Iris Energy (NASDAQ:IREN): Poised for Explosive 50% Upside with Sustainable Innovation

A 50% upside beckons as Iris Energy combines renewable energy with rapid expansion, dominating Bitcoin mining and unlocking new revenue streams in AI and HPC markets | That's TradingNEWS

Iris Energy (NASDAQ:IREN): A Sustainable Powerhouse in the Bitcoin Mining Industry

Iris Energy Ltd. (NASDAQ:IREN) has positioned itself as a leading force in the sustainable crypto and blockchain sector. Leveraging 100% renewable energy for its Bitcoin mining and high-performance computing (HPC) operations, IREN has demonstrated robust operational growth and strategic foresight in a volatile industry. Let’s delve into the detailed analysis of the company’s recent performance, expansion plans, and future potential.

Sustainable Growth and Expansion in Bitcoin Mining

Iris Energy’s focus on renewable energy aligns with global trends in sustainability and gives it a competitive edge in the energy-intensive Bitcoin mining industry. The company operates data centers with a capacity of 260 MW, which is expected to scale up to 510 MW by 2025. This growth coincides with IREN’s plans to achieve a total hash rate of 50 exahashes per second (EH/s) by mid-2025, an acceleration from its previously announced timeline of late 2025. The use of advanced S21 Pro miners, secured at a fixed cost of $18.9 per terahash, underscores the company’s commitment to cost efficiency and financial predictability.

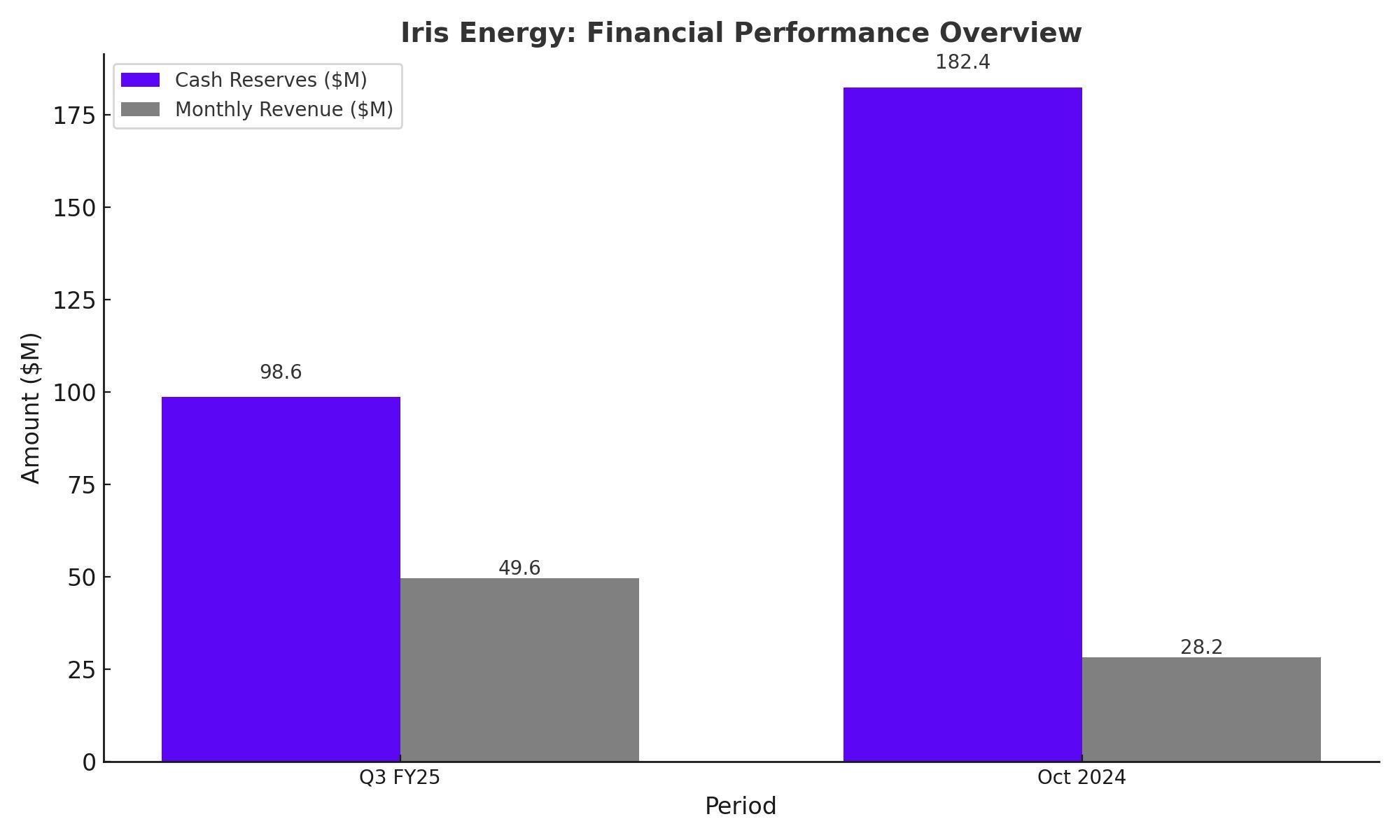

In October 2024, IREN reported a monthly revenue of $28.2 million, reflecting a 32% increase compared to the previous period. This growth was driven by an operating hash rate of 21 EH/s and favorable Bitcoin prices, highlighting the company’s ability to capitalize on market opportunities.

Financial Strength and Shareholder Commitments

Iris Energy’s balance sheet reflects its strong financial health, with $98.6 million in cash reserves as of Q3 FY25, which increased to $182.4 million by the end of October 2024. The company operates with no debt, providing it with the financial flexibility to fund its ambitious expansion plans and consider shareholder returns. Notably, IREN has hinted at potential cash or Bitcoin distributions to investors by 2025, signaling confidence in its financial stability and commitment to enhancing shareholder value.

Adjusted EBITDA for Q1 FY25 was reported at $2.6 million, alongside Bitcoin mining revenue of $49.6 million. While this represented a decline from Q4 FY24, it was offset by a 28% growth in AI Cloud Services revenue, which reached $3.2 million. This diversification into AI and HPC markets underscores IREN’s strategy to reduce reliance on Bitcoin’s price volatility.

Strategic Diversification: Beyond Bitcoin Mining

IREN is exploring diversification opportunities, as evidenced by interest from a “trillion-dollar hyperscaler” in its 1.4 GW Sweetwater data center project in Texas. This facility is designed to support 90 EH/s of Bitcoin mining capacity and host up to 800,000 GPUs for HPC activities. Such initiatives position Iris Energy to tap into the burgeoning AI and HPC markets, which promise significant revenue potential and reduced dependence on cryptocurrency price fluctuations.

The company’s investment in NVIDIA H200 GPUs and advanced liquid cooling systems enhances its capabilities in AI cloud services, enabling it to cater to the increasing demand for power-dense computing solutions. These developments align with IREN’s vision of being a leader in sustainable and scalable digital infrastructure.

Market Sentiment and Analyst Upgrades

IREN’s stock has been on an upward trajectory, with a 30% surge following the announcement of its accelerated expansion plans. Analysts have taken notice, with HC Wainwright & Co. raising its price target to $16 per share and Cantor Fitzgerald increasing its target to $23 per share while maintaining an Overweight rating. These upgrades reflect growing confidence in IREN’s operational efficiency, growth prospects, and strategic initiatives.

The stock’s valuation, with a forward price-to-sales (P/S) ratio of 2.2, appears reasonable given its forecasted revenue growth and strong market position. The company’s low production cost of $29,000 per Bitcoin further bolsters its profitability, making it a compelling choice for investors seeking exposure to the crypto and blockchain sectors.

Challenges and Risks

While IREN’s prospects are promising, risks remain. The company’s reliance on Bitcoin prices exposes it to market volatility, and its ambitious expansion plans involve significant capital expenditure. The Q3 FY25 CAPEX of $391 million highlights the capital-intensive nature of its operations. However, the company’s debt-free status and efficient cost structure mitigate these risks to an extent.

Additionally, the ongoing class action lawsuit alleging misrepresentations related to its Childress County site poses a legal challenge. Investors should monitor developments in this case, as it could impact IREN’s reputation and financial standing.

Positioning for Long-Term Success

Iris Energy’s commitment to sustainability, cost efficiency, and strategic diversification positions it as a leader in the evolving crypto and blockchain industry. Its accelerated expansion plans, combined with strong financial metrics and a focus on shareholder returns, underscore its potential for long-term success.

With Bitcoin prices recently surpassing $90,000 and favorable regulatory developments under a pro-crypto U.S. administration, IREN is well-poised to capitalize on industry tailwinds. As it scales its operations and explores new revenue streams in AI and HPC markets, Iris Energy (NASDAQ:IREN) remains a stock to watch for investors seeking sustainable growth in the digital economy.