Bitcoin's Bullish Outlook - Navigating Future Potential

From strategic high-value transactions to El Salvador's sustainable mining initiatives, discover how Bitcoin's current market stance signals a strong upward trajectory in the cryptocurrency landscape | That's TradingNEWS

Bitcoin's Market Dynamics and Future Potential

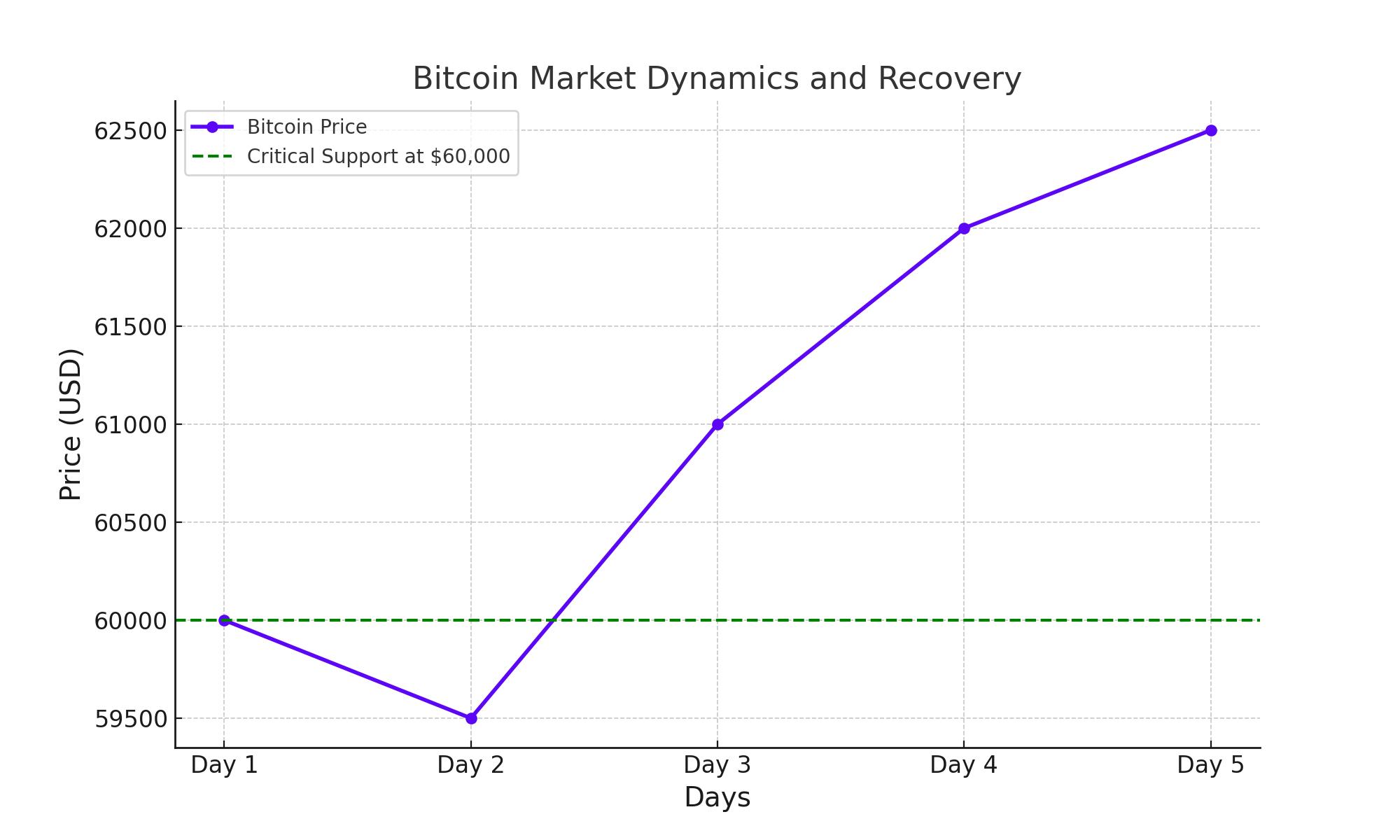

Recovery and Stabilization Above Critical Support Levels

Bitcoin's recent rebound to $62,000, after a brief dip, underscores a resilient support base at $60,000. The cryptocurrency’s ability to hold this level despite market volatilities is a positive sign for investors. This stabilization is key to forming a base for potential upward movement, particularly as renewed buying interest at this level suggests a strong market sentiment.

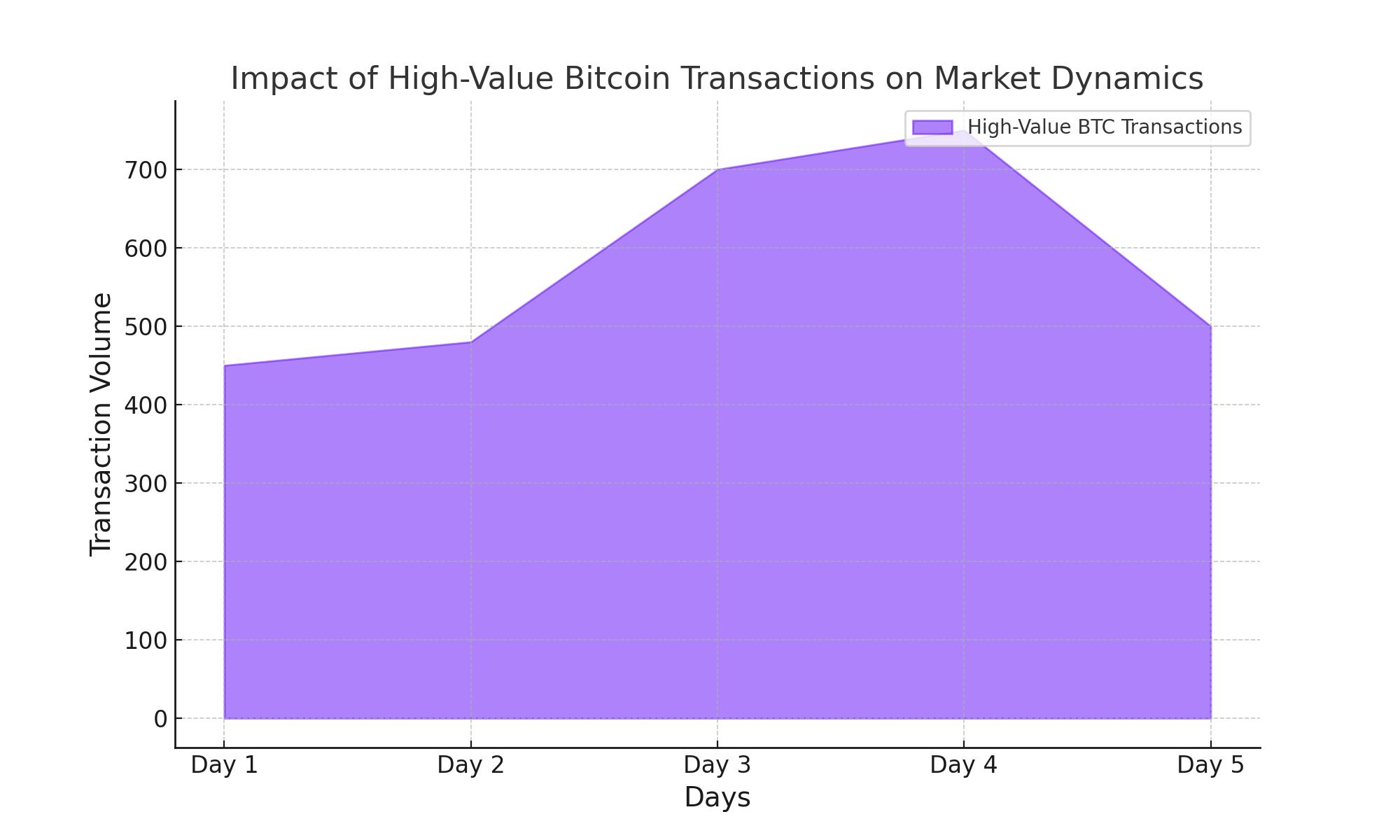

Impact of High-Value Transactions

The significant transfer of 7,999 BTC, worth nearly half a billion dollars, from Coinbase to an undisclosed address, has injected both liquidity and volatility into the market. These large movements often precede bullish trends as they typically involve accumulation by large-scale investors or institutions with a longer-term investment horizon. This could indicate a growing confidence in Bitcoin’s upward potential among influential market players.

Technical Indicators and Price Resilience

Despite the current trading position below the 50-day moving average, the recent daily surge of 1.84% signals growing momentum. If Bitcoin can consistently close above this average, it could catalyze a more sustained bullish trend. Moreover, the presence of significant liquidation zones just above current levels suggests that overcoming these could lead to accelerated price gains as short positions are covered.

Derivative Markets Signaling Underlying Strength

The derivatives market reveals an intriguing insight into investor sentiment. Despite modest open interest growth, the stable funding rates and contained liquidations point to a market that is neither over-leveraged nor prone to panic sell-offs. This stability is crucial for sustainable price growth and indicates that investors are prepared to hold positions through minor fluctuations.

Macro Influences Offering Long-Term Support

While the Federal Reserve’s current stance on interest rates presents a headwind, the long-term outlook for Bitcoin remains favorable. As a hedge against inflation and currency devaluation, Bitcoin could benefit from continued monetary expansion and fiscal policies that devalue fiat currencies. Moreover, upcoming CPI data may further validate Bitcoin’s role as a non-correlated asset, attracting more institutional investors looking for portfolio diversification.

El Salvador’s Pioneering Move into Sustainable Mining

El Salvador's initiative to mine Bitcoin using geothermal energy not only enhances its economic strategy but also positions Bitcoin as a leader in sustainable digital assets. This forward-thinking approach can enhance the appeal of Bitcoin as an investment, aligning it with global trends towards environmental responsibility.

Conclusion: A Promising Horizon for Bitcoin

Bitcoin’s current market position and the surrounding economic environment present a complex yet promising landscape. The resilience at the $60,000 level, combined with strategic interest from large-scale investors and a positive derivative market outlook, all contribute to a bullish case for Bitcoin's future. As it navigates through macroeconomic challenges, Bitcoin's foundational attributes—decentralization, fixed supply, and increasing adoption—underscore its potential as a long-term store of value and investment asset. Investors should remain observant of key technical levels and macroeconomic indicators, but the underlying trends suggest a bullish trajectory for Bitcoin in the upcoming periods.

Read More

-

Ferrari Stock Price Forecast - RACE at $377 Stock Turns Sentiment Slump Into A High-Margin Buying Window

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Holds the $2 Line as Clarity Act Vote and Powell Drama Put Crypto on Edge

12.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast Oil Slip as Iran “Control” Claim and Fast-Tracked Venezuela Deal Test the $60 Floor

12.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow, S&P 500, Nasdaq Drop As Gold Rips Higher And WMT, TEM, SNCY Rally

12.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Spikes Back Toward 1.35 as Fed Turmoil Cracks the Dollar

12.01.2026 · TradingNEWS ArchiveForex