Mixed Earnings Signals: Revenue Growth vs. Earnings Miss

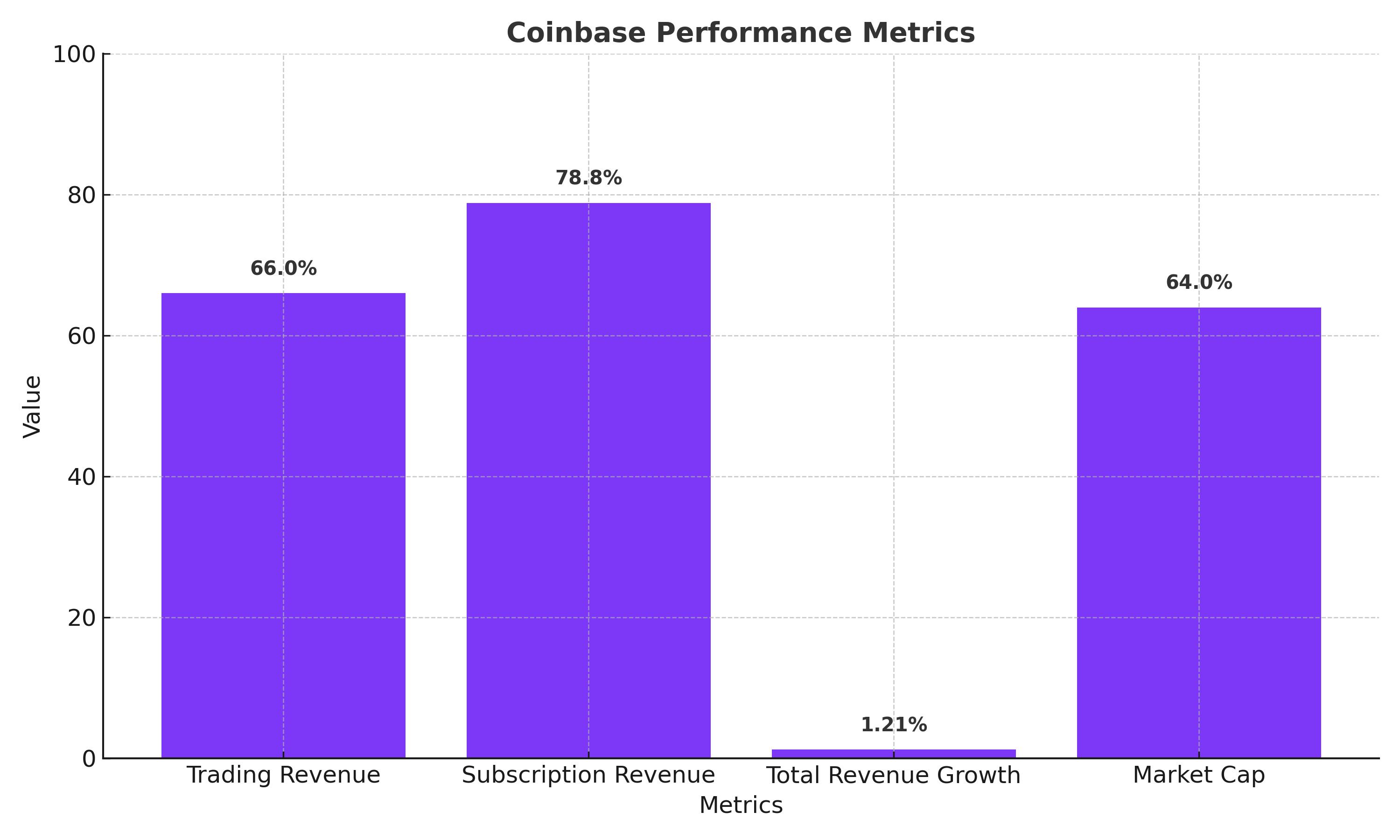

Coinbase reported robust revenue growth in its latest earnings release, with $1.21 billion reflecting a 78.8% year-over-year increase. However, this fell short of analyst expectations. Earnings per share stood at $0.28, missing the anticipated $0.41, underscoring profitability challenges despite revenue expansion. Subscription and service revenue, driven by stablecoin yield and staking rewards, grew 66% year-over-year, showcasing Coinbase’s efforts to diversify beyond trading income. Nonetheless, trading remains its core revenue driver, and the company faces significant volatility due to dependence on altcoin spreads, with smaller tokens like Dogecoin and XRP contributing disproportionately to transaction fees. Bitcoin trading volumes also grew, reclaiming 37% of total activity in Q3, but margins remain under pressure as larger coins generate lower spreads.

Analyst Sentiment and Valuation Concerns

The valuation for Coinbase remains a critical factor. Trading at approximately 10x FY25 expected revenue and 20x adjusted EBITDA, the stock appears priced for perfection. Analysts expect revenue of $6.12 billion for FY25, but the question is whether this reflects sustainable growth or is inflated by temporary crypto market rallies. Adjusted EBITDA margins, which hovered around 48% for Q3, highlight operational efficiency but also underscore the reliance on unpredictable trading activity. With a $1 billion share buyback announced, the company aims to create shareholder value, but the repurchase only reduces outstanding shares by a modest 1.3%, leaving room for skepticism among investors who view the buyback as insufficient relative to the company’s cash reserves of $8.2 billion.

Regulatory Environment and Institutional Participation

Coinbase is well-positioned to benefit from a pro-crypto regulatory stance under the current administration, with President Trump signaling a favorable approach to digital asset innovation. This could encourage institutional adoption, which already accounts for over 80% of trading volume. Institutional players’ growing participation may stabilize revenue streams, but the reliance on trading activity tied to market sentiment and crypto volatility presents risks. Smaller altcoins, though lucrative, remain highly speculative, adding to the fragility of Coinbase's revenue base.

Competitive Pressures and Sustainability Challenges

Competition among crypto exchanges continues to heat up, with platforms offering lower fees and enhanced features vying for market share. Coinbase’s premium valuation and fee structure could face pressure as users gravitate toward alternatives. Furthermore, environmental concerns linked to the energy-intensive nature of cryptocurrency mining could emerge as a headwind. Although Coinbase is not directly involved in mining, its position as a market leader places it in the spotlight of sustainability debates. Any regulatory push toward greener practices could indirectly affect trading volumes and revenue.

Future Projections and Investment Outlook

The key question for investors is whether Coinbase can maintain its growth trajectory amid these challenges. The recent crypto rally, driven by Bitcoin approaching $100,000 and altcoin surges, has bolstered revenue temporarily, but the long-term sustainability of these trends remains uncertain. Analysts’ mixed ratings and price targets reflect this uncertainty. While the stock has significant upside potential, particularly if crypto adoption accelerates, downside risks tied to market corrections, regulatory changes, and competition cannot be ignored.

For investors evaluating Coinbase, the decision hinges on their outlook for the broader cryptocurrency market. With its heavy reliance on trading and a valuation that assumes continued growth, the stock remains a high-risk, high-reward proposition. For now, cautious optimism prevails, but the stock’s performance will closely mirror the unpredictable dynamics of the crypto market.

That's TradingNEWS