AMD (NASDAQ:AMD): Strong Q3 Growth and AI Market Expansion Bolster Long-Term Outlook

Analyzing AMD's Data Center Surge, AI Revenue Guidance, and Competitive Position Against Nvidia | That's TradingNEWS

Advanced Micro Devices (NASDAQ:AMD): Navigating AI Expansion and Market Challenges

Data Center Dominance Drives Revenue Growth

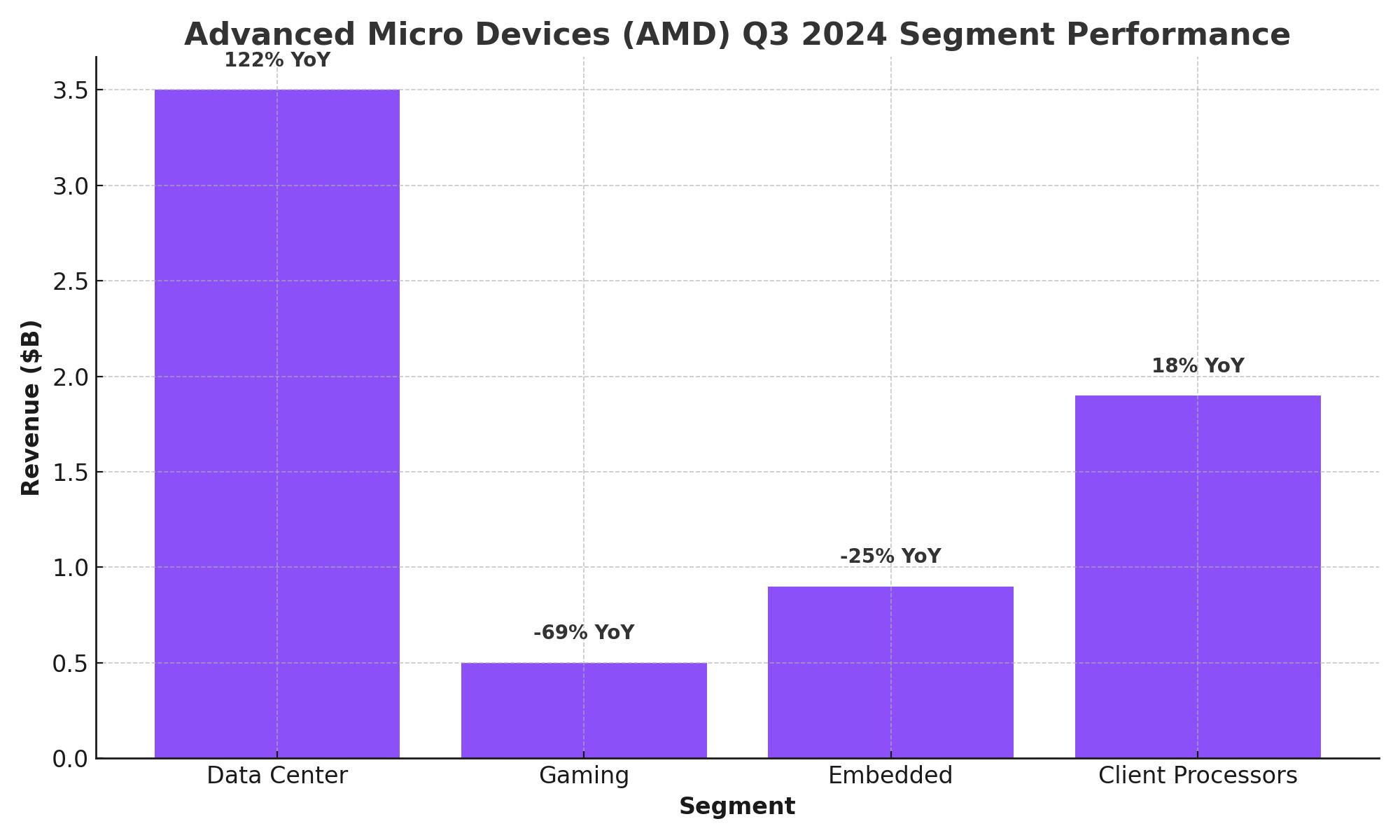

Advanced Micro Devices, Inc. (NASDAQ: AMD) has positioned itself as a formidable competitor in the data center market, with its Q3 2024 financial results underscoring significant growth in this segment. The company reported a staggering 122% year-over-year (YoY) increase in data center revenues, totaling $3.5 billion. This growth stems largely from the rapid adoption of AMD’s EPYC CPUs, with major clients such as Meta Platforms deploying over 1.5 million units. This demand for data center GPUs and CPUs reflects AMD's successful foray into the AI-driven cloud space, where it offers customers optimized performance and cost advantages.

Despite the impressive growth in the data center segment, other areas face challenges. AMD's gaming segment saw a severe revenue decline, down 69% YoY, while the embedded segment decreased by 25%, totaling $927 million. The decrease in gaming revenue is attributed partly to inventory adjustments by major clients like Sony and Microsoft and an ongoing transition to AMD’s new RDNA 4 architecture. However, the decline in these areas hasn’t diminished AMD’s robust overall performance, with total revenues reaching $6.8 billion, an 18% YoY increase, primarily driven by the thriving data center and client processor sales.

AI Revenue Projections and Market Expectations

AMD raised its AI revenue guidance from $4.5 billion to $5 billion for FY2024, a forecast that, while ambitious, fell short of the market's expectations. The anticipated growth in the AI accelerator market presents AMD with a substantial opportunity, with management forecasting a $500 billion total addressable market (TAM) by 2028. However, the company’s incremental guidance increase was met with skepticism, as investors and analysts alike had hoped for a more aggressive projection to compete with Nvidia’s well-established dominance in AI hardware. While AMD's long-term growth in AI is evident, its near-term outlook has tempered some market enthusiasm, reflecting the risks tied to the rapid and competitive nature of the AI sector.

The company’s MI300 series, a promising AI accelerator, has garnered significant demand from hyperscalers. However, AMD faces substantial execution risks, particularly with supply chain constraints that could impact production cadence and overall market capture. Investors should closely monitor AMD's progress in meeting demand, as supply challenges could disrupt revenue flows in 2025 and beyond. Nonetheless, AMD maintains a unique edge over Intel in the data center CPU space, a segment that now accounts for over 50% of AMD’s total revenue, offering robust support to the company's profitability amid pricing pressures in AI.

Financial Performance and Valuation Metrics

Despite mixed sentiment, AMD’s financial performance remains solid, backed by Wall Street’s forecasts of sustained revenue growth through FY2026. Q3 results reveal a notable expansion in gross margin, now at 51%, up 3 percentage points YoY, driven primarily by higher-margin data center sales. AMD’s operating margin also improved, reaching 11% compared to 4% in the previous year. Cash flow from operations increased to $628 million, up from $421 million in Q3 2023, giving AMD a comfortable cash reserve of $4.5 billion. This financial cushion, along with a current ratio of nearly 2.5 and minimal debt (2.5% of total assets), indicates a solid balance sheet, capable of supporting continued investment in AI and data center technologies.

From a valuation perspective, AMD’s forward PEG ratio stands at 1.05, around 40% below the median for the technology sector, suggesting a favorable entry point for long-term investors. Although Nvidia boasts a much higher EV/EBITDA multiple (42x vs. AMD's 45.5x forward), AMD's attractive valuation reflects the market's cautious approach to its growth potential. Nevertheless, the current valuation could present a strong buying opportunity for those willing to bet on AMD’s AI and data center growth prospects over the next several years.

Competitive Landscape: Challenges in AI and Market Share

In the race against Nvidia, AMD faces hurdles in both technology and ecosystem integration. Nvidia’s CUDA platform enjoys a dominant position in AI development, whereas AMD’s ROCm stack remains less established. This disparity presents challenges in attracting large customers accustomed to Nvidia's ecosystem, a factor that may inhibit AMD's ability to gain market share. However, AMD’s annual product cadence, with the upcoming MI350 series expected in late 2025 and the MI400 series by 2026, signifies AMD's commitment to accelerating AI development and meeting customer needs in a timely manner.

Notably, AMD's pursuit of market share in AI chips comes amid rising demand for custom hardware solutions among major tech companies. Amazon's adoption of its Graviton chips and OpenAI’s collaboration with Broadcom for custom AI chips reflect a trend among hyperscalers to diversify from merchant chips, which could impact AMD's growth in the AI segment. If major players increasingly turn to proprietary solutions, AMD may face additional pressure in achieving its TAM projections, although its data center growth remains resilient.

Investment Outlook and Rating Decision: Buy, Sell, or Hold?

Given the current market conditions, the technical and fundamental analysis suggests a Buy stance on (NASDAQ: AMD). Despite short-term volatility and execution risks, AMD’s growth potential in the AI and data center segments remains intact. AMD’s attractive valuation, combined with its robust balance sheet, positions it well for long-term gains as the company scales its AI capabilities. The stock has endured a near 20% drop from its October 2024 highs, potentially nearing a dip-buying opportunity for investors who believe in AMD’s growth story.

The recent sell-off in AMD stock highlights the market's caution but also underscores an opportunity for investors with a long-term perspective. Should AMD’s AI revenue and data center growth meet or exceed expectations, the stock could see a strong upward re-rating. For investors looking to add exposure to the AI revolution without paying Nvidia’s premium valuation, AMD presents a compelling alternative, offering growth potential at a reasonable price point.

AMD's ability to continue expanding its data center presence, combined with an impressive product roadmap, suggests that it is well-positioned to benefit from ongoing AI-driven market trends. Given its financial stability, competitive data center products, and promising AI accelerator pipeline, (NASDAQ:AMD) remains a Buy for long-term investors seeking growth in the semiconductor space. For more detailed information on insider transactions and current stock performance, investors can visit AMD Insider Transactions or view the real-time chart.

That's TradingNEWS

Read More

-

Broadcom Stock Price Forecast - AVGO 13% Post-Earnings Slide vs. $73B AI Backlog at ~$350

13.01.2026 · TradingNEWS ArchiveStocks

-

Solana Price Forecast - SOL-USD Holds Around $143 as $135–$145 Zone Decides the Next Big Move

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex