Bullish Gold Price Predictions: How Inflation, Central Banks, and Fed Policies Will Drive Gold to $5,000 by 2030

Analyzing Gold’s Future as the Safe-Haven Asset Amid Global Economic Uncertainty, Inflation, and Central Bank Demand | That's TradingNEWS

Gold’s Market Performance

Gold prices have witnessed a surge in 2024, supported by increasing global demand, economic uncertainties, and geopolitical tensions. As of September, gold is trading around the $2,500 mark, but with periods of volatility influenced by various economic factors. Central banks' continued purchases, inflation expectations, and upcoming U.S. Federal Reserve decisions are poised to have significant impacts on gold's trajectory in the near and long term.

Geopolitical Tensions and Central Bank Purchases as Key Drivers

Geopolitical uncertainty remains one of the biggest contributors to gold’s performance. With rising tensions across regions like the Middle East, gold has continued to stand out as the safe-haven asset for investors. Central banks globally, particularly in emerging markets like China and Russia, have aggressively stockpiled gold, purchasing over 1,000 tons in 2024 alone, a record-setting number that signals sustained future demand. These factors have pushed gold prices up by approximately 23% year-to-date, significantly outpacing major stock indices, including the S&P 500, which has posted a more modest gain of 17%.

The Influence of the U.S. Dollar and Fed Policy on Gold Prices

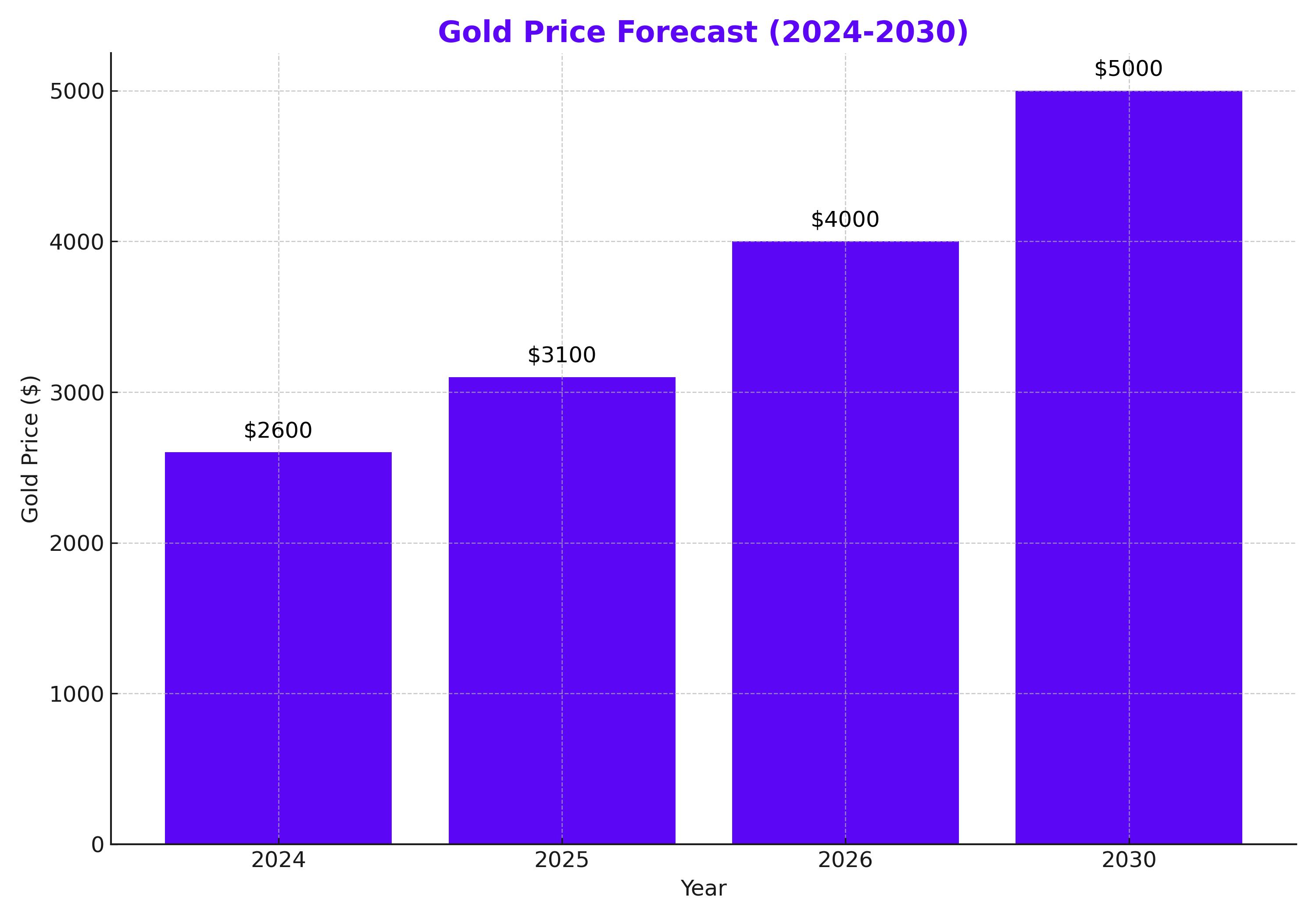

The strength or weakness of the U.S. dollar has always played a critical role in shaping gold prices. A weakened dollar in 2024, alongside expectations of upcoming Federal Reserve rate cuts, has further fueled optimism among gold investors. According to Goldman Sachs, the Fed’s anticipated interest rate reductions—likely beginning in mid-September—could reinvigorate Western capital inflows into gold markets. This development is expected to support gold’s price momentum into 2025, with projections of gold reaching between $2,300 to $3,100 by that time, and potentially hitting $4,000 by 2026.

However, the upcoming Non-Farm Payrolls (NFP) data this week could shape the Fed’s rate decision, directly impacting gold prices. Current market sentiment suggests a 25 basis point cut, but weak labor market data may trigger a more aggressive rate reduction, which would likely bolster gold prices.

Technical Analysis: Key Support and Resistance Levels

From a technical perspective, gold's recent fall below the psychological $2,500 level has triggered some bearish sentiment. On Wednesday, gold prices hovered around $2,486, with indicators pointing to potential further declines if significant resistance at $2,500 persists. Short-term charts suggest a downside trajectory, with immediate support at $2,485 and a potential lower test at $2,480 if selling pressure continues.

Conversely, should gold rebound above $2,491, a bullish trend could take hold, with a key resistance level positioned at $2,501. Breaking past this point could see gold attempt to test higher levels, possibly reaching $2,525 in the short term. Longer-term outlooks remain bullish, largely driven by monetary policy changes and ongoing geopolitical concerns.

Impact of Inflation and Monetary Base Growth on Gold’s Future

Inflation expectations have consistently been a fundamental driver of gold prices. In 2024, rising inflation, coupled with increases in the U.S. monetary base (M2), has positioned gold favorably. Historically, gold tends to track the monetary base closely, often overshooting during inflationary periods, before correcting. Analysts believe that the current trajectory of monetary growth and consumer price index (CPI) trends will support a steady, albeit gradual, rise in gold prices through 2025 and 2026.

Long-Term Price Predictions: A Bullish Outlook

Looking forward, gold’s long-term forecast remains strong, with multiple bullish reversal patterns emerging on technical charts. Over a 50-year horizon, gold has entered a new bull market phase, supported by a decade-long cup and handle formation. This technical pattern, combined with strong central bank demand, suggests that gold’s current uptrend is not a short-term phenomenon.

By 2025, most analysts expect gold to trade between $2,300 to $3,100, with significant upside potential as economic conditions evolve. The peak price prediction for 2030 stands at $5,000, driven by continued global uncertainty, rising inflation, and the growing recognition of gold as a hedge against economic downturns and currency devaluation.

Market Sentiment and Investor Behavior

Despite some recent declines, sentiment in the gold market remains positive. Gold’s role as a hedge against risk, particularly in the face of volatile global markets and uncertain economic policies, continues to attract both institutional and retail investors. The weak dollar and lower U.S. Treasury yields, with the 10-year bond yield down 25 basis points over the last month, have further enhanced gold's attractiveness.

Moreover, with global stock markets experiencing fluctuations—like the 2.1% drop in the S&P 500 and 3.2% decline in the Nasdaq Composite—gold has reaffirmed its position as a safe-haven asset, even though it uncharacteristically declined in tandem with these indexes earlier this week. Experts believe that any further signs of economic weakness will likely drive renewed buying interest in gold.

Conclusion

Gold’s current market environment, influenced by monetary policy, geopolitical tensions, and inflation expectations, continues to support a bullish outlook. While short-term price volatility may persist, particularly as traders await key economic data like the U.S. Non-Farm Payrolls, the long-term trajectory for gold remains positive. With price forecasts projecting a peak of $5,000 by 2030, gold is set to continue its role as a core investment in uncertain economic times.

That's TradingNEWS

Read More

-

SPYD ETF Price at $43.57: Is This High-Dividend S&P 500 Fund Still Cheap for 2026?

30.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Ignite: XRPI at $10.79 and XRPR at $15.43 While XRP-USD Holds the $1.80 Floor

30.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast $4: Storage Slides, UNG Climbs and NG=F Targets $5.50

30.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 158 Ceiling and 154.50 Support Define the 2026 Battle

30.12.2025 · TradingNEWS ArchiveForex