Economists Warn of Impending U.S. Recession in the Next 12 Months, Survey Finds

Economic Experts Warn of Looming Recession as Majority of Economists Anticipate Turbulent Times Ahead

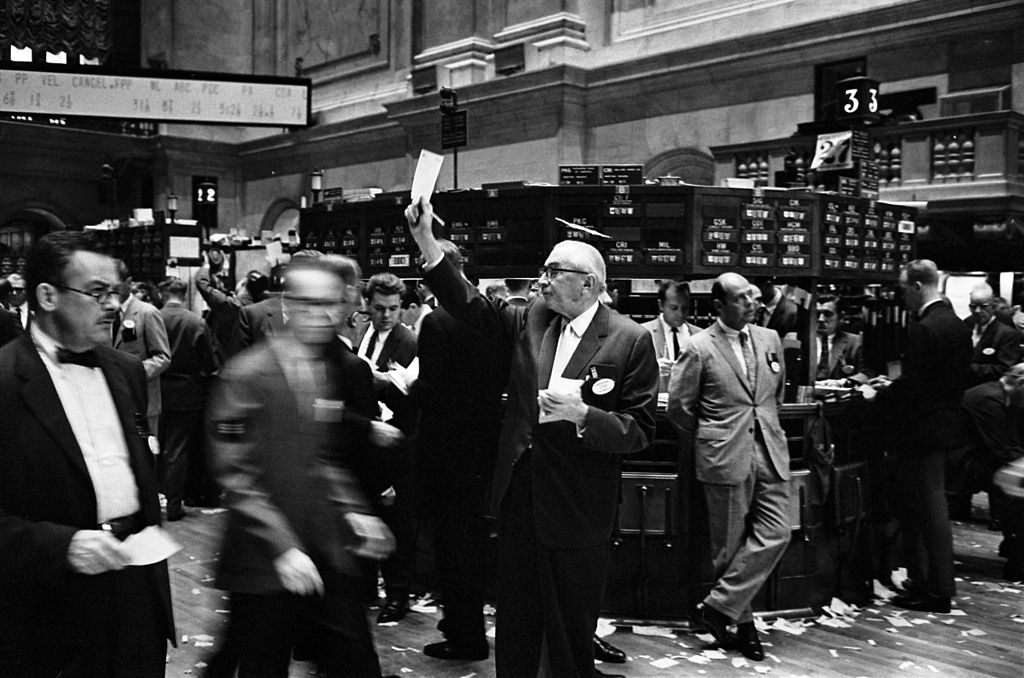

The economic landscape in the United States is currently under scrutiny as economists analyze potential banking and debt ceiling challenges. A recent survey conducted by TradingNews.com sheds light on economists' perspectives, revealing cautious optimism alongside concerns of a looming recession. This comprehensive analysis considers various economic factors, including inflation, monetary policy, market sentiment, and investment considerations.

Among the economists surveyed, approximately 59% anticipate a recession within the next 12 months. However, there has been a shift in the projected timeline, with economists now predicting a potential recession starting in the third quarter or later. This adjustment suggests that the economy may exhibit greater resilience than initially anticipated. Nonetheless, concerns persist regarding the impact of "too much monetary tightness" resulting from the Federal Reserve's repeated interest rate hikes aimed at curbing inflation. It is crucial to monitor the consequences of these rate hikes on economic growth and market stability.

Economists foresee a moderation of inflationary pressures, indicating a potential slowdown in price increases. Despite this, the majority of respondents believe that it will take until 2025 or later for the Federal Reserve's primary inflation gauge, the core Personal Consumption Expenditures index, to reach the 2% target. This extended timeline suggests that inflationary pressures may persist in the near term. As a result, interest rates are expected to remain elevated throughout the year, with some economists predicting rate cuts in the first quarter of the following year. The possibility of a rate cut would depend on factors such as a slowdown in inflation, a rise in unemployment, or a severe recession.

The Federal Reserve's monetary policy decisions play a crucial role in shaping the economic landscape. Federal Reserve Chair Jerome Powell has adopted a data-driven approach, leaving room for flexibility in the decision-making process. While Powell has hinted at a potential pause in the interest rate hiking cycle, other Fed officials express differing views. Federal Reserve Governor Christopher Waller maintains a stance in favor of rate hikes unless there is clear evidence of inflation moving towards the 2% target. On the other hand, Federal Reserve Bank of Boston President Susan Collins suggests that monetary policy may soon reach a point where interest rate increases can be paused. These nuanced perspectives reflect ongoing deliberations within the Federal Reserve regarding the appropriate course of action.

In light of the economic outlook and monetary policy considerations, investors should carefully evaluate their investment strategies. TradingNews.com recommends a cautious approach, taking into account factors such as inflation expectations, market sentiment, and the potential for future rate cuts. It is essential to conduct thorough research and analysis of individual investment opportunities, considering the specific risks and opportunities associated with each asset class. Diversification across different sectors and asset types can help mitigate risk and optimize potential returns.

When it comes to investment considerations, it is important to assess the potential impact of economic factors on various asset classes. The stock market, for instance, may be influenced by economic indicators, market sentiment, and company-specific factors. While a potential recession may raise concerns, it is worth noting that market performance during recessions can vary. Historical data shows that some sectors and companies have been resilient during economic downturns, while others have faced challenges. In such circumstances, investors should focus on companies with strong fundamentals, stable cash flows, and a history of navigating challenging economic environments.

Furthermore, fixed-income investments, such as bonds, can be an attractive option for investors seeking stability and income. The outlook for interest rates should be carefully considered when investing in bonds, as changes in rates can impact bond prices. In a rising interest rate environment, bond prices tend to decline, while falling interest rates can lead to bond price appreciation. Therefore, investors should assess their risk tolerance and investment objectives when considering fixed-income investments.

Real estate investments can also be an avenue for diversification and potential long-term growth. Factors such as interest rates, supply and demand dynamics, and demographic trends can influence the performance of the real estate market. It is crucial to conduct thorough market research and due diligence when investing in real estate, considering factors such as location, property type, and rental income potential.

In conclusion, the economic outlook remains dynamic, with economists expressing cautious optimism while acknowledging the potential for a future recession. The Federal Reserve's monetary policy decisions, particularly regarding interest rates, continue to shape market sentiment and investment considerations. Investors should stay informed, adapt their strategies to changing economic conditions, and seek professional advice when needed. By staying vigilant and proactive, investors can navigate the evolving economic landscape and position themselves for long-term success.

Read More

-

Salesforce Stock Price Forecast - Why CRM Stock Around $238 Still Discounts Agentforce And 34% FCF

14.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Holds Above $2 as Luxembourg EMI and CLARITY Act Cut Regulatory Risk

14.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Oil Breaks Out Toward $62 as Brent Jumps Above $66 on Geopolitical Risk

14.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Slides to 48,977 as BAC, WFC Sink and Gold Blasts to $4,621

14.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Holds 1.34–1.35 Band As Fed Independence Shock Offsets Strong US Numbers

14.01.2026 · TradingNEWS ArchiveForex