Analyzing Gold's Turbulence: Economic and Market Predictors for 2024

Delve into how global economic data, central bank policies, and geopolitical tensions are driving the volatility and investment appeal of gold in the current financial landscape | That's TradingNEWS

Comprehensive Analysis: Gold Market Dynamics and Economic Indicators

Gold Price Volatility Amid Economic Uncertainty

Amid a tumultuous economic landscape, gold prices have experienced notable fluctuations. As of the latest trading session in Europe, gold retreated slightly to approximately $2,314 - $2,315, down from recent highs. This correction follows a period of recovery, indicating the metal's sensitivity to global economic signals and U.S. monetary policy expectations. Despite this pullback, the potential for Federal Reserve rate cuts later this year—spurred by underwhelming U.S. economic data—has softened the U.S. Dollar to near two-month lows, providing a supportive backdrop for gold, a non-yielding asset.

Geopolitical Risks and Gold's Safe-Haven Appeal

The geopolitical landscape continues to inject volatility into global markets, reinforcing gold's status as a safe-haven asset. Current tensions, particularly in the Middle East, not only sustain a bullish outlook for gold but also limit the downside potential for its price. Investors are closely monitoring these developments, which are likely to influence gold's price trajectory significantly in the near term.

Impact of Central Bank Decisions and Economic Data

This week is pivotal for gold traders, with several major economic releases and central bank decisions on the horizon. The Bank of Canada's policy decision and the European Central Bank's meeting are expected to provide fresh cues that could sway the gold market. Additionally, the U.S. Nonfarm Payrolls report due on Friday is a critical indicator that might shape Federal Reserve policy expectations and, consequently, gold's price movements.

Market Drivers: Fed Rate Expectations and Economic Indicators

Influence of US Economic Data on Gold Prices

Recent U.S. economic data has played a significant role in shaping market expectations around Federal Reserve monetary policy. For instance, the Personal Consumption Expenditures (PCE) Price Index and core gauge have aligned with expectations, reinforcing predictions of impending rate cuts. Moreover, the Manufacturing PMI dip in May has contributed to a decline in Treasury bond yields, further dampening the U.S. Dollar and bolstering gold prices.

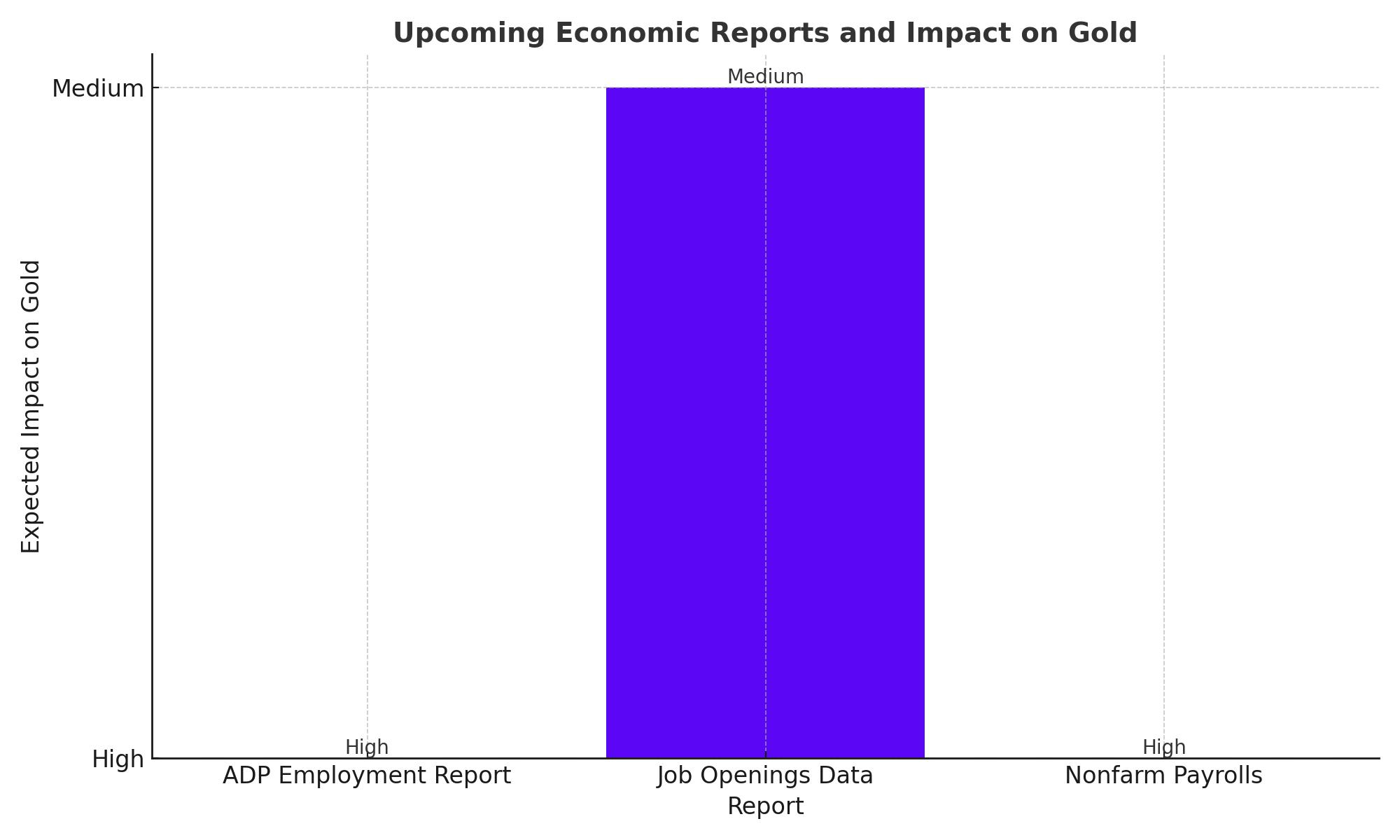

Upcoming Economic Reports and Gold Market Reaction

Traders are now positioning for short-term opportunities ahead of imminent U.S. economic reports, including the ADP employment report and additional job openings data. These indicators will provide further insights into the health of the U.S. economy and potentially influence gold prices. The anticipation surrounding these reports underscores the market's sensitivity to economic data in shaping monetary policy expectations.

Technical Analysis and Trading Strategies for Gold

Technical Perspective on Gold's Price Movements

From a technical standpoint, gold has shown resilience by maintaining levels above the pivotal $2,334 area, marked by the 50-day Simple Moving Average (SMA). Immediate resistance is seen near the $2,360 region, suggesting potential upward movements if broken. Conversely, a breach below the $2,314 support could trigger deeper corrections, highlighting the importance of these technical levels in forecasting gold's price direction.

Strategic Trading Considerations

Given the current market setup, traders might consider buying dips in gold prices, especially if the metal continues to hold above strategic support levels. This approach leverages gold's safe-haven appeal amid economic uncertainty and expected fluctuations in the U.S. Dollar. However, traders should remain cautious and responsive to new economic data and geopolitical developments that could abruptly alter market dynamics.

Conclusion: Navigating Gold's Future Trajectory

In conclusion, gold's investment landscape is intricately tied to economic indicators, central bank policies, and geopolitical events. As we approach key economic releases and central bank meetings, the potential for heightened volatility in gold prices is significant. Investors should remain vigilant, considering both the protective appeal of gold in times of uncertainty and the impact of economic trends on its price. Strategic trading should focus on technical thresholds and market sentiment, guided by upcoming economic data and global events.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex