Gold Gains Momentum: Can XAU/USD Shatter $2,700?

With geopolitical unrest, dollar shifts, and inflation heating up, gold is primed for a breakout. Here's why this rally is far from over | That's TradingNEWS

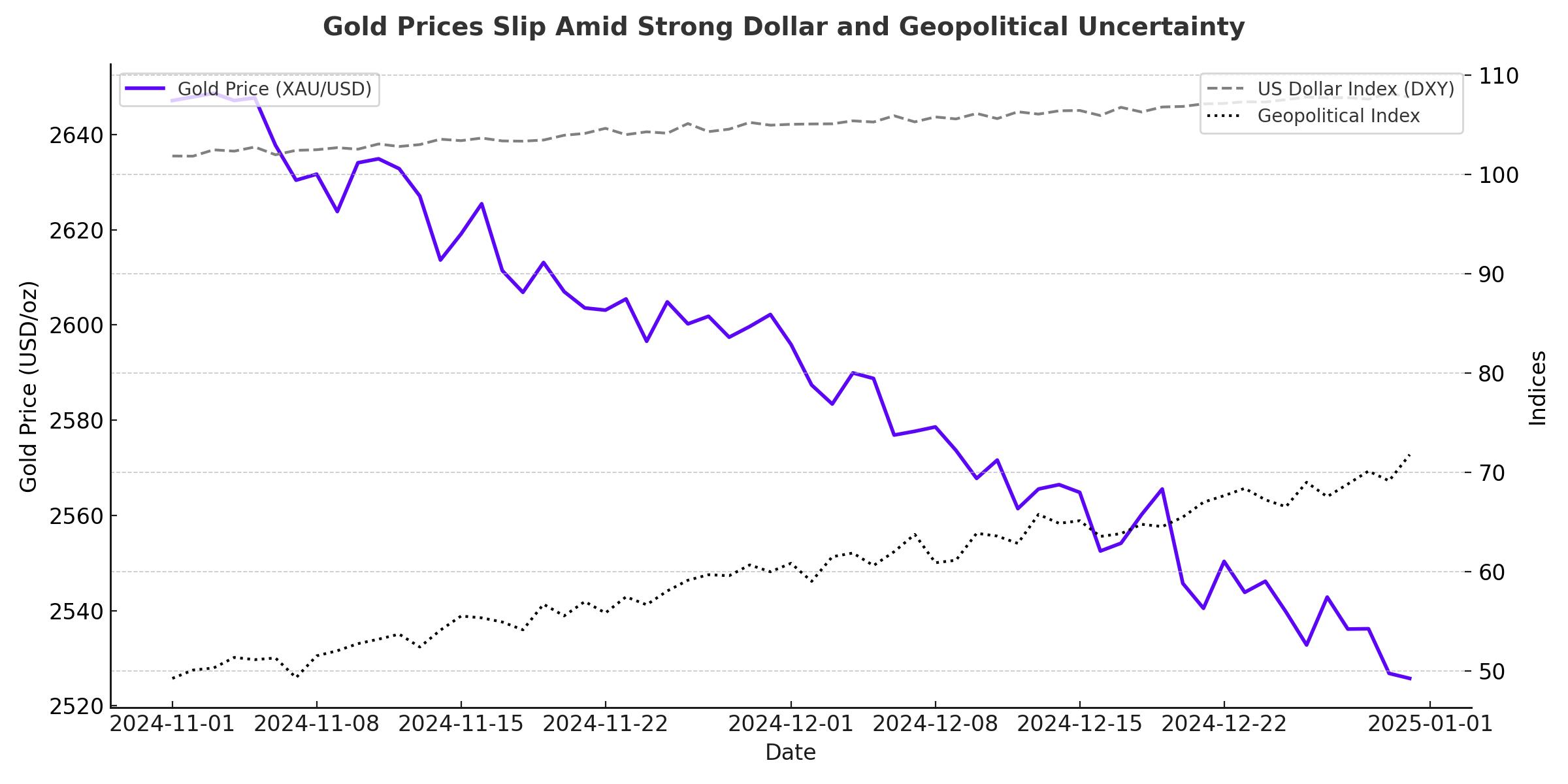

Gold Prices Slip Amid Strong Dollar and Dimming Fed Rate Cut Expectations

Gold (XAU/USD) prices retreated sharply on Monday, marking the end of a four-session rally as a robust U.S. dollar weighed heavily on the yellow metal. Spot gold dropped 0.9% to trade near $2,630.99 per ounce, while U.S. gold futures followed a similar trend, falling 1.01% to $2,653.80. This decline was fueled by a combination of stronger-than-expected U.S. economic data, hawkish Federal Reserve signals, and geopolitical uncertainties that partially supported safe-haven demand.

Dollar Strength Dampens Gold's Shine

The U.S. dollar index (DXY) gained 0.5% on Monday, marking its best performance in over a week. A stronger dollar increases the cost of dollar-priced bullion for overseas buyers, reducing demand. This renewed strength came after comments from President-elect Donald Trump, who proposed a 100% tariff on BRICS nations if they pursued an alternative currency to the U.S. dollar, reinforcing the greenback's dominance.

Trump's comments not only bolstered the dollar but also raised uncertainty over global trade dynamics, indirectly influencing gold prices. The market also interpreted these developments as reducing the likelihood of an aggressive Federal Reserve stance toward rate cuts, further pressuring gold.

Geopolitical Risks Provide Limited Support

Despite its decline, gold found some underlying support from escalating geopolitical tensions. Russian and Syrian forces launched coordinated airstrikes against rebel factions in Syria, while unrest in the Middle East continued to simmer. These developments kept safe-haven demand for gold relatively intact, preventing a steeper decline.

Ongoing trade uncertainties also played a role in cushioning gold prices. Concerns over a potential second wave of trade wars, fueled by Trump's tariff threats, added to the broader risk-off sentiment.

Macroeconomic Data and Fed Policy Weigh Heavily

Market participants are closely monitoring upcoming U.S. macroeconomic data, including the ISM Manufacturing PMI, which is expected to rise to 47.5 in November from 46.5 previously. Later in the week, the spotlight will shift to U.S. non-farm payrolls (NFP) data, which could further shape market expectations around the Federal Reserve's next moves.

Major brokerages and analysts still anticipate a 25-basis-point rate cut by the Fed in December. However, the Fed's cautious approach to rate cuts, bolstered by Trump's potential expansionary policies, has dimmed hopes for aggressive monetary easing. This has negatively impacted the non-yielding gold, which thrives in low-interest-rate environments.

Technical Outlook: Gold's Path of Resistance

From a technical perspective, gold's recent slide below a key descending channel boundary suggests bearish momentum is gaining traction. Oscillators on daily and 4-hour charts point to further downside potential, with the next support levels seen at $2,605 and $2,575, marked by the 100-day simple moving average (SMA).

On the upside, resistance lies at $2,642 and $2,665, which aligns with last week's highs. A sustained break above these levels could open the door to a retest of the psychological $2,700 mark. However, the broader trend remains under pressure unless geopolitical or macroeconomic conditions shift significantly in gold's favor.

Global Economic Uncertainty Continues to Shape Demand

Gold's role as a hedge against economic instability remains a focal point as we approach 2025. The metal's performance will be dictated by factors such as inflationary pressures, central bank policies, and geopolitical risks. Central banks, particularly in emerging markets, continue to bolster their reserves, providing a long-term floor for gold prices.

Geopolitics and Trade Risks Loom Large

Beyond monetary policy, geopolitical tensions and trade risks are likely to remain key drivers for gold. Middle East unrest, along with Trump's aggressive trade policies, could provide intermittent spikes in demand for the safe-haven asset. However, these factors are competing with stronger headwinds from the dollar and interest rate outlooks.

Conclusion: A Volatile Road Ahead

Gold's recent retreat underscores the complexity of its drivers, with dollar strength and Fed policy outweighing geopolitical concerns in the short term. However, the ongoing tug-of-war between safe-haven demand and macroeconomic pressures suggests that gold's trajectory will remain volatile. As the market braces for key economic data and geopolitical developments, gold's ability to reclaim higher ground will depend on how these factors play out in the weeks ahead. For now, the metal remains under pressure but is far from losing its safe-haven appeal entirely.