Broadcom (NASDAQ: AVGO) Positioned for Significant Gains Amid AI-Driven Growth

With Analysts Forecasting a 50% Upside, Broadcom's Strategic Positioning in the AI Market Offers Compelling Investment Potential | That's TradingNEWS

Broadcom's Impressive Recovery and AI-Driven Growth

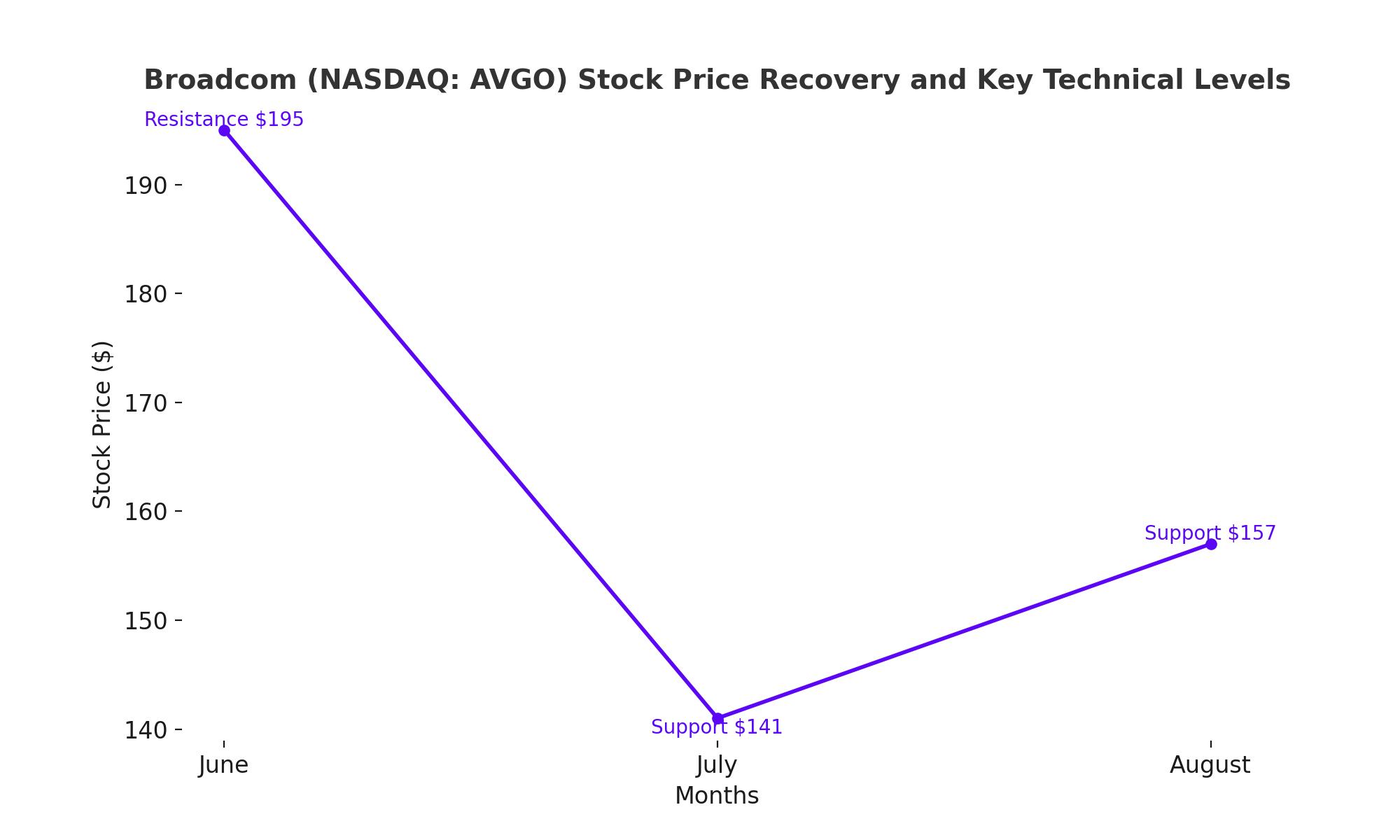

Broadcom Inc. (NASDAQ: AVGO) has shown remarkable resilience and growth potential, particularly in the rapidly expanding AI market. After a substantial 31% correction from its June highs, Broadcom has rebounded strongly, reclaiming its 50-day moving average by the end of August. However, the recovery occurred with decreasing trading volumes, indicating caution among institutional investors. As the company prepares to release its fiscal third-quarter earnings report on September 5, all eyes are on its AI-driven revenue growth, which has been a critical driver of its recent performance.

Key Technical Levels for NASDAQ: AVGO

Investors should closely monitor key technical levels leading into Broadcom's earnings release. The first critical support level is around $157, which has acted as a floor during recent market fluctuations. Should the stock fail to hold this level, the next significant support is around $141, a level where Broadcom traded sideways for four months earlier this year. On the upside, key resistance levels to watch are at $168 and $195, which could come into play if the company delivers a strong earnings report.

AI Revenue Surge and Market Position

Broadcom's AI revenue has been a standout, with a reported 280% year-over-year increase in the previous quarter. The company has projected over $11 billion in AI-related revenue for 2024, with some analysts suggesting that this figure could be conservative. Broadcom's custom AI chips, particularly its application-specific integrated circuits (ASICs), are being rapidly adopted by major technology companies for training and deploying AI models. This has not only bolstered Broadcom's semiconductor sales, which accounted for 58% of its total revenue, but also driven its overall growth.

Financial Performance and Earnings Expectations

For the upcoming fiscal third quarter, analysts are expecting Broadcom to report $12.96 billion in revenue and earnings per share (EPS) of $1.20. However, given the company's track record of beating estimates, there is potential for an upside surprise. In the previous quarter, Broadcom reported an EPS of $10.96, surpassing expectations by $0.12, and revenues of $12.49 billion, a 43% year-over-year increase. With these figures, the company's robust financial performance underscores its strong market positioning.

Strategic Ventures and VMware Integration

Broadcom's strategic acquisition of VMware has also been a critical factor in its growth. The integration of VMware has contributed significantly to Broadcom's infrastructure software revenue, which increased by 175% in Q2'24. The transition from perpetual licenses to a subscription-based model for VMware products has been particularly successful, with a 28% sequential growth in VMware sales. Management is targeting a $4 billion run rate for VMware, which, if achieved, will further solidify Broadcom's dominance in the enterprise software market.

Long-Term Growth Potential and Analyst Ratings

Looking ahead, Broadcom's growth prospects remain robust. Analysts forecast that the company's AI-driven semiconductor revenue could increase at an annual rate of 30% to 40% over the next four to five years, with a cumulative AI revenue opportunity estimated at $150 billion. The company's forward earnings multiple of 27x, based on expected earnings of $4.75 per share this year, reflects investor confidence in its long-term growth trajectory.

According to Wall Street analysts, Broadcom's stock is poised for significant gains, with a 12-month average price target of $240, representing a 50% upside from its current trading levels. This bullish outlook is supported by Broadcom's strategic positioning in the AI market and its ability to consistently outperform earnings expectations.

Potential Risks and Considerations

Despite Broadcom's strong growth potential, there are risks to consider. The company faces competition in the AI networking space and could be impacted by a slower-than-expected economy or prolonged high-interest rates. Additionally, Broadcom's ability to meet high market expectations is crucial; any failure to do so could result in downward pressure on the stock. Investors should weigh these risks carefully before making investment decisions.

Conclusion: Why NASDAQ: AVGO Is a Strong Buy

Broadcom (NASDAQ: AVGO) presents a compelling investment opportunity, particularly for those looking to capitalize on the explosive growth in the AI market. With robust financials, strategic acquisitions like VMware, and a dominant position in AI-driven semiconductor solutions, Broadcom is well-positioned for sustained long-term growth. The current price levels offer an attractive entry point, with significant upside potential as reflected in analyst price targets. Investors should consider adding Broadcom to their portfolios ahead of its upcoming earnings release and holding for the long term to capitalize on the company's growth trajectory.

For a detailed view of Broadcom's real-time stock performance, visit the AVGO Real-Time Chart.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex