Bitcoin’s Critical Moment: Price Consolidation Signals Potential Shift

Assessing Bitcoin’s Future as It Navigates Between Strong Support and Overhead Resistance | That's TradingNEWS

Bitcoin's Market Dynamics: An In-Depth Analysis

Bitcoin's Technical Landscape: Resistance and Support Levels

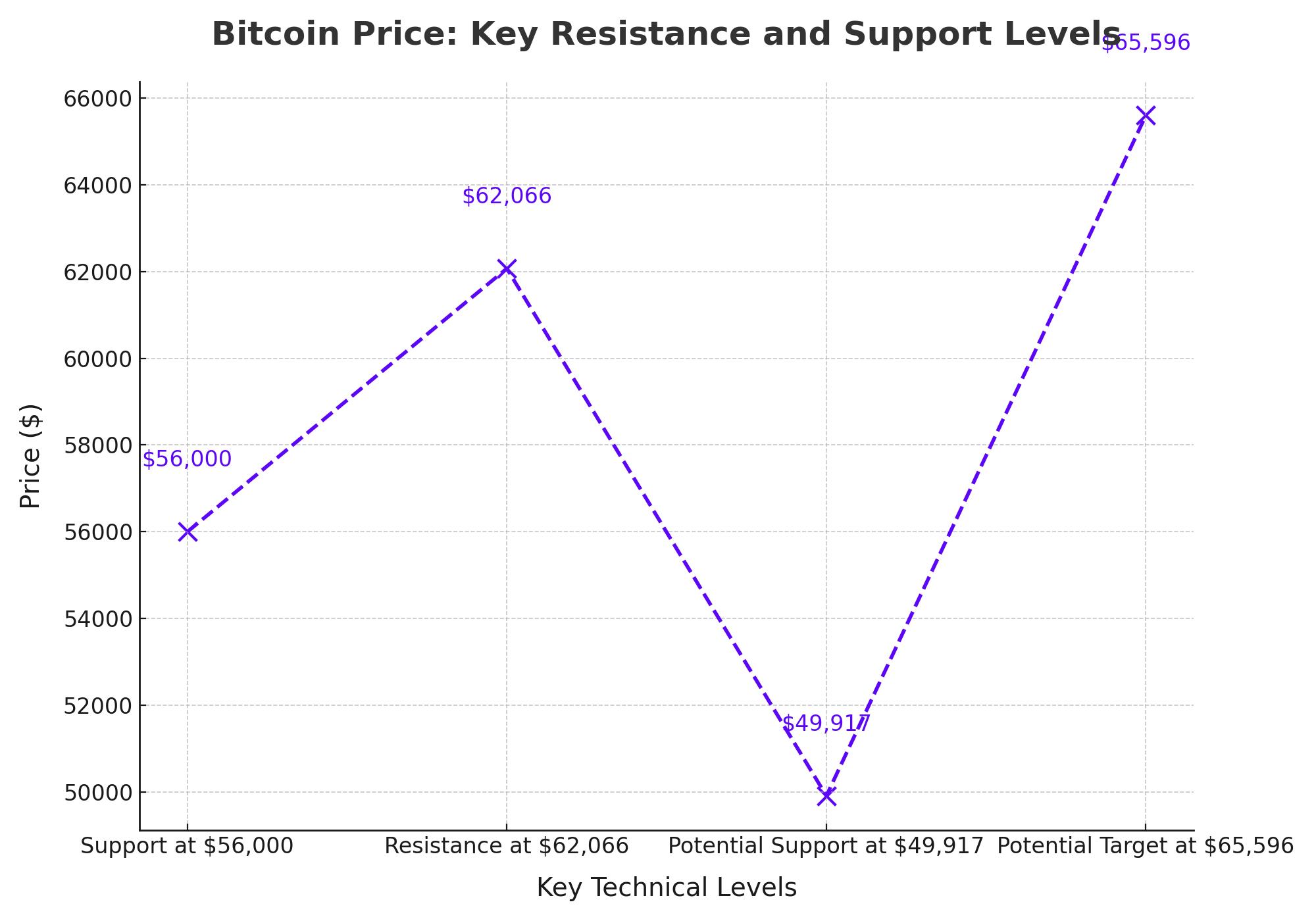

Bitcoin (BTC-USD) has been navigating a volatile trading range, with recent price action consolidating between $57,000 and $62,000. Monday's early trading hours saw Bitcoin pulling back slightly to around $58,000, with the $56,000 level offering notable support beneath it. This range-bound movement suggests a period of consolidation, with market participants closely watching the $62,000 resistance level.

Momentum indicators, including the Relative Strength Index (RSI) and Awesome Oscillator (AO), remain below their neutral levels, indicating potential bearish momentum. If Bitcoin fails to break above the $62,066 resistance level, a retracement towards $57,115, and potentially further down to $49,917, could be on the cards. However, a successful breach of this resistance could propel BTC towards the $65,596 mark, signaling a potential bullish reversal.

Market Sentiment and Bitcoin’s Correlation with Broader Risk Appetite

The Bitcoin market’s recent behavior can be partly attributed to broader market sentiment, particularly in relation to risk appetite. Bitcoin has often been compared to assets like the NASDAQ 100, with its performance mirroring broader trends in risk-on and risk-off environments. The ongoing uncertainty in global markets, compounded by geopolitical tensions and economic data from major economies, continues to impact Bitcoin’s price action.

Interestingly, despite the bullish sentiment following the approval of Bitcoin ETFs, which initially spurred inflows, the market has since exhibited a lack of clear direction. This has led to a more cautious stance among traders, with many adopting a "buy the dip" strategy rather than betting on an aggressive upward movement.

Bitcoin's Struggle Against Key Resistance Levels

Bitcoin has been grappling with maintaining momentum above the $60,000 mark. The failure to establish a strong foothold above this level has led to increased selling pressure, with long positions being liquidated in the face of mounting resistance. The market's inability to capitalize on positive developments, such as the cooler-than-expected U.S. inflation data and lower jobless claims, suggests underlying technical weaknesses.

The current consolidation phase between $57,000 and $62,000 could be seen as a critical juncture for Bitcoin. A breakdown below this range could expose the cryptocurrency to further downside risks, potentially testing the $50,000 psychological support level. Conversely, a breakout above $62,066 would require significant buying momentum, likely driven by a shift in market sentiment or a strong macroeconomic catalyst.

Bitcoin’s Broader Market Impact: Altcoins and Market Sentiment

Bitcoin’s price action has had a ripple effect on the broader cryptocurrency market. Major altcoins like Ethereum (ETH-USD) and Ripple (XRP-USD) have mirrored Bitcoin's volatility, with Ethereum facing its own challenges near the $2,843 resistance level. Ripple, on the other hand, has found some stability around the $0.544 support level, hinting at a potential recovery.

The overall market sentiment, as measured by the Cryptocurrency Fear & Greed Index, has slipped into the "extreme fear" category. This heightened caution among traders is likely contributing to the subdued price action across the board. However, with key economic events on the horizon, including the release of the Federal Open Market Committee (FOMC) minutes and Fed Chair Jerome Powell’s speech, the market could see increased volatility.

Strategic Reserve and Bitcoin’s Future in U.S. Financial Policy

In the backdrop of Bitcoin’s price movements, discussions around the establishment of a U.S. Bitcoin Strategic Reserve have gained traction. Spearheaded by Senator Cynthia Lummis, the proposal aims to secure the dollar’s position as the world’s reserve currency by incorporating Bitcoin into the national reserve strategy. This concept, while controversial, underscores the growing recognition of Bitcoin’s potential role in the global financial system.

The proposal suggests that acquiring a significant portion of Bitcoin’s supply could bolster the U.S. financial position, particularly in an era of increasing digital asset adoption. However, the implications of such a move on Bitcoin’s market dynamics and its price volatility remain a subject of intense debate among financial experts.

Bitcoin’s Price Outlook: Bullish or Bearish?

The current state of the Bitcoin market presents a mixed outlook. While the technical indicators suggest potential downside risks, the broader macroeconomic environment, including the anticipation of rate cuts by the Federal Reserve, could provide a tailwind for Bitcoin. Additionally, the ongoing debate around Bitcoin’s role in national reserves adds another layer of intrigue to its future trajectory.

For investors, the key takeaway is the importance of monitoring both technical levels and macroeconomic developments. Bitcoin’s price action in the coming weeks will likely hinge on its ability to break out of the current consolidation range and the market's response to upcoming economic data and geopolitical events.

Conclusion: Navigating Bitcoin’s Volatility

Bitcoin remains at a critical juncture, with its price consolidating within a narrow range amidst a backdrop of mixed market signals. While the potential for a breakout exists, the risks of a further decline cannot be ignored. Investors should remain vigilant, keeping an eye on key resistance and support levels, as well as the broader economic landscape that continues to shape Bitcoin’s price dynamics. Whether Bitcoin is a buy, sell, or hold at this stage depends on the market's next move and the external factors that could influence its direction.

That's TradingNEWS

Read More

-

SCHG ETF Near $32.42: AI Growth ETF Back Toward The Top Of Its Range

16.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI And XRPR Attract $1.27B As XRP-USD Clings To $2.00 Support Zone

16.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Around $3 As US Surplus Clashes With Europe’s TTF Weather Spike

16.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Hovers Near 158 As Intervention Risk And BoJ Policy Warnings Hit The Carry Trade

16.01.2026 · TradingNEWS ArchiveForex