Can EUR/USD Surpass $1.0550 or Tumble Below $1.0450? Key Drivers Explained

EUR/USD hovers near $1.0510 as traders await Fed and ECB decisions. Learn how inflation trends, rate cuts, and technical patterns shape the pair’s next move | That's TradingNEWS

EUR/USD Price Struggles Amid Mixed Signals From Fed and ECB Policies

The EUR/USD pair has shown limited direction around the 1.0500 level in recent sessions, with traders closely monitoring central bank decisions on both sides of the Atlantic. The Federal Reserve’s anticipated quarter-point rate cut has already been priced into markets, but its forward guidance for 2025 and beyond holds the potential to sway the pair’s trajectory. Meanwhile, the European Central Bank continues its dovish tilt, setting the stage for further rate cuts as inflation stabilizes.

Federal Reserve's Impact on EUR/USD

The Fed’s final meeting of 2024 is pivotal for EUR/USD dynamics, as a quarter-point rate cut to a range of 4.25%-4.50% is widely expected. Market participants are less focused on this reduction and more attuned to Chair Jerome Powell’s commentary. Powell’s guidance on future rate cuts could significantly influence the dollar’s performance. A hawkish tone, emphasizing economic resilience and tempered inflation concerns, might bolster the greenback, pushing EUR/USD lower. Conversely, dovish rhetoric may support the euro, creating room for a short-term rebound.

Recent U.S. economic data adds complexity to the Fed’s decision. Retail sales surged 0.7% in November, far exceeding expectations and showcasing robust consumer spending. Inflationary pressures remain a concern, with headline CPI at 2.7% and core CPI at 2.2%, which could make the Fed cautious about signaling aggressive rate cuts in 2025. This backdrop sustains support for the dollar, keeping EUR/USD under pressure.

European Central Bank’s Dovish Trajectory

On the European side, the ECB has maintained its commitment to easing monetary policy, citing progress in disinflation. Inflation in the Eurozone slowed to 2.2% in November, slightly below the 2.3% forecast. ECB President Christine Lagarde and other policymakers have reiterated the need for gradual rate cuts, with expectations for reductions at each of the first two meetings in 2025. However, the pace and scale of these cuts will hinge on incoming economic data and inflation metrics.

Despite improved German ZEW Economic Sentiment, which rose to 17.0, other indicators such as the Ifo Business Climate Index at 84.7 highlight the fragility of economic recovery in the Eurozone. This cautious outlook has weighed on the euro, limiting its upside potential against the dollar.

Technical Analysis of EUR/USD

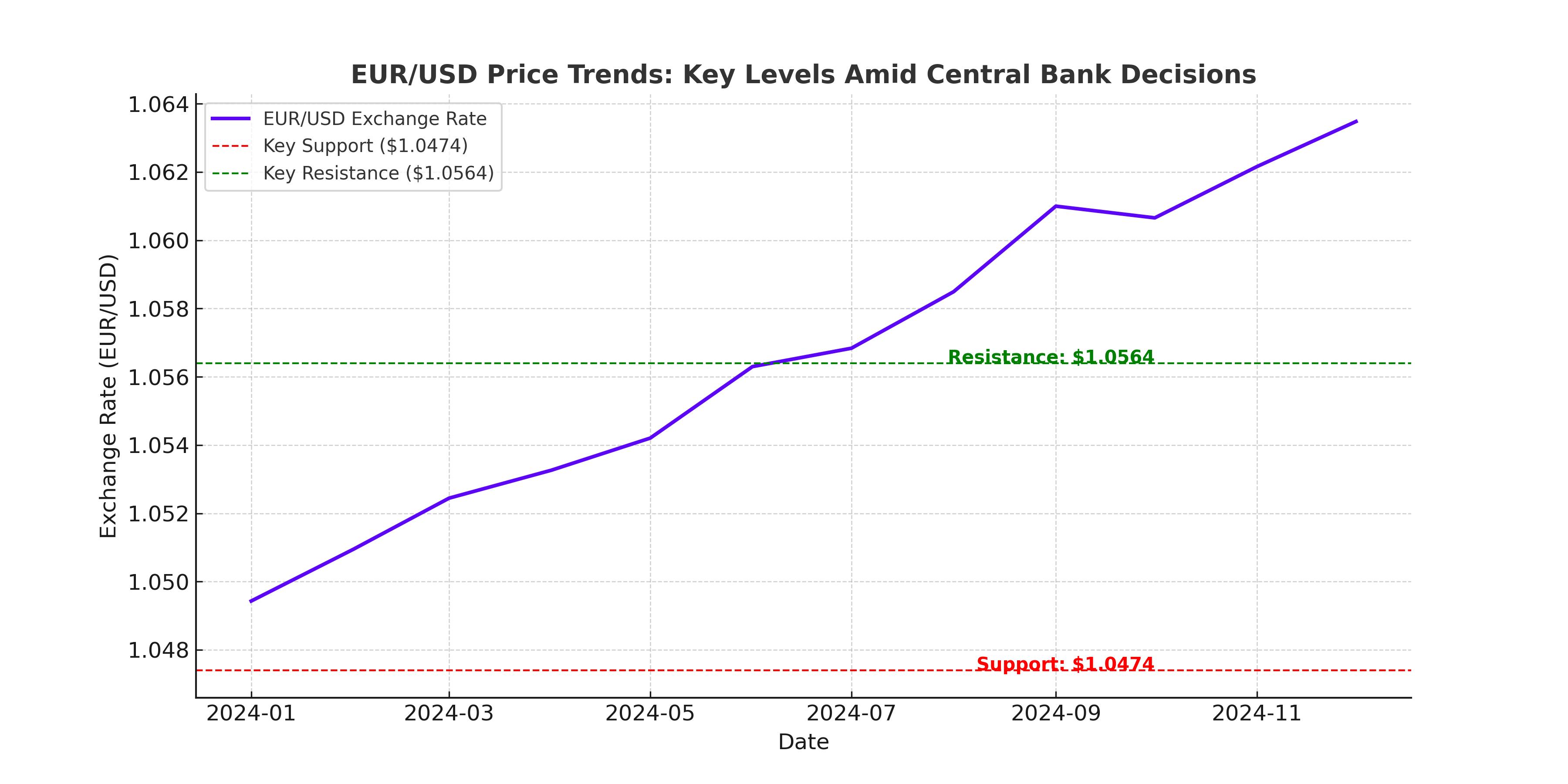

EUR/USD currently trades near $1.0510, showing signs of consolidation. The pair faces immediate resistance at $1.0564, corresponding to the 38.2% Fibonacci retracement level. A breakout above this level could open the path toward the 50% Fibonacci retracement at $1.0634. However, sustained upward momentum appears challenging, given bearish pressure from the 50-day and 200-day EMAs at $1.0653 and $1.0803, respectively.

On the downside, key support levels lie at $1.0474, aligned with the 23.6% Fibonacci retracement, and the psychological $1.0400 level. A breach below these levels could intensify bearish sentiment, potentially targeting yearly lows.

Technical indicators provide mixed signals. The MACD histogram shows easing bearish momentum, but the RSI remains subdued at 43, indicating limited buying interest. Until the pair clears its immediate resistance levels, the outlook remains tilted to the downside.

Macro Factors Weighing on EUR/USD

Broader macroeconomic themes continue to play a role in shaping EUR/USD movements. U.S. Treasury yields remain elevated, with the 10-year yield at 4.38%, reflecting market caution ahead of the Fed’s decision. A hawkish Fed could push yields higher, strengthening the dollar and applying additional pressure on the euro.

Meanwhile, the euro faces challenges from structural economic risks in the Eurozone. Persistent trade tensions with the United States, exacerbated by President-elect Donald Trump’s tariff threats, could dampen European growth prospects. ECB policymakers, including Olli Rehn, have acknowledged these risks, emphasizing the need for negotiation and potential countermeasures.

Short-Term Outlook and Scenarios

The immediate outlook for EUR/USD depends heavily on the Fed’s policy announcement and subsequent market reaction. A dovish Fed could lift the pair toward $1.0600, but resistance near $1.0650 may cap gains. On the other hand, a hawkish surprise or robust U.S. economic data could drive the pair below $1.0450, testing support at $1.0400.

In the broader context, EUR/USD remains vulnerable to macroeconomic headwinds, including diverging monetary policies and geopolitical uncertainties. While the pair may see temporary rebounds, the prevailing bearish bias suggests limited upside potential in the near term. The balance of risks leans toward further dollar strength, keeping EUR/USD under pressure.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex