Bitcoin Price Nears Critical Levels: Is $110K Next?

Can Bitcoin’s Strong Support at $86K Spark a Bullish Breakout? | That's TradingNEWS

Bitcoin Price Surges Amid Market Volatility: BTC-USD Maintains Key Support

Bitcoin (BTC-USD) has shown remarkable resilience despite recent market turbulence, rebounding from a sharp decline that briefly took prices below the critical $90,000 level. As of now, Bitcoin trades at $91,427, a level supported by robust buying interest in the $85,000–$92,000 range, reflecting confidence among institutional and retail investors alike.

Institutional Accumulation Supports Market Stability

Institutional investors have been a key pillar of Bitcoin's stability. Recent data reveals systematic accumulation during price dips, with large-scale purchases indicating long-term bullish sentiment. For instance, MicroStrategy, a leading corporate holder of Bitcoin, recently added 2,530 BTC to its holdings, bringing its total ownership to approximately 450,000 tokens valued at over $43 billion. This persistent accumulation highlights strong institutional conviction in Bitcoin's long-term potential as a digital store of value.

Technical Indicators Signal Market Rebound Potential

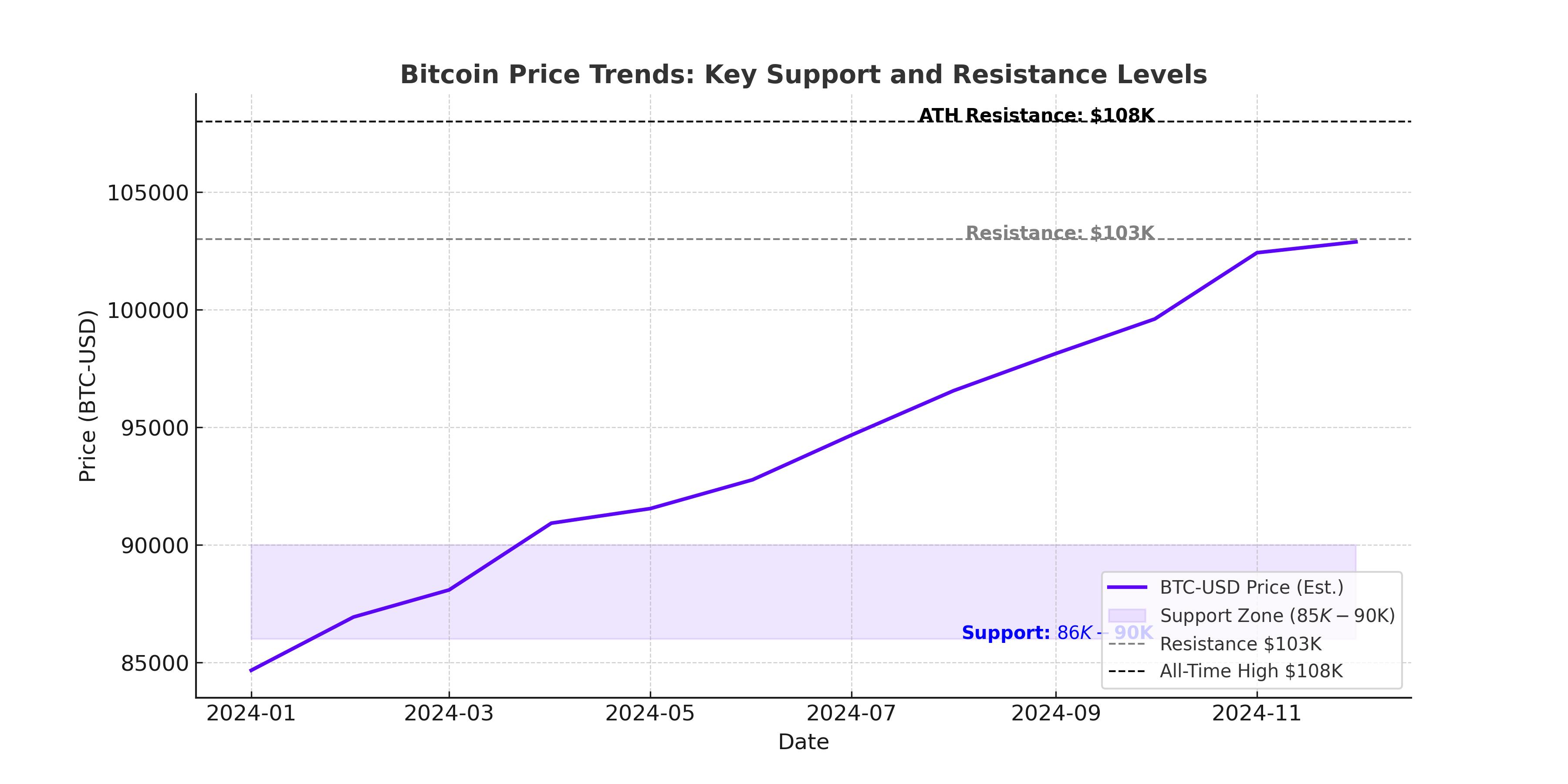

Bitcoin’s adherence to critical technical indicators, such as the 52-week simple moving average (SMA) and the logarithmic growth curve (LGC), has provided a framework for understanding its price movements. Analysts have identified a potential head-and-shoulders pattern, a formation often associated with downward trends, but robust support at $86,000 suggests the possibility of a bullish reversal. Historical patterns further reinforce this view, with Bitcoin frequently rebounding strongly after corrections of 10–15%.

Trading Volume and Liquidity Conditions Show Optimism

Despite recent volatility, trading volume across major exchanges remains healthy, pointing to strong market engagement. The distribution of trading activity within the $90,000–$100,000 range indicates active price discovery. Furthermore, market depth metrics suggest stable liquidity conditions, reducing the likelihood of sudden, sharp price movements and supporting smoother transitions as Bitcoin approaches key resistance levels.

Fed Policy and Macroeconomic Factors Influence Sentiment

Bitcoin’s price has not been immune to macroeconomic pressures, with Federal Reserve policy playing a pivotal role. Recent hawkish comments from the Fed, coupled with strong U.S. job market data, have tempered expectations for immediate rate cuts, dampening risk-on sentiment across financial markets. However, Bitcoin’s ability to decouple from traditional asset classes during certain periods underscores its unique position as both a speculative and a defensive asset.

Key Price Levels to Watch: Support and Resistance

The cryptocurrency has established multiple technical levels that traders are closely monitoring. The $86,000 level has emerged as a crucial support zone, with significant buy-side interest evident in order books. On the upside, Bitcoin faces resistance at $103,000, its recent high, and $108,000, its all-time peak. A breakout above these levels could pave the way for further gains, with some analysts projecting targets as high as $180,000 by the end of 2025.

Will Bitcoin Reach $1 Million? Bold Predictions and Realistic Expectations

While Bitcoin enthusiasts such as Arthur Hayes and Jeff Park have speculated about seven-figure valuations in the long term, these projections hinge on transformative policy shifts, such as a Bitcoin reserve strategy by the U.S. government. More conservative estimates, such as VanEck's forecast of $180,000 by 2025, align with historical growth trajectories and technical projections.

Conclusion: Is Bitcoin a Buy at Current Levels?

Bitcoin’s current price of $91,427 presents a compelling entry point for long-term investors, backed by strong institutional support, resilient technical indicators, and a positive market structure. While macroeconomic challenges and technical resistance levels remain, the broader trajectory for BTC-USD suggests continued growth, making it a worthwhile addition to portfolios seeking exposure to digital assets.

That's TradingNEWS

Read More

-

SCHD ETF: $28.41 Price, 3.67% Yield And The Real Story After Broadcom’s Exit

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI At $11.95 And XRPR At $16.98 While $750M Flees Bitcoin And Ether Funds

12.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Snaps Back from $3.17 Lows as UNG and BOIL Surge

12.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Stalls Just Under 158 While Markets Game a Break or Reversal Near 160

12.01.2026 · TradingNEWS ArchiveForex