Bitcoin Stabilizes at $102,000: Volatility, AI Disruption, and the Fed’s Influence

BTC shows resilience after recovering from a dip below $100K, driven by DeepSeek's AI impact and macroeconomic factors | That's TradingNEWS

Bitcoin Price Recovery: Navigating Volatility Amid AI Disruption and Policy Shifts

Bitcoin Rebounds from $97,000 to Stabilize Above $102,000

Bitcoin (BTC-USD) has shown remarkable resilience, recovering sharply to $102,000 after dipping below the critical $100,000 level. The cryptocurrency faced a sell-off triggered by DeepSeek's groundbreaking AI announcement, which caused massive market volatility. However, BTC managed to recover, signaling underlying market strength despite external pressures. As of now, Bitcoin trades within a narrow range of $100,000 to $103,500, with traders closely monitoring key resistance and support levels.

AI Disruption and its Ripple Effect on Bitcoin

The release of DeepSeek’s AI model disrupted global tech markets, including a $600 billion market cap loss for NVIDIA. This disruption extended into crypto, triggering an $860 million liquidation across major trading platforms. Despite this, Bitcoin’s recovery highlights its growing maturity as an asset class. While AI advancements raised questions about tech valuations, they also created risk-off sentiment, driving some investors toward Bitcoin as a hedge against broader market instability.

Institutional Activity and ETF Trends

Institutional behavior continues to shape Bitcoin’s price movements. Recent data shows $1.9 billion in inflows into digital asset investment products, with Bitcoin dominating the inflow, accounting for over $1.6 billion. Notably, BlackRock's iShares Bitcoin Trust attracted $63.94 million in net inflows, showcasing strong institutional confidence despite the volatility. On the other hand, Grayscale Bitcoin Trust (GBTC) recorded significant outflows of $108.47 million, reflecting mixed sentiment among traditional and institutional investors.

Federal Reserve and Regulatory Developments

Macroeconomic factors, particularly U.S. Federal Reserve policy, remain pivotal for Bitcoin’s near-term trajectory. The market anticipates that the Fed will maintain interest rates within the 4.25%-4.50% range. Any dovish signal from the Fed could act as a catalyst for Bitcoin to breach higher resistance levels, particularly the $104,000 and $107,000 zones. Furthermore, U.S. President Donald Trump’s executive order supporting cryptocurrency regulations has sparked optimism, driving institutional inflows and signaling a potential shift toward broader adoption.

Technical Analysis: Key Resistance and Support Levels

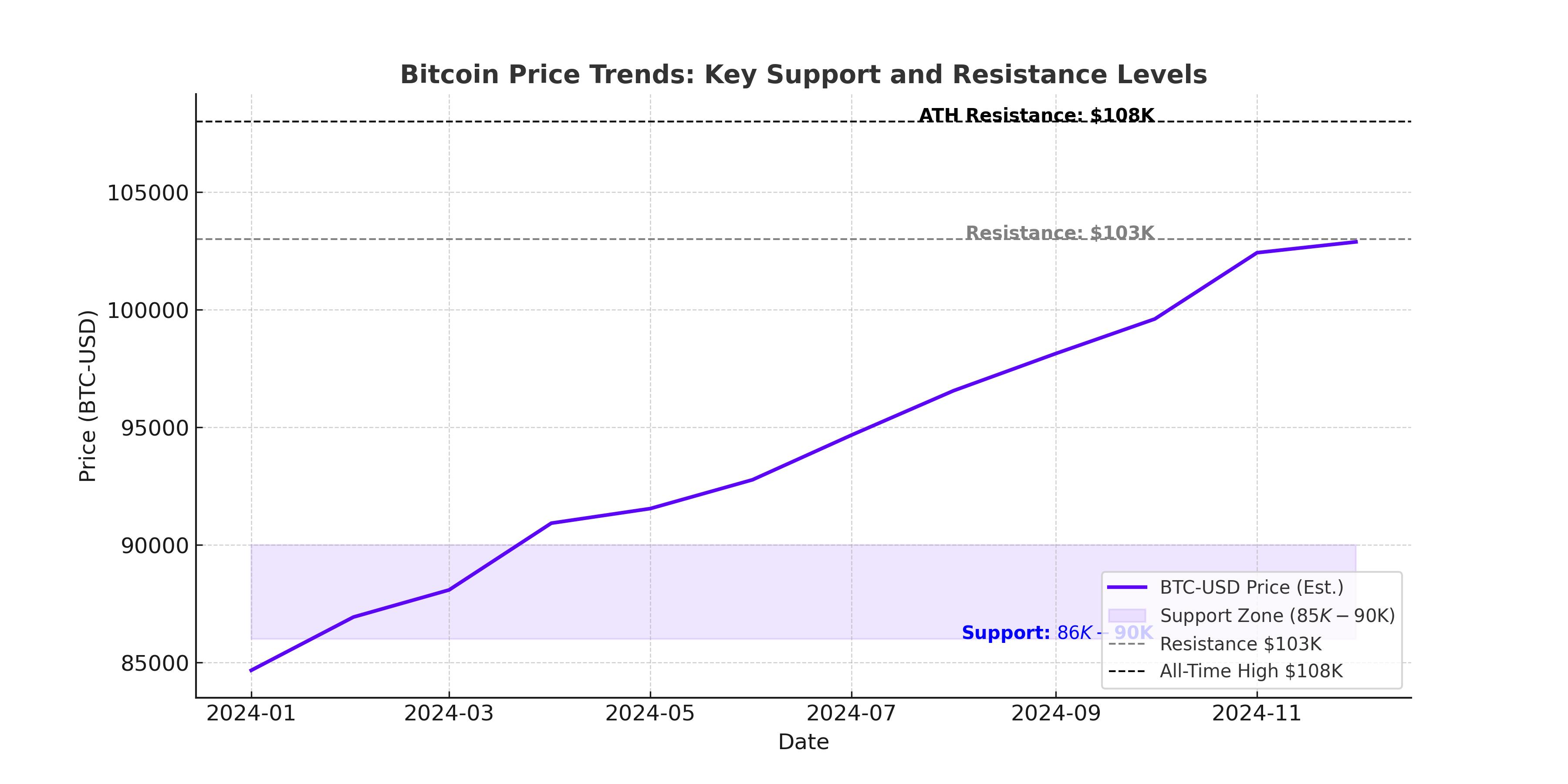

Bitcoin’s technical indicators present a mixed outlook. BTC recently tested the $103,000 resistance, with a bearish trend line forming near this level. Immediate support lies at $100,000, while a break below could expose the $89,900 level. On the upside, the $104,200 resistance serves as a key target for bulls. A breach above this level may lead to further gains, potentially revisiting the all-time high of $109,000 recorded earlier in January.

The Relative Strength Index (RSI) holds a neutral reading near 59, suggesting a consolidation phase. Meanwhile, the Moving Average Convergence Divergence (MACD) shows bullish momentum, further supporting a potential upward move. Bitcoin must maintain its position above the 100-hour Simple Moving Average (SMA) to sustain bullish sentiment.

DeepSeek and Trump’s Crypto Stance Shape Market Sentiment

DeepSeek’s AI breakthrough has fueled debates about technological disruption and its implications for crypto markets. Despite initial sell-offs, Bitcoin’s recovery underscores its role as a digital hedge. Simultaneously, Trump’s comments on fostering crypto-friendly regulations have bolstered confidence among U.S. investors. The proposed creation of a digital asset reserve further solidifies the narrative that Bitcoin is gaining recognition as a strategic asset.

Short-Term Outlook and Market Sentiment

Bitcoin’s ability to stabilize above $102,000 suggests that the market is digesting recent volatility while preparing for the next significant move. The cryptocurrency has outperformed traditional assets like the NASDAQ, highlighting its potential as a diversification tool. However, caution prevails, with traders awaiting clear signals from macroeconomic events, such as the Fed’s policy meeting and upcoming regulatory developments.

In the short term, Bitcoin’s price action is expected to remain range-bound, with $100,000 acting as a psychological support level. A breakout above $104,200 could pave the way for a test of $107,000, while sustained selling pressure may push prices toward $97,000. Long-term holders and institutional investors appear undeterred, suggesting confidence in Bitcoin’s potential as a hedge against inflation and economic uncertainty.

Conclusion

Bitcoin’s recovery from recent lows demonstrates its resilience in a volatile market environment. While macroeconomic factors and AI-related disruptions weigh on sentiment, institutional inflows and supportive regulatory developments provide a bullish undertone. Traders and investors should monitor key technical levels and macroeconomic cues as Bitcoin navigates this critical phase, potentially setting the stage for its next major move.

That's TradingNEWS

Read More

-

QQQ ETF At $626: AI-Heavy Nasdaq-100 Faces CPI And Yield Shock Test

11.01.2026 · TradingNEWS ArchiveStocks

-

Bitcoin ETF Flows Flip Red: $681M Weekly Outflows as BTC-USD Stalls Near $90K

11.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Near $3.33: NG=F Sinks as Supply Surges and China Cools LNG Demand

11.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Breaks Toward ¥158 as Yen Outflows and US Data Fuel Dollar Charge

11.01.2026 · TradingNEWS ArchiveForex