Bitcoin Price Soars to $67K: ETF Inflows and U.S. Election Stir Market Volatility

With Bitcoin’s dominance at its highest since 2021 and strong ETF inflows, the crypto market faces heightened volatility ahead of the U.S. election | That's TradingNEWS

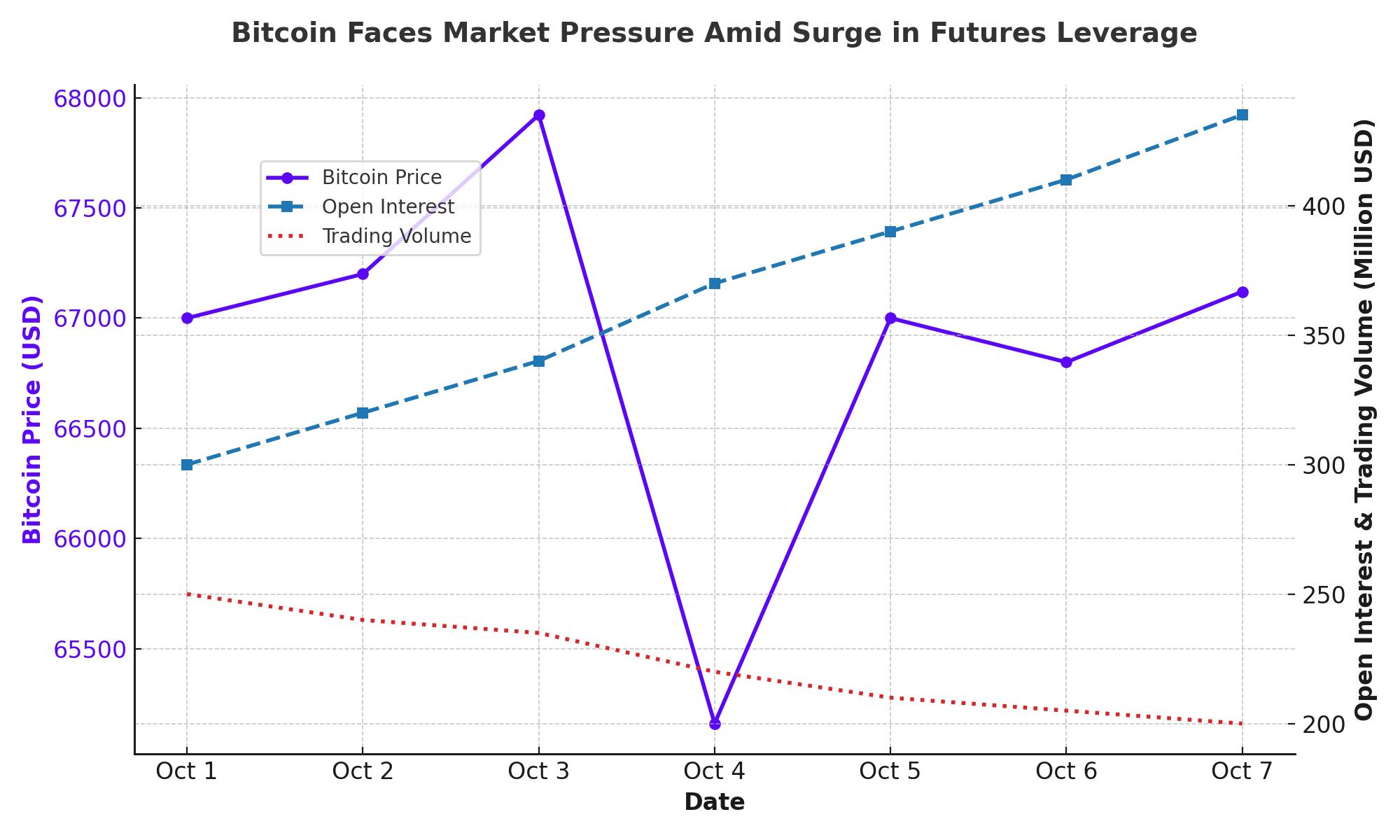

Bitcoin Faces Market Pressure Amid Surge in Futures Leverage

Rising Open Interest and Declining Volume Signal Volatility Risks

Bitcoin (BTC) is currently trading at approximately $67,120, after experiencing significant price fluctuations that saw it reach $67,922 before a sharp drop to $65,160 within a short period. These movements led to the liquidation of $302.25 million in leveraged positions, primarily affecting long positions to the tune of $185.9 million, according to CoinGlass data.

The notable surge in open interest for Bitcoin futures, which has reached new highs for 2024, is creating concern among analysts. With open interest climbing, funding rates are also hitting their highest levels since June. Yet, despite the leveraged positions, Bitcoin's trading volume has been on a downtrend. This mismatch—high leverage with low volume—is making the market particularly sensitive to sharp price reversals.

As Illia Otychenko, Lead Analyst at CEX.IO, explains, “A drop in volume while leverage rises is a red flag—it creates an environment where even small price changes can spark liquidation cascades. If traders start locking in profits, especially on long positions, the market could unravel quickly.”

Technical Indicators Show Warning Signs of Potential Pullback

Bitcoin is currently testing resistance at $68,000, a key level that has proven difficult for the asset to break through in recent attempts. Technical indicators, including the Bollinger Bands, suggest that BTC is nearing the upper boundary, which could signal a pullback. Moreover, RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) are showing bearish divergences, indicating that the current rally may lack the momentum needed to sustain further gains.

With RSI currently near overbought levels, and MACD signaling a potential reversal, Bitcoin's near-term outlook is precarious. These indicators are critical for traders watching for signs of whether the market has the strength to push higher or if a correction is imminent.

Institutional Flows and the Fear and Greed Index Show Diverging Sentiment

Institutional support remains robust, with $371 million in Bitcoin ETF inflows reported recently, highlighting sustained interest from larger investors. Additionally, the Fear and Greed Index has risen to 73, reflecting growing confidence among market participants. However, this index also indicates that the market is nearing a critical juncture where either a breakout will occur, or selling pressure will force a correction.

At the same time, the ongoing U.S. election cycle is adding a layer of uncertainty to the crypto market. As Donald Trump’s odds of winning the 2024 presidential election have surged to 58.9% according to Polymarket, this has contributed to speculation about potential shifts in Bitcoin policy. Trump's pro-crypto stance could encourage further adoption, but the political climate is also adding to the market’s volatility.

Bitcoin Dominance Hits New Highs—Altcoin Market Struggles

Bitcoin’s dominance (BTC.D), which measures its share of the total cryptocurrency market, has reached 58.76%, its highest level since April 2021. This surge in dominance suggests Bitcoin is outperforming altcoins, which are struggling to keep pace. Historically, when Bitcoin dominance rises to such levels, it often precedes a period of price consolidation or a market top.

Crypto analyst Elja Boom has pointed out that BTC dominance is nearing a point of significant decline, signaling the potential onset of an altcoin season. “Bitcoin dominance is about to crash hard. This’ll send alts to new highs,” Boom stated. However, other analysts are more cautious, suggesting that while Bitcoin’s dominance may peak soon, the altcoin market is not yet showing the strength needed for a sustained rally.

Political and Institutional Factors Drive Price Volatility

Bitcoin's price is also being influenced by the upcoming U.S. elections, with crypto-friendly stances from both Kamala Harris and Donald Trump. Trump’s support for Bitcoin has bolstered investor sentiment, particularly after his World Liberty Financial project raised $220 million in token sales.

Additionally, analysts are closely watching Spot Bitcoin ETFs, which have seen strong inflows recently, with $556 million flowing into U.S. Bitcoin ETFs on October 14 alone. These institutional moves are contributing to the bullish momentum, with some analysts predicting Bitcoin could reach $115,000 in the near future. However, these same factors are also creating heightened volatility as political and regulatory shifts loom large.

The Outlook for Bitcoin and the Altcoin Market

The crypto market is in a unique phase, where Bitcoin has broken out of its multi-month range but remains sensitive to external factors such as political events and institutional flows. As Bitcoin approaches key resistance levels around $70,000, it faces potential price volatility driven by both technical and macroeconomic factors.

While Bitcoin’s dominance continues to rise, altcoins are struggling to gain traction. The Altcoin Season Index currently sits at 20, well below the threshold for what is considered a full-blown altcoin season. Some analysts believe that Ethereum (ETH) needs to break through key resistance levels for altcoins to outperform Bitcoin.

In the short term, Bitcoin’s rally is expected to continue, but with caution around its overbought technical indicators and the potential for a correction. Traders and investors should remain vigilant as the market navigates through both political uncertainty and institutional shifts that could influence the broader trajectory of the crypto market.