NASDAQ:ASML – Is the Chip Equipment Giant a Buy After Strong Q4?

ASML’s Blockbuster Q4 – A Recovery in Motion?

NASDAQ:ASML delivered a stellar Q4 2024, reporting net sales of €9.3 billion, a sharp jump from the previous year. Investors had been wary after a disappointing Q3, where net bookings came in at just €2.6 billion, well below the expected €5.6 billion. That shortfall raised fears of a semiconductor slowdown, but Q4’s results suggest ASML is still a dominant force.

Even after supply chain disruptions and trade restrictions affecting China’s semiconductor industry, ASML’s backlog remains massive at €36 billion, covering over five quarters of projected sales. The company’s leadership in EUV lithography, the cutting-edge technology required for advanced semiconductor chips, gives it a near-monopoly in its field.

Can ASML Maintain Growth Amidst Industry Volatility?

ASML’s growth trajectory hinges on the semiconductor industry's demand, which took a hit in 2024. The AI-driven demand for high-performance computing chips has helped TSMC (NYSE:TSM), Nvidia (NASDAQ:NVDA), and Intel (NASDAQ:INTC) continue expansion plans, securing ASML’s role as a key supplier.

A critical factor in ASML’s long-term success is the transition to High-NA EUV lithography, which allows for smaller and more efficient chip designs. This technology is crucial for next-gen AI processors, high-bandwidth memory (HBM), and cutting-edge logic chips. In Q4, ASML shipped two High-NA systems, an important step toward future growth.

While the industry faces cyclical downturns, AI-driven chip demand is projected to push ASML’s revenue to €30–35 billion in 2025, with a gross margin between 51% and 53%. The company’s strong pricing power allows it to sustain profitability even in weaker semiconductor cycles.

Earnings Breakdown: Key Metrics and Trends

- Q4 2024 Revenue: €9.3B vs. €7.4B in Q4 2023

- Full-year 2024 Revenue: €28.3B, up from €24.1B in 2023

- Net Income: €2.7B in Q4 2024, with EPS at €6.85

- Gross Margin: 51.7% in Q4, in line with long-term targets

- Net Bookings: €7.1B in Q4, a huge improvement from Q3’s €2.6B

- Free Cash Flow: €8.8 billion, showing strong liquidity and financial health

Insider Transactions and Stock Buybacks – Are Executives Bullish?

ASML returned €3 billion to shareholders through dividends and stock buybacks, signaling confidence in future performance. However, insider transactions (check here) reveal that some executives have reduced holdings, which may hint at caution regarding valuation levels.

A major red flag in ASML’s capital strategy is its inefficient buyback program. During the Q3 drop when shares hit €600, management failed to repurchase any stock—a missed opportunity to create shareholder value. Yet, when ASML’s shares were at all-time highs in 2021, the company aggressively bought back stock. This raises questions about management’s timing in capital allocation.

2025 Outlook – Is ASML Undervalued?

ASML's 2025 guidance suggests a 15% revenue growth, driven by recovery in non-AI chip segments and increased EUV adoption. Despite this, analysts seem skeptical, with ASML trading at a 12-month forward P/E of 30x, which is low for a company growing EPS by 20%+ annually.

For long-term investors, ASML’s pricing power, backlog, and technology leadership remain intact. However, with China-related risks, supply chain uncertainties, and potential slowdowns in new semiconductor fabs, investors must weigh near-term volatility against long-term dominance.

Buy, Sell, or Hold?

ASML remains one of the strongest long-term semiconductor plays, especially with the rise of AI, cloud computing, and edge processing. Given its €36B backlog, monopolistic position in EUV, and strong projected EPS growth, it is likely undervalued at current levels.

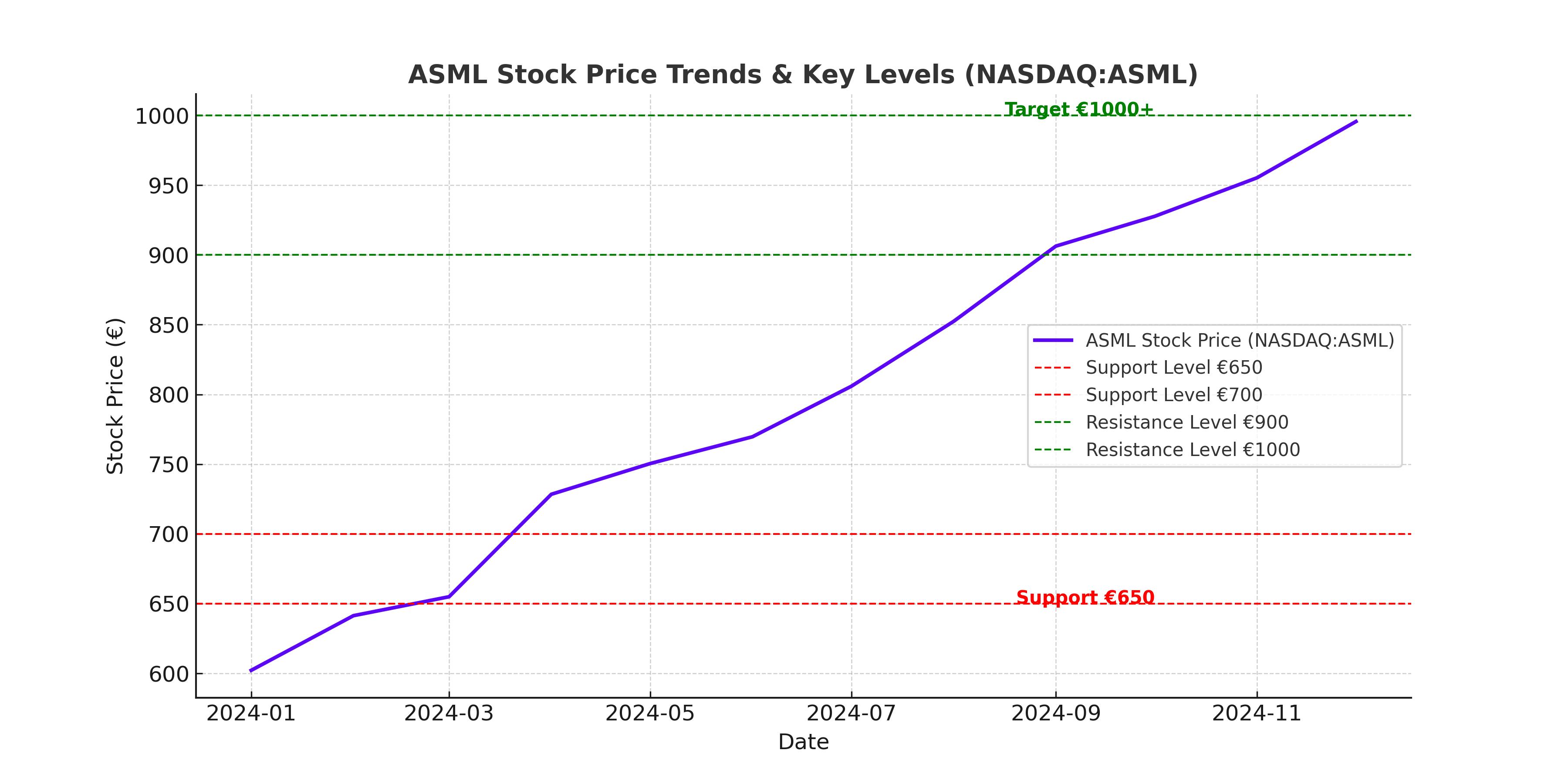

However, traders should watch for short-term volatility due to cyclicality in chip demand. If ASML dips back toward €650–700, it would present a strong buying opportunity. Otherwise, long-term investors can accumulate at current levels, anticipating a return to €1,000+ by 2026.

For live ASML stock movements, check real-time ASML price charts.