Amazon (NASDAQ:AMZN): Resilient Growth with 27% Upside Potential

E-commerce efficiency, AWS dominance, and soaring ad revenues make AMZN a strong buy at $215 | That's TradingNEWS

Amazon (NASDAQ:AMZN): Dominance Across E-commerce and Cloud Propels Future Growth

Amazon.com, Inc. (NASDAQ:AMZN) stands as a global leader, showcasing robust dominance in e-commerce and cloud computing through its AWS division. With the stock trading at approximately $215 and a year-to-date gain of over 45%, AMZN continues to solidify its position as a long-term growth asset in an otherwise volatile market. Analysts project a compelling trajectory for Amazon’s revenues, profitability, and competitive edge, driven by strategic expansion in cloud services, innovative e-commerce logistics, and accelerating advertising revenues.

E-commerce: Unmatched Scale and Efficiency Driving Growth

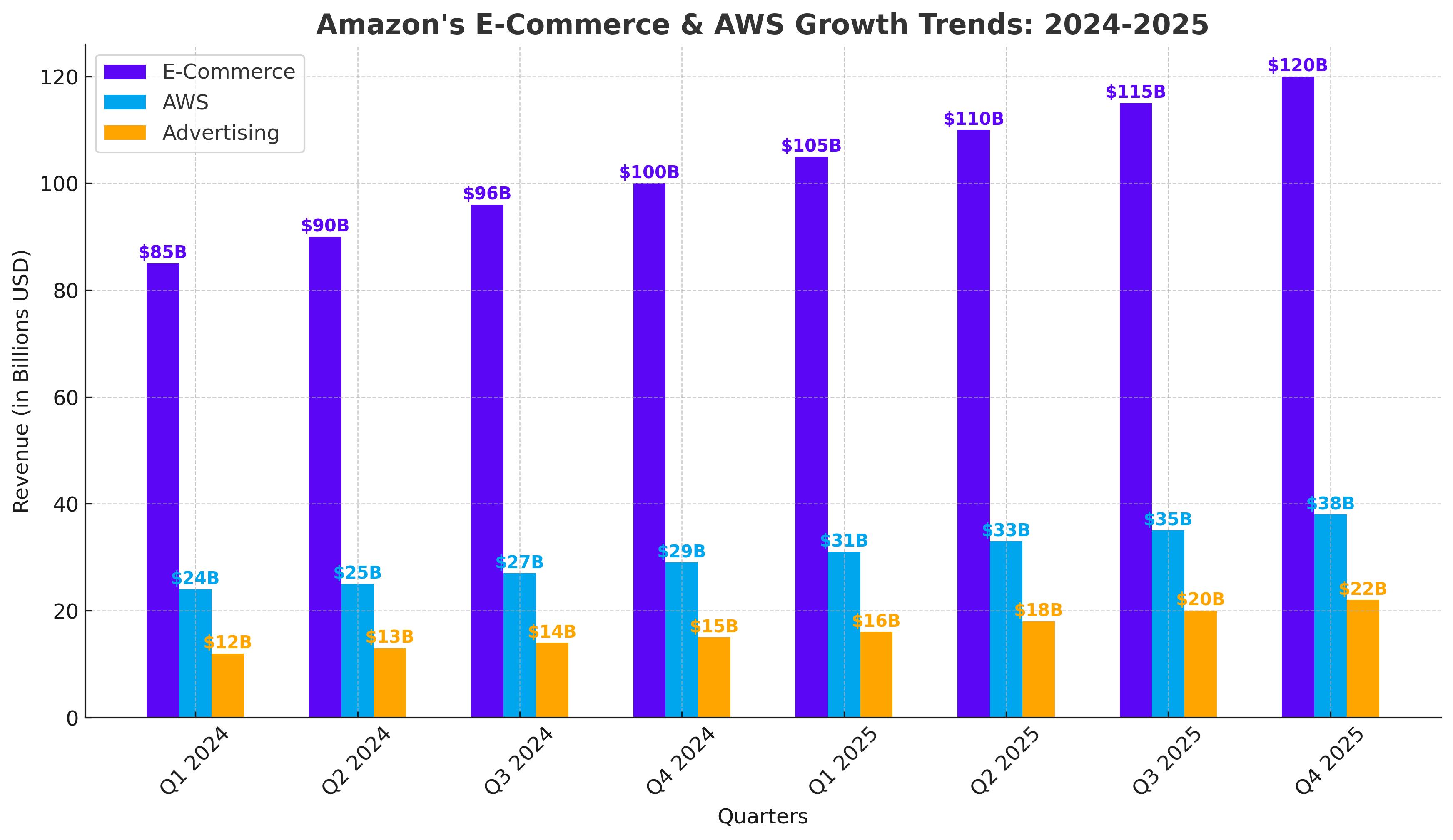

Amazon’s North American e-commerce segment, the largest contributor to its revenue, delivered $95.54 billion in Q3 2024, a year-over-year increase of 8.7%. Operating income for this division rose 31.5%, reaching $5.66 billion. The company's emphasis on pricing, product selection, and delivery efficiency has allowed it to gain market share even in a highly competitive retail environment. For instance, Amazon’s ability to enhance fulfillment speed by 25% year-over-year underscores its logistical superiority.

In the international segment, revenues climbed 11.7% year-over-year to $35.89 billion in Q3 2024. Remarkably, this division achieved profitability, swinging from a $95 million operating loss in Q3 2023 to a $1.3 billion profit in the latest quarter. This turnaround is attributed to strategic investments in local fulfillment centers and optimized shipping networks, which mirror the success of the North American model.

Amazon’s advertising revenue, an often-overlooked segment, reached $14.3 billion in Q3 2024, reflecting a 26% increase year-over-year. Analysts project ad revenues to surpass $100 billion annually by 2026, positioning Amazon as a formidable competitor to Alphabet (GOOG) and Meta Platforms (META). Its integration of AI-driven advertising tools further enhances its monetization capabilities, making this a key driver for future profitability.

AWS: Cloud Leadership Strengthened by Generative AI

Amazon Web Services (AWS), its cloud computing division, posted $27.45 billion in Q3 2024 revenues, a 19.1% year-over-year growth. Operating income surged 49.8% to $10.45 billion, bolstered by a record-high 37.8% operating margin. AWS maintains a commanding 31% market share in the global cloud infrastructure sector, outperforming rivals like Microsoft Azure and Google Cloud.

AWS is increasingly becoming integral to generative AI development. With Goldman Sachs projecting global cloud revenues to reach $2 trillion by 2030, AWS’s ability to integrate AI-powered workloads ensures sustained growth. Recent partnerships, including an expanded collaboration with ServiceNow for generative AI solutions, underline AWS’s pivotal role in shaping the future of cloud technology. AWS also launched innovative features, such as the "Buy with AWS" service, to streamline partner integrations, further solidifying its ecosystem.

Strategic Financial Position and Shareholder Value

Amazon’s financial health remains robust, with $88 billion in cash reserves and $54.9 billion in debt. The company's strong balance sheet enables it to continue heavy investments in growth areas like cloud expansion, AI integration, and logistics enhancements. Operating cash flows grew by 22.4% year-over-year to $25.97 billion in Q3 2024, reflecting consistent improvement in cash generation.

Management’s focus on profitability is evident as operating income surged 56% year-over-year to $17.4 billion in the last quarter. Looking ahead, Amazon forecasts Q4 2024 revenues to range between $184 billion and $188.5 billion, representing 11% growth at the high end. Operating income is expected to climb further to $20 billion.

Valuation and Growth Outlook

Amazon trades at a forward price-to-earnings (P/E) ratio of approximately 40x, supported by an estimated five-year annualized EPS growth rate of 20%. The PEG ratio of 2.0 underscores the stock's attractiveness relative to its growth potential. Analysts estimate that AWS alone could be valued at $1.76 trillion, contributing approximately $167 per share, while the e-commerce business, with its projected $550 billion in 2025 revenues, could add $107 per share. Combined, this suggests a fair value of $273 per share, representing 27% upside from current levels.

Consensus revenue forecasts anticipate growth of 11% in FY2025, with projections reaching $676 billion by FY2027. The company’s ability to scale profitability while maintaining a diversified revenue base ensures resilience against economic fluctuations.

Key Risks and Mitigation Strategies

Amazon’s e-commerce and cloud businesses are built on strong foundations with significant barriers to entry. However, competitive threats remain significant, particularly in the cloud sector, where Microsoft Azure and Google Cloud continue to expand aggressively, leveraging their vast financial resources. AWS, while maintaining a 31% market share, must continuously innovate to defend its leadership position, especially as generative AI becomes a critical battleground for cloud dominance. Additionally, Amazon faces ongoing scrutiny in the European Union over alleged anti-competitive practices in its e-commerce operations. If fines or regulations arise, they could impact short-term financial performance and brand reputation.

Another challenge lies in the cyclical nature of technology investments. If enterprise spending slows, AWS growth could decelerate, creating headwinds for overall revenue growth. However, Amazon’s diversified revenue streams, including its booming advertising segment, which contributed $14.3 billion in Q3 2024, provide a buffer against sector-specific downturns. The company’s ability to generate consistent cash flow and profitability across its business lines minimizes exposure to these risks.

Expansion into AI and Advertising Leadership

One of Amazon’s most promising growth avenues lies in artificial intelligence and advertising. AWS’s deep integration with AI-driven workloads solidifies its position as a preferred cloud provider for businesses looking to scale machine learning applications. The company’s partnerships with industry leaders like ServiceNow and its continuous innovation with tools like Amazon Bedrock highlight AWS's potential to dominate the AI revolution.

The advertising segment, often overshadowed by AWS and e-commerce, has emerged as a powerhouse, with revenues projected to exceed $100 billion annually by 2026. This segment’s growth far outpaces that of competitors like Google and Meta, demonstrating Amazon’s ability to leverage its vast e-commerce ecosystem to monetize ad inventory effectively. AI-driven enhancements to advertising platforms further position Amazon to gain market share in this $700 billion industry.

Final Analysis

Amazon’s leadership across e-commerce, cloud computing, and advertising makes it a cornerstone of innovation and profitability. With a forward price-to-earnings ratio of approximately 40x and an expected five-year annual EPS growth of 20%, the stock offers a compelling investment opportunity. Current valuations suggest a fair price target of $273, reflecting a 27% upside potential.

The company’s aggressive investments in AI, coupled with its relentless pursuit of operational efficiency, bolster its long-term prospects. Amazon’s ability to expand margins in North America and turn international operations profitable highlights its operational excellence. For long-term investors seeking exposure to transformative growth sectors, Amazon remains a "strong buy," supported by its robust cash flow, strategic innovation, and a resilient business model.

That's TradingNEWS

Read More

-

AMLP ETF (NYSEARCA:AMLP): 8.29% Yield From America’s Midstream Toll Roads

06.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Lift XRPI to $13.12 and XRPR to $18.57 as XRP-USD Price Targets $2.40+

06.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Breaks Down as Henry Hub Spot Hits $2.86 and NG=F Slips Toward $3.00

06.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.70 While Markets Weigh Softer NFP Risk Against a Hawkish BoJ

06.01.2026 · TradingNEWS ArchiveForex