Bitcoin Rockets Past $63K – Is $65K the Next Target After the Fed’s Rate Cut?

With the Fed cutting rates, Bitcoin sees renewed momentum. Investors and analysts are watching for a potential breakout towards $65,000 and beyond | That's TradingNEWs

Bitcoin Surges Past $63,000: Fed Rate Cut Sparks Momentum for BTC (BTC-USD)

The Road Ahead for Bitcoin: Is $65,000 the Next Big Target?

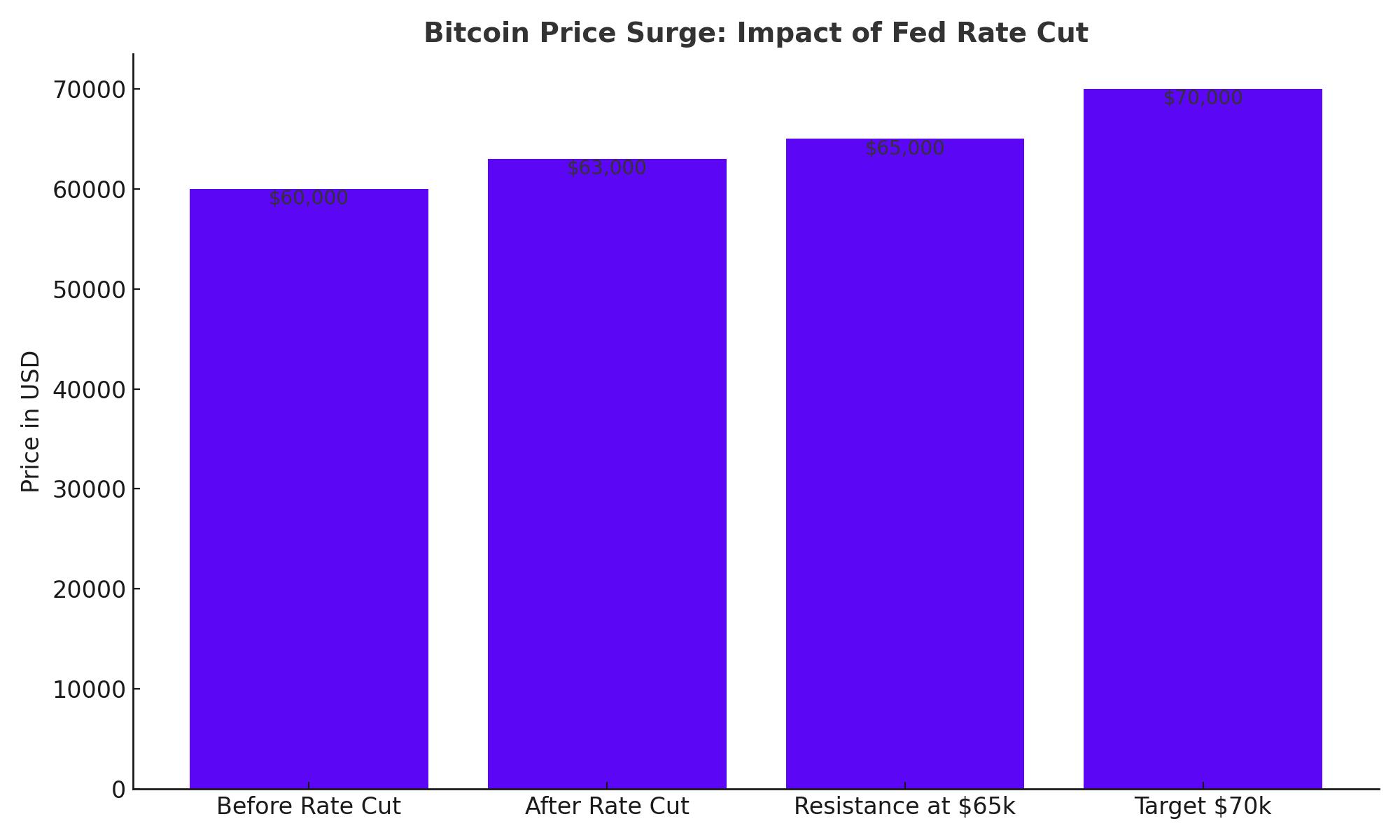

Bitcoin (BTC-USD) recently crossed $63,000, driven by a market-wide rally following the Federal Reserve’s decision to cut interest rates by 50 basis points. This rate cut, signaling a shift towards looser monetary policies, has fueled optimism for riskier assets like Bitcoin, which thrives on excess liquidity. With investors looking for alternative stores of value in uncertain economic times, Bitcoin is gaining significant traction.

The Impact of the Fed's Rate Cut on Bitcoin (BTC-USD)

The rate cut has been a major catalyst for Bitcoin’s recent surge. Lower interest rates reduce the opportunity cost of holding non-yielding assets like Bitcoin, making it a more attractive investment option. The Federal Reserve indicated that this rate cut marks the beginning of a broader easing cycle, with the potential for a further reduction of 125 basis points in the coming months. As liquidity increases, investors are shifting towards speculative assets, boosting Bitcoin’s appeal.

Despite the positive sentiment surrounding the rate cut, Bitcoin's performance has faced some resistance, particularly near the $64,000 mark. Profit-taking by short-term traders has caused minor pullbacks, but analysts remain optimistic about the long-term potential. Geoff Kendrick from Standard Chartered sees Bitcoin reaching as high as $200,000 by 2025, driven by inflows into Bitcoin exchange-traded funds (ETFs) and a marginal uptick in inflation.

Bitcoin (BTC-USD) Price Action: Technical Overview

Bitcoin’s recent breakout above $63,000 highlights its strength, but the resistance at $65,000 remains a critical level to watch. The BTC/USD pair could correct to the 20-day exponential moving average (EMA) at $60,232, but if it rebounds from this level, it would likely resume its upward trajectory. A break above $65,000 could set the stage for a push towards $70,000, a key psychological and technical barrier.

On the downside, failure to hold the $61,200 support could lead to a deeper correction, with potential targets around $57,500. The technical indicators, such as the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI), suggest that Bitcoin still has room to grow. The MACD has triggered a buy signal, while the RSI remains below the overbought threshold, indicating that the rally may continue.

Altcoin Market: Ethereum (ETH-USD) and Ripple (XRP-USD) Follow Bitcoin's Lead

While Bitcoin has been leading the charge, major altcoins like Ethereum (ETH-USD) and Ripple (XRP-USD) have also shown strength. Ethereum broke above its resistance level at $2,461 and is now targeting $2,820, with strong support at the $2,461 mark. Ripple has stabilized above its key support level of $0.544, hinting at a continuation of its upward trend, with the next target at $0.626.

In the broader cryptocurrency market, risk appetite remains high, with investors looking for opportunities in both Bitcoin and altcoins. However, regulatory uncertainty, especially in the U.S. with the upcoming 2024 elections, could weigh on the market’s future performance. Additionally, central banks in Europe and Japan are expected to follow the Fed’s lead, further influencing the global financial landscape.

Long-Term Outlook for Bitcoin: A Path to $200,000?

Looking ahead, Bitcoin’s trajectory remains bullish, with analysts like Kendrick predicting a significant rally over the next few years. The launch of Bitcoin ETFs, coupled with the removal of regulatory barriers such as the Staff Accounting Bulletin-121, could open the floodgates for institutional investment, pushing Bitcoin towards $200,000 by the end of 2025.

However, investors should remain cautious, as geopolitical risks and a potential economic slowdown could create volatility in the short term. The recent price action suggests that Bitcoin is poised for further gains, but the market may experience periods of consolidation before testing new highs.

In conclusion, Bitcoin’s rally above $63,000 signals strong bullish momentum, driven by macroeconomic factors and increased liquidity. As the market digests the implications of the Fed's rate cut, Bitcoin could continue its upward march, with $65,000 and $70,000 as the next critical levels to watch. The long-term outlook remains promising, with Bitcoin well-positioned to benefit from both institutional adoption and macroeconomic tailwinds.

That's TradingNEWS

Read More

-

NLR ETF at $145.21: Uranium, Nuclear Power and the AI Baseline Energy Trade

14.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Demand Lifts XRPI, XRPR and Bitwise XRP as XRP-USD Defends $2.10 Support

14.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Slides Toward $3 as Warm Winter Clashes With LNG Demand

14.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Climbs Toward 160 as Japan’s Debt Fears Clash With BoJ Hike Hopes

14.01.2026 · TradingNEWS ArchiveForex