Banco Santander's Financial Landscape: A Detailed 2024 Stock Analysis

Assessing SAN's Market Performance, Dividend Strength, and Strategic Financial Metrics Amid Global Banking Challenges | That's TradingNEWS

Comprehensive Financial Analysis of Banco Santander (NYSE: SAN)

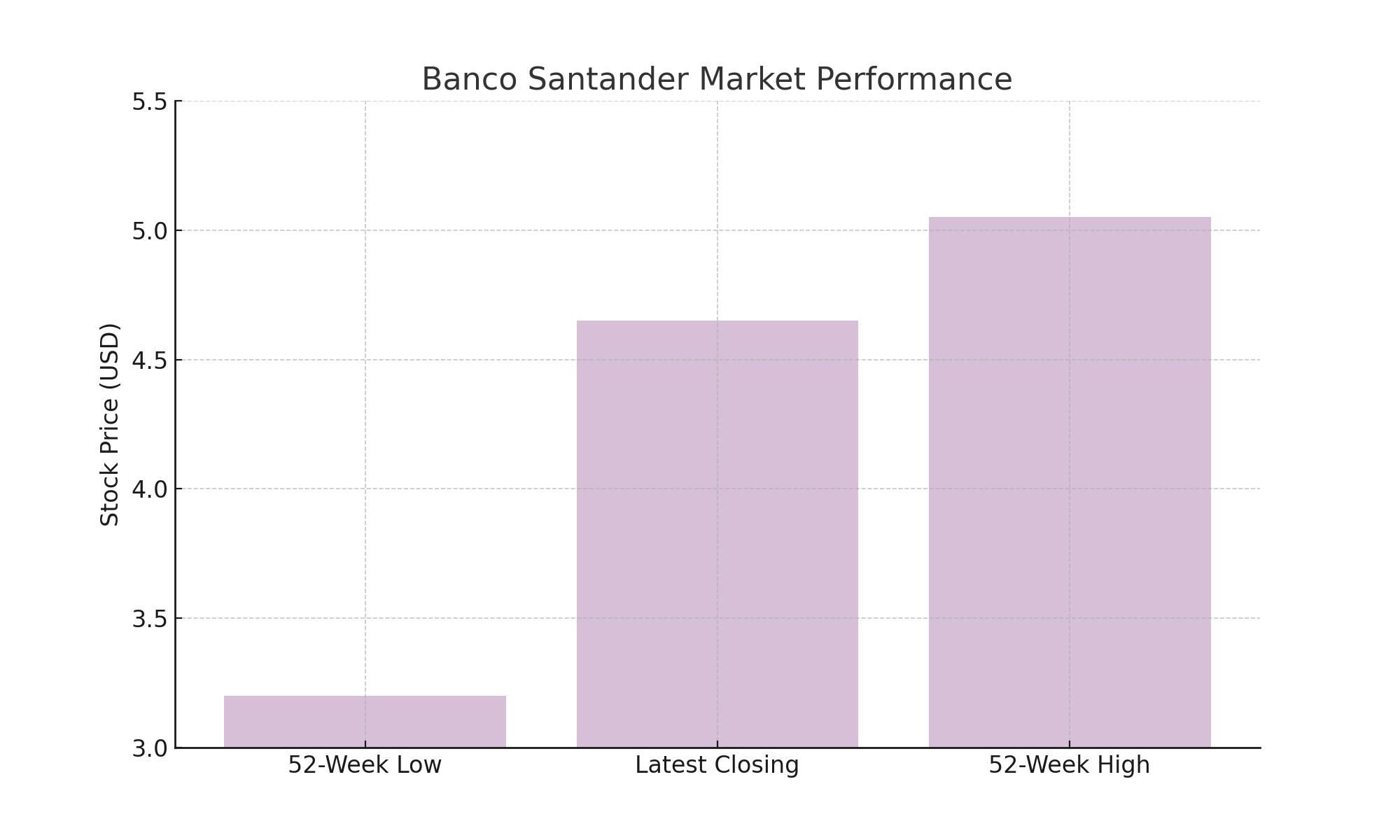

Overview of Banco Santander's Market Performance

Banco Santander, a global banking leader, has experienced varying performance trends influenced by both market conditions and its strategic decisions. As of the latest trading session, SAN closed at $4.65, reflecting a decrease of 2.31% from the previous day. The stock's performance over the year has shown resilience, with a 52-week range between $3.20 and $5.05, suggesting a potential for rebound and growth.

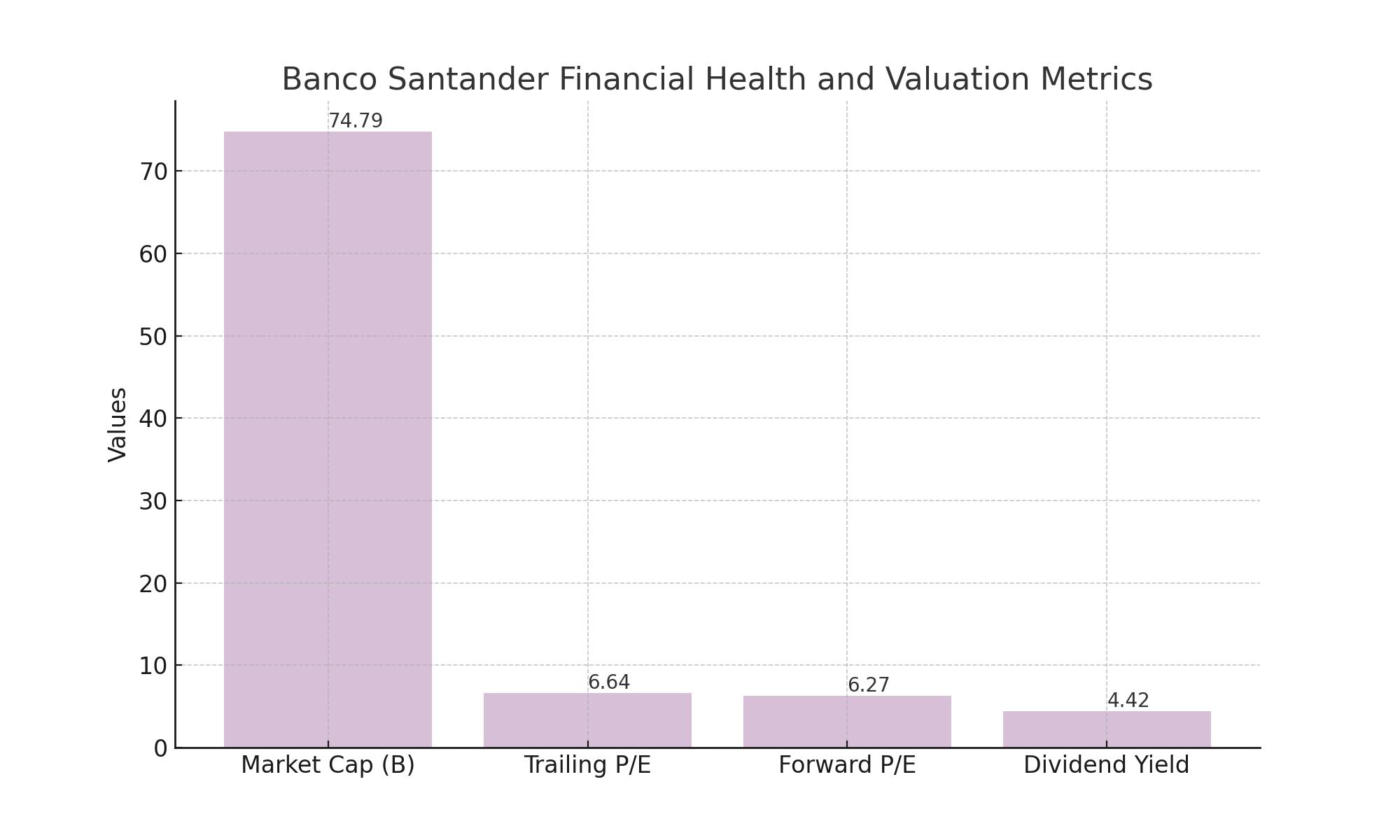

Financial Health and Valuation Metrics

Market Capitalization and Valuation:

Banco Santander boasts a significant market capitalization of $74.79 billion. The bank operates with a trailing Price-to-Earnings (P/E) ratio of 6.64, suggesting a potentially undervalued stock compared to the broader market. This valuation is further underscored by a Forward P/E of 6.27, indicating analysts' expectations of sustained earnings.

Dividend Yield:

With a forward annual dividend rate of $0.21, SAN offers a dividend yield of 4.42%, making it an attractive option for dividend investors. The stability of dividends, combined with a conservative payout ratio of 21.12%, highlights the bank’s commitment to returning value to shareholders.

Liquidity and Debt:

Banco Santander's liquidity ratios reveal a tight cash position, with a current and quick ratio of 0.35. While this suggests a focus on efficiently utilizing assets rather than maintaining cash reserves, the bank's substantial total debt of $369.55 billion necessitates careful debt management strategies to ensure long-term sustainability.

Earnings Performance and Growth Prospects

Recent Earnings Results:

For the most recent quarter, Banco Santander reported earnings per share (EPS) of $0.18, aligning with analysts' expectations. The bank's revenue for the quarter stood at $15.67 billion, demonstrating its robust operational capabilities.

Forward-Looking Earnings Estimates:

Analysts predict a modest increase in earnings, with a consensus estimate of $0.76 EPS for the current year and an anticipated growth to $0.78 in the following year. These projections suggest a steady upward trajectory in Banco Santander’s financial performance.

Insider and Institutional Holdings

Insider Transactions and Holdings:

A closer look at insider transactions here can provide insights into the confidence levels of those closest to the company's internal workings. Presently, insiders hold a negligible percentage of shares, underscoring a potential area for increasing insider investment.

Institutional Influence:

Institutional investors hold approximately 2.42% of SAN’s shares. Recent activities by major financial entities indicate varying levels of engagement and adjustments in their holdings, reflecting their strategic assessments of the bank's stock value.

Technical Indicators and Market Sentiment

Stock Price Movement and Averages:

SAN's stock has been oscillating around significant moving averages, with the 50-day moving average at $4.36 and the 200-day moving average at $3.99. These indicators suggest a generally positive sentiment, with current prices trending above average levels.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex