Oil Prices Surge to $81: Oil is a Buy Amid Middle East Tensions

Oil Soars to $81 per Barrel Amid Middle East Turmoil and Strategic Acquisitions by Major Corporations | That's TradingNEWS

Volatility in Oil Prices Amid Geopolitical Tensions and Market Dynamics

Geopolitical Events Fueling Oil Price Surge

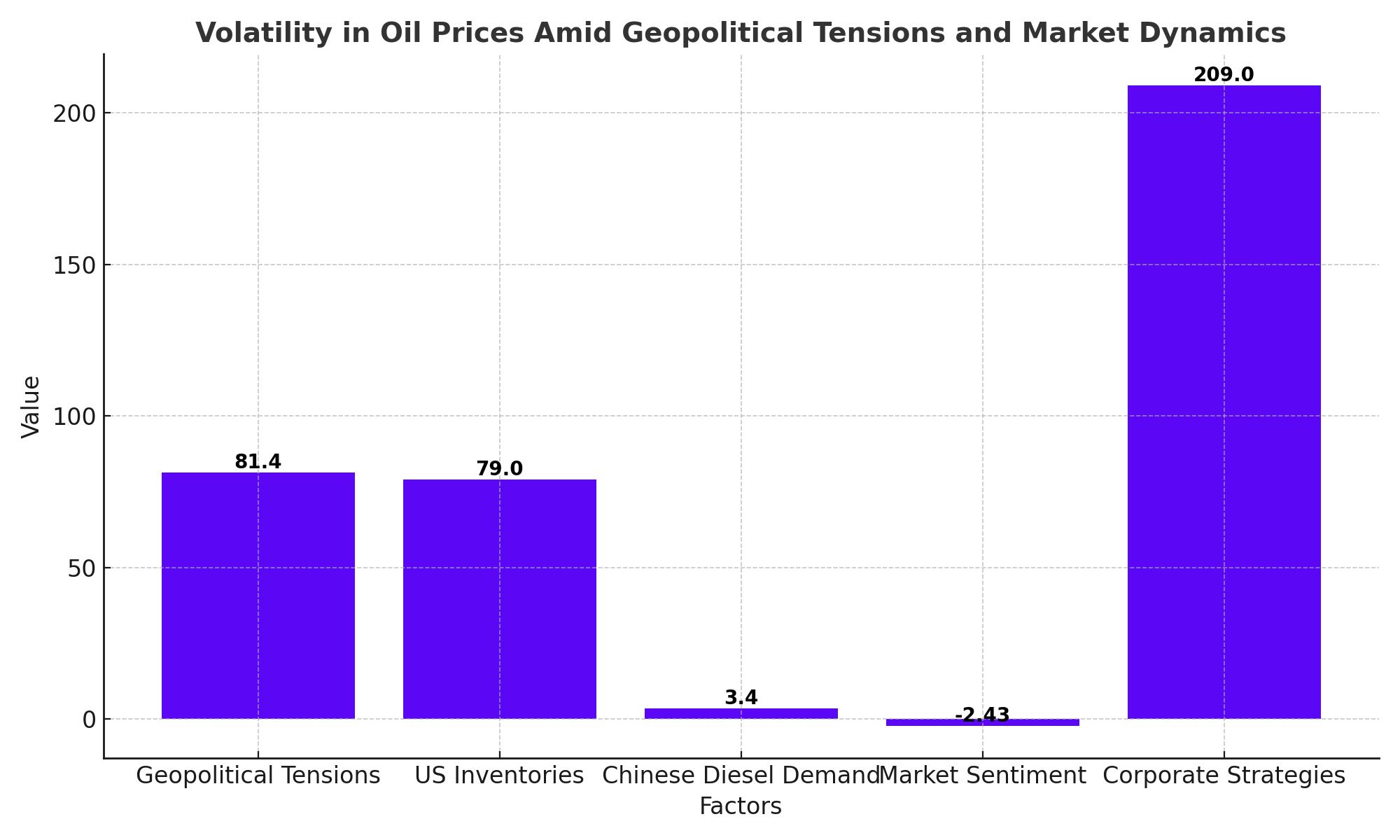

The oil market has experienced significant volatility, with prices spiking due to geopolitical tensions and supply concerns. The assassination of Hamas leader Ismail Haniyeh in Iran, followed by the killing of a senior Hezbollah commander in Beirut, escalated tensions in the Middle East, raising fears of a wider regional conflict. This unrest pushed oil prices higher, with Brent crude climbing past $81 per barrel and West Texas Intermediate (WTI) nearing $79 per barrel. The potential threat of Iran blocking the Strait of Hormuz, a critical chokepoint for global oil transport, has also contributed to the bullish sentiment, as it could disrupt 15-20% of the world's oil supply.

Impact of U.S. Inventories and Refining Margins

The U.S. Energy Information Administration (EIA) reported a reduction in crude oil stockpiles by 3.4 million barrels, supporting the price increase. However, Chevron Corporation (NYSE: CVX) reported a decline in second-quarter earnings, impacted by lower refining margins and weak natural gas prices. Chevron's earnings fell to $4.4 billion, or $2.43 per diluted share, down from $6.0 billion, or $3.20 per share, in the same period of 2023. Despite record production in the Permian Basin and higher U.S. output after integrating PDC Energy, the company faced challenges from lower margins on refined product sales.

Chinese Diesel Demand and Global Oil Consumption

China's diesel demand has been particularly weak, with analysts expecting it to remain sluggish for the rest of the year. The property sector crisis and the rise of LNG use in trucking have weighed on diesel consumption, with projections showing a decline of 2-7% in the second half of 2024. This downturn contrasts with China's previous role as a key driver of global oil demand growth, which averaged 4.6% annually over the past decade. With both diesel and gasoline demand plateauing, China's oil demand growth is forecasted to be just below 3% for 2024, down from an 11.7% rebound last year.

Market Sentiment and Investment Strategies

Despite the recent surge in oil prices, the market remains cautious, with demand concerns overshadowing the geopolitical risk premium. Brent crude has fluctuated around $80 per barrel, while West Texas Intermediate (WTI) hovers near $77 per barrel. The July PMI readings indicated a significant slowdown in manufacturing activity across Asia, Europe, and the United States, signaling potential declines in energy consumption. Asia's PMI dropped to 46.8, its lowest in eight months, while the eurozone recorded a stagnant 45.8, underscoring a contraction in factory activities. In contrast, the EIA's report of stronger-than-expected domestic oil demand for May, which reached a seasonal record of 20.80 million barrels per day, has provided a glimmer of hope. This optimistic data suggests potential demand growth for the remainder of the year, despite prevailing uncertainties.

Corporate Strategies and Market Movements

Vitol's acquisition of Noble Resources Trading Limited for $209 million exemplifies the strategic maneuvers by major traders to broaden their market presence and reinvest profits. This acquisition is a significant step in Vitol's strategy to fortify its foothold in the energy products and industrial raw materials sectors. Noble Resources, a key player in energy coal, oil products, and metallurgical coke supply chains, enhances Vitol's capabilities and market reach. Similarly, BP's agreement with the Iraqi government to rehabilitate and develop four oil fields in Kirkuk highlights ongoing efforts by major oil companies to secure and optimize new production sources. This deal, involving the development of fields with an estimated nine billion barrels of recoverable crude, aims to stabilize and potentially increase production, addressing both short-term supply challenges and long-term strategic goals.

Outlook and Strategic Considerations

As oil prices continue to exhibit volatility, with Brent crude prices recently exceeding $81 per barrel, the market remains vigilant. Geopolitical developments, such as the heightened tensions in the Middle East, and supply chain disruptions are critical factors influencing market dynamics. The potential for further escalation in the region, especially threats to the Strait of Hormuz, could significantly impact global oil supply and prices. Meanwhile, economic uncertainties, particularly around manufacturing slowdowns and energy consumption, persist. Despite these challenges, strategic investments and enhanced operational efficiencies by major players like Chevron, Vitol, and BP are pivotal. Chevron's recent production increase and BP's strategic agreements are designed to ensure resilience and capitalize on emerging opportunities in the energy sector.

Conclusion

The current bullish trend in oil prices is underpinned by a complex interplay of geopolitical tensions, supply concerns, and fluctuating market dynamics. Significant events, such as the assassination of key figures in the Middle East and strategic corporate acquisitions, are shaping the landscape. With Brent crude oscillating around $81 per barrel and WTI near $77 per barrel, the oil market remains a critical focus for investors and analysts. As these factors evolve, it is essential to monitor geopolitical developments, inventory levels, and demand indicators closely. Strategic investments and operational efficiencies will play a crucial role in navigating the evolving energy landscape and making informed investment decisions.

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex