Alphabet (NASDAQ:GOOG): Stock Analysis , Growth Prospects and Market Dynamics

Evaluating Alphabet's Market Position, Financial Strength, and Future Potential Amidst Competitive Tech Giants | That's TradingNEWS

Alphabet Inc. (NASDAQ:GOOG): Future Growth, Financial Strength, and Market Potential

Alphabet’s Market Cap and Growth Potential

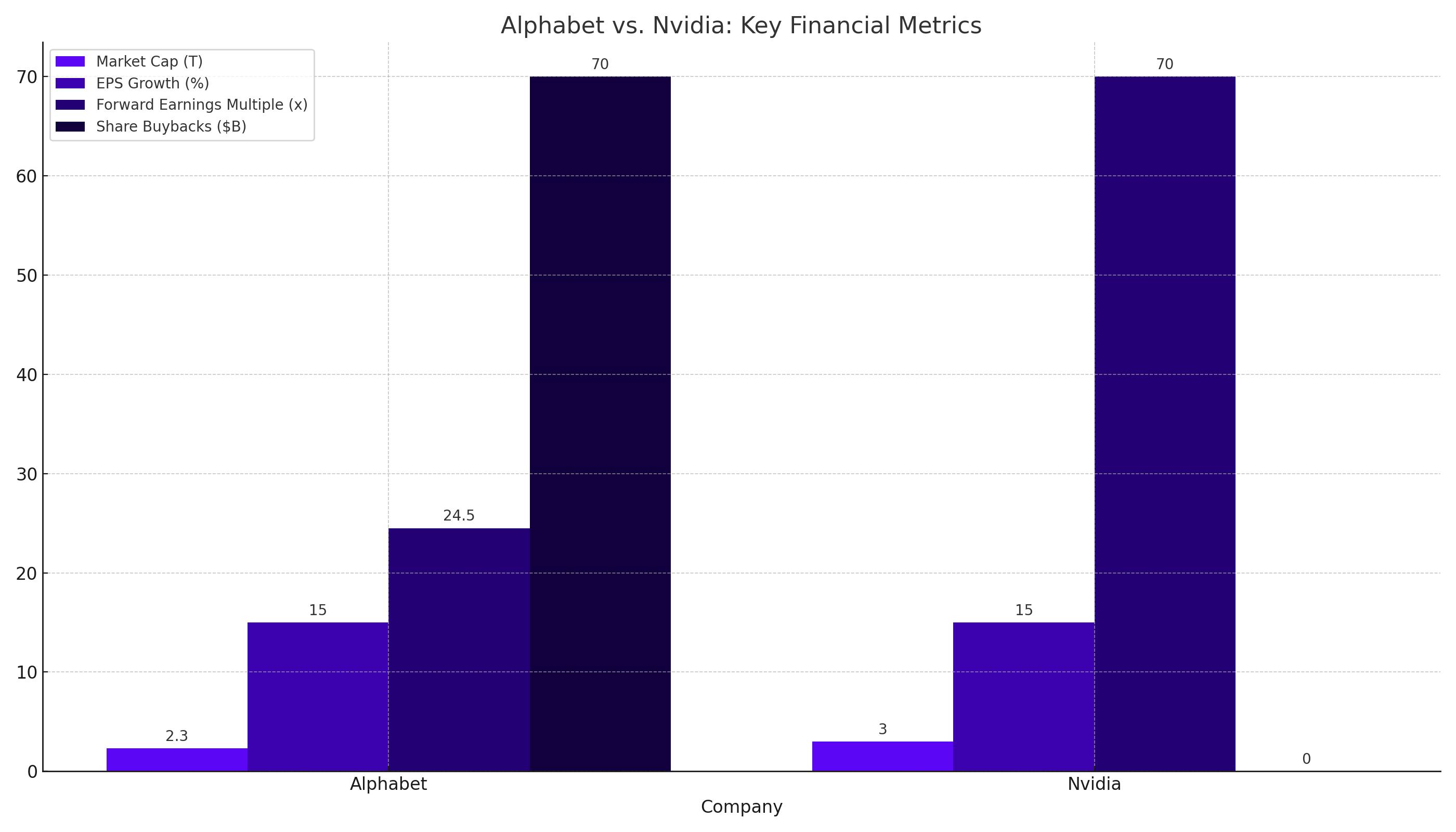

Alphabet Inc. (NASDAQ:GOOG) is poised for substantial growth, potentially surpassing Nvidia in market capitalization over the next few years. With Nvidia's market cap at approximately $3 trillion and Alphabet at around $2.3 trillion, Alphabet would need to achieve a 31% growth rate to catch up. This target is feasible given Alphabet's historical performance and growth trajectory. Alphabet's current forward earnings multiple is 24.5 times, which is modest compared to Microsoft's 34 times and Apple's 33 times. If Alphabet were valued similarly, its market cap would approximate $3.08 trillion.

Earnings Growth and Share Buybacks

Alphabet’s earnings growth is robust, supported by aggressive share buyback programs. Analysts project Alphabet's EPS to grow at a compound annual growth rate (CAGR) of 15%, potentially reaching a $3 trillion market cap by 2026. The company’s new $70 billion share repurchase plan leverages its $110 billion in cash assets and $12 billion in long-term debt, strengthening its market position. Alphabet has consistently spent over $12 billion per quarter on share buybacks, illustrating its commitment to enhancing shareholder value through reduced share count and increased earnings per share.

Advertising Revenue and AI Integration

Alphabet's advertising revenue, particularly from Google Search and YouTube, continues to drive significant growth. The introduction of generative AI features in Google Search, including the Gemini model and AI Overviews, has accelerated revenue growth. In Q1 FY2024, Google Search revenue grew by 14.4% year-over-year, contributing to a total revenue increase of 15.4%. YouTube, especially YouTube Shorts, has shown impressive growth. The monetization rate for YouTube Shorts has doubled over the past 12 months in the U.S., driven by AI enhancements like Dream Screen. This segment's continued growth is crucial for Alphabet's overall advertising revenue.

Google Cloud and AI Investments

Google Cloud's revenue grew by 28.4% year-over-year in Q1 FY2024, surpassing Amazon's AWS growth rate. The expanding operating margin in Google Cloud, combined with increased revenue from Google Services, pushed Alphabet’s overall EBIT margin to 31.6%, the highest since Q3 FY2021. This margin expansion has led to a 61% year-over-year increase in GAAP EPS. Alphabet's significant investment in AI infrastructure, including a projected 52% year-over-year increase in capital expenditures for FY2024, underscores its commitment to sustaining long-term growth. These investments focus on the Gemini foundation model and other AI innovations, ensuring Alphabet's competitive edge in the tech industry.

Regulatory Risks and Competitive Landscape

Alphabet faces regulatory scrutiny, particularly regarding its dominant search engine position and data collection practices. Recent Supreme Court rulings and ongoing antitrust investigations could impact its operations. Despite these risks, Alphabet's strong financial foundation and strategic investments in AI position it well for future growth. Alphabet’s robust financial health, aggressive share buybacks, and strategic investments in AI are driving significant growth across its product ecosystem. Despite its recent stock performance, Alphabet remains undervalued compared to its peers, presenting a compelling investment opportunity. As the company continues to innovate and expand its market presence, it is well-positioned to achieve a market cap of $3 trillion, potentially surpassing Nvidia. Investors should closely monitor Alphabet's financial performance, regulatory landscape, and technological advancements to make informed investment decisions.

Valuation and Financial Metrics

Alphabet's current forward earnings multiple is 24.5 times, slightly above the broader market's 22.3 times but significantly lower than Microsoft's 34 times and Apple's 33 times. Alphabet's relatively lower valuation suggests a potential for upward revaluation. If Alphabet were valued at a 33 times forward earnings multiple, its market cap would approximate Nvidia's at $3.08 trillion. Alphabet’s significant investment in AI infrastructure, including a projected 52% year-over-year increase in capital expenditures for FY2024, underscores its commitment to sustaining long-term growth. These investments focus on the Gemini foundation model and other AI innovations, ensuring Alphabet's competitive edge in the tech industry.

Regulatory Risks and Competitive Landscape

Alphabet faces regulatory scrutiny, particularly regarding its dominant search engine position and data collection practices. Recent Supreme Court rulings and ongoing antitrust investigations could impact its operations. Despite these risks, Alphabet's strong financial foundation and strategic investments in AI position it well for future growth.

Conclusion

Alphabet Inc. (NASDAQ:GOOG) is leveraging its robust financial health, aggressive share buybacks, and strategic investments in AI to drive significant growth across its product ecosystem. Despite its recent stock performance, Alphabet remains undervalued compared to its peers, presenting a compelling investment opportunity. As the company continues to innovate and expand its market presence, it is well-positioned to achieve a market cap of $3 trillion, potentially surpassing Nvidia. Investors should closely monitor Alphabet's financial performance, regulatory landscape, and technological advancements to make informed investment decisions.

That's TradingNEWS

Read More

-

SCHV ETF Price Forecast - SCHV Near $31 High: Is This The Right Value Hedge To The AI Trade?

29.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF XRPI Slides to $10.28 as XRPR Trades Around $15 and XRP-USD Stays Below $1.90

29.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas price jumps toward $4 as U.S. freeze and 242 Bcf draw squeeze supply

29.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Comeback From 159 High Turns 150 Zone Into the Next Big Test

29.01.2026 · TradingNEWS ArchiveForex