Bitcoin Faces Selling Pressure Amid Government Liquidations

Navigating Recent Declines and Analyzing Key Support Levels for Future Price Movements | That's TradingNEWS

Bitcoin Faces Selling Pressure Amid Government Liquidations and Market Dynamics

Current Bitcoin Price Dynamics

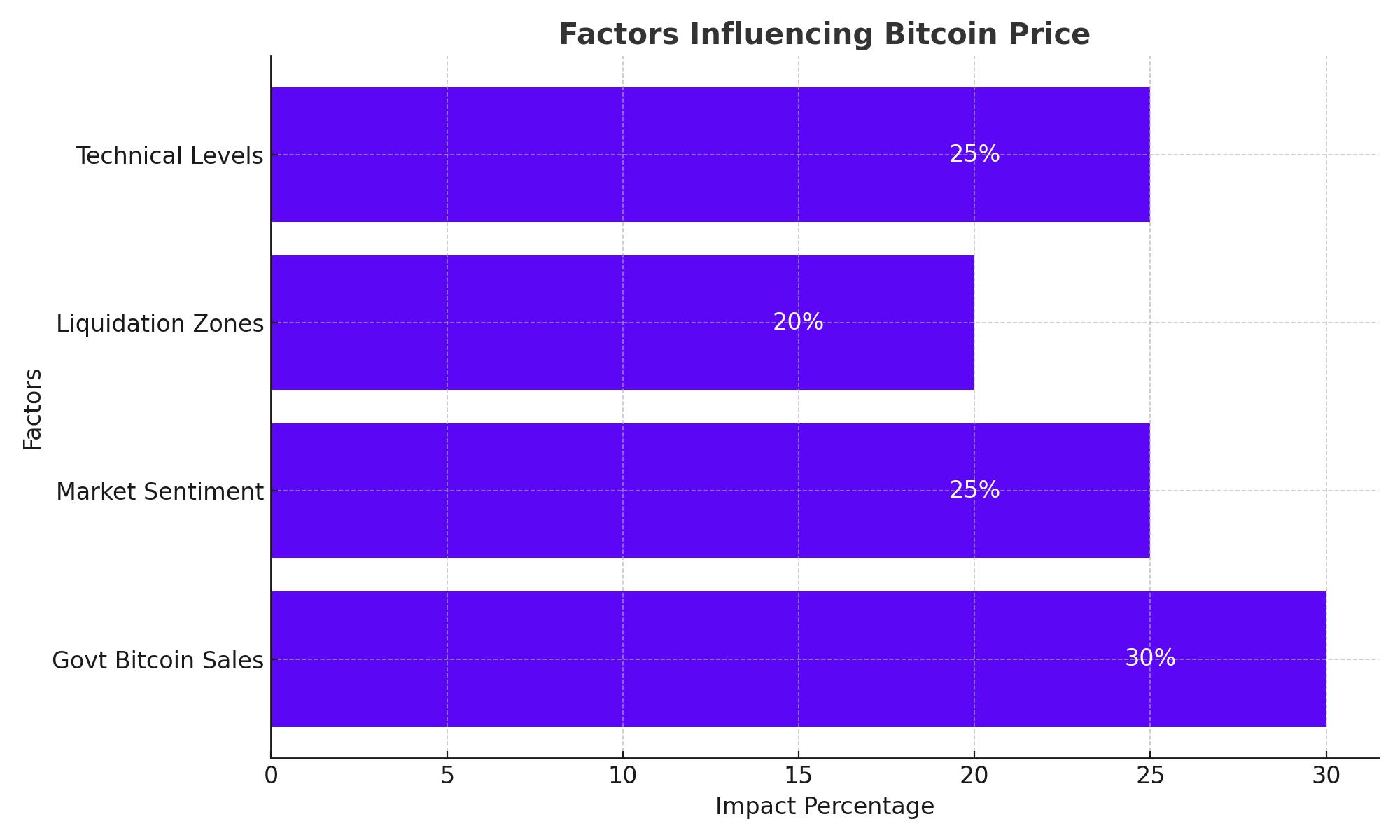

Bitcoin (BTC-USD) experienced a significant decline, dropping about 16% recently, falling below its support zone at $61,000 and then below its previous daily support. The cryptocurrency reached a low of $53,500 before regaining some ground, trading around $57,300 at the time of writing. This decline was exacerbated by fear, uncertainty, and doubt (FUD) stemming from the sale of Bitcoin by the German and American governments and the start of Bitcoin distribution from the defunct exchange Mt. Gox.

Technical Analysis of Bitcoin

Despite the short-term bearish structure, Bitcoin's medium-to-long-term trend remains bullish. However, recent fluctuations have caused the price to fall below the critical 50-day and 200-day moving averages. This has raised concerns about the continuation of the bullish trend. The next significant support level is identified around $52,000, indicating potential further declines if current support levels fail to hold.

Derivatives Market Impact on Bitcoin

The open interest in Bitcoin perpetual contracts has decreased along with the price drop, indicating reduced speculative participation. More than $46 million in long positions were liquidated, showing capitulation among buyers. Despite this, the funding rate remained positive, indicating that a majority of speculators were still oriented towards buying. Short position liquidations were observed as Bitcoin showed signs of regaining strength.

Market Sentiment and Liquidation Zones

The liquidation heatmap for BTC/USDT indicates buying interest at the $56,000 level, suggesting defense of this zone for now. Significant liquidation zones are noted above the current price at $64,000 and further away at $72,300. Below the current price, significant zones are around $50,000. These areas represent major points of interest for investors and could trigger increased volatility if the market approaches these levels.

Hypotheses for Bitcoin Price Movements

If Bitcoin manages to stay above $53,500, a return to $58,500 is anticipated, with resistance levels at $60,000 to $61,000 and $63,800. Conversely, if Bitcoin falls below $53,500, support is expected around $51,800, with further declines to $50,500 and potentially between $49,200 and $48,200, representing a possible drop close to 15%.

Government Bitcoin Sales and Market Reactions

The German government's liquidation of Bitcoin has added to the selling pressure. Recently, the government moved $339.2 million worth of Bitcoin to addresses linked to centralized crypto exchanges and market makers. This follows the seizure of 50,000 Bitcoins from the piracy site Movie2k and subsequent transfers to exchanges. The government's sales have sparked discussions about their impact on market sentiment, with some industry experts viewing it as a replacement of "dumb money" with "smart money."

Bitcoin Price Reaction to Market Events

Bitcoin's price saw a slight rise to $57,386.4, although sentiment remains cautious over potential spikes in token supply. Ether (ETH-USD) outpaced Bitcoin, rising 0.7% to $3,074.46 amid speculation of an upcoming spot exchange-traded fund (ETF). Despite steep losses over the past two weeks, Bitcoin appears to have stabilized, with strong capital inflows into crypto investment products helping to improve sentiment.

Impact of Crypto Investment Inflows

Data from CoinShares showed crypto investment products saw inflows totaling $441 million in the week to July 8, driven by bargain hunting amid price declines. Bitcoin continued to control a bulk of the inflows, with Ether products seeing about $10 million in inflows. The Securities and Exchange Commission (SEC) is expected to approve spot ETF filings from major issuers later in July, potentially boosting confidence in the token.

Market Influences and Technical Factors

Bitcoin's recent slide to $55,000 was influenced by German government wallet activities, spooking traders. The government received over $200 million worth of Bitcoin back from exchanges, helping stabilize the price. Spot Bitcoin ETFs recorded nearly $300 million in net inflows, indicating buying opportunities perceived by investors. Bitcoin's mining difficulty also saw a significant drop, favoring smaller miners and potentially reducing selling pressure from larger mining operations.

Overall Market Sentiment and Future Outlook

Despite the recent selling pressure, Bitcoin's long-term bullish trend remains intact. Market participants are closely watching key levels and government activities to gauge future price movements. The continued inflows into crypto investment products and potential ETF approvals are positive signs for the market. However, the impact of government sales and macroeconomic factors will continue to influence Bitcoin's price dynamics in the near term.

Final Thoughts

Bitcoin's recent fluctuations have highlighted the significant impact of government actions and market sentiment on its price. While the medium-to-long-term outlook remains bullish, short-term volatility is expected to persist. Investors should remain vigilant, monitoring key support and resistance levels and considering both technical and fundamental factors in their analysis.

That's TradingNEWS

Read More

-

SCHD ETF: $28.41 Price, 3.67% Yield And The Real Story After Broadcom’s Exit

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI At $11.95 And XRPR At $16.98 While $750M Flees Bitcoin And Ether Funds

12.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Snaps Back from $3.17 Lows as UNG and BOIL Surge

12.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Stalls Just Under 158 While Markets Game a Break or Reversal Near 160

12.01.2026 · TradingNEWS ArchiveForex