 million (+25%), yet widened its operating loss to $324.4 million as it invests heavily in platform expansion.

Analyst Notes: Valuation Gaps and Tactical Views

Goldman Sachs downgraded Avis Budget (CAR) to Sell—citing >10x EV/EBITDA vs. 7–8x historical norms and projecting 38% downside. BTIG’s Jonathan Krinsky flags a retest of S&P 6,100 as plausible, while Morningstar regards recent tariff moves as largely anticipated. Capital Economics remains constructive on U.S. equities, believing AI-led earnings will outlast cyclical headwinds.

Tactical Trade Calls

-

AMZN: Sell – tepid guidance to weigh further on price.

-

AAPL: Buy – premium growth and $20 billion FCF tailwind from new tax deductions.

-

NVDA: Hold – leadership intact but valuation stretched near 27x forward earnings.

-

JPM: Sell – slowing credit lines up margin pressure.

-

CVX: Buy – earnings slump priced in; attractive yield cushion.

-

CAR: Sell – GS projects a 38% pullback from current levels.

-

INTC: Buy – leadership shift and on-shoring incentives could catalyze turnaround.

-

CCL/NCLH/RCL: Hold – strong booking trends are supportive, but valuations rich.

-

AI (C3.ai): Hold – solid revenue growth yet unprofitable; monitor margin progress.