Bitcoin Price Declines Amid Fed Uncertainty

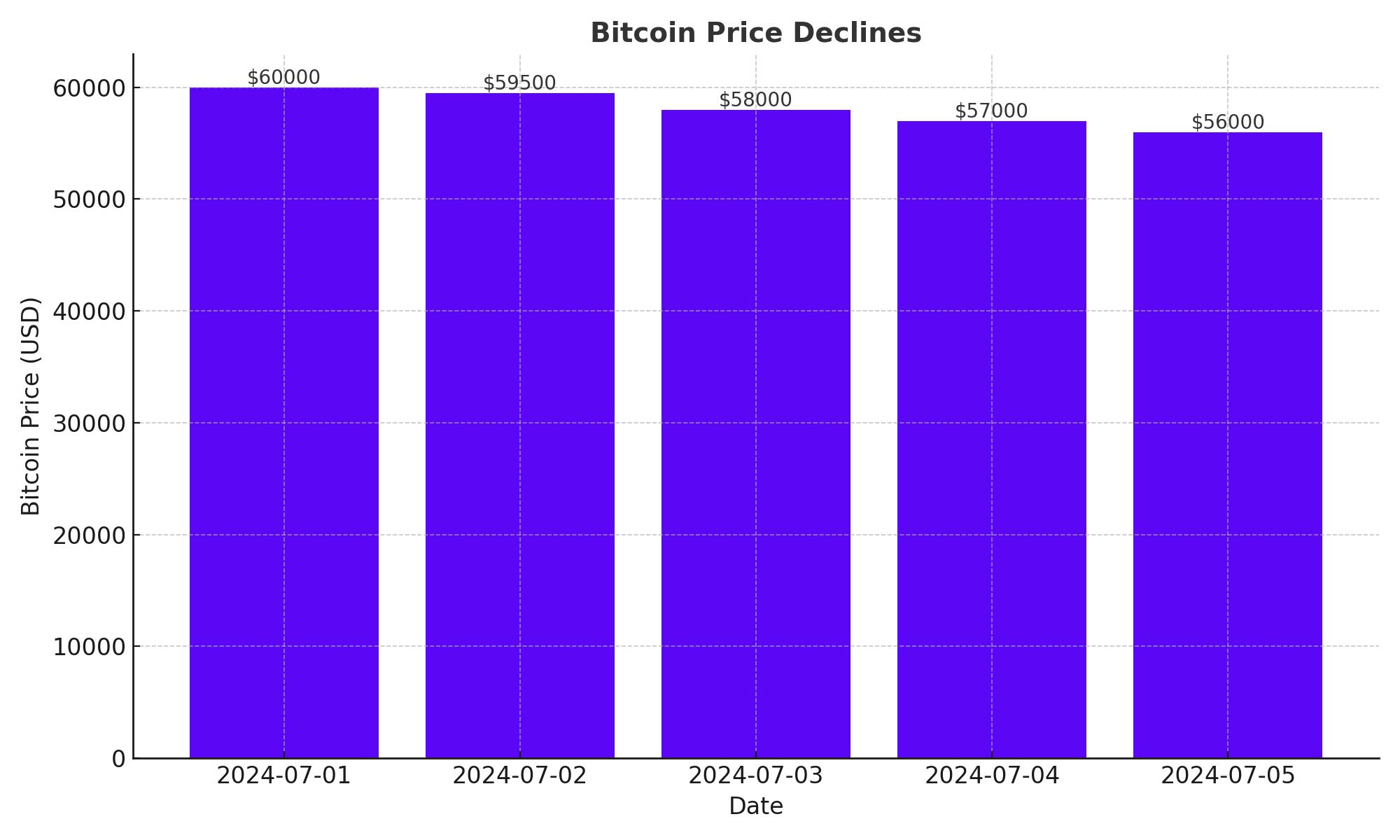

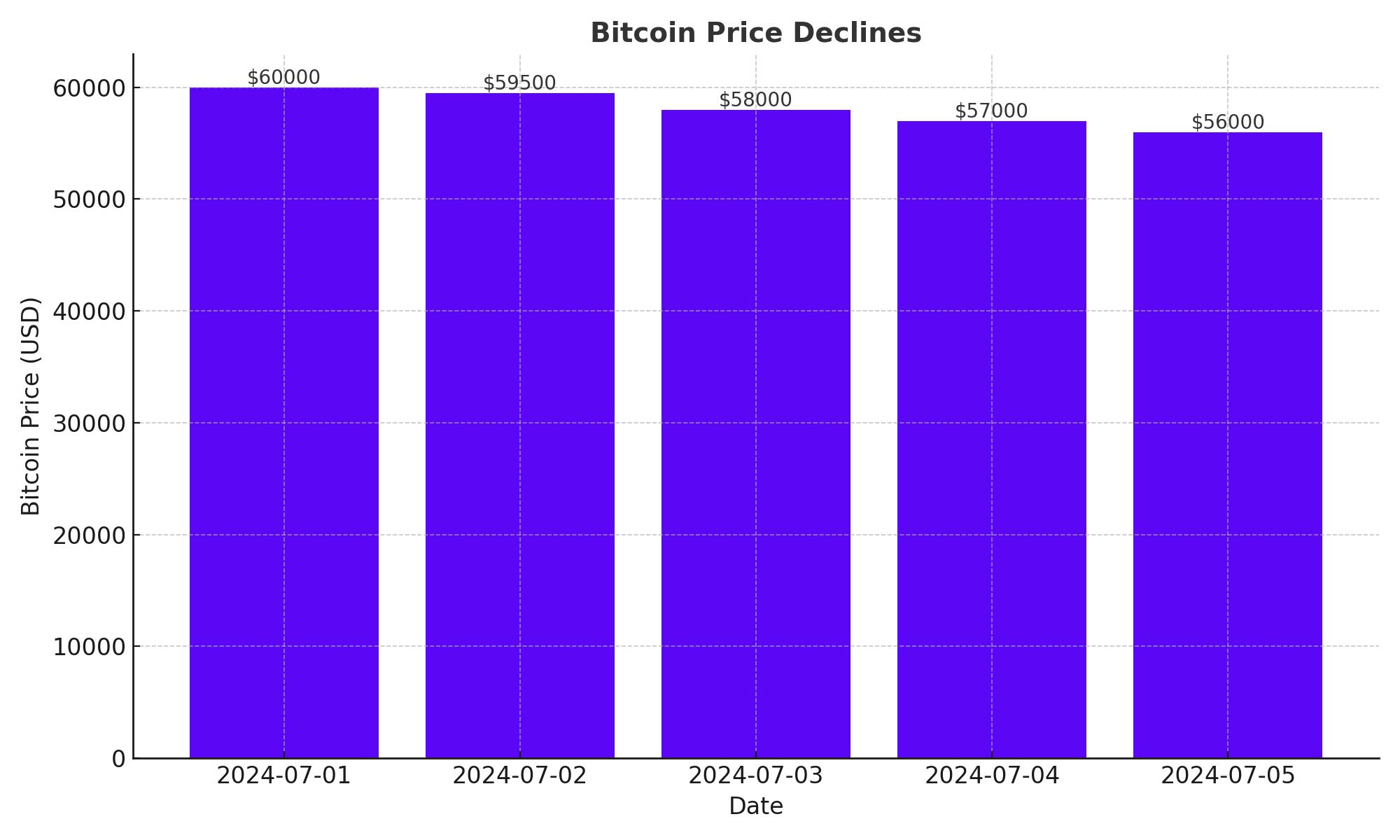

Bitcoin's value fell approximately 5% in the past 24 hours, dropping below $57,000 for the first time since May 1, according to data from CoinGecko. The decline came after the Federal Reserve released minutes from its June meeting, indicating officials' reluctance to lower interest rates until inflation moves towards the 2% target. This has created a challenging environment for Bitcoin, as higher interest rates typically dampen investor risk appetite.

Mt. Gox Distribution Raises Market Concerns

Bitcoin has faced additional pressure from the upcoming distribution of approximately $9 billion worth of Bitcoin by the defunct exchange Mt. Gox. The distribution to creditors, set to begin in July, has raised fears of significant selling action in the market. Analysts anticipate that many creditors, having waited nearly a decade, might choose to sell their holdings, further increasing downward pressure on Bitcoin prices.

Historical Trends and Halving Events

Despite recent setbacks, historical market cycles suggest that Bitcoin's price could still reach new heights. The cyclical nature of Bitcoin's market, characterized by halving events that reduce the supply of new Bitcoins, has historically preceded periods of price expansion lasting between 12 to 18 months. According to research by CCData, this pattern indicates potential for future gains, though the market remains volatile.

Federal Reserve's Influence on Bitcoin

Federal Reserve Chair Jerome Powell's recent remarks have highlighted the critical period the Fed faces regarding monetary policy. Powell emphasized the need for more data before considering rate cuts, despite the U.S. being on a "disinflationary path." The Federal Reserve's cautious stance has led to increased market speculation about the timing and extent of future rate cuts, directly influencing Bitcoin's performance.

Bitcoin's Technical Analysis and Key Levels

Bitcoin has been trading within a range between $59,000 and $72,000 since reaching an all-time high of $73,700 in March. The recent drop below $57,000 has disrupted the bullish outlook, breaking significant support levels. Market analysts, such as Markus Thielen of 10x Research, warn that further declines could see Bitcoin prices falling to the low $50,000s, especially if support around $58,000 fails to hold.

Impact of Institutional Investment and ETFs

The approval of the first U.S. spot Bitcoin ETF by the Securities and Exchange Commission (SEC) in March had initially driven Bitcoin to record highs. ETFs have made it easier for institutional investors to gain exposure to Bitcoin, legitimizing the asset class. However, recent net outflows from Bitcoin ETFs and the overall cautious market sentiment have tempered this enthusiasm.

Broader Cryptocurrency Market Trends

Other cryptocurrencies have mirrored Bitcoin's decline, with Ether falling 5% to $3,120 and altcoins like Solana and Cardano also experiencing significant drops. The global cryptocurrency market cap decreased by 4.1% over the past day, according to Coingecko data. The overall market sentiment remains bearish amid uncertainties about interest rate cuts and selling pressure from large Bitcoin holders.

Insider Transactions and Market Sentiment

For detailed insider transactions, visit Bitcoin Insider Transactions.

The cryptocurrency market has seen substantial liquidations, with futures traders losing over $240 million in the past 24 hours. This spike in liquidations has further exacerbated Bitcoin's price decline, as leveraged positions are forcefully closed, adding to the selling pressure.

Market Outlook and Predictions

Despite the current bearish trend, some analysts remain optimistic about Bitcoin's long-term potential. Historical data shows that Bitcoin has returned an average of 7% in the month of July between 2013 and 2023. However, the market's near-term trajectory will largely depend on how it navigates the ongoing economic uncertainties and potential mass sell-offs from entities like Mt. Gox.

Conclusion

Bitcoin's recent price drop reflects a complex interplay of selling pressure, economic uncertainty, and cautious monetary policy from the Federal Reserve. While historical trends suggest potential for future gains, the market remains highly volatile. Investors should closely monitor key support levels and market developments, including institutional investment flows and regulatory changes, to make informed decisions in this challenging environment.