Can Analog Devices (NASDAQ:ADI) Reach $255? Price Insights and Growth Potential

With NASDAQ:ADI closing at $211.78, analysts forecast a potential rise to $255. Discover how financial performance, insider activity, and market trends shape its future | That's TradingNEWS

Analyzing Analog Devices Inc. (NASDAQ:ADI): A Comprehensive Breakdown of Stock Performance and Future Prospects

Strong Institutional Activity and Insider Transactions Driving Attention

Analog Devices Inc. (NASDAQ:ADI) has drawn significant interest from institutional investors, with notable activity reported in recent filings. Principal Financial Group Inc. increased its holdings by 2.7% in the third quarter, now owning 605,596 shares valued at $139.39 million. This represents 0.12% of Analog Devices' outstanding shares. Similarly, Grove Bank & Trust raised its position by 3.1%, holding 1,445 shares worth $333,000, reflecting broader institutional confidence. The company's insider transactions add further intrigue. Gregory M. Bryant, EVP, sold 30,000 shares at an average price of $224.10, yielding $6.72 million, while CEO Vincent Roche offloaded 10,000 shares at $223.87, generating $2.24 million. Both sales align with strategic stock disposals but highlight reduced insider ownership by 21.57% and 31.27%, respectively. For detailed insights into insider actions, visit the Analog Devices stock profile.

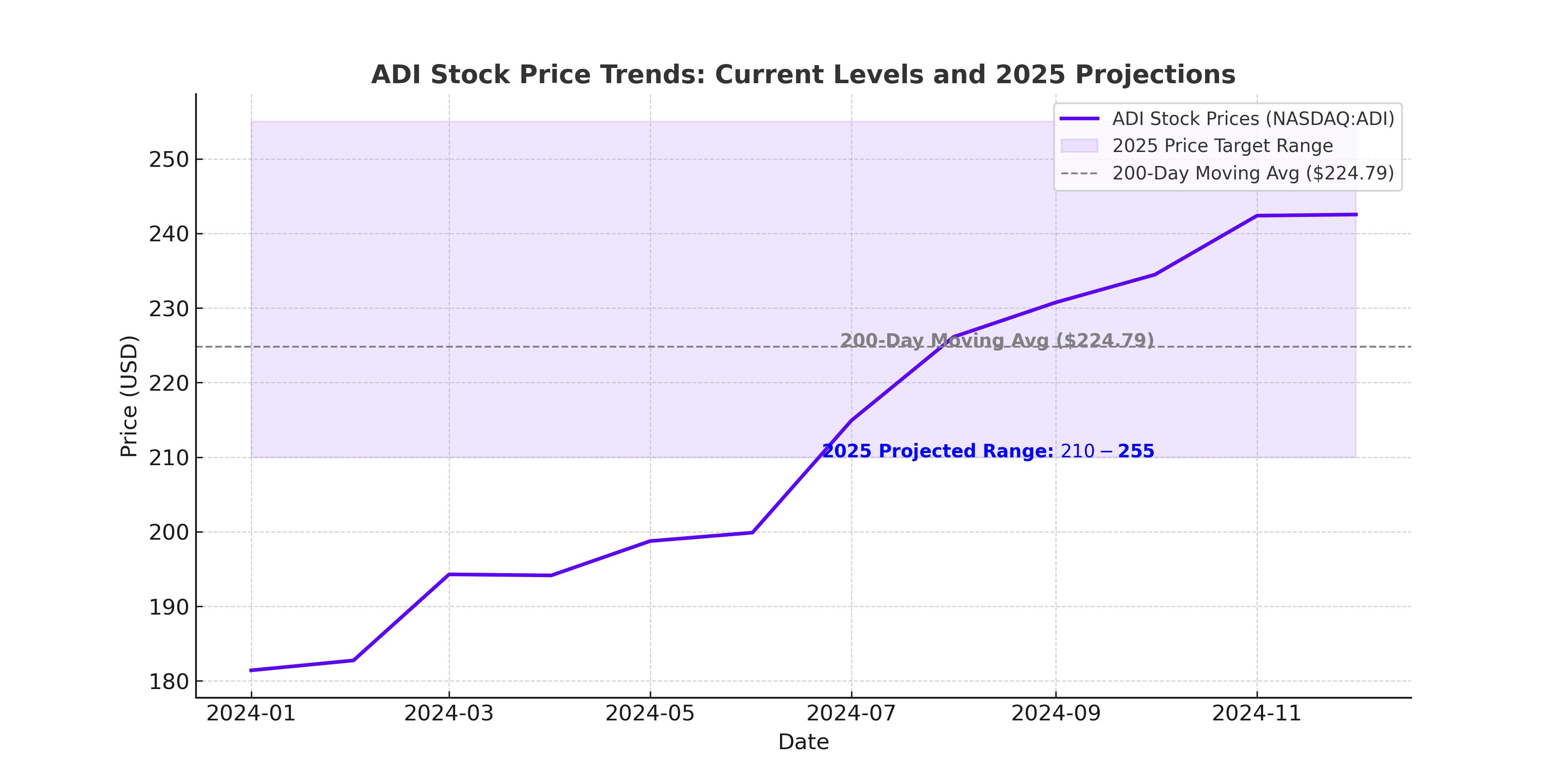

Price Movement and Technical Indicators

On Friday, NASDAQ:ADI saw an uptick of $4.00, closing at $211.78 with a trading volume of 6.6 million shares—double its daily average. Despite trading below its 200-day moving average of $224.79, the stock exhibits resilience, bouncing off a one-year low of $181.80 while remaining distant from its $244.14 peak. With a P/E ratio of 64.37 and a PEG ratio of 2.47, Analog Devices' valuation leans on the higher side compared to its sector peers. Investors should monitor its beta of 1.05, indicating moderate volatility.

Q4 Earnings Beat and Dividend Consistency

In its recent earnings report, Analog Devices exceeded expectations with an EPS of $1.67, narrowly surpassing analyst estimates of $1.64. Revenue of $2.44 billion aligned with projections but marked a 10.1% year-over-year decline. The semiconductor firm's dividend remains a compelling feature, paying $0.92 per share quarterly. With a current yield of 1.74% and a payout ratio of 111.85%, the stock offers steady income but hints at stretched sustainability if revenue contraction persists.

Market Segments and Growth Potential

Analog Devices operates across high-growth domains, including automotive, industrial, and consumer markets. The automotive segment, contributing 30% of revenue, benefits from demand for battery management systems and autonomous vehicle solutions. Market forecasts project a 10.68% CAGR in automotive chips, potentially adding 3.1% to Analog Devices' topline growth. Industrial applications, accounting for 40% of revenue, are poised for recovery, driven by automation and aerospace sectors expanding at 8% annually. The communications segment, impacted by inventory adjustments, is expected to rebound in FY25 with normalized distributor levels.

Competitive Landscape and Strategic Moves

Facing intense competition from peers like Texas Instruments (NASDAQ:TXN), ON Semiconductor (NASDAQ:ON), and NXP Semiconductors (NASDAQ:NXPI), Analog Devices differentiates itself with a diversified portfolio spanning 75,000 SKUs. Its focus on cutting-edge applications, including surgical robotics and AI-enhanced products, underscores its commitment to innovation. The company's partnerships with third-party distributors, generating 58% of revenue, offer a strategic advantage in scaling distribution efficiently.

Guidance and Financial Outlook for FY25

Management projects Q1 FY25 revenue of $2.35 billion, indicating early signs of market recovery. Analysts expect full-year revenues to grow 7.9% to $10.2 billion, with EPS anticipated to rise 23% to $4.05. Free cash flow is projected to improve, enabling Analog Devices to fulfill its commitment to return all free cash flow to shareholders. Margins, currently pressured by low utilization, are forecasted to expand gradually as demand stabilizes.

Valuation and Analyst Sentiment

The consensus price target for NASDAQ:ADI stands at $252, implying a 19% upside from current levels. Bullish estimates reach $295, reflecting confidence in the company's long-term growth trajectory. However, bearish projections of $212 emphasize near-term risks, including dependency on third-party foundries like TSMC and exposure to China's economic downturn, accounting for 22.6% of revenue.

Conclusion

Analog Devices presents a compelling case for long-term investors, balancing current challenges with robust fundamentals and growth prospects. Its strategic positioning in high-growth markets, commitment to innovation, and improving financial metrics support a cautiously optimistic outlook. Based on available data, NASDAQ:ADI is a Buy with a one-year target price of $255, reflecting a balanced view of potential risks and rewards. For real-time updates, visit the Analog Devices chart.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex