Fed Chairman Addresses Regional Bank Failures Amid Persistent Inflation Concerns

Central Bank Raises Interest Rates Despite Economic Risks, Aiming to Restore Inflation Target

Fed Governor Addresses Regional Bank Failures Amid Tightening Credit Conditions: A Comprehensive Analysis of Current Economic and Regulatory Scenarios

The Federal Reserve Chairman, at a recent press conference, acknowledged the impact of recent regional bank failures on credit conditions, stating that this could potentially affect the economy. Despite these concerns, the Chairman emphasized the stability and strength of the US banking system, ensuring the use of all necessary tools to maintain its resilience.

Fed Chairman Jerome Powell revealed that the events at regional banks, including the collapse of Silicon Valley Bank, Signature Bank, and Silvergate Capital, have put pressure on credit terms for households and businesses. In response, the Federal Reserve decided to raise the interest rate by 25 basis points, from 4.75% to 5%. This move was aimed at gradually moderating the persistently high inflation rate, which currently stands at 6% per year.

Recent data highlights stubborn inflation levels that are slow to decrease, even as global commodity prices fall and supply chain disruptions ease. Core inflation, excluding food and energy prices, remained high at 5.5% per year in February. Powell emphasized the Fed's primary goal of returning to the inflation target of 2% per year.

Despite warnings from economists and analysts that raising interest rates at this time could exacerbate pressures on smaller banks and financial institutions, the Fed adheres to the "principle of separation" in modern central banking. This approach prioritizes achieving price stability, using additional policy tools to support financial stability as needed.

Powell also addressed the mismanagement of Silicon Valley Bank, which led to the bank's exposure to interest-rate risk and uninsured deposits. Regulatory filings reveal that about 93.8% of SVB’s deposits were uninsured as of the end of 2022, exceeding the $250,000 cap on deposit insurance provided by the Federal Deposit Insurance Corporation (FDIC). Additionally, SVB was overexposed to long-dated Treasury securities, creating substantial interest-rate risk as the Federal Reserve increased rates to combat inflation. Bond prices decrease as interest rates rise, forcing SVB to sell off portions of its bond portfolio at a loss to meet depositors’ withdrawal demands amid concerns about the bank’s long-term viability.

This announcement of losses from bond sales caused the company's stock to plummet, sparking concern among depositors who rushed to withdraw their money, exacerbating the bank's woes, and prompting its failure. Consequently, the FDIC, in concert with the Federal Reserve and Treasury Department, seized SVB, deeming it a systemic risk to the financial system. They provided protection for all the bank’s depositors, including those with account balances above the standard $250,000 cap on FDIC deposit insurance.

In conclusion, the Federal Reserve Chairman reassured the public about the stability and strength of the US banking system, despite recent regional bank failures. The focus remains on returning to the inflation target of 2% per year while maintaining financial stability.

Read More

-

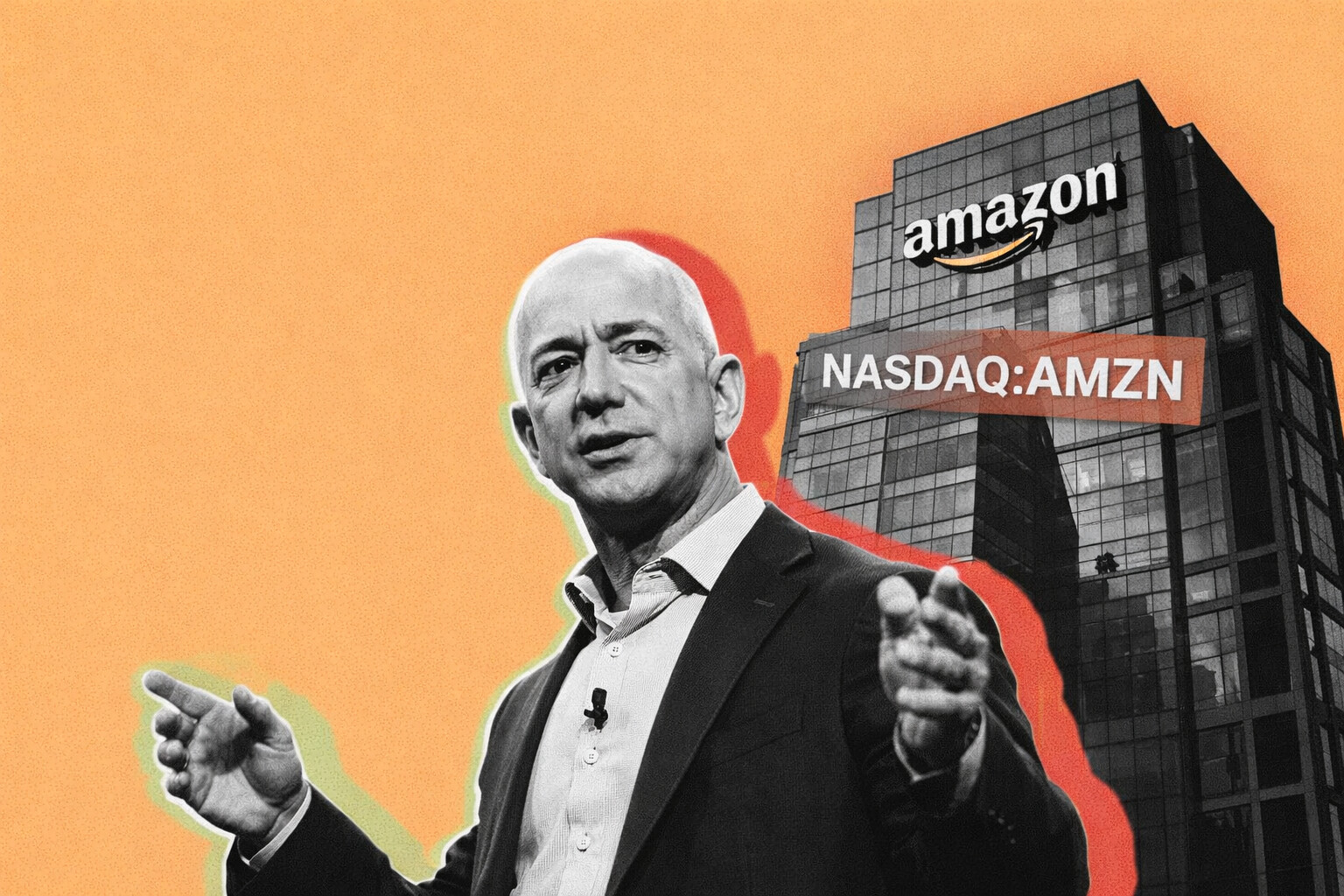

Amazon Stock Price Forecast - AMZN Stock; AI Capex, AWS Acceleration And The Road To $300

21.01.2026 · TradingNEWS ArchiveStocks

-

Solana Price Forecast - SOL-USD Clings to the $125–$145 Zone as Futures Flush, ETFs Accumulate and SKR Airdrop Hits the Market

21.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Skyrockets Toward $5: NG=F Short Squeeze Meets Deep Freeze

21.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones, S&P 500 And Nasdaq Rebound As Gold Soars To $4,859 And Netflix Slumps

21.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Tests 1.3450 as Sticky UK Inflation and Trump’s Greenland Tariffs Hit the Dollar

21.01.2026 · TradingNEWS ArchiveForex