Amazon (NASDAQ:AMZN) Soars to $220 – Can It Reach $270?

Exploring AWS Momentum, E-Commerce Gains, and the Road to New Highs | That's TradingNEWS

Amazon's AWS Drives Exceptional Growth for NASDAQ:AMZN

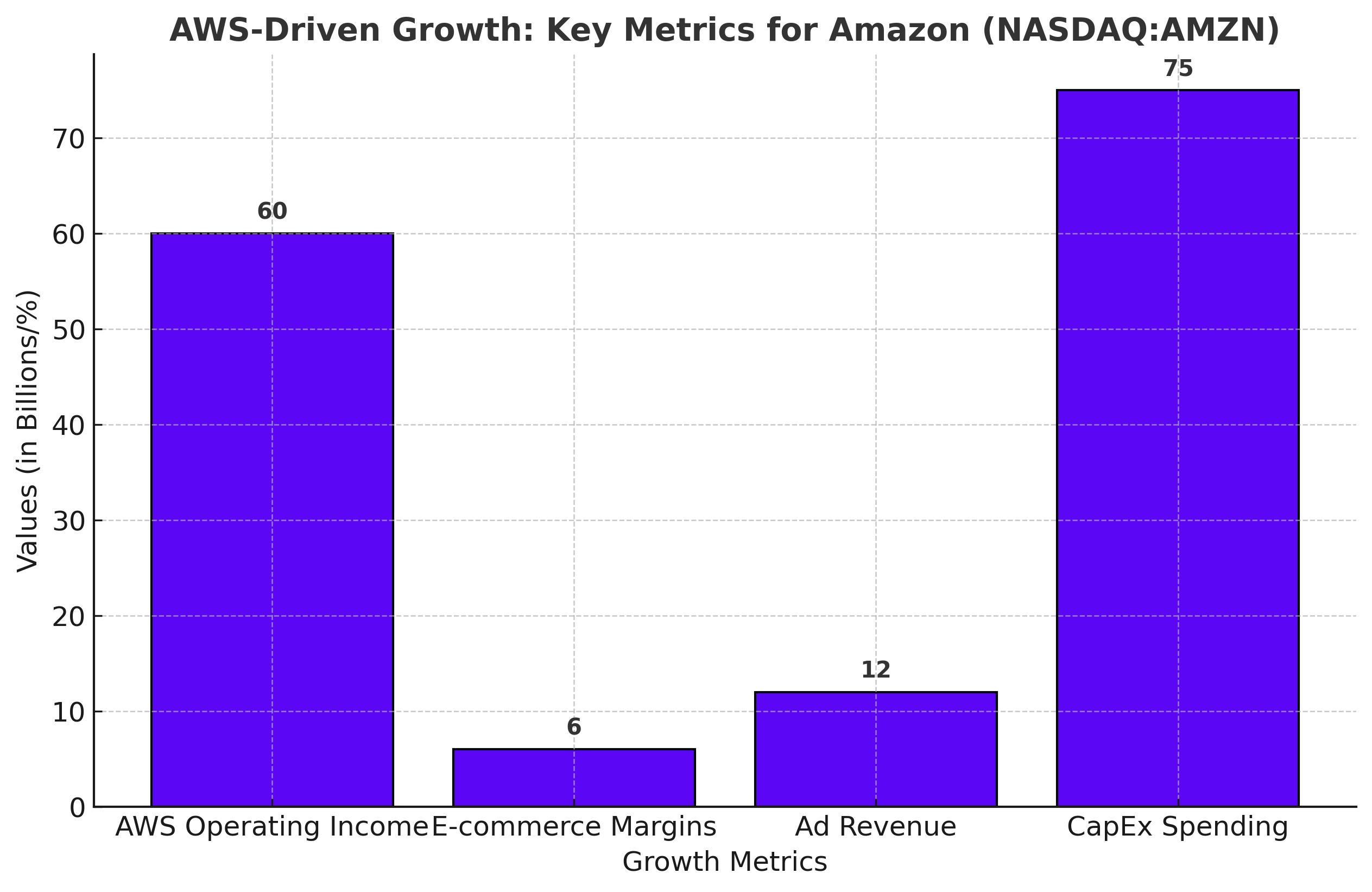

Amazon (NASDAQ:AMZN) has witnessed an extraordinary run in 2024, with its stock climbing over 45%, closing near $220. The surge stems largely from the 38.1% operating margins posted by its Amazon Web Services (AWS) segment in Q3 2024. AWS alone contributed $10.4 billion in operating income, accounting for 60% of Amazon's total operating profits. This reflects not just the strength of AWS but also its growing importance in bolstering Amazon’s overall financial performance.

AWS's Dominance and Cloud Sector Trends

AWS continues to dominate the cloud sector, holding 31% market share, ahead of Microsoft Azure (20%) and Google Cloud (13%). AWS’s 19% year-over-year revenue growth in Q3 2024 signals its resurgence after previously lagging competitors in growth rates. The improvement in margins also highlights Amazon's ability to maintain premium pricing despite fierce competition.

Rivals like Google Cloud reported 17% operating margins in the same quarter, up from 3% the previous year, but AWS’s margins remain unmatched. This suggests Amazon has room to keep capitalizing on its dominant position, especially as the Big Three cloud providers consolidate nearly two-thirds of the global cloud market.

Amazon’s investments in custom AI chips, now endorsed by Apple, further fortify its position. By offering cost-efficient alternatives to Nvidia's AI GPUs, AWS could lure enterprise customers, reducing dependency on Nvidia and boosting its competitive edge. With AI-based services driving cloud demand, AWS is likely to be a central pillar of Amazon's growth strategy.

E-Commerce: Margin Expansion and Operational Efficiencies

Beyond AWS, Amazon’s North American e-commerce division posted record 6% operating margins in Q3, up from 4% a year earlier. The international segment, long a drag on profitability, is also turning the corner, nearing positive operating income. As Amazon scales back warehouse expansion and optimizes operations, its e-commerce margins are expected to improve further, contributing to a stronger bottom line.

The company’s advertising business, a high-margin growth driver, is expanding rapidly. Ad revenue in 2024 reached $12 billion in Q3 alone, showing double-digit growth. Combined with AWS and e-commerce improvements, these factors position Amazon as a profit powerhouse.

Capital Expenditures and AI Integration

Amazon spent $75 billion in capex in 2024, primarily on AI infrastructure and chips. While high spending poses risks, CEO Andy Jassy sees it as a “once-in-a-lifetime opportunity” tied to generative AI. However, this gamble requires efficient monetization to avoid the bearish sentiment that hit competitors like Microsoft after similar aggressive AI investments.

Despite these risks, Amazon’s strategic focus on efficiency and scaling AI services ensures that its capex investments align with long-term growth. AWS is expected to lead Amazon’s expansion, especially as enterprises adopt AI-driven tools, reinforcing the bullish outlook for the stock.

EPS Growth and Valuation

Amazon has received 34 upward EPS revisions in the past 90 days, with Wall Street projecting 20% growth in 2025 and 22% in 2026. These figures could be conservative if AWS and advertising outperform expectations. Currently trading at 30x 2026 forward earnings, Amazon appears slightly more expensive than Microsoft (27x) and Apple (25x). However, its superior growth trajectory justifies the premium.

Amazon’s valuation is further supported by its 19.8x price-to-operating cash flow (P/OCF), a 22% discount to its 15-year average of 25.5x. Given its historical ability to generate consistent cash flow and improve profitability, the stock remains an attractive buy at current levels.

Risks and Opportunities

Key risks include potential pricing pressure in the cloud market, regulatory scrutiny, and delayed monetization of AI-related investments. However, AWS’s continued dominance, growing advertising revenues, and improving margins in e-commerce make Amazon a resilient long-term play. The concentration of the cloud market among the Big Three players reduces competitive threats, ensuring stable margins for AWS.

Investor Takeaway

With AWS driving growth and operating margins expanding across all segments, NASDAQ:AMZN is well-positioned to deliver strong performance in 2025. The stock’s forward-looking EPS growth, combined with its strategic investments in AI and cloud infrastructure, suggests significant upside potential. Current valuations remain attractive for long-term investors, making Amazon a buy at its current price of $220 with a 2025 price target of $270.

That's TradingNEWS

Read More

-

SCHD ETF: $28.41 Price, 3.67% Yield And The Real Story After Broadcom’s Exit

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI At $11.95 And XRPR At $16.98 While $750M Flees Bitcoin And Ether Funds

12.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Snaps Back from $3.17 Lows as UNG and BOIL Surge

12.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Stalls Just Under 158 While Markets Game a Break or Reversal Near 160

12.01.2026 · TradingNEWS ArchiveForex