Apple Stock (NASDAQ:AAPL) Targets $282 – Is This Just the Beginning?

Growth in Services, AI Leadership, and Robust Margins Drive NASDAQ:AAPL Momentum | That's TradingNEWS

Analysis of Apple Inc. (NASDAQ:AAPL): Growth, Margins, and 2025 Projections

Services: The Key Driver Behind Apple’s Growth

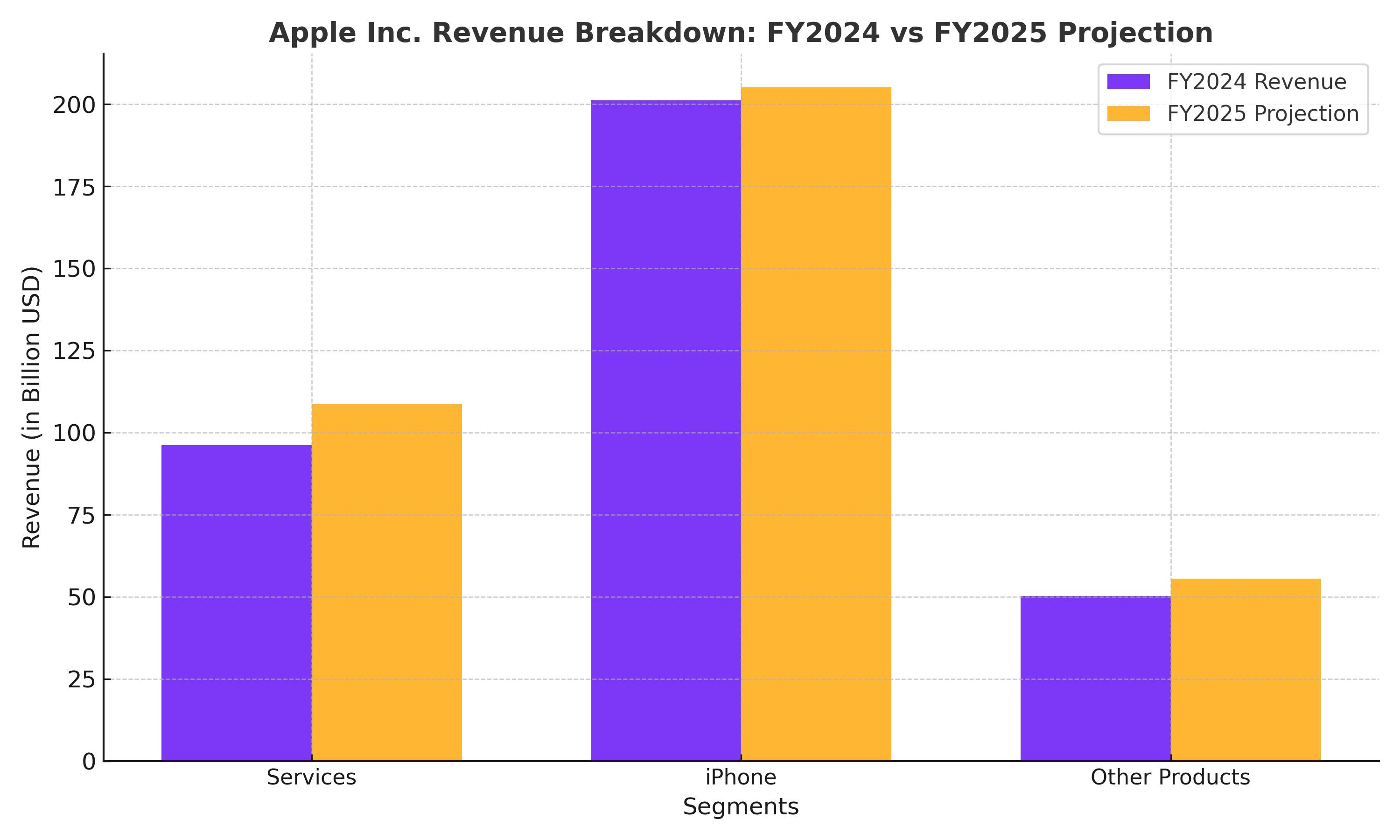

Apple Inc. (NASDAQ:AAPL) continues to redefine its revenue streams, with its services segment emerging as the company's primary growth engine. In FY2024, services revenue reached $96.17 billion, marking an impressive 12.9% year-over-year growth. This segment now constitutes 26% of Apple’s total revenue, up from 22% three years ago. Services such as Apple Music, iCloud, and Apple Pay benefit from high margins—73.9% in the latest quarter compared to 70.8% a year prior. The scalability of these offerings provides Apple with a sustainable competitive advantage. For Q1 2025, services revenue is projected to grow 13% to $26.12 billion, reflecting Apple’s strong push into AI-powered services like personalized recommendations on Apple Music and advanced fitness features on Apple Fitness+.

iPhone Sales: Slowing Growth Amid Macroeconomic Headwinds

While services soar, Apple’s flagship iPhone business faces challenges. FY2024 iPhone revenue remained flat at $201.18 billion. Global shipments in Q4 fell 4.1% year-over-year, reflecting weak consumer sentiment in key markets like the U.S. and China. Shipment declines of 25% in China highlight Apple’s exposure to regional economic slowdowns. However, the iPhone 16, equipped with Apple Intelligence AI features, has potential to revive demand. Q1 2025 estimates suggest iPhone sales of $71.10 billion, slightly below consensus, as delayed AI rollouts in non-English-speaking regions and cautious consumer spending could suppress near-term upgrades.

AWS vs. AI: Apple's Strategic Focus

Unlike peers such as Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ:AMZN), Apple has sidestepped the AI arms race, instead focusing on on-device AI. With over 2.2 billion active devices globally, Apple integrates AI features like Apple Intelligence to enhance its ecosystem. This approach eliminates reliance on costly cloud infrastructure, preserving margins and maintaining user privacy. Additionally, Apple’s investment in custom AI chips, bolstered by the acquisition of DarwinAI in 2024, positions the company to deliver superior on-device performance. These chips, designed for efficiency, could eventually reduce Apple’s dependence on Nvidia (NASDAQ:NVDA), providing long-term cost advantages.

Margins and Profitability: A Robust Balance Sheet

Apple’s gross margin climbed 208 basis points to 46.1% in FY2024, driven by the high-margin services segment and operational efficiencies in its product lines. The North American retail segment achieved a record-high operating margin of 6%, up from 4% a year ago. For FY2025, management has guided for a gross margin of 46-47%, with Q1 gross profit projected at $58.42 billion. Despite challenges in hardware sales, Apple's cost-cutting measures, including reduced warehouse expansion and workforce optimization, have enhanced profitability. Net debt declined to $41.46 billion, improving the company’s financial flexibility in an elevated interest rate environment.

International Markets: Emerging Opportunities

Apple's international segment, which had historically underperformed, is now showing signs of growth. FY2024 revenue from international markets grew 12% to $35.9 billion, aided by strategic investments in logistics and e-commerce infrastructure in Europe and Asia. The company’s expansion into emerging markets, particularly in Africa and Southeast Asia, offers significant upside. These regions are seeing rising smartphone penetration and increasing demand for Apple’s services, creating a long runway for revenue growth.

Valuation and Forward Outlook

Apple’s valuation remains robust, trading at 30.8x forward earnings. The stock is slightly more expensive than Microsoft (27x) and Amazon (30x), but Apple’s superior profitability justifies this premium. For FY2025, diluted EPS is projected at $7.48, growing at a compound annual rate of 16% through FY2027. Analysts anticipate revenue to compound at 6.7% annually over the next three years, with services leading the charge and iPhone sales stabilizing. By 2027, Apple’s gross margin is expected to exceed 50%, with operating margins reaching 34%.

Apple’s Competitive Position: A Moat Like No Other

Apple’s ability to retain customers through its integrated ecosystem remains unparalleled. The "walled garden" approach ensures that users of iPhones, Macs, and iPads find it difficult to switch to competing platforms. Furthermore, Apple’s pricing power, demonstrated by a gross margin significantly higher than competitors like Samsung (37%), underscores its ability to command premium pricing without sacrificing demand. The company’s strategic focus on AI and efficiency further strengthens its economic moat.

Investor Sentiment and Stock Performance

Despite an 8% decline in 2024, Apple stock gained 45% over the last five years, outperforming peers like Microsoft and Amazon. Its Sharpe Ratio of 1.58 reflects superior risk-adjusted returns, outperforming many hedge funds. With Q4 2024 earnings on the horizon, Apple is expected to deliver $187.3 billion in revenue, marking a 10% year-over-year growth. Positive momentum across services, AI, and international markets could drive the stock higher in 2025, with a price target of $282 representing a 10% upside.

Verdict: Buy or Hold?

Apple’s strategic focus on high-margin services, AI innovation, and operational efficiency positions it for sustained growth. While macroeconomic headwinds could weigh on iPhone sales, the company’s diversified revenue streams and robust balance sheet mitigate risks. Trading at 30x forward earnings, Apple is not cheap, but its growth trajectory justifies the valuation. For long-term investors, NASDAQ:AAPL remains a compelling buy, with a $282 price target by year-end 2025.

That's TradingNEWS

Read More

-

SCHD ETF: $28.41 Price, 3.67% Yield And The Real Story After Broadcom’s Exit

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI At $11.95 And XRPR At $16.98 While $750M Flees Bitcoin And Ether Funds

12.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Snaps Back from $3.17 Lows as UNG and BOIL Surge

12.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Stalls Just Under 158 While Markets Game a Break or Reversal Near 160

12.01.2026 · TradingNEWS ArchiveForex