Can Disney Stock (NYSE:DIS) Reclaim $200 Amid Streaming Gains and ESPN Decline?

With its stock at $112, Disney navigates streaming growth, aging IP, and $38.9B in debt—can it regain its former highs? | That's TradingNEWS

NYSE:DIS Faces Mounting Challenges Amid Growth in Streaming and Legacy Operations

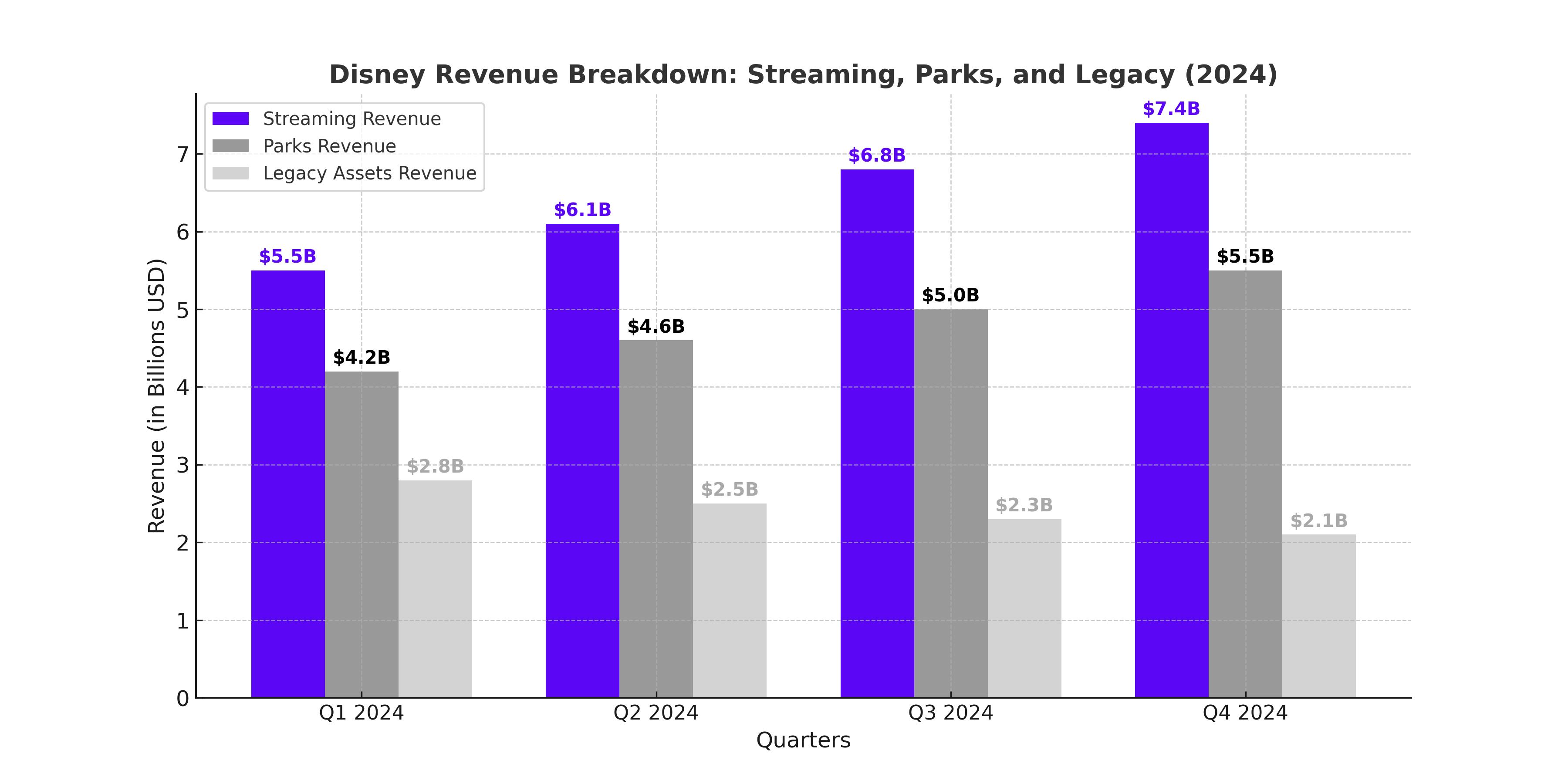

The Walt Disney Company (NYSE:DIS) stands at a critical juncture. While its stock has rebounded to $112 following strong Q4 2024 results, the company grapples with significant operational hurdles and industry headwinds. The challenges are multifaceted, spanning its heavy reliance on streaming, aging intellectual property, and the increasing pressure to adapt to evolving consumer preferences. Despite a 15% year-over-year subscriber increase in Disney+ and robust revenue from its parks and entertainment segments, the broader landscape reveals structural issues that demand urgent attention. Legacy segments like ESPN and ABC face steep declines in profitability, posing risks to Disney's long-term valuation and operational focus.

Disney's foray into the streaming market has undoubtedly been transformative, contributing substantially to its valuation recovery. However, the competitive dynamics in streaming are intense, with Disney+ fighting for market share against industry giants like Netflix and Amazon. While Disney+’s bundled offerings, including Hulu and ESPN+, have driven subscriber growth, questions linger about sustainability. Pricing increases may support short-term gains, but the churn rate remains a significant risk, particularly as growth slows in the U.S., its primary market. Competitors with a global reach are better positioned to weather such challenges.

The streaming segment accounted for a substantial portion of Disney's Q4 revenue surge, but profitability in the sector remains elusive. Disney has focused on scaling its platform, yet the reliance on price increases and aggressive bundling strategies exposes vulnerabilities. As competitors like Netflix shift towards advertising-supported models and global expansion, Disney must recalibrate its strategy. It faces the dual challenge of growing its subscriber base while maintaining profitability in an oversaturated and price-sensitive market.

The Burden of Legacy Assets: ESPN’s Decline and Mounting Debt

ESPN, once a cornerstone of Disney's media empire, exemplifies the struggle of legacy assets in a digital-first world. The sports network has seen a 20% decline in its audience since 2018 and recorded a $78 million operating loss in 2024. Rising costs for sports rights, coupled with declining viewership for traditional broadcasts, have eroded ESPN's profitability. Despite launching ESPN Bet to tap into the burgeoning sports betting market, the results have been underwhelming. The segment's challenges underscore the urgent need for Disney to address its long-term strategy for ESPN, potentially spinning it off to unlock value. Analysts estimate ESPN's standalone valuation at $23.2 billion, which could provide Disney with the resources to invest in its core growth areas.

Disney's debt load further compounds its challenges. The company carries $38.9 billion in long-term debt, with annual servicing costs of approximately $2 billion. While Disney has reduced its debt by 14.4% over the past two years, the burden limits its financial flexibility. The cost of servicing this debt diverts funds from potential investments in new intellectual properties and strategic growth initiatives. A more aggressive approach to debt reduction could enhance Disney's ability to navigate a rapidly evolving entertainment landscape.

ABC Networks: A Shrinking Asset in a Dwindling Market

ABC Networks, another legacy asset, has become a liability as linear television continues its decline. Advertising revenues have dwindled, and the network faces intensifying competition from digital platforms. Disney has reportedly received offers between $8 billion and $10 billion for ABC, far below its historical valuation of up to $90 billion. Holding onto ABC risks further depreciation of its value, yet Disney appears hesitant to act decisively. A spin-off or strategic sale could enable Disney to streamline its operations and focus on high-growth segments like streaming and international markets.

Intellectual Property and Creative Challenges

Disney's reliance on its aging IP catalog raises concerns about its ability to engage new audiences. While sequels like "Moana II," which has grossed $717 million and is on track to surpass $1 billion, highlight the enduring appeal of its franchises, the overreliance on established properties limits its creative dynamism. The 2025–2027 film slate is dominated by sequels, leaving little room for original content that could redefine Disney’s cultural relevance. The lack of innovative IP threatens to dilute Disney’s brand equity over time, particularly as audiences demand fresh and diverse narratives.

Leadership and Strategic Vision

Leadership instability adds another layer of complexity to Disney's challenges. Robert Iger’s return as CEO has provided some stability, but the company has yet to articulate a clear succession plan. Iger’s tenure until 2026 gives Disney a window to address its structural issues, but the lack of new leadership vision could impede the company's ability to adapt to future disruptions. A comprehensive strategy to reposition Disney as a lean, innovation-driven enterprise is essential to sustaining its competitive edge.

Final Thoughts on NYSE:DIS

Disney's recent stock performance reflects optimism around its Q4 2024 results and its ability to leverage its core strengths. However, the company faces significant challenges that could impede its long-term growth. Addressing legacy assets like ESPN and ABC through divestitures or spin-offs could unlock value and allow Disney to focus on its high-growth segments. Simultaneously, reducing its reliance on aging IP and investing in new creative ventures will be critical to maintaining its leadership in the entertainment industry. While Disney remains a strong player in the market, its ability to navigate these challenges will determine whether it can sustain its current momentum or face a plateau in its growth trajectory. Investors should weigh these factors carefully, as the company’s success hinges on its willingness to adapt and innovate.

That's TradingNEWS

Read More

-

SCHD ETF: $28.41 Price, 3.67% Yield And The Real Story After Broadcom’s Exit

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI At $11.95 And XRPR At $16.98 While $750M Flees Bitcoin And Ether Funds

12.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Snaps Back from $3.17 Lows as UNG and BOIL Surge

12.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Stalls Just Under 158 While Markets Game a Break or Reversal Near 160

12.01.2026 · TradingNEWS ArchiveForex