Can Bitcoin Soar to $200,000?

With BTC trading around $95,278, analysts weigh in on whether $200,000 is within reach. Explore the market trends, institutional drivers, and risks shaping Bitcoin’s future | That's TradingNEWS

Bitcoin Price Dynamics: Unpacking the Path to $200,000 and Market Challenges

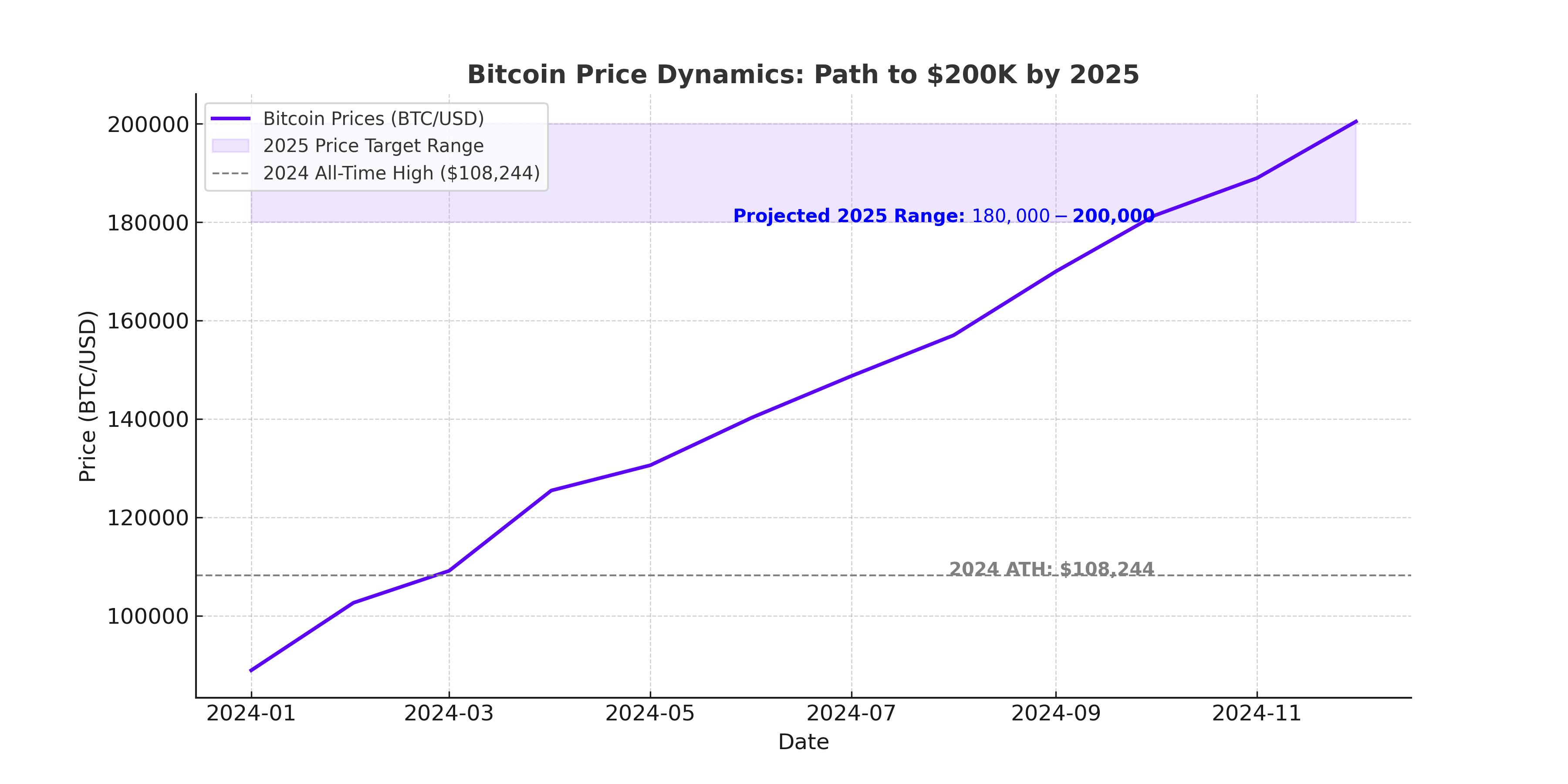

The price of Bitcoin (BTC-USD) has once again captured global attention with its rapid ascent to record levels, trading at $95,278 at the time of writing. After peaking at $108,244 last week, Bitcoin has faced profit-taking and macroeconomic headwinds. Analysts remain bullish for the long term, predicting the price could reach $200,000 in this bull market cycle. However, the road is far from smooth, with volatility, geopolitical shifts, and evolving Federal Reserve policies shaping the market's future.

Institutional Demand and Spot Bitcoin ETFs Driving Growth

Institutional demand continues to be a critical driver for Bitcoin’s performance. The launch of spot Bitcoin ETFs earlier in the year, combined with high-profile endorsements, such as BlackRock and Fidelity, has bolstered market confidence. These ETFs have attracted over $36 billion in inflows, a number expected to maintain pace into 2025, according to data from Farside Investors. This demand underscores the growing mainstream acceptance of Bitcoin as a legitimate asset class, pushing prices to historic highs. Analysts believe that sustained institutional adoption will keep Bitcoin's price momentum alive, especially post-2024 halving, which historically catalyzes bullish market phases.

Federal Reserve Policy and Its Impact on Bitcoin Volatility

The Federal Reserve’s hawkish stance remains a key factor influencing Bitcoin prices. Recent interest rate cuts of 25 basis points, coupled with signals of a slower rate-cutting pace in 2025, have created uncertainty among investors. The central bank projects only two rate cuts for the coming year, a significant revision from earlier expectations. This cautious approach has pressured Bitcoin prices, reducing its appeal as a risk asset. Bitcoin fell over 10% in the past week, trading below $100,000 for the first time since its recent rally.

Bitcoin’s sensitivity to macroeconomic conditions remains evident. As the Fed tightens liquidity conditions and Treasury yields remain elevated, Bitcoin and other cryptocurrencies face headwinds. Despite these challenges, analysts argue that rate cuts in the second half of 2025 could reignite Bitcoin's upward trajectory, particularly as lower rates diminish the appeal of traditional yield-bearing assets.

Geopolitical and Policy Developments: A Boon for Bitcoin?

The geopolitical landscape has also played a pivotal role in Bitcoin’s rally. Incoming U.S. President Donald Trump’s administration is widely seen as pro-crypto, with several key appointments emphasizing blockchain innovation. Notably, the proposed creation of a U.S. strategic Bitcoin reserve could drive additional demand for the cryptocurrency. If implemented, this policy has the potential to solidify Bitcoin's position as a strategic financial asset, potentially leading to a rally toward the $200,000 target.

Global interest in Bitcoin as a hedge against inflation and geopolitical risks remains strong. China's growing restrictions on private cryptocurrency activity have pushed demand toward Western markets. Meanwhile, speculation about Russia and other nations building Bitcoin reserves as part of their economic strategies adds a layer of intrigue to the global Bitcoin narrative.

On-Chain Metrics Highlight Critical Support Levels

Analyzing Bitcoin’s on-chain data reveals key support levels that could define its near-term trajectory. The realized price of short-term holders at $98,705 serves as immediate resistance, while stronger support is identified at $77,792, reflecting heavy accumulation by long-term investors. These metrics suggest that while Bitcoin faces pressure, robust buyer interest could emerge at these critical levels, cushioning potential declines.

Technical indicators also point to potential downside risk before a broader recovery. Bitcoin’s three-day chart highlights the $89,000 level as a crucial Fibonacci retracement zone. Breaching this support could lead to further declines toward $76,930, aligning with the 50-day exponential moving average. Conversely, reclaiming $100,000 as a psychological threshold would signal renewed bullish momentum.

The Path to $200,000: Opportunities and Risks

Predictions of Bitcoin reaching $200,000 hinge on several factors, including continued institutional adoption, favorable regulatory policies, and macroeconomic tailwinds. Bitwise, Standard Chartered, and VanEck project Bitcoin prices between $180,000 and $200,000 by the end of 2025. Key catalysts include spot ETF flows, post-halving supply dynamics, and broader acceptance of Bitcoin as a store of value.

However, risks abound. High volatility, shifting macroeconomic conditions, and potential liquidity constraints remain significant challenges. Analysts from VanEck caution that Bitcoin could experience sharp corrections of up to 30% during the year, underscoring the need for cautious optimism.

Conclusion: Strategic Accumulation Amid Volatility

Bitcoin’s current price action reflects a market in transition, balancing bullish institutional demand against macroeconomic pressures. Trading around $95,000, Bitcoin presents both opportunities and risks for investors. With analysts predicting a potential climb to $200,000, strategic accumulation at key support levels could prove rewarding. However, navigating the volatility inherent in Bitcoin’s journey will require a balanced approach and a long-term perspective.

That's TradingNEWS

Read More

-

QQQ ETF At $626: AI-Heavy Nasdaq-100 Faces CPI And Yield Shock Test

11.01.2026 · TradingNEWS ArchiveStocks

-

Bitcoin ETF Flows Flip Red: $681M Weekly Outflows as BTC-USD Stalls Near $90K

11.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Near $3.33: NG=F Sinks as Supply Surges and China Cools LNG Demand

11.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Breaks Toward ¥158 as Yen Outflows and US Data Fuel Dollar Charge

11.01.2026 · TradingNEWS ArchiveForex