Amazon NASDAQ:AMZN Stock Is Definitely a Buy

Unpacking NASDAQ: AMZN's latest $9 billion investment in Singapore's cloud services and its impact on the global market, alongside a bullish outlook for its stock | That's TradingNEWS

Overview of Amazon's Global Expansion

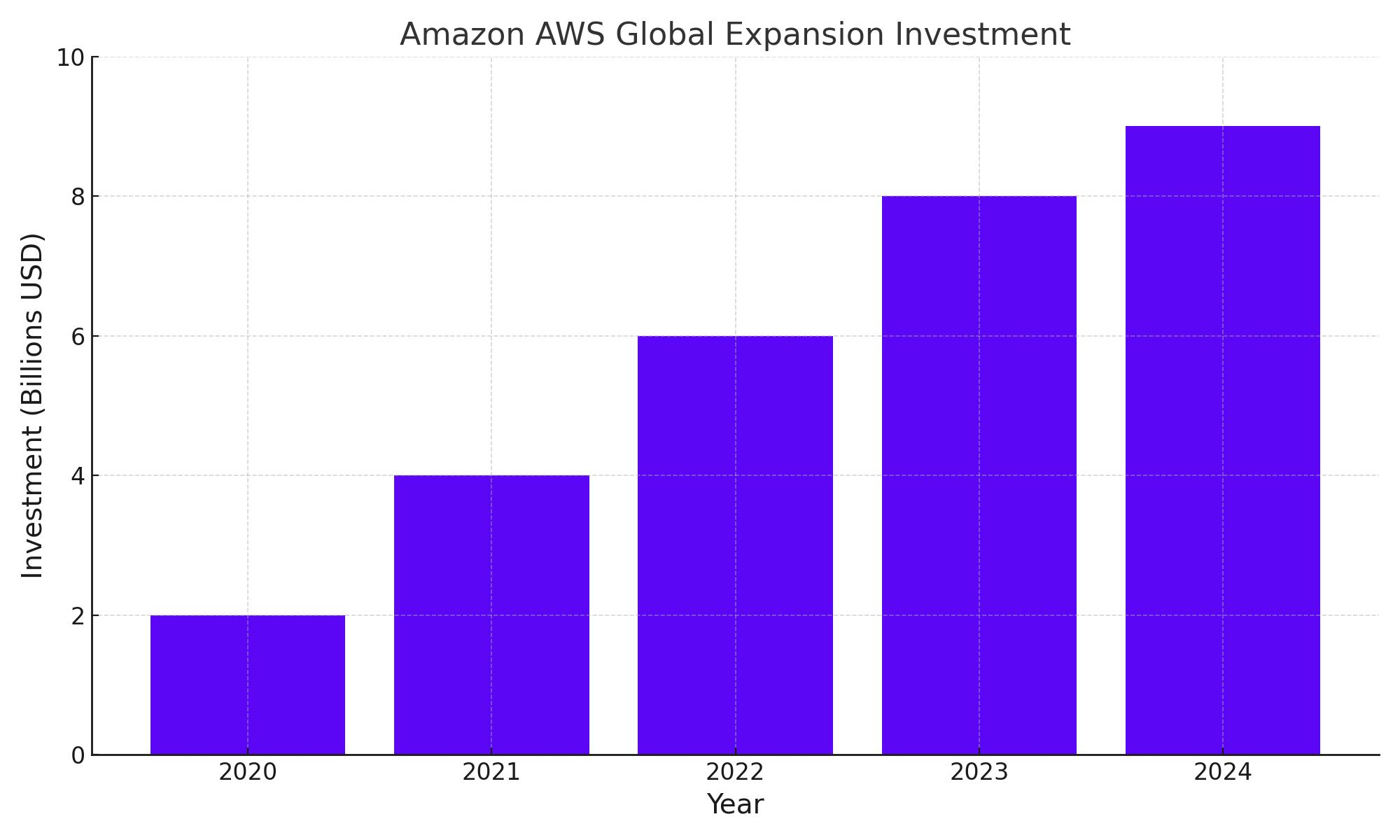

Amazon's recent announcement of a $9 billion investment to expand its cloud infrastructure in Singapore underscores the company's aggressive growth strategy in the global cloud computing arena. This move is part of Amazon Web Services' broader effort to enhance service delivery across Southeast Asia, a region experiencing rapid digital transformation.

Overview of Amazon's Global Expansion

Amazon's recent announcement of a $9 billion investment to expand its cloud infrastructure in Singapore underscores the company's aggressive growth strategy in the global cloud computing arena. This move is part of Amazon Web Services' broader effort to enhance service delivery across Southeast Asia, a region experiencing rapid digital transformation.

NASDAQ: AMZN's Financial Health

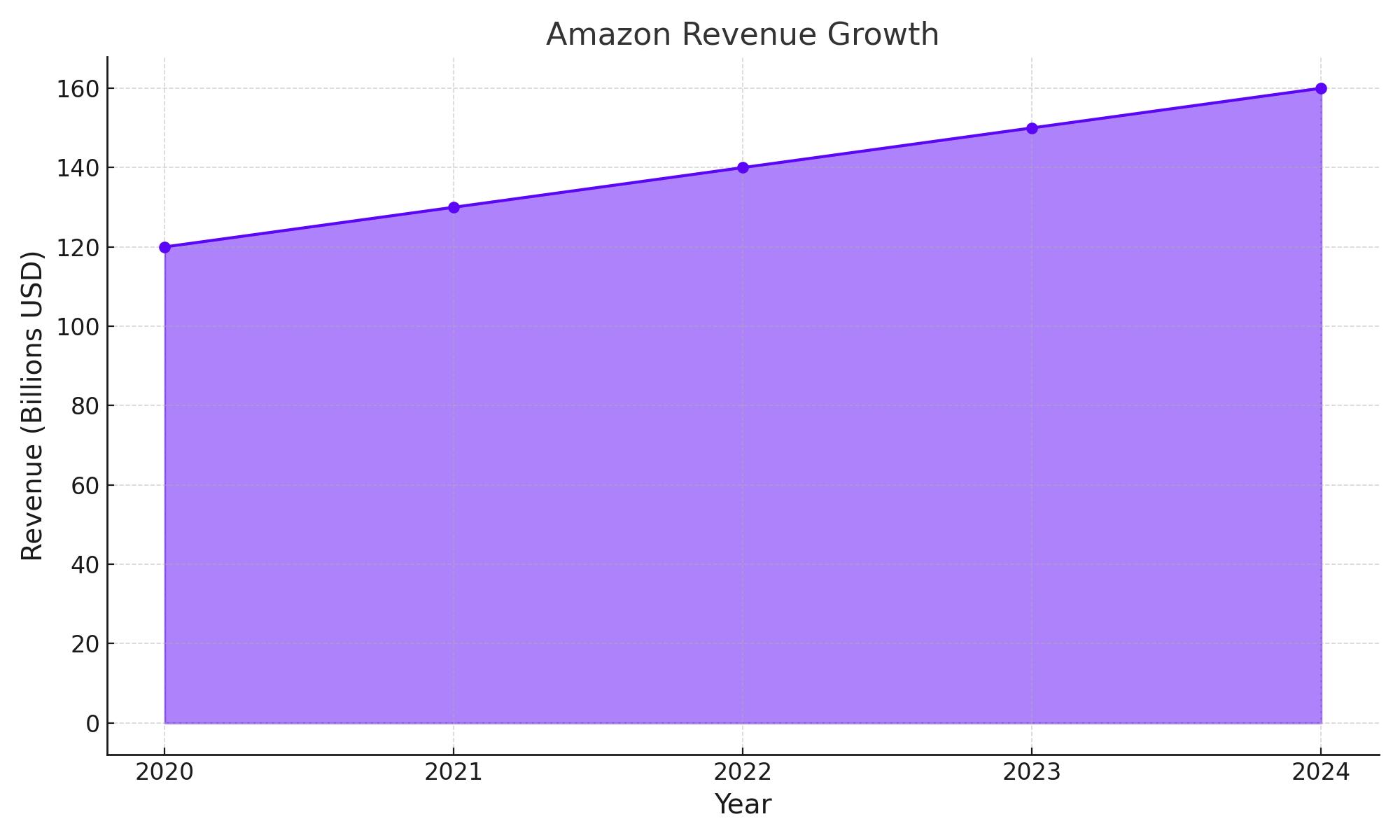

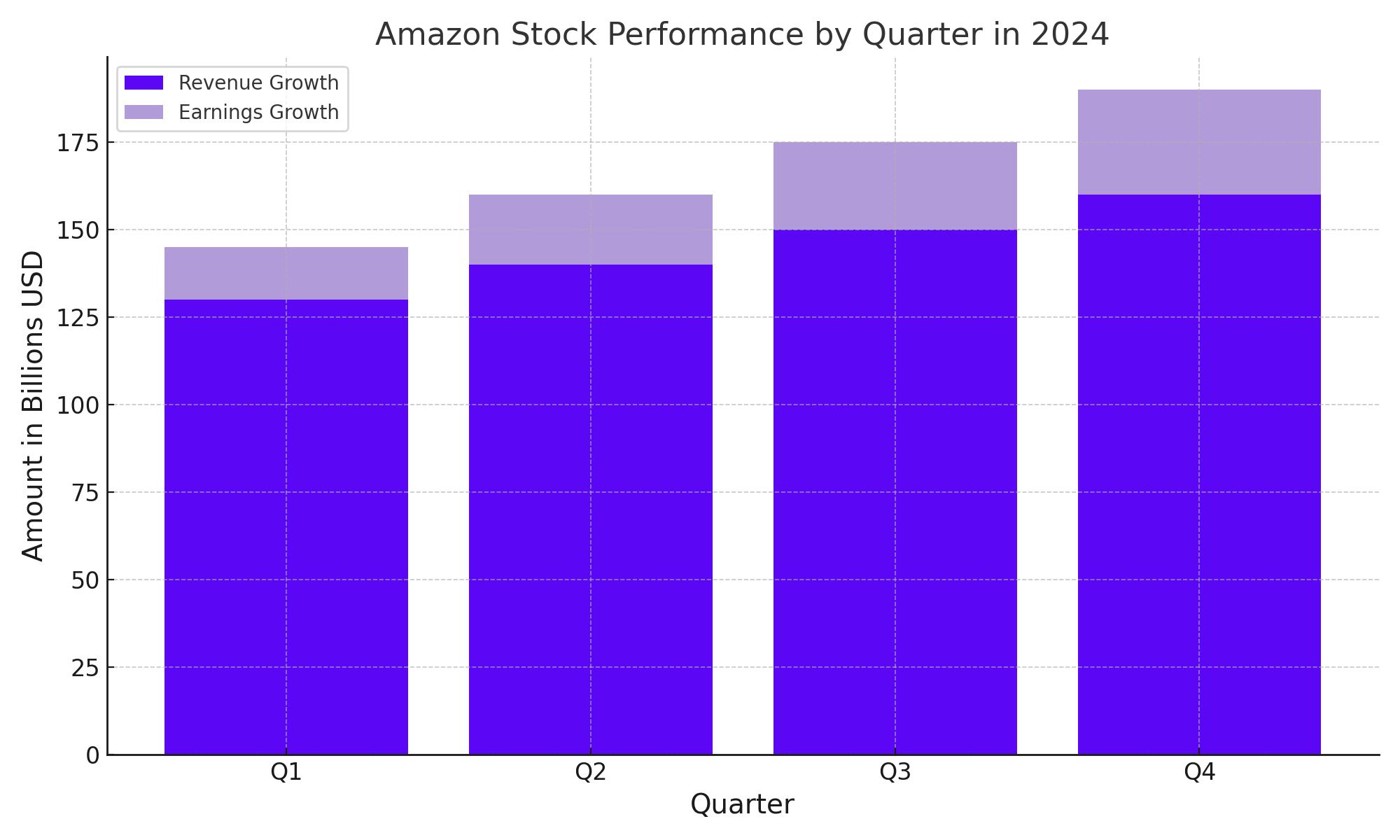

In the latest financial quarter, Amazon (NASDAQ: AMZN) showcased a remarkable performance, with a significant revenue jump to $143.3 billion, a 13% increase year-over-year. This growth is not just a testament to its e-commerce prowess but also highlights the burgeoning dominance of AWS, Amazon’s cloud computing division, which itself reported a 17% increase in revenue, reaching $25 billion.

For detailed stock performance, visit Amazon's Real Time Chart.

Amazon Web Services (AWS): Fueling Amazon's Market Leadership

Amazon Web Services (AWS) remains a fundamental component of Amazon's growth strategy and profitability. As of the latest reports, AWS boasts an impressive annual revenue run rate of $100 billion. This achievement underscores its pivotal role in Amazon's robust competition against major players like Microsoft Azure and Google Cloud. The segment has notably seen a significant improvement in its operating margin, reflecting Amazon's commitment to efficient scalability and strategic cost management. This fiscal efficiency is key to AWS's success in a highly competitive cloud computing market.

Strategic Capital Expenditures Drive Innovation

In the first quarter, Amazon reported a sharp increase in capital expenditures, amounting to $14 billion. This investment is directed towards enhancing its technological framework, with a strong emphasis on AI capabilities and the expansion of its global cloud infrastructure. These strategic investments are designed to secure long-term growth by capitalizing on the burgeoning demand for generative AI technologies, which are quickly becoming indispensable in the realm of cloud computing.

Navigating the Competitive Tech Landscape

Amazon's strategy extends beyond mere geographical expansion; it involves significant technological advancements to outpace its competition. In the fiercely competitive cloud sector, dominated by giants such as Microsoft and Google, Amazon's continual investment in AI and the enhancement of its data centers worldwide is crucial. This not only helps Amazon maintain its market dominance but also ensures it stays at the forefront of technological innovation, providing cutting-edge solutions to its global customer base.

Expanding AWS's Global Reach

Amazon's aggressive expansion of AWS across international markets is a testament to its global ambitions. Recent initiatives include multi-billion dollar investments in regions like Asia, Europe, and the Middle East, aimed at enhancing service delivery and reducing latency for local and multinational corporations. These investments not only strengthen AWS's global presence but also underscore its role in the digital transformation journeys of businesses worldwide.

AWS's Role in Amazon's Broader Ecosystem

Beyond its direct financial impact, AWS plays a critical role in supporting other Amazon businesses, including e-commerce and digital streaming. By providing a robust cloud infrastructure, AWS enables these segments to handle massive volumes of transactions and data, thereby supporting Amazon's overall ecosystem in delivering seamless customer experiences.

Future Outlook: AI and Cloud Innovation

Looking ahead, Amazon is positioned to continue its leadership in the cloud sector through relentless innovation in AI. Plans to introduce more AI-driven services and solutions promise to further revolutionize industries and create new opportunities for growth within AWS. As cloud technology continues to evolve, Amazon's proactive approach in adopting and integrating these advancements will be pivotal in sustaining its competitive edge and driving future revenue growth.

Future Outlook and Investment Considerations for Amazon (NASDAQ: AMZN)

Robust Growth Trajectory in Cloud Computing

Amazon Web Services (AWS) is set to maintain its leadership in the cloud computing arena with consistent expansion and innovation. As of the latest financial reporting, AWS achieved a staggering $100 billion annual revenue run rate, demonstrating robust growth and significant market dominance. This segment has effectively capitalized on the rising demand for cloud services and AI technologies, solidifying Amazon's competitive position against major players like Microsoft Azure and Google Cloud. The ongoing development in AI and machine learning capabilities within AWS is likely to drive further adoption and deepen customer engagement.

Financial Performance and Stock Valuation

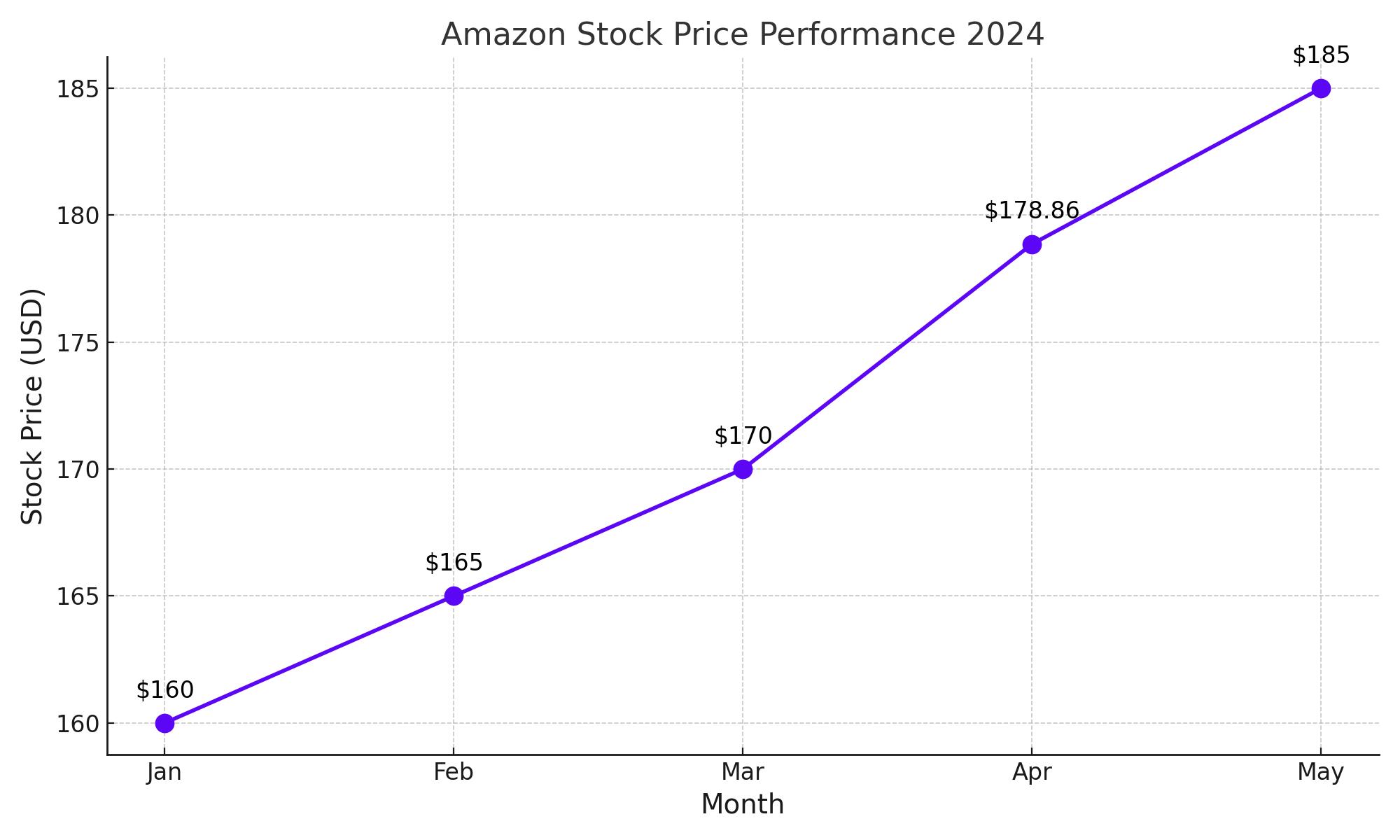

Amazon's stock price has shown impressive growth, reflecting the company’s strong financial performance and market confidence in its future prospects. As of the last trading session, Amazon's shares were trading at approximately $178.86, marking a significant rise of over 18% year-to-date. The company’s operating income surged by an impressive 220% to $15.3 billion in the most recent quarter, indicating robust profitability and efficient cost management. This financial strength supports a bullish outlook for Amazon's stock, with a forward price-to-earnings ratio that remains attractive compared to industry averages.

Capital Expenditure and Strategic Initiatives

Amazon’s strategic focus on high capital expenditure, notably $14 billion in the recent quarter, primarily allocated towards AI and global infrastructure enhancement, is poised to fuel long-term growth. These investments are critical in maintaining technological leadership and supporting the scaling of operations across new and existing markets. The proactive expansion of AWS data centers globally ensures Amazon remains at the cutting edge of delivering high-performance cloud solutions.

Competitive Advantage and Market Share

Amazon continues to hold a significant advantage in terms of market share and technological prowess within the cloud industry. Despite stiff competition, AWS's revenue growth has outpaced that of its closest competitors, indicating strong market demand and customer loyalty. Amazon’s comprehensive service offerings across IaaS, PaaS, and SaaS segments provide it with a diversified revenue stream that mitigates risks and enhances growth potential.

Investment Rating: Buy

Given Amazon’s sustained revenue growth, expanding profit margins, and strategic investments in future technologies, the stock presents a compelling buy opportunity for long-term investors. The company’s aggressive push into AI and continued expansion of its global infrastructure are likely to yield significant returns. Financial metrics such as EBIT growth and a strong revenue run rate in AWS underscore the company's operational efficiency and market leadership.

Price Target and Financial Outlook

With the current momentum and strategic investments, Amazon is well-positioned for continued financial success. Analysts project a potential 20% upside in the stock price, with a target of around $220 per share in the medium term. This projection is supported by Amazon’s strong quarterly performance, high growth potential in AI technologies, and robust expansion strategies.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex