Analysis NYSEARCA:XLE ETF Amidst Current Energy Sector Dynamics

Exploring the Investment Potential, Strategic Positioning, and Market Influences on the Energy Select Sector SPDR Fund ETF | That's TradingNEWS

Comprehensive Analysis of NYSEARCA:XLE Amidst Current Energy Sector Dynamics

Introduction

Oil is one of the most crucial commodities influencing global inflation and economic stability. The World Bank Group's research highlights that oil price shocks have been the main driver of global inflation variations over the past five decades, contributing over 38% to the fluctuations. This underscores the importance of understanding recent developments in the oil market, particularly in relation to the Energy Select Sector SPDR Fund ETF (NYSEARCA:XLE), the largest energy ETF globally. This analysis delves into recent trends and their implications for NYSEARCA:XLE

Bullish Sentiments from Major Financial Players

Goldman Sachs Report

Goldman Sachs recently published a report titled "Peak oil demand is still a decade away," challenging the notion that oil demand will soon plateau. The report anticipates that oil demand will continue to grow until 2034, driven by the petrochemical sector and specialized refined products such as jet fuel. According to Goldman Sachs, consensus estimates on peak oil demand are too conservative.

OPEC's Stance

OPEC has reaffirmed its expectation of a 2.2 million barrels per day increase in oil demand for 2024. This forecast is supported by robust summer demand and strategic production cuts by OPEC and its allies. Daily OPEC production fell by 80,000 barrels, and the group has extended production curbs into the next year, emphasizing its regained pricing power.

Key Factors Influencing NYSEARCA:XLE

EV Adoption and Its Impact

The rapid adoption of electric vehicles (EVs) is a critical factor in the oil demand equation. However, current trends suggest a slowdown in this transition. For instance, the European Union appears to be reconsidering its petrol/gasoline car ban, which could prolong the peak oil demand timeline.

Geopolitical and Economic Dynamics

Geopolitical tensions, particularly in the Middle East, and the ongoing Russia-Ukraine conflict have significant implications for oil supply and prices. Additionally, the U.S. shale revolution has reshaped global oil supply dynamics, with the Permian Basin being the only U.S. basin capable of long-term growth post-pandemic.

Performance and Prospects of NYSEARCA:XLE

Recent Performance

Since mid-September, NYSEARCA:XLE has returned 4.4%. The ETF's performance is bolstered by favorable demand/supply dynamics, with oil prices stabilizing around $81 WTI, providing a conducive environment for energy companies to thrive. Major U.S. oil companies are breakeven in the low-$40 range, making the current price levels highly profitable.

Sector-Wide Implications

Energy Demand Boom

The demand for energy is projected to increase significantly, driven by the rapid growth in artificial intelligence (AI) applications and strong economic activity. According to the International Energy Agency (IEA), global energy demand is expected to grow by 4% annually through 2030. This surge is not solely reliant on renewable energy sources; traditional energy sources like oil and natural gas remain crucial. In fact, the U.S. Energy Information Administration (EIA) forecasts that natural gas demand will grow by 5.1% annually up to 2040, primarily driven by power generation and industrial uses. Additionally, the anticipated global oil demand is set to reach 104.5 million barrels per day by 2025, up from 103 million barrels per day in 2024, indicating a continued reliance on fossil fuels amidst the energy transition.

Free Cash Flow Generation

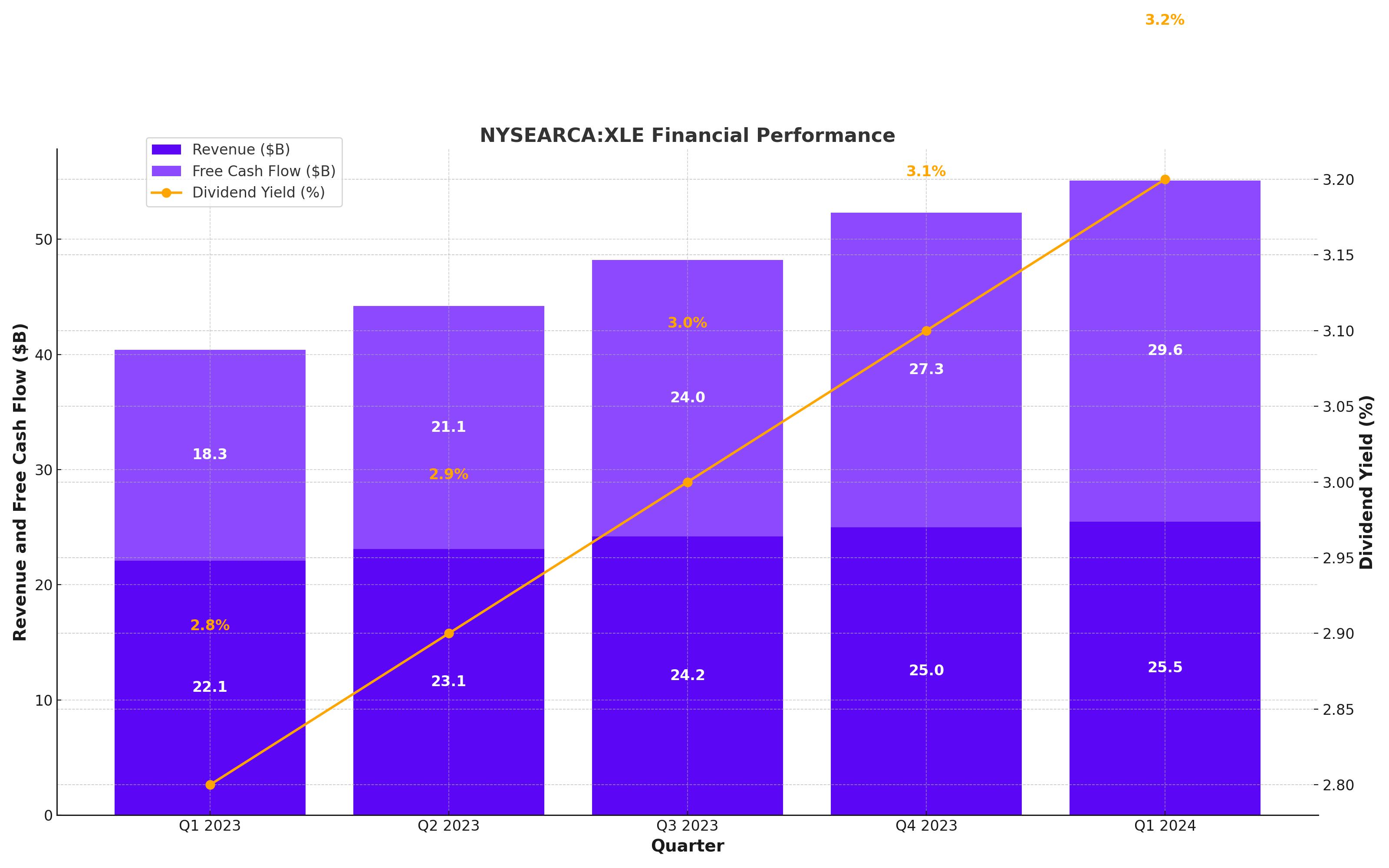

Energy companies are currently experiencing substantial free cash flow generation, underpinned by technological advancements and effective balance sheet management. For instance, Exxon Mobil (XOM) reported a free cash flow of $29.6 billion in 2023, a significant increase from $18.3 billion in 2022. Similarly, Chevron (CVX) generated $27.3 billion in free cash flow in 2023, up from $21.1 billion the previous year. This financial strength enables these companies to return capital to shareholders through dividends and share buybacks. Exxon Mobil has increased its dividend by 3% in 2023, while Chevron announced a $10 billion share buyback program. These actions make energy stocks within NYSEARCA:XLE highly attractive for dividend investors, as the ETF itself boasts a yield of 3.1%, supported by a three-year compound annual growth rate (CAGR) of 11.4% in dividends.

Strategic Moves and Consolidation in the Sector

The energy sector is witnessing significant consolidation, with major mergers and acquisitions reshaping the landscape. Notable deals include Exxon Mobil's $60 billion acquisition of Pioneer and Diamondback Energy's $26 billion merger with Endeavor. These consolidations are expected to enhance operational efficiencies and drive further growth.

Investment Outlook for NYSEARCA:XLE

Long-Term Prospects

The long-term prospects for NYSEARCA:XLE are robust, bolstered by a bullish outlook on oil demand and strategic positioning within the energy sector. The Energy Select Sector SPDR Fund ETF comprises blue-chip energy stocks known for their resilience and financial strength. For instance, major holdings such as Exxon Mobil (XOM) and Chevron (CVX) not only have substantial free cash flows—$29.6 billion and $27.3 billion respectively in 2023—but also maintain strong balance sheets. These companies have demonstrated their ability to weather market fluctuations, supported by their solid financials and consistent dividend payouts. Exxon Mobil and Chevron have increased their dividends by 3% and 6% respectively in 2023, reflecting their commitment to returning value to shareholders.

NYSEARCA:XLE also benefits from its diversified exposure to the energy sector, including significant positions in midstream companies like Williams Companies (WMB) and ONEOK (OKE), and refining giants such as Marathon Petroleum (MPC). The ETF's dividend yield stands at 3.1%, with a three-year compound annual growth rate (CAGR) of 11.4%, making it an attractive option for dividend-focused investors. The ETF’s total expense ratio is 0.09%, ensuring that investors retain a larger portion of their returns.

Risks and Considerations

While the energy sector offers lucrative investment opportunities, it is not without risks. The price volatility of underlying commodities like oil and natural gas can significantly impact performance. For example, West Texas Intermediate (WTI) crude oil prices have fluctuated from a low of $56 per barrel in 2020 to a high of $81 per barrel in 2023. Geopolitical uncertainties, such as conflicts in the Middle East or tensions between major oil-producing nations, can also influence market stability. Additionally, regulatory changes and environmental policies aimed at reducing carbon emissions pose long-term challenges to the sector.

However, NYSEARCA:XLE mitigates these risks through its diversified approach. The ETF includes a mix of upstream (exploration and production), midstream (transportation and storage), and downstream (refining and marketing) companies. This diversification helps balance exposure to different segments of the energy market, reducing the impact of adverse events in any single area. Furthermore, the financial strength of its holdings, evidenced by their substantial free cash flows and strong balance sheets, provides a buffer against market volatility.

Strategic Positioning and Market Dynamics

NYSEARCA:XLE is strategically positioned to capitalize on favorable market dynamics. The global energy demand is projected to grow by 4% annually through 2030, driven by economic expansion and the rise of artificial intelligence (AI) applications, which are energy-intensive. The U.S. Energy Information Administration (EIA) forecasts natural gas demand to increase by 5.1% annually up to 2040, highlighting the continued importance of traditional energy sources.

OPEC's recent reaffirmation of oil demand growth by 2.2 million barrels per day in 2024, coupled with production cuts aimed at stabilizing prices, suggests a supportive environment for oil prices. Goldman Sachs projects that oil demand will not peak until 2034, driven by emerging markets in Asia and the demand for petrochemicals and specialized refined products. These factors collectively create a bullish outlook for the energy sector.

NYSEARCA:XLE's focus on industry leaders such as Exxon Mobil and Chevron ensures that investors benefit from companies with significant market influence and operational efficiencies. The ETF's exposure to midstream and downstream segments adds stability, as these sectors tend to be less volatile than upstream operations. The inclusion of companies with robust dividend policies further enhances the attractiveness of the ETF, providing investors with regular income and the potential for capital appreciation.

Conclusion

Oil remains a pivotal driver of global economic trends, significantly influencing inflation and economic stability. The Energy Select Sector SPDR Fund ETF (NYSEARCA:XLE) stands out as a robust investment option, benefiting from favorable market dynamics and strategic positioning. With a promising outlook supported by major financial players and strong sector fundamentals, NYSEARCA:XLE is poised for sustained growth. The ETF’s diversified approach, solid dividend yield, and exposure to financially strong companies make it an attractive choice for investors seeking exposure to the energy sector. As global energy demand continues to rise and market dynamics remain favorable, NYSEARCA:XLE offers a compelling investment opportunity for both long-term growth and income generation.

Read More

-

PayPal Stock Price Forecast - PYPL at a Five-Year Low: Deep-Value Bet at $57 With Upside Toward $100–$120

20.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Focus: Are XRPR at $15.56 and XRPI at $10.96 Setting Up a Rebound?

20.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Jumps Above $3.80 on Arctic Blast as Traders Target the $4.00 Line

20.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Tumble as Greenland Tariffs Trigger ‘Sell America’

20.01.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast - USDJPY=X Eyes 160 as Japan’s Fiscal Shock Overpowers Classic Safe-Haven Flows

20.01.2026 · TradingNEWS ArchiveForex