Bitcoin Slides to $94,150 After $104K Record: A Path to $120K?

Massive $1.7 Billion Liquidations Shake Market, Yet Institutional Inflows Signal Bullish Momentum | That's TradingNEWS

Bitcoin (BTC-USD): A Comprehensive Look at the Market's Volatility and Long-Term Outlook

Bitcoin Price Volatility and Recent Performance

Bitcoin (BTC-USD) has been on a rollercoaster ride, with the price recently dropping to $94,150, a sharp correction from its all-time high of $104,088 reached just last week. The decline triggered a massive $1.7 billion liquidation event across the crypto market, impacting 583,530 traders. Despite this, Bitcoin managed to recover slightly, stabilizing around $97,800 as of Tuesday. This dip in price, while unsettling for some, aligns with Bitcoin's history of volatility, often driven by leverage, profit-taking, and external market pressures.

One of the key drivers behind the recent drop has been the heavy liquidation of long positions, with Bitcoin longs accounting for $180 million of the total liquidations. The event has been described as the largest long liquidation since 2021, reflecting the immense leverage within the crypto ecosystem. This deleveraging is seen by some analysts as a "healthy flush," potentially paving the way for more sustainable price growth in the near term.

The Impact of Institutional Activity and ETFs

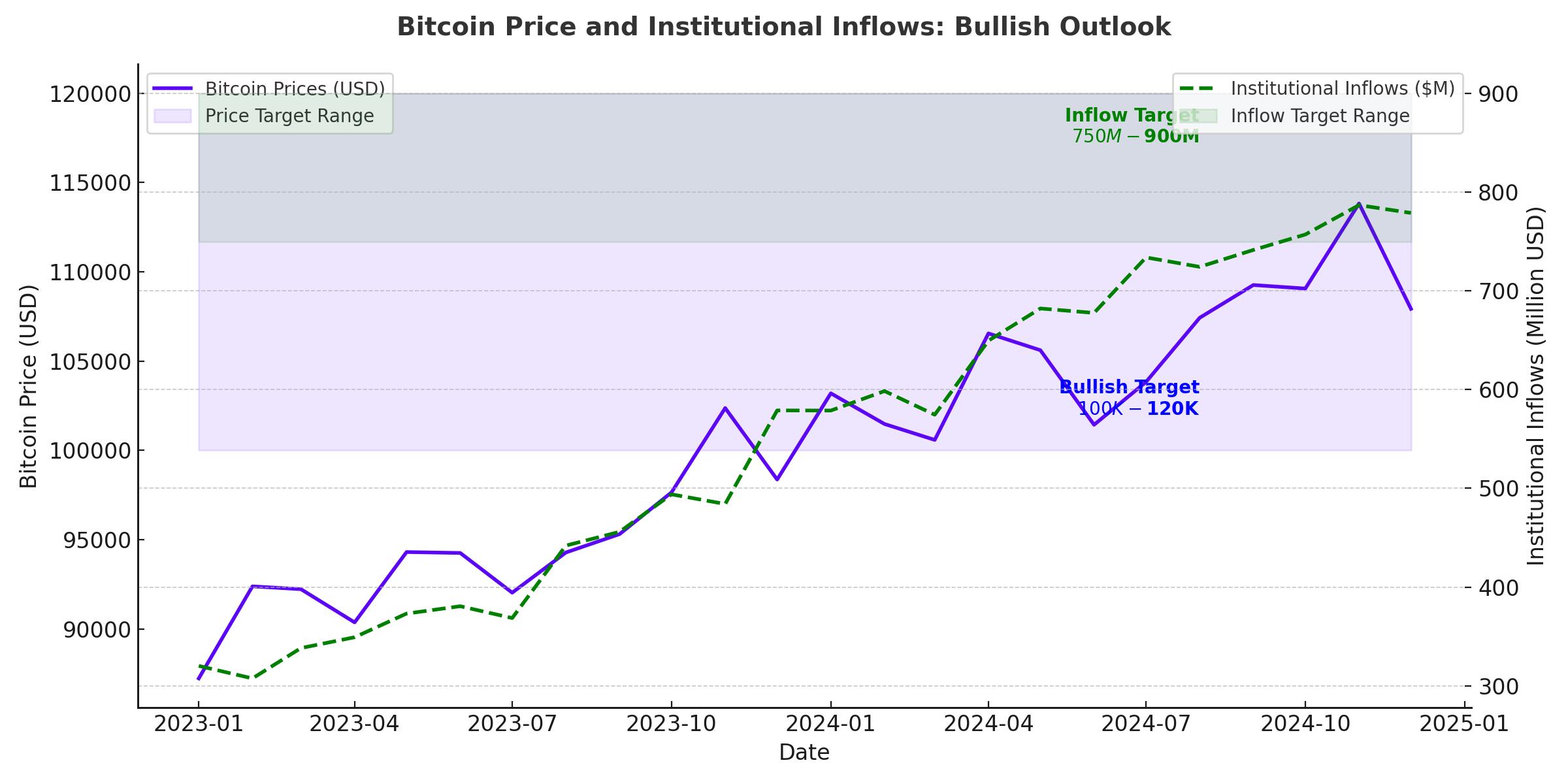

Despite the recent price drop, institutional demand for Bitcoin remains robust. Bitcoin Spot Exchange Traded Funds (ETFs) recorded a significant inflow of $483.6 million on the same day the market experienced a sharp decline. This suggests that institutions are taking advantage of lower prices to accumulate Bitcoin, reinforcing its status as a strategic asset.

MicroStrategy, a prominent institutional player, announced the acquisition of an additional 21,550 BTC at an average price of $98,783 per Bitcoin. This purchase brings the company's total holdings to 423,650 BTC, acquired at an average price of $60,324 per coin. MicroStrategy's aggressive accumulation strategy highlights the growing interest among institutions in Bitcoin as a long-term store of value.

Market Sentiment and Technical Analysis

The market sentiment for Bitcoin is currently mixed. On the technical front, Bitcoin's Relative Strength Index (RSI) on the daily chart indicates weakening bullish momentum, with a decline during the recent uptrend. A breach of the $90,000 psychological support level could trigger further losses, potentially bringing the price down to $85,000. Conversely, if Bitcoin can break above $104,088, it could pave the way for a rally toward the next significant resistance level at $119,510, aligned with the 141.4% Fibonacci extension.

Open interest in Bitcoin futures has also seen a decline, dropping from $65 billion on December 5 to $60 billion by December 9. This reduction in open interest indicates caution among traders and suggests that a sustained recovery rally might require a resurgence in trading activity.

The Role of Quantum Computing in Bitcoin’s Future

Adding to market uncertainties, Google recently announced advancements in quantum computing with its new "Willow" chip, boasting 105 qubits. While this development is a significant milestone in quantum technology, experts agree that it remains far from posing a practical threat to Bitcoin’s cryptographic security. Estimates suggest that breaking Bitcoin’s encryption would require at least 13 million qubits, a far cry from the capabilities of current quantum computers.

Bitcoin's cryptographic infrastructure, built on the Elliptic Curve Digital Signature Algorithm (ECDSA) and SHA-256 hashing, remains robust. However, the crypto community is actively discussing the need for quantum-resistant cryptographic protocols to safeguard against future advancements in quantum computing.

Geopolitical and Macroeconomic Influences

Bitcoin’s price movements are also influenced by broader geopolitical and macroeconomic factors. Heightened tensions in the Middle East and uncertainty over U.S. interest rates have dampened global risk appetite, leading to profit-taking across the crypto market. Additionally, the market is closely watching the upcoming U.S. Consumer Price Index (CPI) data, which could shape expectations around Federal Reserve policy.

On the geopolitical front, developments such as Russia's proposal to create a strategic Bitcoin reserve and the U.S. Treasury’s classification of Bitcoin as "digital gold" highlight the growing recognition of Bitcoin’s role in global finance. Russia's initiative, aimed at circumventing financial sanctions, underscores Bitcoin's potential as a decentralized reserve asset. Meanwhile, the U.S. could further integrate Bitcoin into its financial system, with discussions around a national Bitcoin reserve gaining traction.

Bitcoin's Path Forward: Opportunities and Risks

Looking ahead, Bitcoin faces a mix of opportunities and challenges. The integration of Bitcoin into mainstream finance, driven by institutional adoption and spot ETFs, could solidify its position as a legitimate asset class. However, the market remains susceptible to regulatory uncertainties, particularly with the transition to a new U.S. administration under Donald Trump. The potential for pro-crypto policies, including the nomination of crypto-friendly officials, could provide a tailwind for Bitcoin’s growth.

In the near term, Bitcoin’s price is expected to remain range-bound between $92,000 and $105,000. A sustained break above or below these levels will likely dictate the market's direction. For long-term investors, the current dip presents an opportunity to accumulate Bitcoin, supported by strong institutional demand and its growing role as a hedge against inflation and macroeconomic instability.

Final Thoughts

Bitcoin's journey in 2024 exemplifies its dual nature as both a high-risk, high-reward asset and a strategic addition to diversified portfolios. As it navigates through periods of volatility, driven by a combination of technical, macroeconomic, and geopolitical factors, Bitcoin continues to evolve as a cornerstone of the digital asset ecosystem. With a robust institutional foundation and increasing recognition as "digital gold," Bitcoin remains poised for further growth, albeit with the inherent risks that define its market.

That's TradingNEWS

Read More

-

QQQ ETF At $626: AI-Heavy Nasdaq-100 Faces CPI And Yield Shock Test

11.01.2026 · TradingNEWS ArchiveStocks

-

Bitcoin ETF Flows Flip Red: $681M Weekly Outflows as BTC-USD Stalls Near $90K

11.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Near $3.33: NG=F Sinks as Supply Surges and China Cools LNG Demand

11.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Breaks Toward ¥158 as Yen Outflows and US Data Fuel Dollar Charge

11.01.2026 · TradingNEWS ArchiveForex