EUR/USD Surges Past 1.0500: Inflation Data and ECB Moves Ignite Market Action

Dollar Softens Amid Mixed Signals as Euro Eyes Momentum Ahead of Key Data Releases | That's TradingNEWS

EUR/USD: Analyzing the Pair Amid Economic Shifts and Market Dynamics

Recent Performance and Key Drivers of EUR/USD

The EUR/USD pair has displayed notable resilience despite macroeconomic pressures. As of Wednesday's European trading session, EUR/USD climbed near 1.0530, marking a modest rebound from the recent low of 1.0330. This uptick was largely influenced by the weakening US Dollar (USD), which hit a fresh weekly low of 106.35 on the US Dollar Index (DXY). The softer dollar comes amid cautious sentiment ahead of critical US economic data releases, including Personal Consumption Expenditure (PCE) Price Index, GDP growth estimates, and Initial Jobless Claims.

While the EUR/USD rise signals optimism, its trajectory remains uncertain as the European Central Bank (ECB) prepares for a possible 25 to 50 basis point (bps) rate cut in December. The divergent monetary policy paths between the ECB and the Federal Reserve (Fed) continue to weigh heavily on the pair.

US Economic Landscape and Its Impact on EUR/USD

The US economy’s mixed data has provided contrasting signals for the USD. Consumer Confidence rose to 111.7 in November, showcasing underlying optimism, while New Home Sales disappointed at 610K versus a forecast of 725K. Durable Goods Orders posted a modest increase of 0.4%, reflecting some resilience, but upcoming data on PCE inflation and GDP will be pivotal.

PCE inflation, the Fed’s preferred metric, is expected to show an annualized rise to 2.3% in October from 2.1% previously, with core PCE forecasted at 2.8% from 2.7%. These readings will directly influence expectations for the Fed’s December interest rate decision. Minneapolis Fed President Neel Kashkari hinted at a potential rate cut, citing decelerating inflation and a strong labor market, which could further pressure the USD.

European Economic Concerns and ECB Policy Outlook

On the European side, the Euro faces headwinds due to weak economic sentiment. Germany’s GfK Consumer Climate Index dropped to -18.8, reflecting heightened concerns over economic stagnation. ECB officials, including Mario Centeno, have expressed worries about inflation undershooting targets and have warned of accumulating downside risks. Market expectations for a December rate cut range from 25 bps to 50 bps, depending on forthcoming inflation data.

The Harmonized Index of Consumer Prices (HICP) for November is expected to show a slight uptick in inflation, which will be critical in shaping the ECB’s policy stance. This scenario leaves EUR/USD vulnerable to short-term volatility as traders assess the implications of inflationary trends and ECB action.

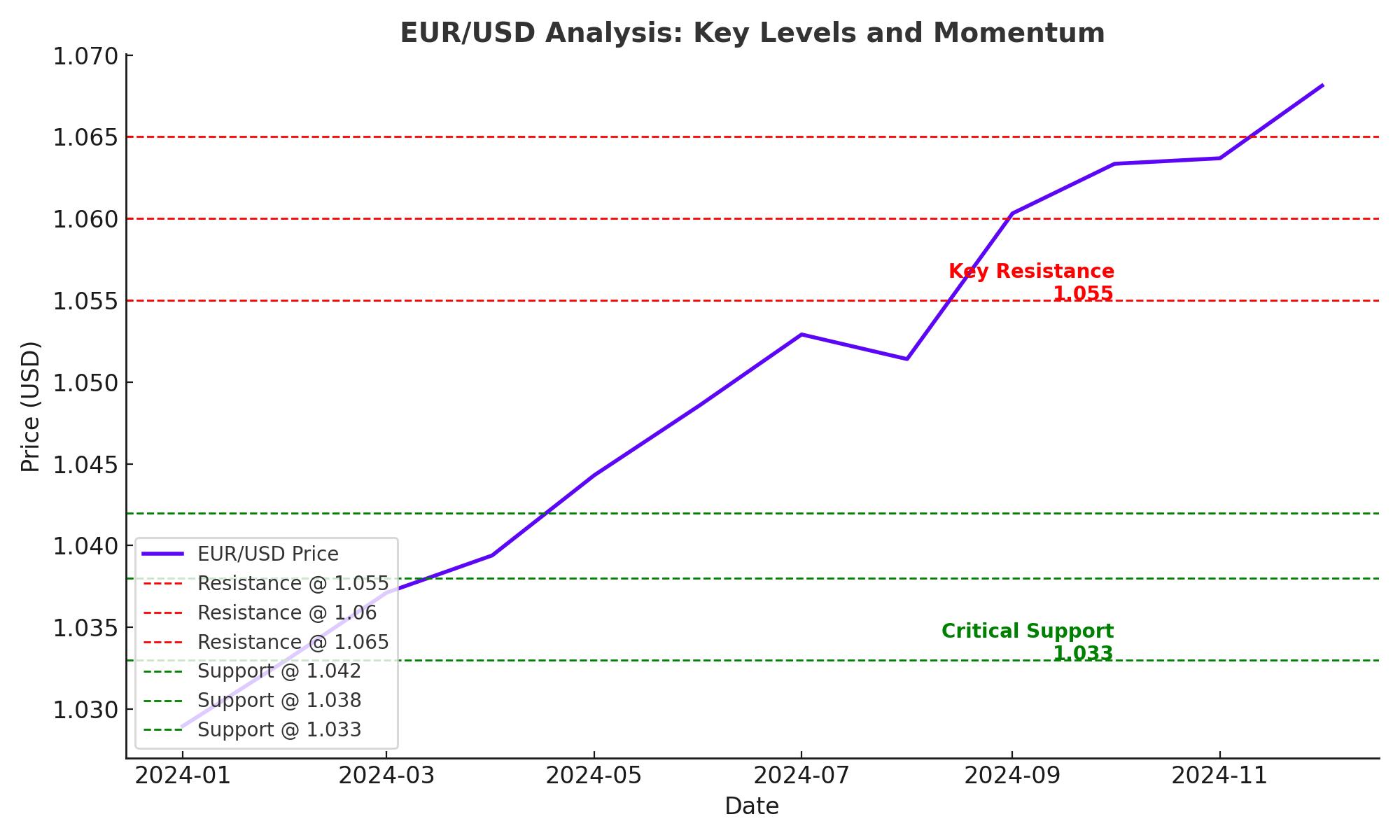

Technical Analysis: Resistance, Support Levels, and Momentum

EUR/USD Price Movements

EUR/USD is trading near 1.0530, holding ground above the psychological 1.0500 level. However, the pair's upward momentum remains capped by bearish technical factors. Immediate resistance is seen at 1.0553, with stronger barriers at 1.0600 and 1.0650. A break above these levels would signal a shift toward bullish sentiment.

On the downside, support levels at 1.0425, 1.0384, and 1.0330 provide a safety net for Euro bulls. A breach of 1.0330 would expose the pair to further declines, potentially revisiting lows near 1.0200.

Key Indicators to Watch

- The 14-day Relative Strength Index (RSI) has rebounded from oversold territory, suggesting potential consolidation rather than a clear directional breakout.

- The 50-day Exponential Moving Average (EMA) near 1.0491 adds downward pressure, while the 200-day EMA at 1.0598 remains a critical resistance barrier.

Broader Context: US and Eurozone Divergence

The EUR/USD pair continues to navigate a complex macroeconomic environment shaped by diverging US and Eurozone monetary policies. The Fed’s cautious approach to rate cuts contrasts with the ECB’s urgency to address stagnating growth. The US bond market optimism, stemming from President-elect Donald Trump's fiscal conservatism, adds another layer of complexity. Trump's proposed tariff policies, while dampening market sentiment, could inadvertently support the USD by curbing inflation.

Market Sentiment and Upcoming Data

Market participants remain focused on high-impact data releases. US GDP growth for Q3 is expected to remain steady at 2.8%, while core PCE inflation data will provide crucial insights into the Fed’s inflation outlook. In the Eurozone, Friday’s HICP inflation figures will be the next big catalyst, shaping expectations for the ECB’s December meeting.

Conclusion Pending Further Developments

EUR/USD currently hovers in a state of limbo, influenced by contrasting economic signals and uncertain monetary policies. Both the US and Eurozone economies face pivotal moments, with inflation data and central bank actions likely to determine the pair’s near-term direction. Until these uncertainties are resolved, the EUR/USD pair is expected to trade within a tight range, with technical levels playing a decisive role.

That's TradingNEWS

EUR/USD Battles 1.0500: Will Economic Data or ECB Policy Turn the Tide?

EUR/USD Pressured by Strong Dollar and Eurozone Uncertainty – Key Levels to Watch