Broadcom Stock (NASDAQ:AVGO) Shatters Records: AI Revenue Soars, Stock Hits $1 Trillion

AI innovation and VMware integration propel Broadcom (AVGO) to historic highs. What’s driving this unstoppable growth? | That's TradingNEWS

Broadcom (NASDAQ:AVGO) Hits $1 Trillion Milestone: AI Boom and Strategic Execution Drive Unstoppable Momentum

Broadcom Inc. (NASDAQ:AVGO) has cemented its place in the upper echelon of tech giants by crossing the coveted $1 trillion market capitalization threshold. Following an explosive Q4 2024 earnings report, the company's shares surged by over 21% to a record $219.90, underscoring the market's enthusiasm for Broadcom's unparalleled growth in artificial intelligence (AI), its strategic VMware integration, and robust financial performance. This incredible rally is backed by impressive revenue figures, bold projections, and a growing dominance in the AI semiconductor space, which is reshaping the landscape of technological innovation.

AI Revenue Shatters Expectations and Fuels Growth

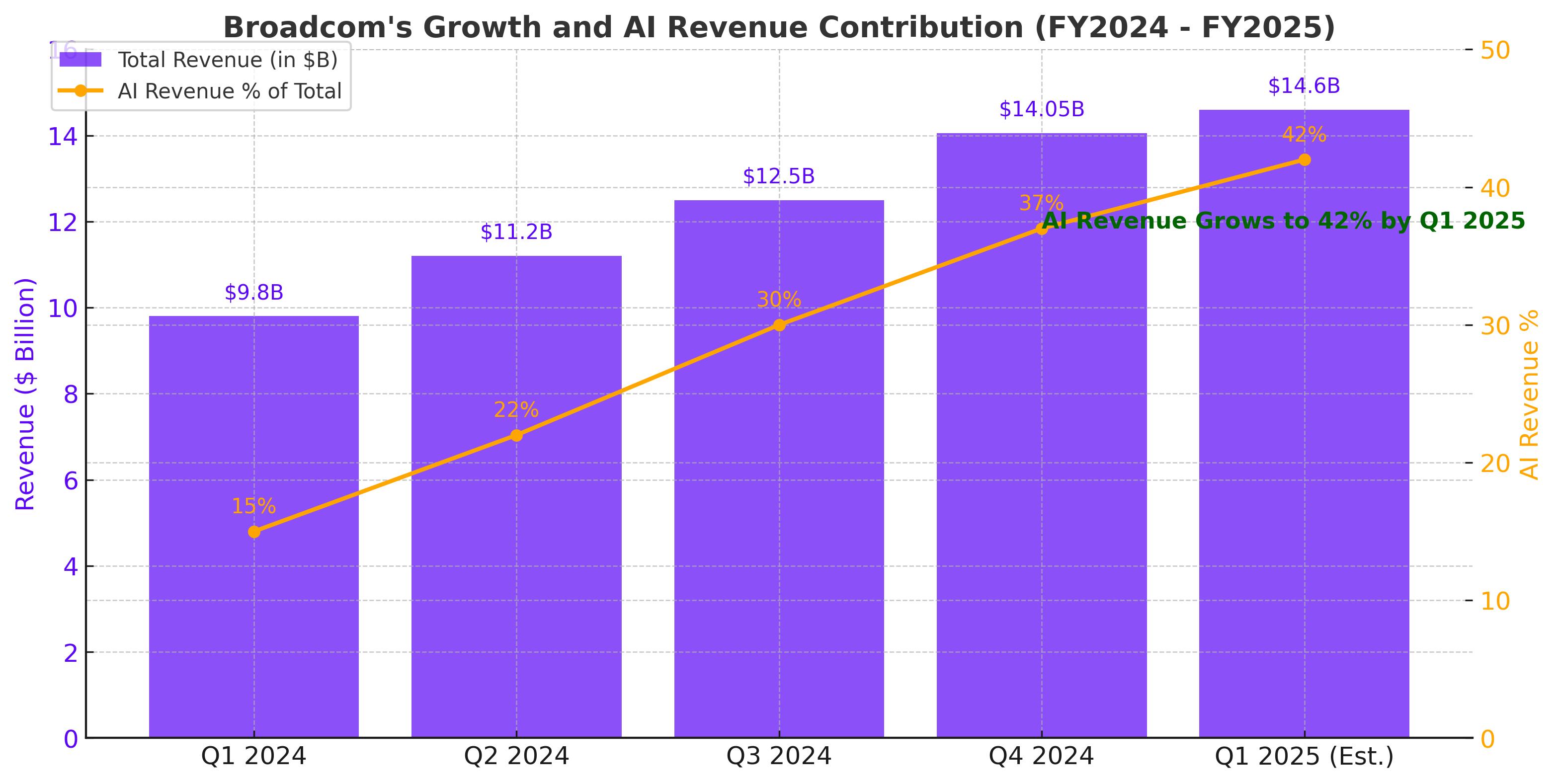

Broadcom's AI segment has become the crown jewel of its business, generating $3.7 billion in revenue during Q4 alone—a 150% year-over-year increase. For fiscal 2024, AI revenue reached a staggering $12.2 billion, representing a 220% surge from the previous year and outpacing even the most optimistic guidance of $12 billion. CEO Hock Tan described the company's opportunity in AI as "massive," projecting AI-related revenue to soar between $60 billion and $90 billion over the next three years.

Broadcom's custom AI chips, known as XPUs, are at the core of this growth. These chips are designed for hyperscaler customers who deploy large-scale AI workloads, with three key clients—widely believed to include Amazon, Microsoft, and Alphabet—already ramping up production. Additionally, two new hyperscaler clients, rumored to be Apple and OpenAI, are advancing the development of next-generation AI XPUs with Broadcom, signaling even greater revenue potential in the coming years.

The partnership with Apple to create AI server chips demonstrates Broadcom's ability to diversify its offerings while reducing dependency on any single product line, such as the Wi-Fi and Bluetooth chips it supplies for Apple's iPhones. This diversification mitigates risks and positions Broadcom as a leading player in the burgeoning AI infrastructure market.

VMware Integration Delivers Immediate Results

The successful integration of VMware into Broadcom's portfolio has redefined its software business. The Infrastructure Software segment reported $5.8 billion in Q4 revenue, a 200% increase from the prior year, largely due to VMware's contribution. Broadcom's strategic decision to focus on its top 500 VMware clients—down from an initial target of 2,000—has streamlined operations and reinforced customer loyalty.

VMware's annualized booking value (ABV) grew by 32% year-over-year to $2.5 billion, driven by demand for VMware Cloud Foundation (VCF), an integrated software stack for private clouds. Broadcom’s ability to automate VMware's operations has generated significant cost savings, with quarterly operating expenses dropping from $1.6 billion to $1.3 billion between Q2 and Q3.

This strategic pivot has not only enhanced VMware's profitability but also strengthened Broadcom's position in the private cloud market. By consolidating VMware's 8,000 stock-keeping units (SKUs) into just four primary product offerings, Broadcom has simplified its portfolio and improved customer-centricity, enabling rapid adoption by over 3,000 enterprise clients.

Strong Financials and Generous Shareholder Returns

Broadcom's Q4 revenue of $14.05 billion marked a 51% year-over-year increase, while net income grew by 23% to $4.32 billion. The company’s free cash flow reached $5.3 billion, representing 37% of total revenue and underscoring its operational efficiency. Adjusted EBITDA for Q4 came in at an impressive $9.3 billion, reflecting a gross margin of 77%.

Broadcom’s ability to convert revenue into robust cash flow has enabled it to maintain an aggressive capital return program. The company raised its dividend by 11% to $0.59 per share while maintaining a conservative payout ratio of just 50%. With an annualized dividend yield of approximately 2.2% at current prices, Broadcom continues to reward its shareholders while reinvesting in growth.

The company also executed $1.4 billion in share buybacks during the quarter, eliminating 8.4 million shares and boosting earnings per share. With ample free cash flow, Broadcom is well-positioned to continue its buyback program, further enhancing shareholder value.

Navigating Risks and Seizing Opportunities

Despite its meteoric rise, Broadcom faces challenges, including its dependency on a few hyperscaler clients and the cyclicality of tech spending. Non-AI semiconductor revenue declined by 23% year-over-year in Q4 to $4.5 billion, highlighting the uneven performance across its product portfolio. However, Broadcom’s diversification into high-growth markets such as AI and software mitigates these risks.

The AI semiconductor market, projected to grow by 74% in 2025, provides a strong tailwind for Broadcom’s future growth. While non-AI semiconductors are expected to grow by just 12% next year, Broadcom’s focus on AI-centric products positions it to capture outsized gains in the rapidly expanding accelerator chip market.

Outlook for FY2025 and Beyond

Broadcom’s guidance for Q1 2025 indicates continued momentum, with revenue projected to reach $14.6 billion—a 22% year-over-year increase—and adjusted EBITDA expected to hit $9.64 billion. AI revenue is forecasted to grow sequentially by 10%, underscoring the sustained demand for its cutting-edge chips.

Analysts have raised their price targets for Broadcom, with Bernstein increasing its target to $250 from $195, citing the company’s dominant position in AI semiconductors. Despite its rich valuation, Broadcom’s growth prospects justify the premium, making it a compelling buy for long-term investors.

Outlook for FY2025 and Beyond

Broadcom projects Q1 2025 revenue to reach $14.6 billion, a 22% year-over-year increase, with adjusted EBITDA at $9.64 billion. AI revenue is forecasted to grow 10% sequentially, highlighting strong demand for custom AI chips driving its $12.2 billion annual AI revenue in FY2024. VMware’s annualized bookings surged 32% to $2.5 billion, supporting Broadcom’s diversified growth. Analysts remain bullish, with Bernstein raising its price target to $250, citing Broadcom’s AI dominance and innovation in 3.5D packaging technology. With robust financials, record margins, and expanding market leadership, Broadcom (NASDAQ:AVGO) is positioned for sustained growth in AI and software markets.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex