Bitcoin Plummets as Mt. Gox Repayments and Government Liquidations

Cryptocurrency Market Faces Turmoil with Bitcoin Dropping Below $54,000 Amid Large-Scale Sell-Offs and Pessimistic Market Predictions | That's TradingNEWS

Current Bitcoin Market Analysis

The cryptocurrency market is experiencing significant turmoil as Bitcoin (BTC) and other major cryptocurrencies face a sharp decline. The price of Bitcoin has dropped nearly 7% to around $54,000 in the past 24 hours, while Ether (ETH) has fallen about 10% to approximately $2,850, marking its first dip below $3,000 since mid-May. This downturn has pushed the total cryptocurrency market value down by almost 9% to $2.08 trillion.

Impact of Mt. Gox Repayments

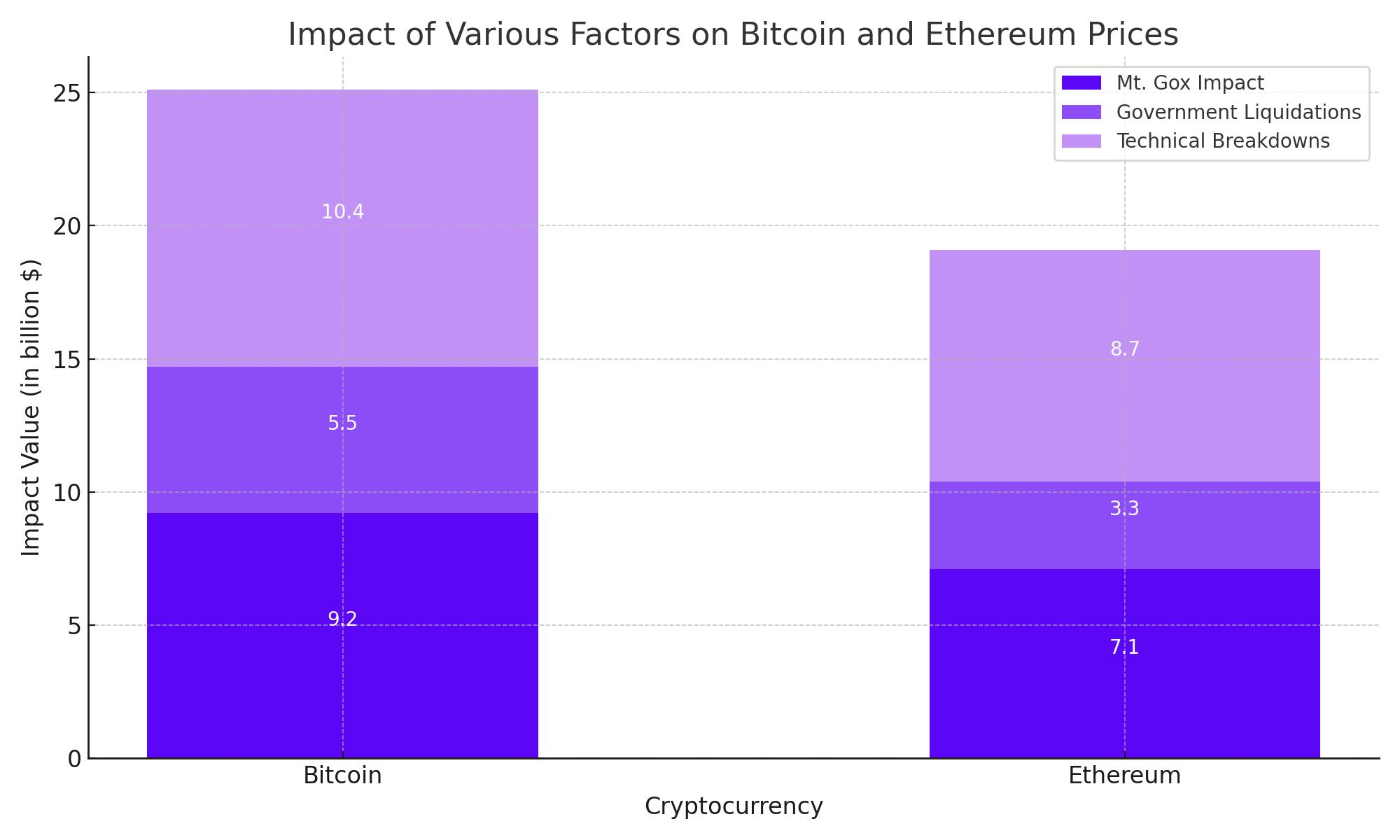

A key factor contributing to the current market instability is the long-awaited repayment process from Mt. Gox, an early cryptocurrency exchange that collapsed over a decade ago. Creditors of Mt. Gox are expected to receive $9.2 billion in Bitcoin, which many anticipate will lead to significant selling pressure as these funds are distributed. Rachel Lin, co-founder and CEO of SynFutures, suggested that the market is bracing for a potential dump of these tokens, which could drive prices even lower.

Broader Market Downturn

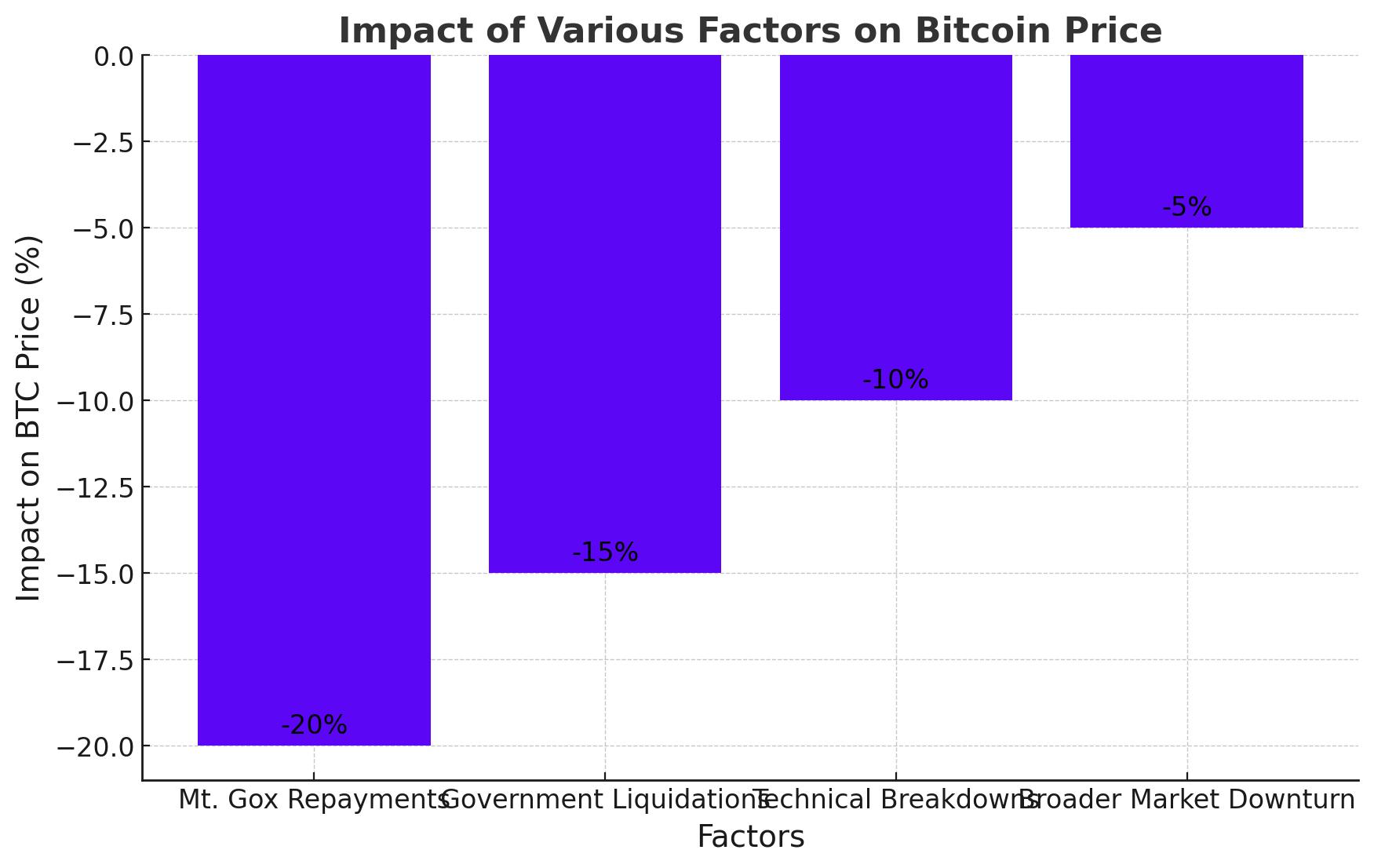

The recent decline in Bitcoin and other cryptocurrencies extends a month-long trend of losses. Despite the approval of spot Ethereum exchange-traded funds (ETFs) by the US Securities and Exchange Commission, the market has not seen the same positive reaction as it did with the approval of Bitcoin ETFs earlier in the year. Since the beginning of June, Bitcoin has dropped nearly 20% from around $67,000, while Ether has plummeted about 24% from approximately $3,700.

Major Factors Behind the Price Drop

-

Mt. Gox Repayments: The imminent repayments to Mt. Gox creditors are expected to release a large volume of Bitcoin into the market, increasing selling pressure. Arkham Intelligence reported test transactions from wallets associated with Mt. Gox, signaling preparations for these distributions.

-

Government Liquidations: The German government recently liquidated about 1,300 BTC, worth approximately $75.53 million, further contributing to the market's downward pressure. This sale was conducted through exchanges like Bitstamp, Coinbase, and Kraken.

-

Technical Breakdowns: Bitcoin's fall below its 200-day moving average of $58,492 has triggered significant investor concern and led to large-scale liquidations in the derivatives market. This breach resulted in forced closures of long positions, totaling $100.4 million.

Pessimistic Predictions

Various analysts predict further declines in Bitcoin's price, potentially dropping below $50,000. Alex Kuptsikevich from FxPro noted that Bitcoin's fall below key technical levels suggests a higher likelihood of reaching $51,500 rather than rebounding to $65,800. Historical performance during the third quarter, particularly in August and September, has typically been weak for Bitcoin, compounding the current bearish outlook.

Market Sentiment and Psychological Thresholds

The breach of critical psychological thresholds, such as the $60,000 mark, has exacerbated market panic. Markus Thielen, founder and CEO of 10x Research, emphasized the importance of these levels for Bitcoin miners and ETF buyers. Thielen cautioned that breaking this support could lead to a significant decline to $50,000, with only poorly informed traders likely to buy at current levels.

Historical Trends and Future Outlook

The third quarter has historically been a challenging period for Bitcoin, with August and September often seeing underperformance. This seasonal weakness suggests that the current decline may be part of a broader trend, with further drops likely before any potential recovery.

Political and Economic Uncertainty

Political changes, such as a less crypto-friendly Democratic candidate replacing Joe Biden, could have significant implications for Bitcoin. Regulatory shifts and political sentiment play crucial roles in shaping market confidence and investor behavior.

Technical Indicators and Chart Patterns

Bitcoin's breach of its descending channel and 200-day moving average are significant bearish signals, indicating continued downward momentum. Technical factors suggest that the market may face ongoing volatility and further declines.

Preparing for the Future

Investors need to be prepared for ongoing volatility. Strategies include diversifying investments, staying informed, placing stop-loss orders, and seeking advice from financial advisors. Diversification can help mitigate risks, and staying informed allows for better decision-making. Stop-loss orders can help avoid significant losses, and financial advisors can provide tailored guidance.

Sentiment Analysis

The Crypto Fear & Greed Index, a measure of market sentiment, has plummeted to its lowest level since early January 2023, indicating extreme fear. This drop in sentiment suggests a buying opportunity, though the reality is more complex. The selling pressure from government liquidations and the Mt. Gox repayments is unlikely to abate in the short term, adding to the market's challenges.

Conclusion

The current decline in Bitcoin's price represents a significant obstacle for the cryptocurrency market. Historical trends, political uncertainty, and technical indicators all point to further potential declines. Investors must remain vigilant and adopt strategic measures to navigate this challenging period. By staying informed and implementing sound investment strategies, it is possible to weather the storm and emerge stronger in the long run.

That's TradingNEWS

Read More

-

Ferrari Stock Price Forecast - RACE at $377 Stock Turns Sentiment Slump Into A High-Margin Buying Window

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Holds the $2 Line as Clarity Act Vote and Powell Drama Put Crypto on Edge

12.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast Oil Slip as Iran “Control” Claim and Fast-Tracked Venezuela Deal Test the $60 Floor

12.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow, S&P 500, Nasdaq Drop As Gold Rips Higher And WMT, TEM, SNCY Rally

12.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Spikes Back Toward 1.35 as Fed Turmoil Cracks the Dollar

12.01.2026 · TradingNEWS ArchiveForex