VanEck Agribusiness ETF (NYSEARCA:MOO): Opportunity Awaits at $67

Can MOO’s Diversified Agribusiness Portfolio Thrive Amid Global Demand? | That's TradingNEWS

VanEck Agribusiness ETF (NYSEARCA:MOO): Exploring Potential in the Global Agribusiness Sector

The VanEck Agribusiness ETF (NYSEARCA:MOO) has been a cornerstone for investors seeking exposure to the global agribusiness market. At its current level near $67, MOO presents a compelling case for long-term investors despite a bearish trend since its April 2022 high of $109.19. With $586 million in assets under management and holdings in major agribusiness players like Deere & Co (DE) and Corteva Inc (CTVA), MOO offers diversified exposure to companies critical for meeting the growing global demand for food and fuel. The ETF tracks the MVIS Global Agribusiness Index, which focuses on companies involved in key agricultural segments such as fertilizers, farm equipment, animal health, and crop protection.

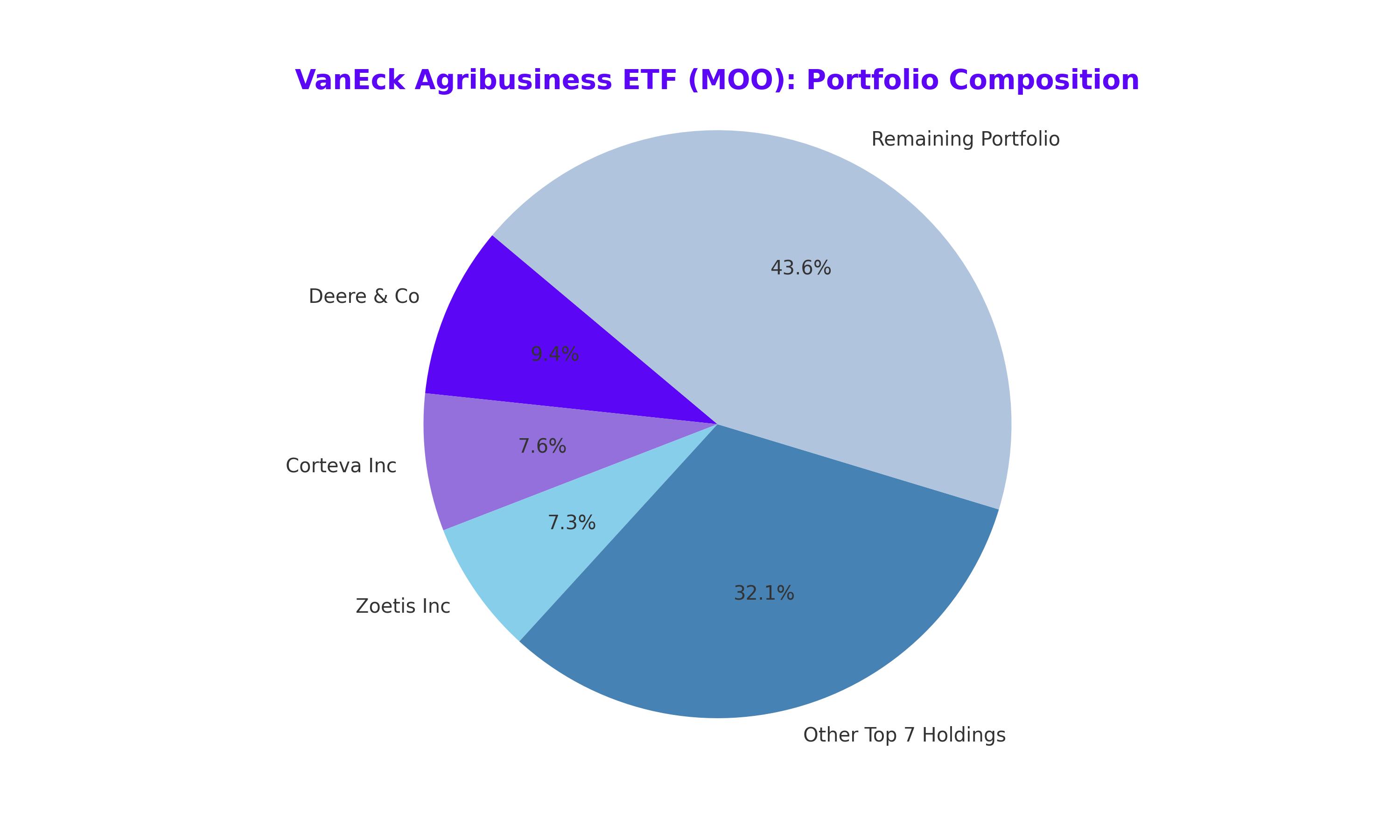

MOO’s Portfolio Composition and Key Holdings

MOO’s top holdings include Deere & Co, which constitutes 9.43% of the fund’s assets, Corteva Inc (7.56%), and Zoetis Inc (7.35%). The top 10 holdings collectively make up approximately 56.43% of total assets, ensuring significant concentration in leading industry players. Deere & Co, the global leader in agricultural machinery, plays a pivotal role in improving farming productivity. Corteva’s expertise in seed and crop protection products, coupled with Zoetis’ dominance in animal health solutions, further highlights the robust portfolio composition. MOO’s diversified holdings extend to fertilizers, aquaculture, and bioenergy companies, ensuring exposure to multiple facets of agribusiness.

Performance and Risk Metrics

The ETF’s year-to-date return is approximately 0.62%, while its one-year performance reflects a decline of -11.13% as of January 2025. Over the last 52 weeks, MOO has traded between $64.29 and $75.71, showcasing volatility in line with broader agricultural markets. The ETF’s beta of 0.92 and a standard deviation of 17.91% over the trailing three years position it as a relatively lower-risk option within the volatile agribusiness sector. Despite the bearish trend, MOO continues to deliver value to long-term investors, with a 12-month trailing dividend yield of 3.39% and an annual dividend of $2.20.

Impact of Global Population Growth and Commodity Cycles

The global population reached 8.1 billion in early 2025, underscoring the growing demand for food, energy, and agricultural products. Agricultural commodity cycles remain inherently tied to population dynamics, with rising food consumption necessitating increased production. However, recent cooperative weather conditions and improved crop yields have temporarily subdued grain and oilseed prices, contributing to MOO’s decline over the past two years. While wheat, corn, and soybean futures experienced multi-year highs in 2022 following geopolitical disruptions, including the Russia-Ukraine war, supply stabilization and favorable weather have since led to a significant pullback in prices.

Dividend and Expense Structure

MOO’s 0.53% expense ratio aligns with industry averages, ensuring cost efficiency for investors. The ETF also provides an attractive dividend yield of 3.28%, supported by its holdings in established companies generating stable cash flows. This combination of cost-effectiveness and dividend income enhances MOO’s appeal, particularly for income-focused investors looking to capitalize on the long-term potential of the agribusiness sector.

Challenges and Market Risks

MOO’s momentum grade of D- reflects the ongoing bearish trend, driven by declining grain and oilseed prices. Additionally, geopolitical uncertainties, potential tariffs under the new U.S. administration, and competition from alternative agricultural ETFs such as the iShares MSCI Agriculture Producers ETF (VEGI) present challenges. MOO’s liquidity grade of B- and risk grade of D highlight the fund’s moderate susceptibility to market fluctuations. Nonetheless, these risks are mitigated by the ETF’s diversification and exposure to companies with strong market positions.

Opportunities in Agribusiness: Buying on Weakness

MOO’s current valuation near $67 offers an attractive entry point for long-term investors. The ETF’s holdings in critical agricultural infrastructure and service providers position it to benefit from future rallies in grain and oilseed markets. A scale-down investment approach—buying incrementally during periods of weakness—may optimize returns, especially as the agricultural sector remains cyclical and highly influenced by weather patterns, geopolitical events, and trade policies.

Technical Analysis and Long-Term Outlook

The five-year chart reveals a persistent downtrend in MOO since its April 2022 peak. Key resistance levels include $76.19, the September 2024 high, with more substantial resistance at the July 2023 peak of $88. Overcoming these levels could signal a trend reversal. However, technical support near the March 2020 low of $42.52 provides a solid base, limiting downside risk. The ETF’s long-term potential remains tied to the inevitability of rising food and energy demand driven by population growth.

Final Analysis

MOO’s current position as a diversified agribusiness ETF makes it a valuable addition to portfolios aiming for exposure to the agricultural sector. While the short-term outlook is clouded by bearish momentum and declining agricultural commodity prices, the long-term fundamentals—anchored by population growth and increasing global food demand—support a bullish thesis. Investors should consider MOO a "Buy on Weakness," particularly at current levels, leaving room for additional purchases if prices drop further. With a focus on essential agribusinesses and a balanced portfolio, MOO stands out as a resilient choice for navigating the evolving global food and energy landscape.