Bitcoin’s Next Bull Run: Why Analysts Are Eyeing New Highs - NASDAQ:COIN & NASDAQ:MSTR Momentum

Uncover the Driving Forces Behind Bitcoin’s $106K Target, ETF Inflows, and How It Impacts Key Stocks Like NASDAQ:COIN and NASDAQ:MSTR

Bitcoin’s Bull Market Trajectory: Comprehensive Analysis of Price Targets, Institutional Impact, and Insights on NASDAQ:COIN and NASDAQ:NVDA

Current Position and Future Projections of Bitcoin’s Bullish Path

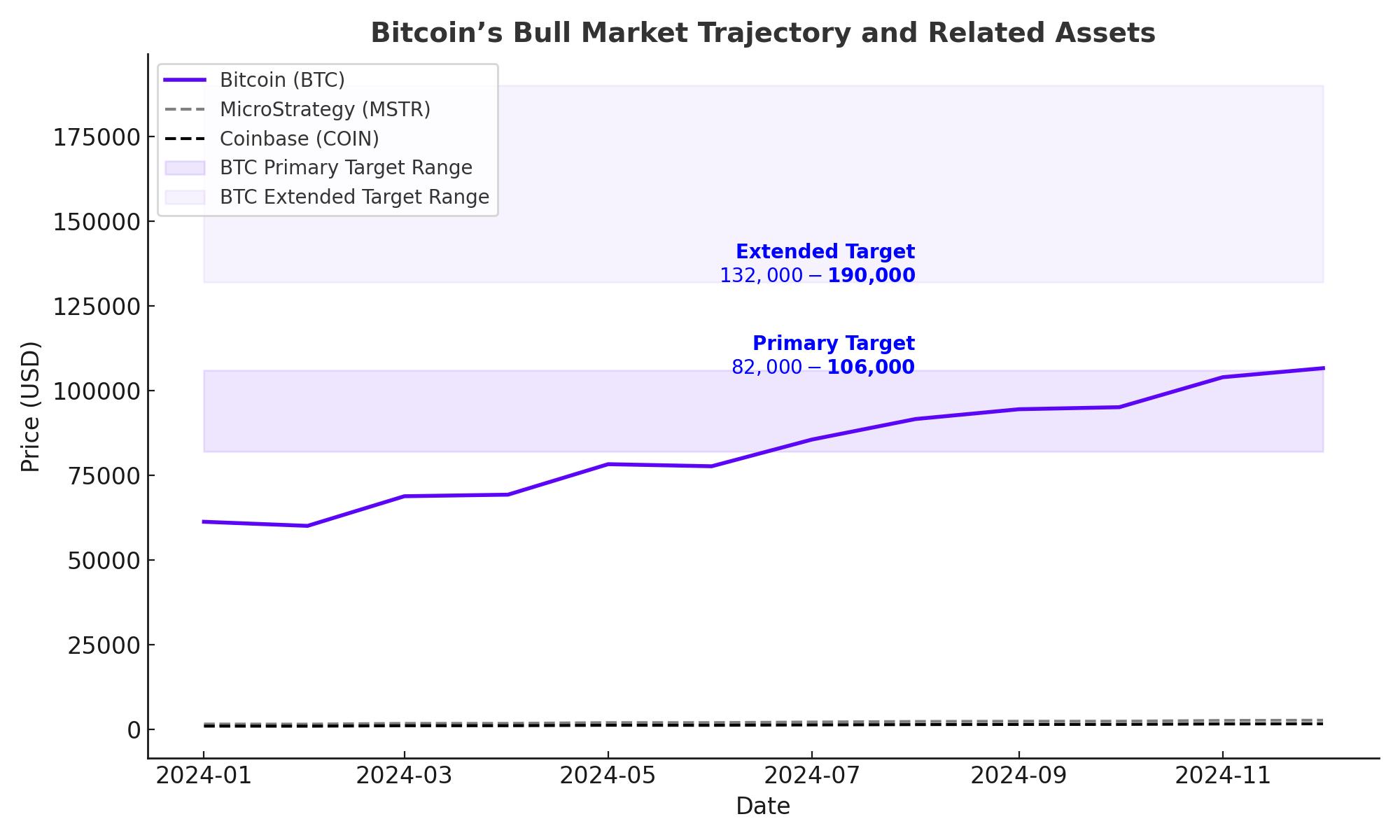

The year 2024 has cemented Bitcoin’s renewed upward trajectory, with technical and on-chain analysis pointing to significant upside potential in the coming months. Despite periodic corrections, Bitcoin remains on track to potentially exceed $100,000, a price level that has captured both institutional and retail investor interest. Current projections, reinforced by the cryptocurrency’s historical bull patterns, suggest a likely target range between $82,000 and $106,000 for Bitcoin in its current bull cycle. If the broader market dynamics sustain Bitcoin’s growth, we could see an eventual move into the $132,000–$190,000 region, marking an extended phase of this crypto bull market.

Since the last major bear market low in 2018, Bitcoin has followed a five-wave Elliott pattern, characteristic of larger cyclical uptrends. This bullish five-wave movement places Bitcoin in a final upward push within this cycle, adding strength to its overall bullish potential. However, this final phase is also typically more volatile, underscoring the importance of risk management as Bitcoin climbs toward these historical price targets.

The substantial increase in Bitcoin’s market capitalization over the past few months has contributed to an environment where institutional interest and increased adoption by high-net-worth investors are fueling a broader acceptance of Bitcoin as a store of value. Despite its past volatility, Bitcoin’s resilience in recovering and establishing new highs reflects the confidence that has developed around its value proposition, particularly amid economic uncertainties and inflationary concerns.

Examining Institutional Inflows and Spot ETF Activity: Key Drivers of Bitcoin’s Demand Surge

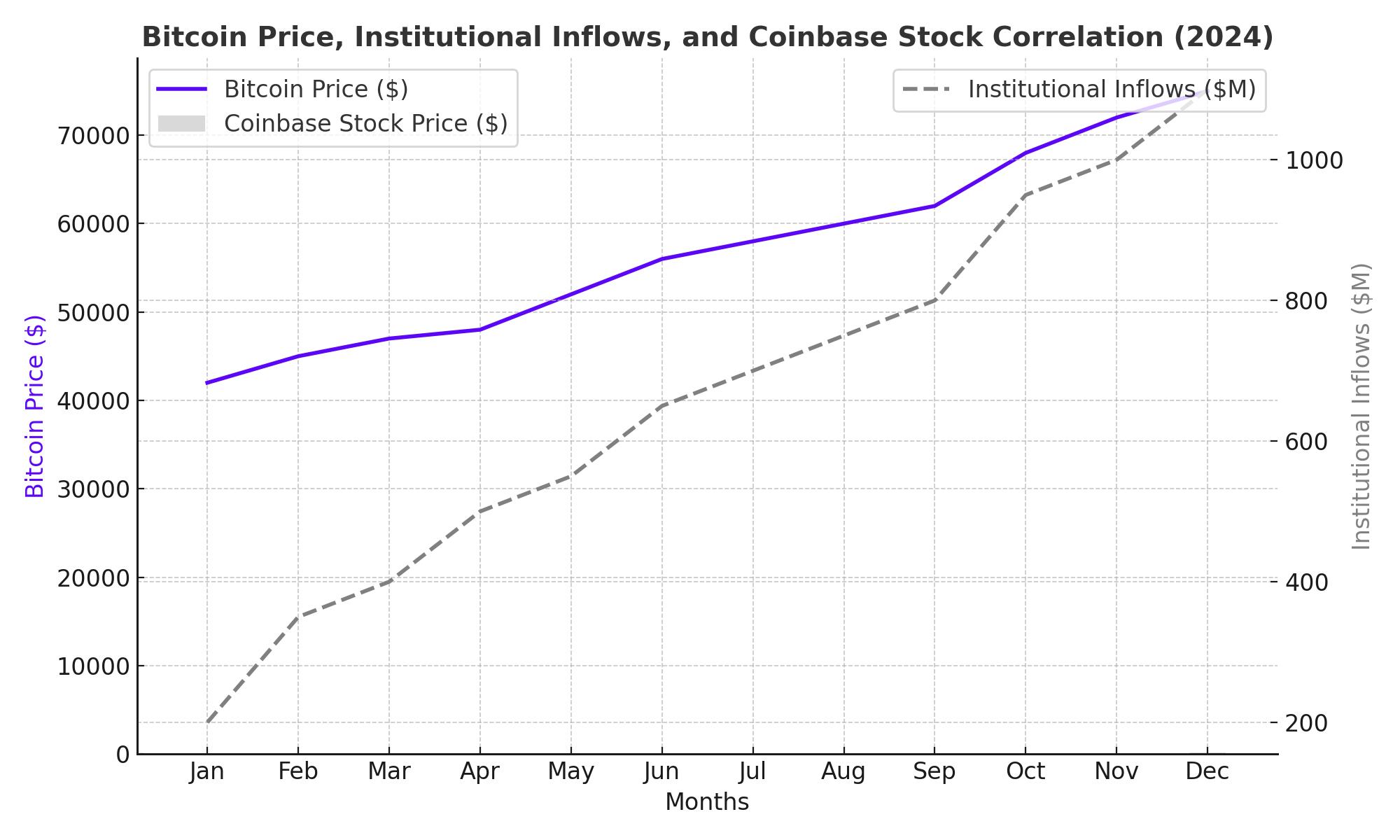

Institutional inflows have become a primary driver of Bitcoin’s price resurgence, particularly through spot Bitcoin ETFs, which have recently recorded inflows surpassing $4 billion. This surge in ETF interest follows recent political and regulatory shifts that favor Bitcoin adoption. Spot ETFs have seen multiple consecutive days of high inflows, totaling $827 million at their peak in late October. This ETF inflow trend aligns with Bitcoin’s price uptick, as the influx of capital into these funds creates a sustained buying pressure on the asset itself.

A key aspect of institutional demand lies in the role of OTC (over-the-counter) desks, often used by large investors to accumulate assets without triggering significant price movement on public exchanges. Throughout 2024, we have observed a drop in daily BTC inflows to OTC desks—down to 90,000 BTC per day in October from more than double that in previous quarters. This reduction in daily OTC activity suggests that larger investors are holding onto their positions, fueling the supply shortage and paving the way for price appreciation. The fact that more Bitcoin is being held off-exchange also implies fewer sell orders hitting the market, which can prevent steep sell-offs and support price stability.

ETF Inflows and Political Influence

Political events have also played a part in Bitcoin’s bullish run, especially with the prospect of U.S. political candidates endorsing more crypto-friendly policies. For instance, former President Donald Trump has been framed as a "pro-crypto" candidate, while current Vice President Kamala Harris maintains a relatively neutral stance. Bitcoin’s resilience in the face of regulatory debates underscores its value to both retail and institutional investors as a global digital asset. The political narrative surrounding Bitcoin adds an extra layer of interest for institutional investors, further fueling the sustained inflows into ETFs and other Bitcoin-related financial products.

NASDAQ:COIN Performance and Earnings Analysis: Tied to Bitcoin’s Movements

Correlation with Bitcoin and Financial Results

Coinbase (NASDAQ:COIN), one of the largest cryptocurrency exchanges, has shown an exceptionally high correlation with Bitcoin’s price movements—maintaining a 20-day rolling correlation of 0.90. This high correlation reflects how closely Coinbase’s fortunes are tied to Bitcoin’s performance, benefiting from increased trading volumes as Bitcoin’s price rises. However, Coinbase’s financial outlook and stock valuation present a complex picture.

In its recent Q3 2024 earnings report, Coinbase reported $1.21 billion in revenue, marking an 80% increase year-over-year. However, this revenue figure fell short of Wall Street expectations by $40 million, while earnings per share missed estimates by 10 cents, reporting at 28 cents per share instead of the anticipated 38 cents. Notably, Coinbase’s core consumer revenue—a primary income stream—declined by nearly 50% from the first quarter of 2024, showcasing the challenges Coinbase faces in maintaining revenue stability amid Bitcoin price fluctuations.

On the positive side, Coinbase’s subscription revenue has shown growth, although Q3 saw some sequential declines. Subscription revenue, if maintained and expanded, could help Coinbase manage some of the volatility in its primary revenue sources. Still, with revenue off by over $400 million from Q1 levels, Coinbase’s dependency on transaction-based revenue means that it will likely continue experiencing volatility alongside Bitcoin’s price cycles.

Operating Costs and Share Repurchase Program

Coinbase reduced its operating costs by 6% quarter-over-quarter, a critical adjustment in light of the decline in consumer revenue. Operating expenses remain substantial, as Coinbase’s business model necessitates continuous technology investments to compete in the fast-evolving crypto exchange space. Adding to the financial complexity is Coinbase’s recent announcement of a $1 billion share repurchase program—a somewhat perplexing move for a company still investing heavily in growth and technology.

With Coinbase’s stock currently trading at roughly 9x forward revenue, investors may find it challenging to reconcile this premium valuation with its dependency on Bitcoin’s price. While the company remains a primary platform for retail investors, high valuation, combined with significant price sensitivity to Bitcoin, poses risks, particularly if Bitcoin’s price momentum slows or experiences corrections. Check the latest insights on Coinbase stock.

(NASDAQ: MSTR)as a Leveraged Bitcoin Play: High Upside and Potential Risks

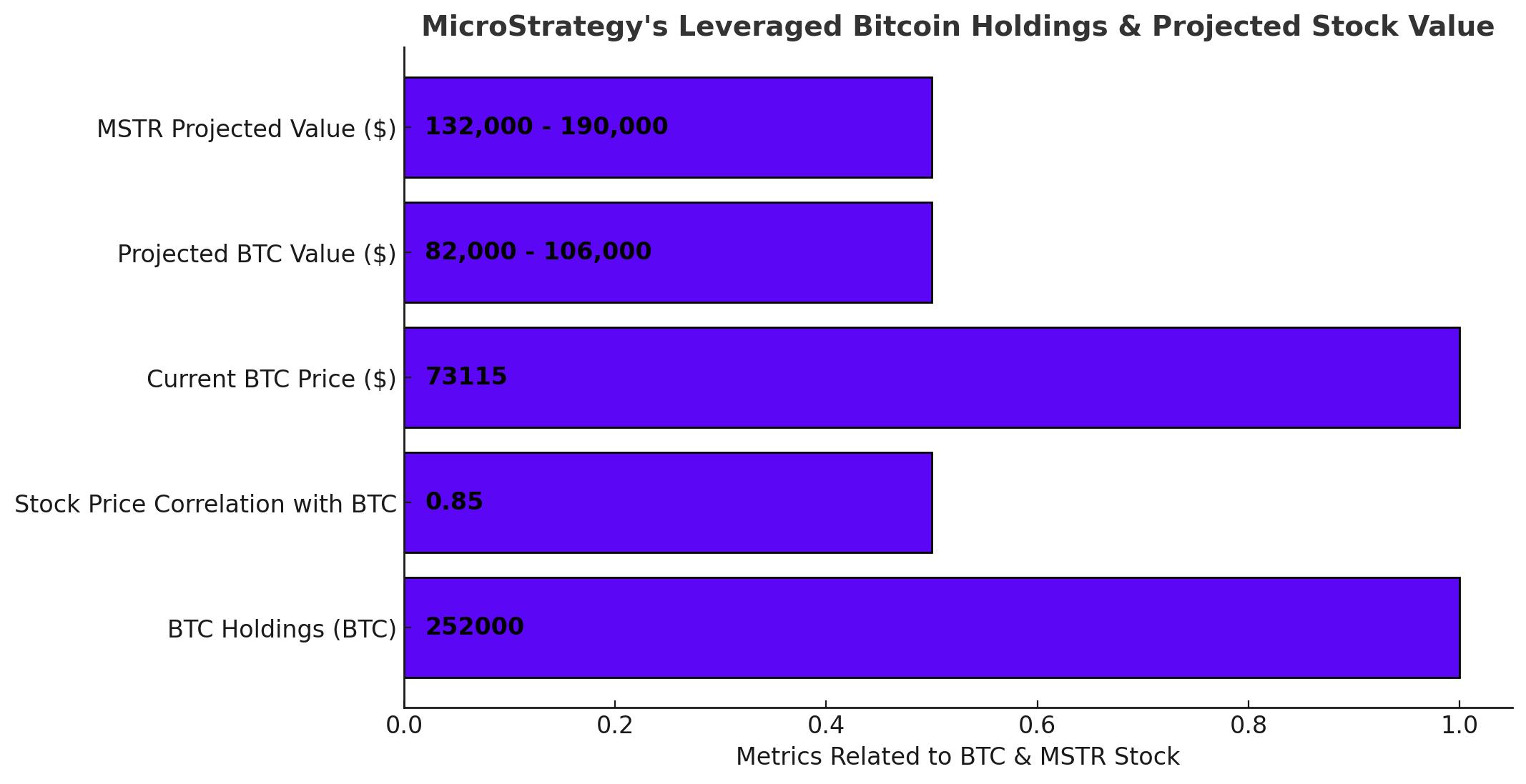

MicroStrategy (NASDAQ:MSTR) has become one of the most significant indirect ways for investors to gain exposure to Bitcoin, given the company’s aggressive strategy of accumulating Bitcoin through debt and equity financing. MicroStrategy’s Bitcoin holdings now exceed 252,000 BTC, with a valuation of approximately $18.5 billion. This leveraged position is financed by over $4.2 billion in long-term debt, primarily in the form of convertible notes with low-interest rates—a strategic choice that enables MSTR to manage its interest expenses while accumulating Bitcoin.

Debt Strategy and the Pyramiding Effect

In Q3 2024, MicroStrategy raised $1.1 billion through equity sales and issued additional convertible notes, thereby acquiring an additional 26,000 BTC. This practice, known as pyramiding, involves reinvesting increased stock value back into Bitcoin acquisitions. As Bitcoin’s price has surged, so too has MicroStrategy’s stock, creating a virtuous cycle for MSTR as long as Bitcoin continues its uptrend.

However, this strategy also increases the company’s debt load and share dilution, potentially limiting the upside for existing shareholders. MicroStrategy’s total interest expense for the upcoming year is estimated at $35 million, which will strain cash flows if Bitcoin’s price does not meet optimistic forecasts. MicroStrategy’s valuation has become highly dependent on Bitcoin’s performance, trading at 2.71x the current value of its BTC holdings—a premium that reflects investor confidence but also amplifies risk. A downturn in Bitcoin’s price could lead to sharp declines in MSTR’s stock, as it’s heavily leveraged with limited cash flow from operations.

Valuation Challenges and Fair Value Assessment

MicroStrategy’s high valuation remains a point of contention among analysts, particularly given that its SaaS business has stagnated, with annualized revenues hovering around $480 million. While MSTR’s core SaaS offerings are positioned in the business intelligence market, the platform has struggled to keep pace with more agile competitors, further highlighting its reliance on Bitcoin as a value driver. Given the current BTC valuation of $73,315, MSTR’s implied share price based on BTC holdings alone sits at $102.63 per share, suggesting the stock may be overvalued by a substantial margin based on traditional valuation metrics. For the latest on MSTR stock movements, see MicroStrategy stock insights.

Technical Analysis and Updated Bitcoin Price Targets

Bitcoin’s price structure supports an optimistic outlook with clearly defined targets. The market currently anticipates Bitcoin reaching between $82,000 and $106,000 in the short term, backed by a continuation of the five-wave Elliott pattern. If Bitcoin reaches this target range, two main scenarios could play out:

-

Red Scenario: Bitcoin peaks within the $82,000–$106,000 range, completing the fifth wave in the cycle. This scenario would likely conclude the bullish phase initiated in 2018, prompting a period of consolidation or correction.

-

Green Scenario: Bitcoin tops within the same range, but undergoes a multi-week correction, establishing a floor above $41,156–$47,750. This would set the stage for a final, extended fifth wave, pushing Bitcoin into the $132,000–$190,000 range, supported by strong demand and investor sentiment.

This technical framework, when coupled with on-chain analysis, indicates that Bitcoin’s price dynamics are supported by solid demand fundamentals. Both scenarios align with long-term bullish momentum, with the latter indicating a possible extension if broader economic conditions remain favorable and regulatory support continues.

On-Chain Analysis and Long-Term Investor Behavior

On-chain data further substantiates the case for Bitcoin’s sustained uptrend. Several metrics, including the 1-Year HODL percentage and the number of non-zero balance addresses, indicate that long-term holders are staying put, which is a bullish signal as it reduces the likelihood of major sell-offs. The 1-Year HODL metric, in particular, measures the percentage of Bitcoin that hasn’t moved in over a year, showcasing long-term investor confidence and minimizing sell pressure.

Data from WealthUmbrella highlights that as of recent months, the number of non-zero addresses is climbing steadily, reflecting new investor interest even as prices rise. Coupled with increased Bitcoin ETF flows, these factors underscore a renewed demand from both institutional and retail investors. This foundational support from HODLers provides a significant cushion for Bitcoin’s price, helping to prevent steep declines and maintaining upward momentum.

Adding to this, the number of newly created Bitcoin addresses has been on the rise, a trend that signals incoming retail investors and early adopters. Given the current trends, Bitcoin is not only seeing an inflow of capital but is also witnessing strong on-chain fundamentals, which typically precede significant price increases. The current structural uptrend in HODL metrics implies that Bitcoin’s support levels are likely to rise, creating a higher price floor.

ETF Flows and the Impact of Bitcoin’s Spot Price on NASDAQ:MSTR and NASDAQ:COIN

For Coinbase (NASDAQ:COIN), which acts as a primary entry point for retail investors, these ETF flows are particularly significant. Coinbase’s revenue, despite some disappointing Q3 results, remains closely correlated with Bitcoin’s price trends. The exchange has a 20-day rolling correlation of 0.90 with Bitcoin, underscoring the direct impact of Bitcoin’s price on Coinbase’s trading volumes and transaction fees. Additionally, if Bitcoin ETFs continue to attract substantial inflows, it could fuel trading activity on Coinbase, which may, in turn, help stabilize Coinbase’s primary revenue streams and potentially increase subscription revenue.

For MicroStrategy (NASDAQ:MSTR), the correlation with Bitcoin is even more direct, as the company holds over $18 billion in Bitcoin and has structured its financial strategy around Bitcoin acquisitions. MSTR has employed a leveraged approach to accumulating Bitcoin, with much of its capital coming from convertible debt and stock sales. If Bitcoin continues its upward momentum, MSTR stands to gain considerably as the valuation of its Bitcoin holdings rises. Given that MSTR’s total BTC holdings exceed 252,000, even a modest increase in Bitcoin’s price could significantly impact MSTR’s market capitalization.

Price Targets for Bitcoin and Strategic Implications for NASDAQ:COIN and NASDAQ:MSTR

Bitcoin’s updated price targets are supported by technical and on-chain analysis, both of which indicate potential price levels within the $82,000–$106,000 range. The path forward includes two likely scenarios:

-

$82,000 to $106,000 Target Zone: This range is likely achievable in the near term, given the strong demand from institutional buyers and Bitcoin ETFs. This target aligns with the ongoing wave pattern and is backed by increased ETF inflows, which provide additional buying pressure.

-

Extended Upside into the $132,000 to $190,000 Region: If Bitcoin consolidates around $100,000 without a major correction, it could continue toward this extended target. This scenario would represent an expansion beyond the traditional cycle pattern and implies a much higher level of institutional participation and retail adoption.

For NASDAQ:MSTR, reaching these targets could significantly inflate its stock valuation due to its leveraged exposure to Bitcoin. As of now, MSTR trades at a premium relative to its BTC holdings, with a valuation multiplier of around 2.71x Bitcoin’s market value. Should Bitcoin break into the extended target range, MSTR’s stock could continue appreciating, offering further upside for shareholders. However, this scenario also amplifies the risks tied to Bitcoin volatility, especially given MSTR’s high debt load.

Similarly, NASDAQ:COIN would benefit from increased trading volumes and subscription growth as Bitcoin gains traction. The trading volume on Coinbase’s platform correlates highly with Bitcoin’s price; a run towards $132,000 or higher could drive Coinbase’s revenue back to growth, despite recent revenue declines in consumer segments. The current level of enthusiasm around Bitcoin ETFs and the anticipated spot market ETF approvals could be a boon for Coinbase, providing new users and boosting subscription revenue.

Technical and On-Chain Analysis: Supporting a Strong Bullish Structure for Bitcoin

The technical setup for Bitcoin suggests that the cryptocurrency is in the midst of its fifth and final wave in a long-term Elliott Wave cycle that began in 2018. This fifth wave is incomplete, with two additional swings expected to push Bitcoin to new highs. As long as Bitcoin holds above key support levels in the $58,800–$60,800 range, it is well-positioned to continue its upward movement.

On-chain analysis also reveals that Bitcoin’s realized price—calculated as the average price each Bitcoin last traded—has increased, providing a robust price floor. Currently, Bitcoin’s realized value sits at approximately $33,000, while the Thermocap price floor is around $28,300. These levels are unlikely to be tested in the short term given the strength of current demand, but they provide a downside cushion should the market correct.

Additionally, the Coppock Curve indicator has turned positive on Bitcoin’s weekly chart, an event historically followed by significant price increases. The last occurrence of this positive Coppock Curve reading preceded Bitcoin’s run to $69,000. With this technical indicator suggesting upward momentum, Bitcoin is in a prime position to advance into new territory, particularly if ETF inflows and on-chain data continue to reflect strong demand.

Evaluating the Volatility and Potential Risks for Bitcoin, NASDAQ:MSTR, and NASDAQ:COIN

For NASDAQ:MSTR, the primary risks include a slowdown in trading volumes if Bitcoin experiences prolonged consolidation or a downturn. Coinbase has mitigated some of this risk by building out its subscription revenue, yet a bear market in crypto could adversely impact its user base and transaction volumes. Additionally, Coinbase’s premium valuation at roughly 9x forward revenue suggests that much of the expected growth is already priced in, which limits the upside if Bitcoin’s price trajectory stalls.

Investor Sentiment and Long-Term Considerations for Bitcoin and Related Stocks

The current cycle suggests Bitcoin could experience a lengthier bull phase than previous cycles, potentially lasting through late 2025. This projection is based on the historical lengthening of Bitcoin’s bull markets with each halving event. During the 2012–2016 cycle, Bitcoin’s bull market lasted approximately one year, while the subsequent cycles extended to 1.5 years. If the current cycle follows this lengthening trend, Bitcoin’s bullish phase could continue into 2025, providing extended upside for both NASDAQ:MSTR and NASDAQ:COIN.

On-chain indicators show that Bitcoin’s long-term holders are displaying strong conviction, with metrics like the 1-Year HODL and Metcalfe’s Law premium model supporting continued price growth. Moreover, the absolute price floor, derived from Bitcoin’s Thermocap and realized value, has risen, indicating resilience even if the broader market encounters volatility.

If Bitcoin manages to sustain a price above the $70,000 range, it will likely attract even more institutional interest, particularly if spot Bitcoin ETFs continue to grow. In this scenario, NASDAQ:COIN would benefit from heightened trading activity and potential user growth, while NASDAQ:MSTR would gain from its extensive Bitcoin holdings, provided its leverage remains manageable.

Concluding Insights: Buy, Hold, or Sell?

Given the current data and projections, Bitcoin remains a Buy for long-term investors willing to accept its inherent volatility. The technical structure and on-chain metrics provide strong backing for further upside, with ETF inflows and institutional interest creating additional demand. NASDAQ:MSTR also appears poised for continued growth, albeit with elevated risk due to its leveraged Bitcoin exposure. Investors in MSTR should closely monitor Bitcoin’s price as well as the company’s debt servicing capacity to avoid downside risk.

NASDAQ:COIN is best viewed as a Hold at present, with its growth potential largely tied to Bitcoin’s price trajectory and the regulatory landscape surrounding cryptocurrency exchanges. While the stock benefits from Bitcoin’s bullish outlook, its premium valuation and dependency on trading volumes suggest that investors should exercise caution, especially if Bitcoin faces any prolonged corrections.

As Bitcoin’s bull market advances, both MicroStrategy and Coinbase offer unique exposure options. For those seeking direct exposure, Bitcoin itself remains the primary asset. For those interested in leveraged upside or exchange-based revenue exposure, NASDAQ:COIN and NASDAQ:MSTR provide viable alternatives, each with distinct risk and reward profiles.

In summary, Bitcoin’s prospects appear robust as long as its fundamentals and technical indicators continue aligning favorably.

That's TradingNEWS

Read More

-

Alphabet Google Stock Price Forecast - Near $314: Gemini AI Wins, Cloud +34% and Waymo Rides Power 2026 Upside

31.12.2025 · TradingNEWS ArchiveStocks

-

Ethereum Price Forecast - ETH-USD Stalls Below $3K as On-Chain Records and Staking Boom Collide With ETF Outflows

31.12.2025 · TradingNEWS ArchiveCrypto

-

Oil Prices Slide Into 2026: WTI at $58 and Brent at $61 Signal a Cheaper Crude Era

31.12.2025 · TradingNEWS ArchiveCommodities

-

Stock Market Today: S&P 500 (^GSPC), Nasdaq (^IXIC) and Dow (^DJI) Dip as Silver (SI=F) Bubble Deflates

31.12.2025 · TradingNEWS ArchiveMarkets

-

EUR/USD Price Forecast: Euro Near 1.17–1.18: Can Fed 2026 Rate Cuts Push Euro Above 1.18?

31.12.2025 · TradingNEWS ArchiveForex