Microsoft’s Ambitious AI Vision Meets Bitcoin’s Record Surge

NASDAQ:MSFT Explores Bitcoin Adoption as BTC Hits $99,000—Shaping the Future of Tech and Finance | That's TradingNEWS

Microsoft’s Strategic Moves Solidify its Tech Leadership Amid Challenges and Opportunities

Microsoft Corporation (NASDAQ:MSFT) continues to dominate headlines as it grapples with the complexities of scaling its AI ambitions while maintaining robust profitability. Investors have scrutinized the tech giant's approach to monetizing artificial intelligence, its reliance on Azure growth, and its position relative to peers like Nvidia (NASDAQ:NVDA) and Alphabet (NASDAQ:GOOGL). With a market capitalization nearing $3.2 trillion and quarterly revenue exceeding $65 billion, Microsoft stands at a critical juncture.

AI Investment and Azure Expansion Drive Growth for NASDAQ:MSFT

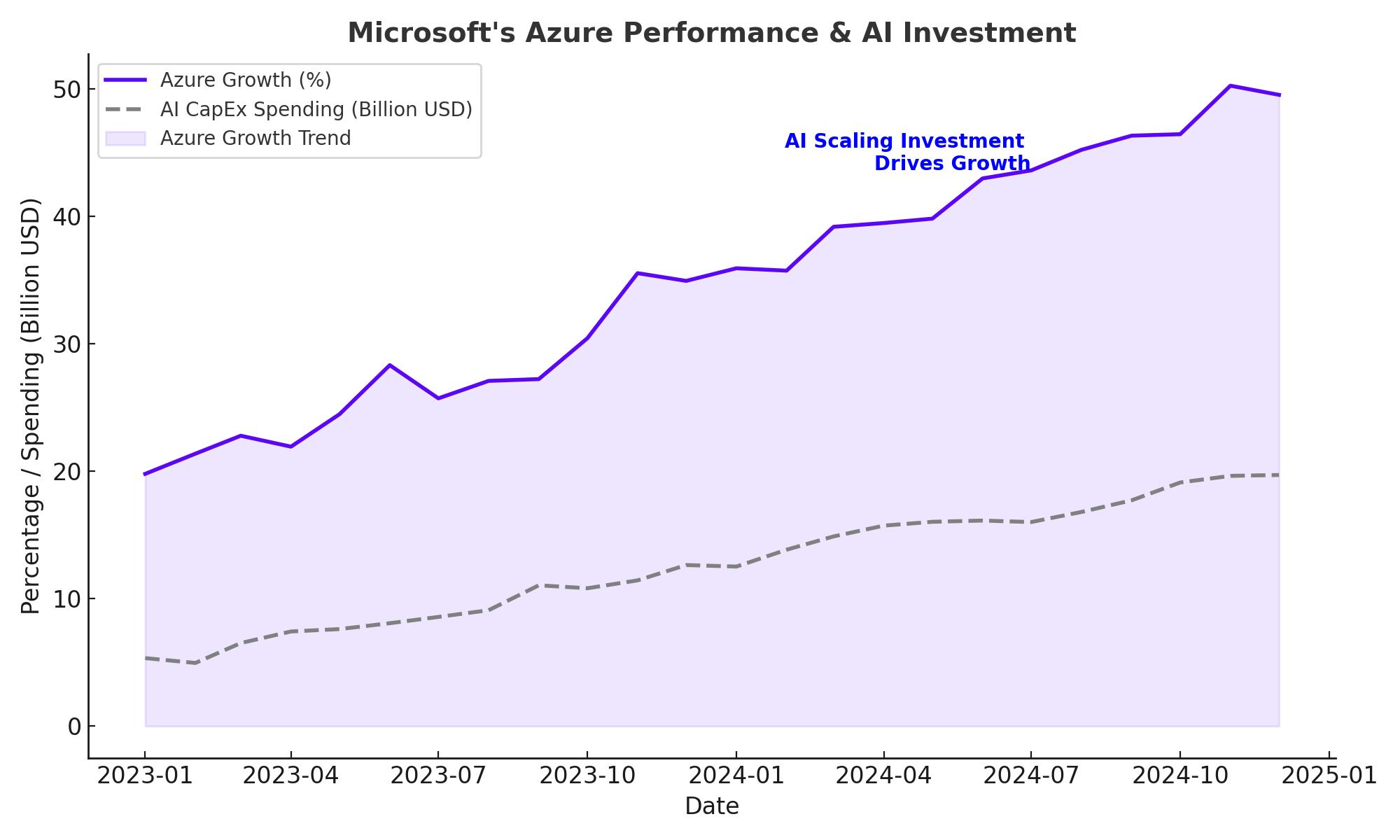

Microsoft's push into AI, backed by its strategic partnership with OpenAI, has positioned the company as a key player in generative AI. Azure’s AI Foundry, modeled after Amazon Web Services' flexible architecture, underscores Microsoft’s pivot to providing adaptable, client-focused solutions. Azure posted a 33% annualized growth in the most recent quarter, contributing significantly to Microsoft's revenue. However, the company's reliance on AI scaling raises questions about execution risks.

Recent earnings data highlighted strong revenue growth, up 16% year-over-year, with net income surging to $24.67 billion. Yet, Azure's growth trajectory remains under scrutiny as data center capacity struggles have slowed momentum. Microsoft's CapEx allocation for AI infrastructure—expected to be part of a $300 billion hyperscaler market by 2025—illustrates the company’s commitment to maintaining its edge.

Strategic Investments and Competitive Positioning

Microsoft has shown adaptability, with initiatives like its Azure AI Foundry reflecting a deliberate shift toward flexibility. These moves respond to competitive pressures from Amazon (NASDAQ:AMZN) and Google, which continue to strengthen their cloud offerings. Microsoft’s AI bundling strategy aims to maximize client value, integrating cutting-edge generative AI into Office and other enterprise solutions.

The competitive dynamics with Nvidia and AWS, particularly in custom chips and AI training infrastructure, pose challenges. Microsoft is investing heavily in its Blackwell AI chips to counter Nvidia's dominance. However, execution delays could impact profitability, particularly as AWS leads in leveraging custom chips for cost reductions and scalability.

Financial Performance Underpins Long-Term Resilience

Microsoft's financials reflect its diversified revenue streams, but challenges persist. The company reported adjusted EPS of $3.30, beating analyst expectations by 6.45%, with revenue at $65.59 billion. Guidance for the upcoming quarter projects $68.1–$69.1 billion in revenue, a 10.6% year-over-year increase at the midpoint.

Despite strong financial performance, Microsoft faces margin pressures. Free cash flow margins are projected to decline due to AI infrastructure costs, which are critical to maintaining Azure’s growth. Analysts have tempered expectations, assigning MSFT a forward P/E ratio of 31.69x, which aligns with peers like Alphabet but falls behind Nvidia.

Comparative Valuation: A Balanced Perspective

Valuation metrics reveal Microsoft’s balanced position within the MAG-7 peer group. A forward price-to-sales ratio of 11.07x places it at the higher end of the spectrum, but still below Nvidia's 27.6x. Meanwhile, its price-to-book ratio of 10.72x underscores a solid valuation compared to Alphabet (6.776x) and Meta Platforms (NASDAQ:META) at 8.502x.

Microsoft’s valuation demands flawless execution of its AI strategy. Its ability to translate investments into scalable and profitable solutions will determine whether it can justify its premium valuation.

Technical Analysis: Key Levels for NASDAQ:MSFT Investors

Microsoft's stock has faced headwinds since reaching its all-time high of $468.35 in July 2024. Currently trading near $417, MSFT shows signs of consolidation, with critical support levels at $385. A break below this threshold could signal a bearish trend, targeting December 2023 lows of $374.46.

However, the stock’s long-term bullish structure remains intact. A resumption of the broader uptrend could see MSFT retest the $460 level, fueled by robust Azure performance and AI monetization milestones. Investors are closely watching price action to identify optimal entry points for long-term positions.

Institutional Backing Reinforces Market Leadership

Institutional ownership remains a cornerstone of Microsoft’s stability. Key stakeholders like Vanguard, BlackRock, and Fidelity collectively hold significant positions, underlining their confidence in the company’s long-term prospects. This robust institutional backing strengthens Microsoft's ability to weather market volatility and execute its ambitious growth strategies.

Strategic Implications of Michael Saylor’s Bitcoin Proposal

Adding a layer of intrigue, MicroStrategy’s Michael Saylor recently proposed a Bitcoin investment strategy to Microsoft’s board. With $78 billion in cash reserves, Microsoft’s adoption of Bitcoin could mark a significant shift in corporate treasury strategies. Although the board has recommended against the proposal, its acknowledgment underscores Bitcoin's growing relevance in corporate finance.

Conclusion: Buy, Hold, or Sell NASDAQ:MSFT?

Microsoft’s strategic investments in AI and cloud infrastructure position it as a leader in next-generation technology. However, challenges in monetizing AI and scaling Azure introduce risks that investors must weigh against its robust financials and institutional support.

The stock’s current consolidation phase offers a compelling entry point for long-term investors confident in Microsoft’s ability to navigate market challenges. With its diversified business model, focus on innovation, and strong market positioning, NASDAQ:MSFT remains a buy for those seeking exposure to cutting-edge technology and long-term growth potential.