Can BlackBerry’s $3.49 Stock Price Thrive Amid IoT Growth and Strategic Changes?

BlackBerry shifts focus to IoT with QNX software growth, streamlined operations, and Cylance divestiture—are these enough to justify a rally? | That's TradingNEWS

BlackBerry’s (NYSE:BB) New Era: Can IoT Growth Revitalize a Troubled Past?

BlackBerry Limited (NYSE:BB) has long been synonymous with transition, and its latest moves indicate a renewed focus on what could finally define its future. The stock surged recently from $2.35 to $3.49, buoyed by profitable third-quarter results and a strategic shift toward the Internet of Things (IoT) while shedding underperforming cybersecurity assets. These developments have sparked investor interest, but does BlackBerry's restructuring mean sustainable growth, or is it another chapter in its turbulent history?

Profitable Q3: Turning the Tide or a One-Off?

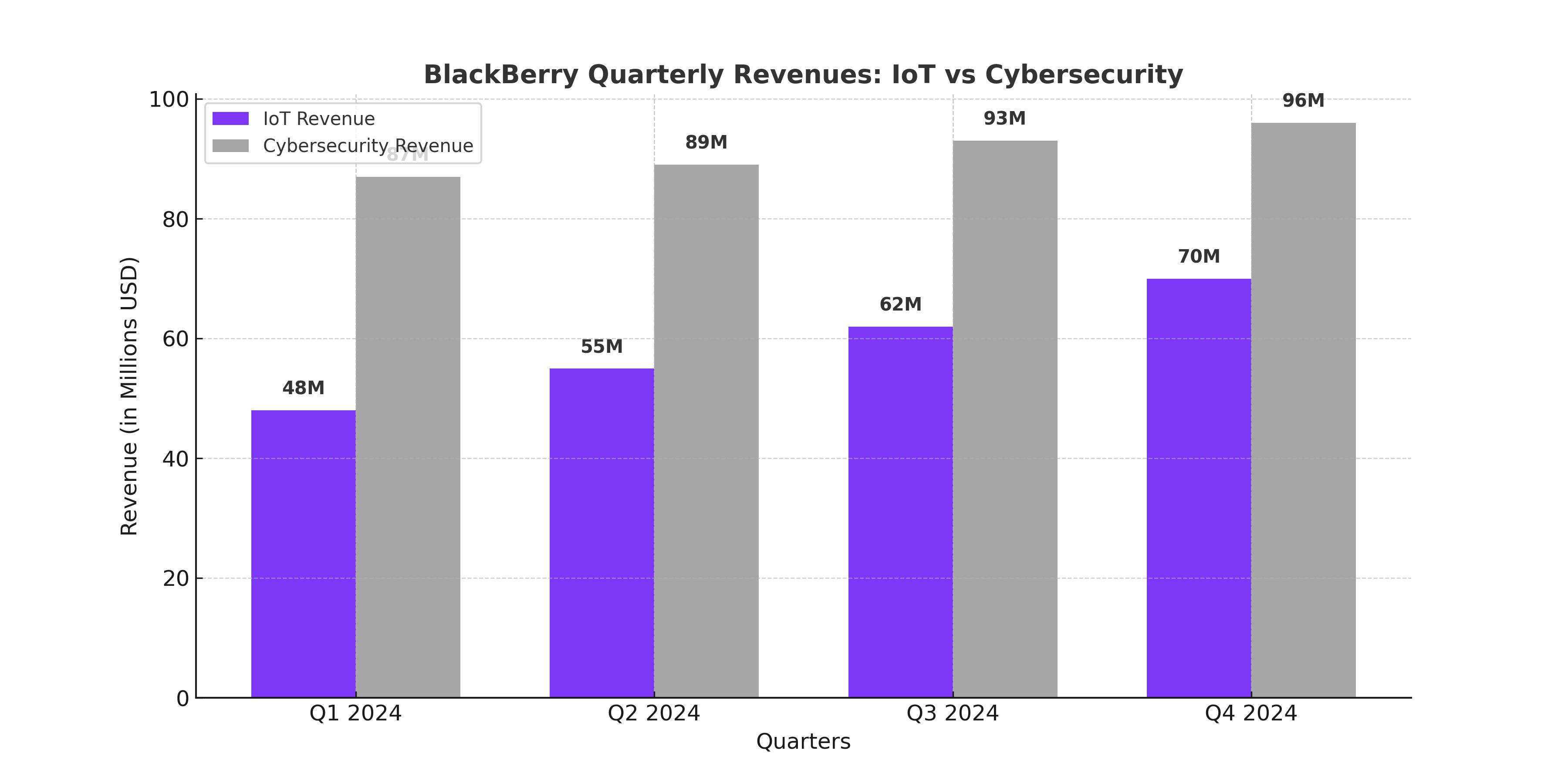

BlackBerry’s Q3 results marked a pivotal moment. The company reported a non-GAAP EPS of $0.02, surprising investors with a gross margin of 74%. IoT revenues, a key growth driver, rose by 13% sequentially to $62 million, with a striking gross margin of 85%. Meanwhile, cybersecurity revenues climbed 7% quarter-over-quarter to $93 million, exceeding guidance.

However, the GAAP story paints a grimmer picture. Including $7 million in restructuring charges and $9 million in amortization, BlackBerry recorded an $11 million net loss. The mixed nature of these results leaves questions about whether profitability is a sustainable trend or simply a result of aggressive cost-cutting and asset sales.

IoT Focus: A New Growth Engine?

IoT has emerged as BlackBerry’s core focus, with the QNX platform—a leader in automotive software—standing out as a critical component. The IoT segment posted sequential growth of 12% to $55 million in Q2 and is expected to continue growing. With a royalty backlog nearing $1 billion, QNX dominates the cockpit and Advanced Driver Assistance Systems (ADAS) software space. BlackBerry’s strategy to lean heavily into IoT aligns with broader trends in automotive digitization, making it a compelling, albeit niche, player in a competitive landscape.

The company aims to expand IoT revenues from $230 million in FY25 to $300 million by FY27, representing a 5% compound annual growth rate (CAGR). While promising, this growth trajectory remains modest compared to industry peers like Aptiv (NYSE:APTV), which leverages similar technology but with greater scale and market penetration.

Cylance Divestiture: Cleaning Up the Balance Sheet

The divestiture of BlackBerry Cylance to Arctic Wolf for $160 million marks a sharp pivot away from cybersecurity. Cylance, once acquired for $1.4 billion in 2019, failed to deliver the anticipated returns. The sale, expected to close in Q4 FY25, includes $80 million in upfront cash and $40 million deferred for one year.

The divestiture enables BlackBerry to focus resources on IoT and strengthens its balance sheet, reducing pressure from underperforming segments. However, the dramatic write-down of Cylance underscores BlackBerry’s persistent struggles to compete with cybersecurity giants like CrowdStrike (NASDAQ:CRWD), Palo Alto Networks (NASDAQ:PANW), and Cloudflare (NYSE:NET), all of which have vastly outperformed BlackBerry in revenue and stock price growth.

Financial Stability and Strategic Flexibility

With $265 million in cash reserves and an additional $80 million from the Cylance sale, BlackBerry is poised to invest in its IoT ambitions. CEO John Giamatteo has hinted at potential mergers and acquisitions to scale operations, particularly in the automotive and industrial IoT spaces. The strategic pivot is timely as the automotive industry increasingly integrates IoT technology, though broader economic risks and tariffs could weigh on growth.

Despite these positives, BlackBerry’s financial health remains precarious. The company’s outstanding notes total $195 million, limiting its ability to deploy capital aggressively. Furthermore, guidance for Q4 revenues of $126–$135 million fell short of analyst expectations of $153 million, reflecting ongoing headwinds in the cybersecurity transition and IoT scaling.

Market Sentiment and Valuation

BlackBerry’s stock currently trades at roughly 2.8 times its FY26 revenue estimate of $650 million, a steep discount compared to software peers like Microsoft (NASDAQ:MSFT) and CrowdStrike. This reflects both the market’s skepticism about BlackBerry’s growth prospects and its historical underperformance. Analysts maintain a cautiously optimistic average price target of $3.35, though this figure has been slashed over time as the company consistently failed to deliver on its growth narratives.

Challenges and Risks

BlackBerry’s path forward is fraught with risks. Its reliance on IoT growth assumes continued automotive sector expansion, yet macroeconomic factors such as tariffs and slowing demand for new vehicles could stifle progress. Additionally, with limited visibility into how the company will reinvest proceeds from the Cylance sale, investors remain wary of another misstep akin to the Cylance acquisition.

The competitive landscape also poses significant challenges. BlackBerry must differentiate itself in an IoT market dominated by established players with broader product portfolios and larger R&D budgets. Moreover, the company’s decision to focus on niche markets like QNX, while strategic, may limit its ability to achieve scale.

Can BlackBerry Rebuild Investor Confidence?

BlackBerry’s strategic restructuring offers a glimmer of hope, particularly as the company refocuses on IoT. The sale of Cylance, while painful, clears the way for a more streamlined operation. The QNX platform’s growth in automotive software and the strengthening of BlackBerry’s balance sheet are encouraging signs. However, the company must demonstrate that IoT growth can offset revenue declines from its divested cybersecurity assets.

Investors should monitor upcoming results closely to gauge whether BlackBerry can meet its FY27 revenue target of $300 million for IoT and achieve positive adjusted EBITDA. While the stock appears undervalued relative to peers, its long-term success hinges on management’s ability to execute its IoT vision effectively and avoid the missteps of the past. For now, BlackBerry remains a speculative buy, best suited for investors with a high-risk tolerance and confidence in the company’s turnaround strategy.

That's TradingNEWS

Read More

-

CGDV ETF at $44.17 Targets $52 as Dividend Value and AI Leaders Drive 2026 Upside

07.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR: $2.20 XRP and $1.6B Inflows Drive 2026’s Hottest Crypto Trade

07.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Rebounds to $3.48 as Market Eyes EIA Storage Shock

07.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.6 as BoJ Hawkish Shift Collides With Fed Cut Expectations

07.01.2026 · TradingNEWS ArchiveForex